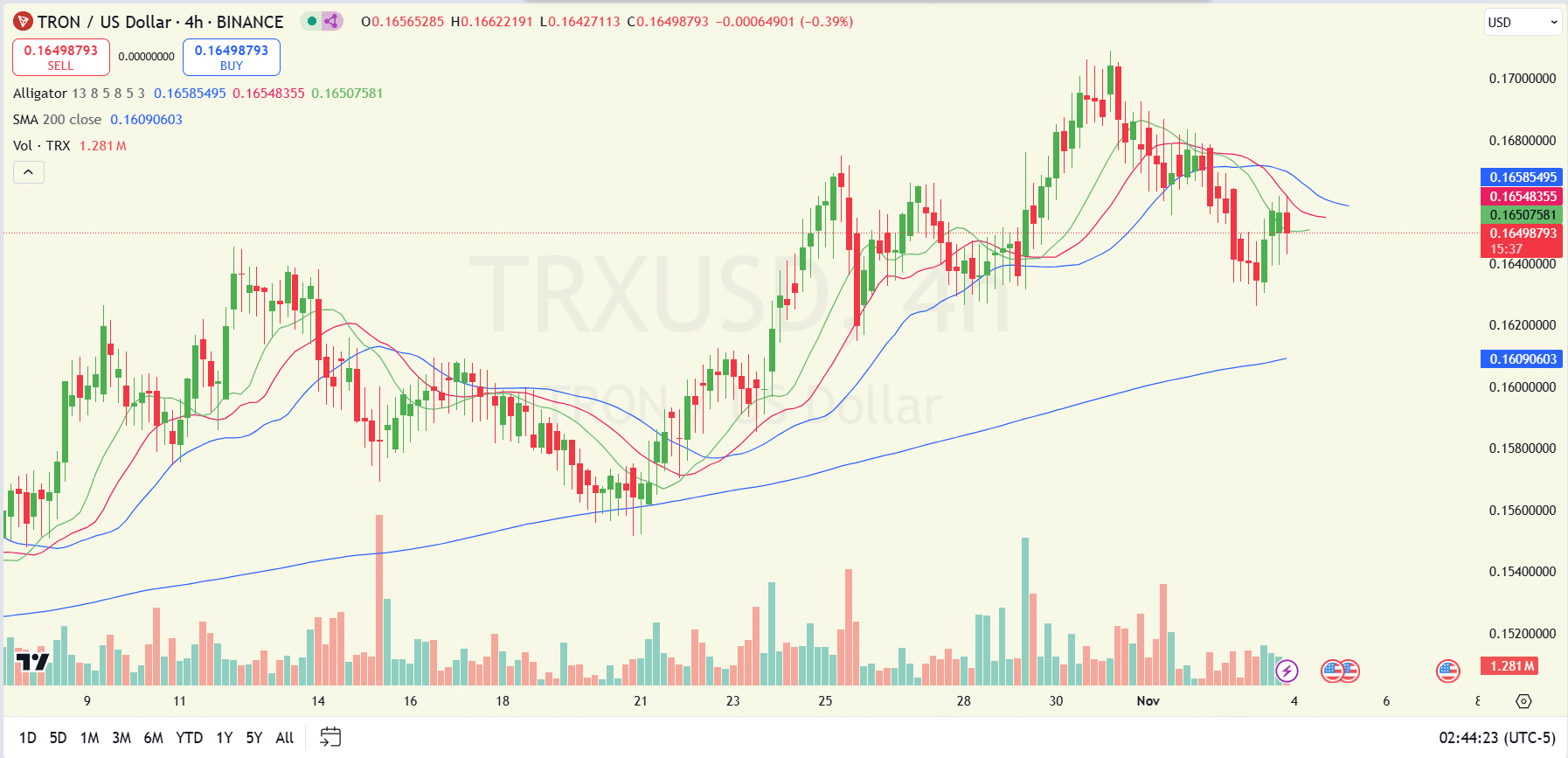

- At the time of writing, TRX was trading above its 200-SMA, showing a long-term bullish trend

- Token burns alluded to a deflationary mechanism for the altcoin

As an analyst with over 10 years of experience in the crypto market, I find myself drawn to TRON (TRX) due to its strategic initiatives and strong investor confidence. The recent dip in price has been met with a surge in trading volume and a climb in market cap – indicators of sustained optimism within the ecosystem.

TRON’s price has seen a small decrease on the graphs, moving downwards from approximately $0.1678 at the start of the month to $0.1654 currently – representing a 1.8% drop.

Despite this, the value of the altcoin’s market cap increased by 0.59%, and its 24-hour trading volume also jumped by a significant 20.49%. This suggests that investor interest in the altcoin is on the rise. These figures underscored the continued enthusiasm among investors for the altcoin’s ecosystem.

It’s important to point out that TRON, through strategic measures such as token burning, has been structured in a way to decrease its supply over time and stimulate the growth of its long-term value.

Analyst predictions continue to be optimistic, suggesting that TRON could experience a significant increase in value, potentially reaching the predicted price point of $1.11. Historically, the $0.1635 level has served as a strong foundation for growth, with movements generally pointing upward from this point. If this level is successfully retested, it may trigger additional bullish activity, possibly leading TRON’s price to reach $0.18 this week.

Technical indicators point to sustained rally

Come October 2024, TRON undertook a substantial token destruction, effectively withdrawing around 149.6 million TRX coins from the market. This amount was roughly equivalent to a market worth of about $25 million.

This burn is a component of Tron’s strategy to decrease the number of tokens in circulation, thereby creating scarcity, which could potentially contribute to price stability in the long run.

For the past month and a half (since early August), the altcoin’s price on the daily chart consistently remains above its Simple Moving Average (SMA) line. This implies that the SMA line’s position has been strengthening a persistent, long-term bullish trend for the altcoin.

At the current moment, the volume levels remained fairly consistent without any significant peaks, indicating a relatively stable and low-risk market scenario for traders dealing with TRX.

The three lines of the Alligator indicator (represented by green, red, and blue) appeared to be drawing closer together, suggesting a period of consolidation. This configuration might indicate that Tron (TRX) is building up power, potentially gearing up for its next significant action.

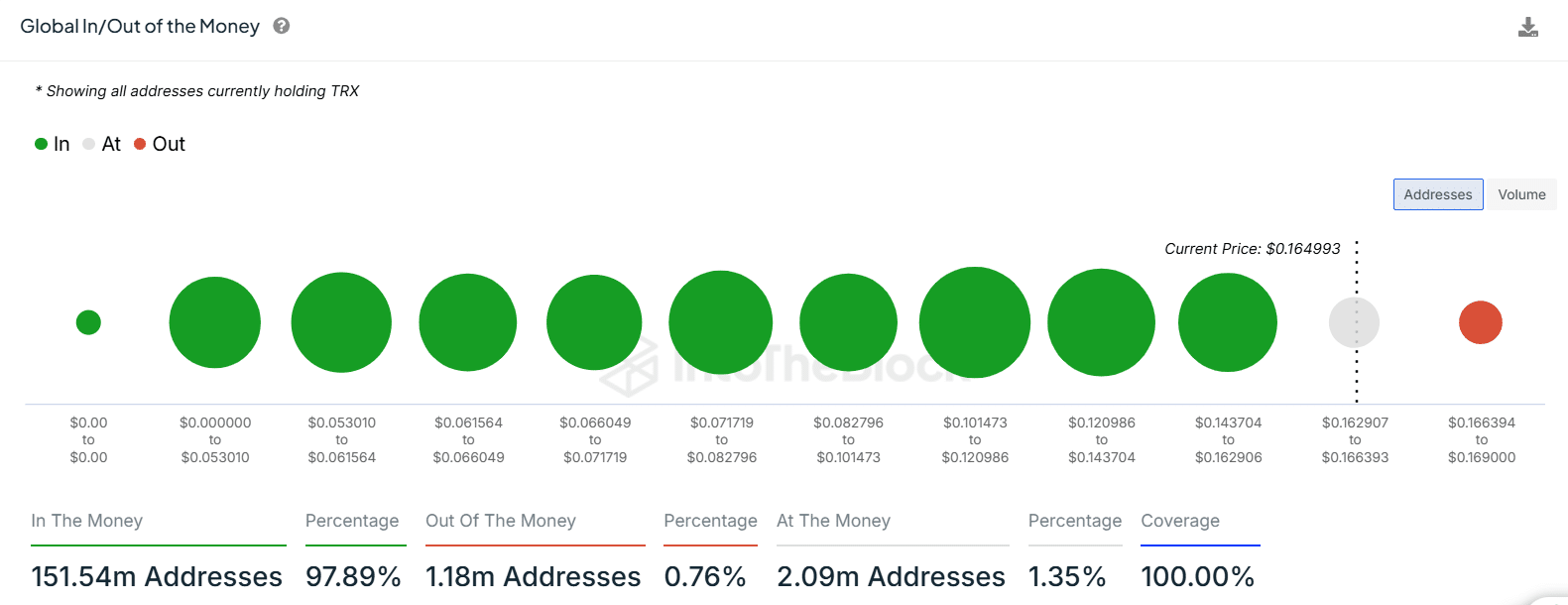

TRON holders enjoy profits, less than 1% at loss

Currently, about 97.89% of all Tron (TRX) addresses contain coins whose current value exceeds their original purchase price, a condition known as “being in the money.” This suggests that most TRX holders are experiencing profits from their investment.

As a researcher studying altcoins, I’ve found that just over seven-tenths of one percent (0.76%) of the addresses I examined were “Out of the Money.” This essentially means that these particular holders are currently facing a loss, given the current price levels of the altcoin at the time of my research.

Approximately 1.35% of the addresses had their holdings priced roughly at the current market value of the cryptocurrency.

A large proportion of profitable TRON addresses indicates robust market faith in TRON, as the majority of investors are reaping benefits from recent price fluctuations.

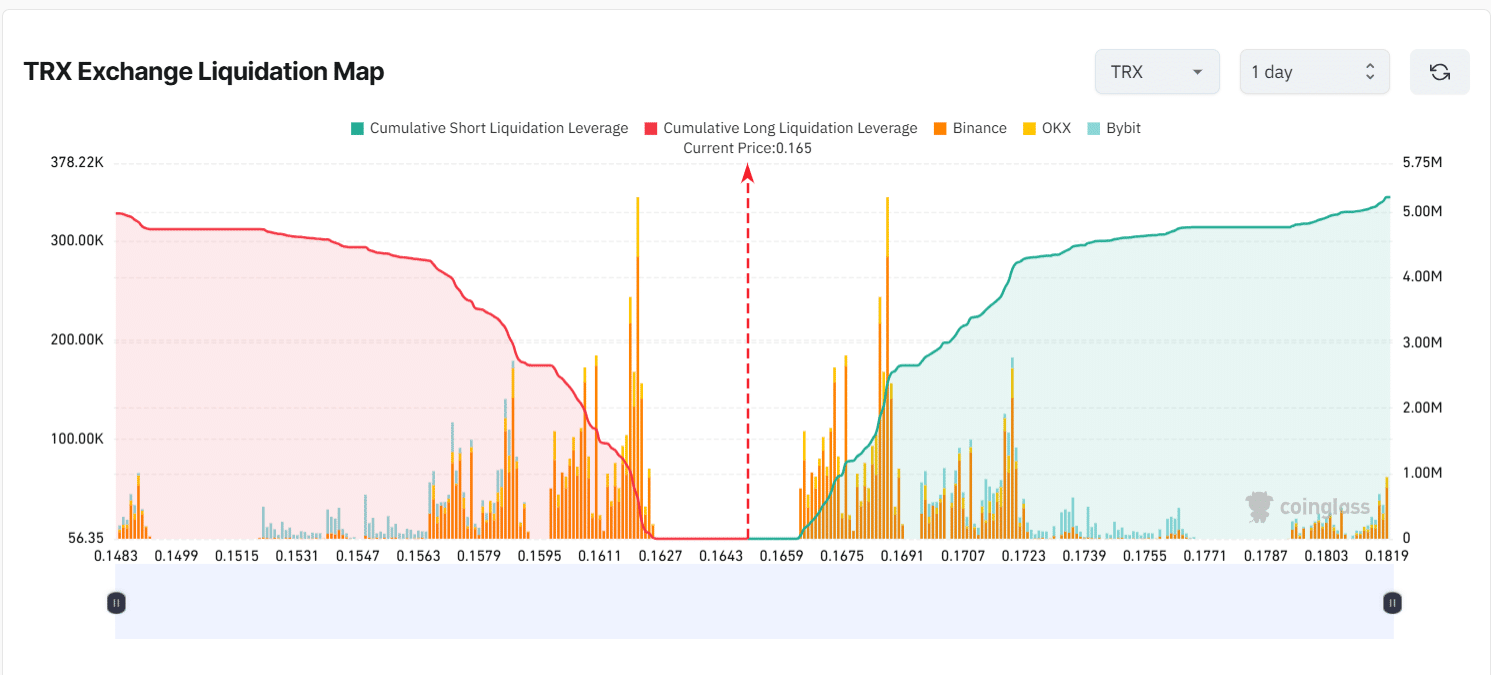

High liquidation levels around $0.165

As I write this, it appears that there’s an even spread of both high and low liquidation points near TRX’s current price of $0.165.

On the left part of the graph, a substantial increase in short liquidation leverage (represented by the red area) was observed just below $0.164. If the price falls further, this situation may become more severe. In simpler terms, traders with short positions had taken on significant risk around these price levels.

On the positive side, as we move over to the right, the accumulated long liquidation leverage (represented by the green area) increased significantly, starting at around $0.166 and further expanding past $0.170.

In simpler terms, if the price of TRX increases significantly, this situation could lead to forced selling (liquidation) of long positions.

Read More

2024-11-05 09:12