-

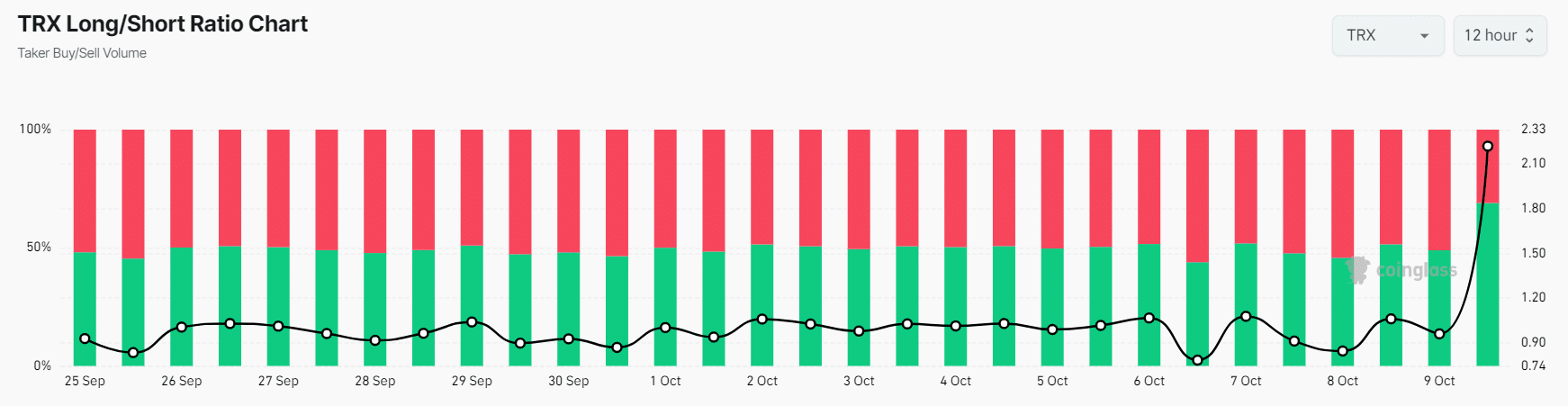

Tron’s Futures Open Interest jumped by 20% suggesting that traders’ long positions have been continuously rising.

68.95% of TRX traders held long positions, while 31.05% of investors held short positions.

As a seasoned crypto investor with a knack for spotting trends and interpreting market signals, I must admit that the recent surge in Tron [TRX] has caught my attention. The 20% jump in Open Interest, coupled with the overwhelming majority of long positions (68.95%) versus short positions (31.05%), is reminiscent of the early days of Bitcoin when a similar imbalance signaled a massive upswing.

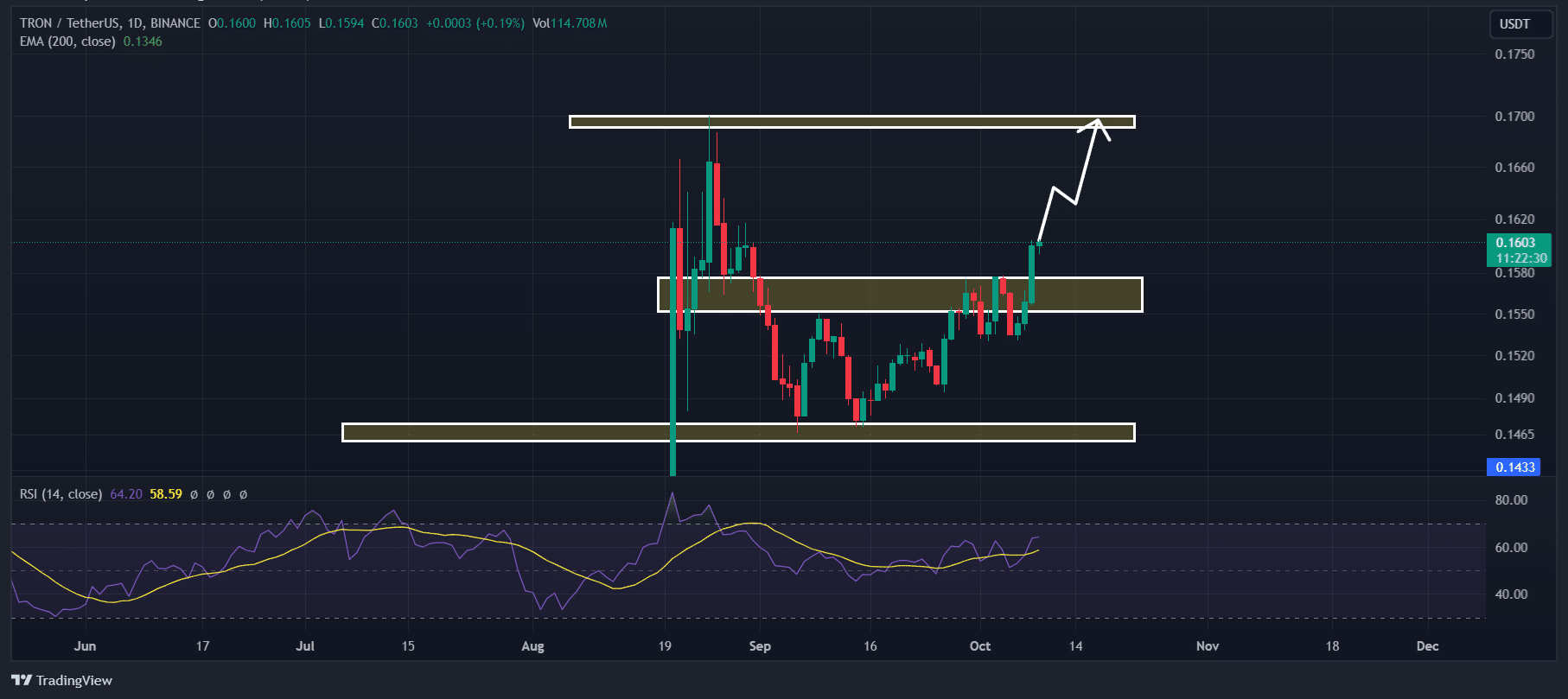

In a bullish market atmosphere, Tron (TRX) surged beyond the significant barrier at $0.157, indicating a potential upward trend among traders.

Currently, Tron (TRX) is being traded close to the $0.161 mark following an increase of more than 2.56% in its value within the last day.

Over that timeframe, there was a 25% increase in trading activity, indicating that more investors and traders are now engaged with the asset due to its recent burst onto the scene.

TRX technical analysis and key levels

According to the technical analysis by AMBCrypto, it’s predicted that Tron (TRX) could see a strong increase in value over the next few days, indicating a generally optimistic outlook for its price movement.

After surmounting the significant resistance at $0.157 with remarkable success, I find it plausible to anticipate that the price of TRX might effortlessly breach its previous peak and establish a new record high.

The technical signs, like the Relative Strength Indicator (RSI) and the 200 Exponential Moving Average (EMA), bolster the optimistic forecast for this altcoin, suggesting a potentially positive trend ahead.

Bullish on-chain metrics

Beyond the optimistic view from technical analysis, it seems that bullish investors were choosing to hold onto the cryptocurrency rather than offloading it based on on-chain data.

As reported by the on-chain analysis company Coinglass, the Long/Short Ratio for TRX stood at 2.22 in a 12-hour period, which is its highest level since late September 2024. This suggests that there’s a strong bullish sentiment in the market.

Moreover, there’s been a 20% surge in the open interest for TRX Futures contracts, and this trend has persisted. This implies that over the last day, traders have consistently taken on more long positions related to TRX.

Read Tron’s [TRX] Price Prediction 2024–2025

At press time, 68.95% of TRX traders held long positions, while 31.05% held short positions.

By examining various indicators on the blockchain and applying technical analysis, it seems that at present, buyers have the upper hand in the market, and optimism is high. This bullish trend might trigger an impressive price surge in the near future.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-10-09 23:35