-

TRX has been consolidating after the rally stirred by the SunPump hype was exhausted.

The narrowing Bollinger bands showed low volatility, preventing significant price changes.

As a seasoned crypto investor with a knack for spotting trends and interpreting technical indicators, I find myself cautiously optimistic about Tron (TRX) at this juncture. The consolidation phase TRX is currently experiencing, as evidenced by the narrowing Bollinger bands, is a common occurrence in any market cycle. However, the bullish bias suggested by the price breaking above the middle band and testing a breakout above the upper band is promising.

This week, Tron (TRX) hasn’t performed as well compared to many other altcoins, and it has dropped out of the top 10 largest cryptocurrencies based on market cap. That position was taken over by Cardano (ADA).

Last month, TRX was one of the top crypto gainers amid a memecoin boom on the blockchain. However, since the hype around Tron meme coins has faded, TRX is now struggling with low volatility.

Tron price prediction

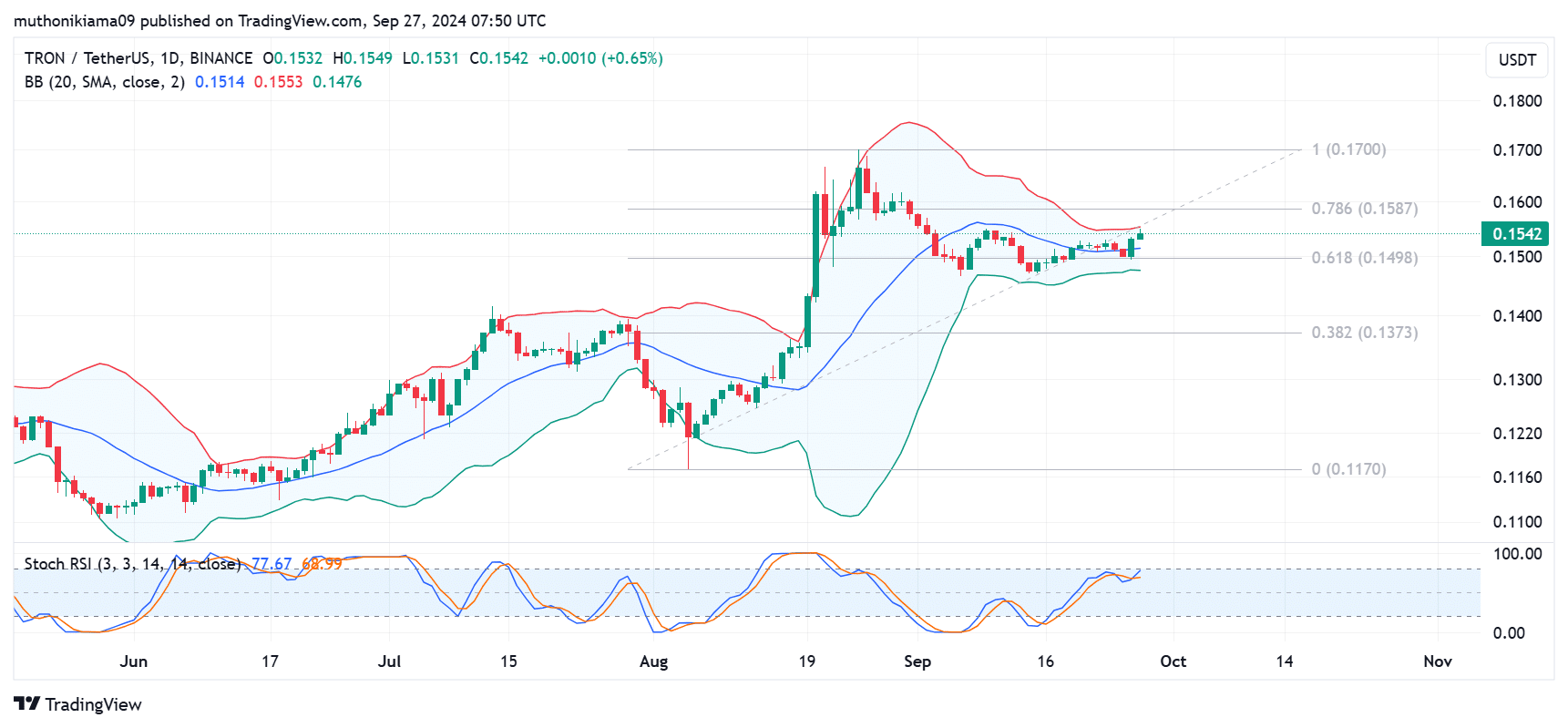

TRX traded at $0.154 at press time after a 1.57% gain in 24 hours. Trading volumes were up by 32% per CoinMarketCap. During this period, the price oscillated between $0.151 and $0.155.

TRX’s Bollinger Bands are becoming tighter, indicating reduced volatility, which could mean the price is currently in a period of consolidation.

Yet, this indicator hinted at a positive outlook since the Tronix (TRX) price surpassed the midline and attempted a breakout beyond the upper line.

If a breakout above the upper band occurs, it could trigger an uptrend to the next target at $0.17.

However, the narrowing bands also show that the TRX rally reached exhaustion, and more buying activity is needed to stir further gains.

In simpler terms, the Stochastic Relative Strength Index (RSI), which measures the speed and change of price movements in an asset, currently stands at 77. This figure falls within the overbought range, suggesting the asset has been bought more than it’s normally sold, but it hasn’t reached its maximum level yet. Therefore, it’s unlikely that a sudden reversal or significant price drop will occur immediately.

Furthermore, as the Stochastic RSI surpassed its signal line, this suggested a buy signal, meaning the present momentum seems to be leaning towards the advantage of buyers.

If the Relative Strength Index (RSI) persists in increasing and surpasses 80, indicating that TRX is overbought, it might signal the initiation of a bearish turnaround similar to what occurred in late August, causing prices to plummet down towards the 0.382 Fibonacci level ($0.137).

Tron transaction volumes drop

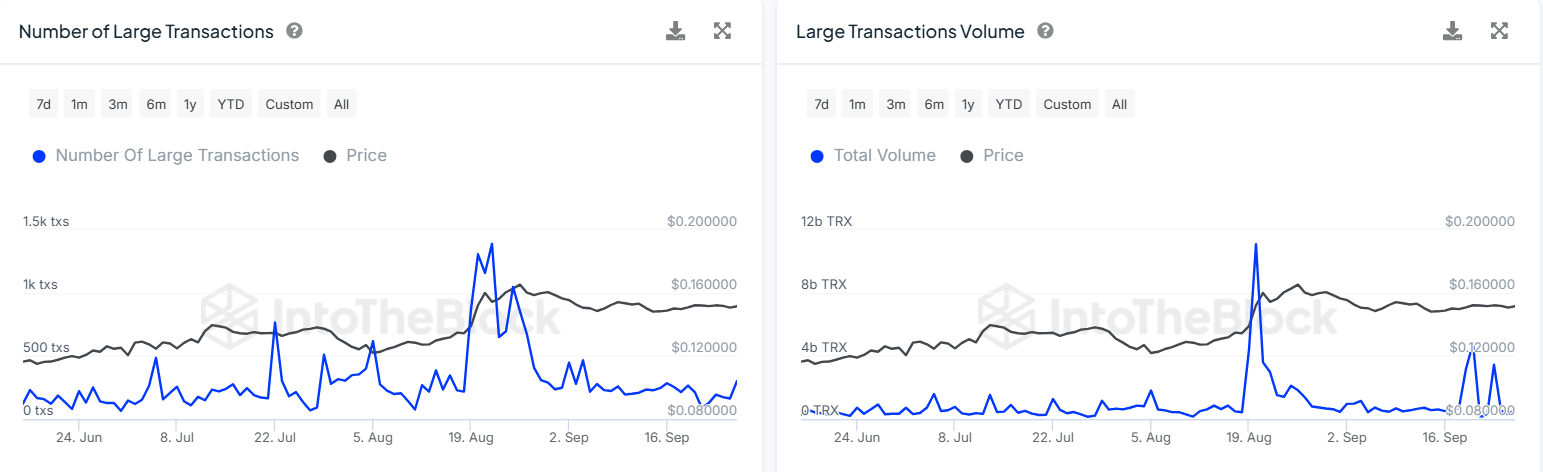

According to IntoTheBlock’s data, there has been a significant decrease in transactions on the Tron blockchain. These transaction volumes peaked in mid-August, but have since fallen dramatically, reaching their lowest point in the past three months.

It’s possible that the absence of substantial transactions this month is contributing to the minimal growth observed in TRX. Typically, large trades are accompanied by increased volume, which can lead to price fluctuations and potential spikes.

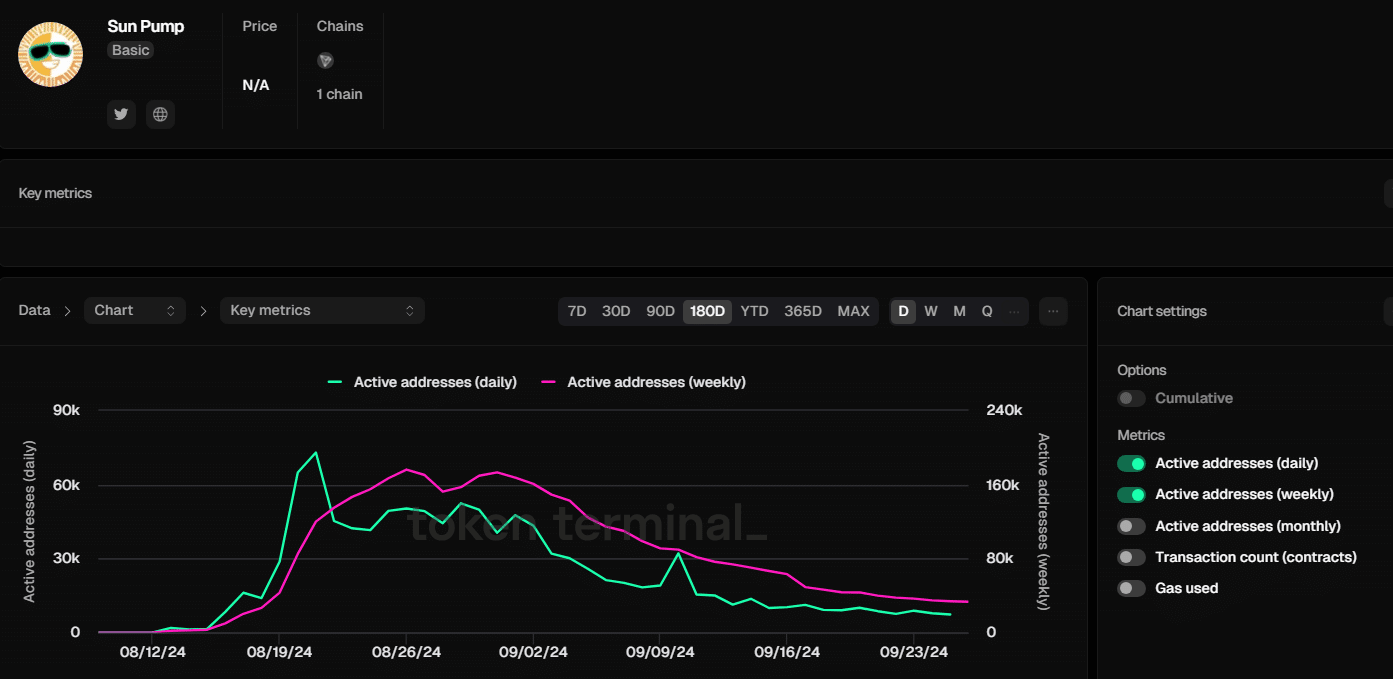

It’s quite possible that the surge in big transactions we saw in August was due to the SunPump launchpad event. As per TokenTerminal’s data, the number of daily active addresses on Tron is rapidly nearing record lows at present.

It indicates that apart from general market fluctuations, there seems to be no significant factor within the Tron system driving an upward trend in the price of TRX.

Read Tron’s [TRX] Price Prediction 2024–2025

Conversely, most TRX holders have a cost basis higher than the current price according to IntoTheBlock. This means these investors may opt to keep their tokens, expecting further price increases.

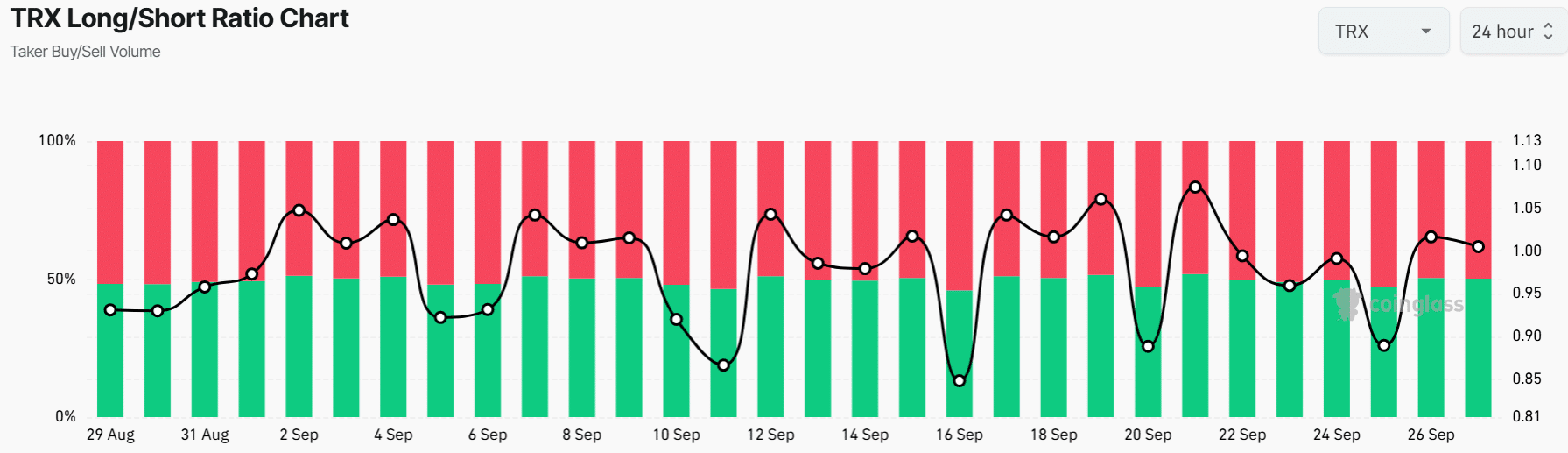

The tendency towards optimism, or bullishness, can be observed not only in general sentiment but also in the long/short ratio. Initially at 0.88, this ratio has now surpassed 1, signifying that short sellers are liquidating their positions as more long-term investors enter the market. This indicates a growing confidence among traders regarding future price fluctuations.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-09-27 17:43