- TRON gains 7% today, setting a positive tone for the week ahead.

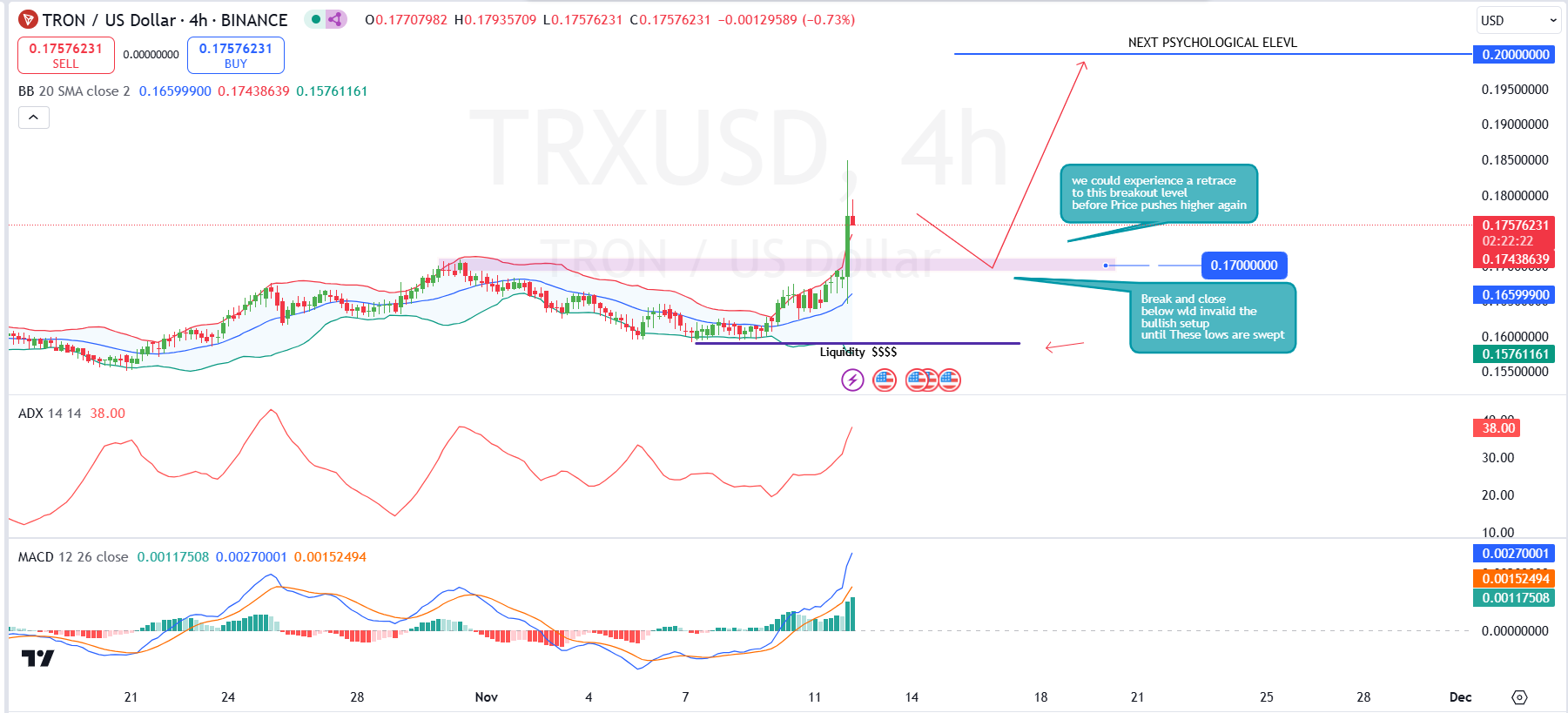

- A breakout above the Bollinger Bands on the 4-hour chart suggests further gains for the token.

As a seasoned researcher with years of experience tracking the cryptocurrency market, I find myself increasingly intrigued by Tron [TRX]. Today’s 7% surge and the breakout above the Bollinger Bands are compelling signs that TRON might be ready for further gains.

At this moment, Tron (TRX) is reflecting increases from the larger crypto market. Presently, it’s being exchanged for approximately $0.1778, showing a rise of more than 7% within the last 24 hours.

Over the last day, TRON’s trading volume significantly increased by 121%, peaking at approximately $1.62 billion. The surge in trading activity reflects a growing investor interest in the token, causing its market capitalization to swell by 7.58% and reach an impressive $15.35 billion.

In the monthly price chart, Tron exhibits robust bullish energy, climbing back up to levels not seen since April 2021. This surge suggests that Tron could retrace its steps to its record-breaking highs from 2018, given the current bullish trend in the crypto market. The intensity of this bull run has heightened post Trump’s recent election victory.

On the 4-hour chart, the price has just shot up above the $0.1700 resistance point, strengthening the bullish momentum. It’s possible we might see a pullback to this same level, which could function as new support. If this happens, it could offer buyers a chance to drive the price towards the significant resistance of $0.20.

The Bollinger Bands suggest heightened volatility when the price approaches the top band, showing robust buying enthusiasm. Yet, it’s possible for the price to retreat within these bands to create balance after recent growth spikes.

A significant resistance level is found close to $0.1600. Dropping below this level and closing could undermine the bullish outlook, possibly triggering additional drops. If it manages to hit the liquidity around the $0.1590 lows, this might draw in more buyers for a rebound.

Reinforcing a positive perspective, the ADX (Average Directional Movement Index) stands at 36.44, demonstrating a powerful trend direction, which aligns with the current momentum in this recent shift. This high ADX level implies that the trend is strong yet potentially overstretched, implying there may still be a correction or pullback ahead.

Crossing of the MACD line over the signal line, accompanied by widening histogram bars, suggests a surge in bullish energy, implying that the buying pressure continues to be robust.

Alternatively, the gap between the MACD and the signal line suggests that the current trend might require a slight pause or stabilization before aiming for another surge.

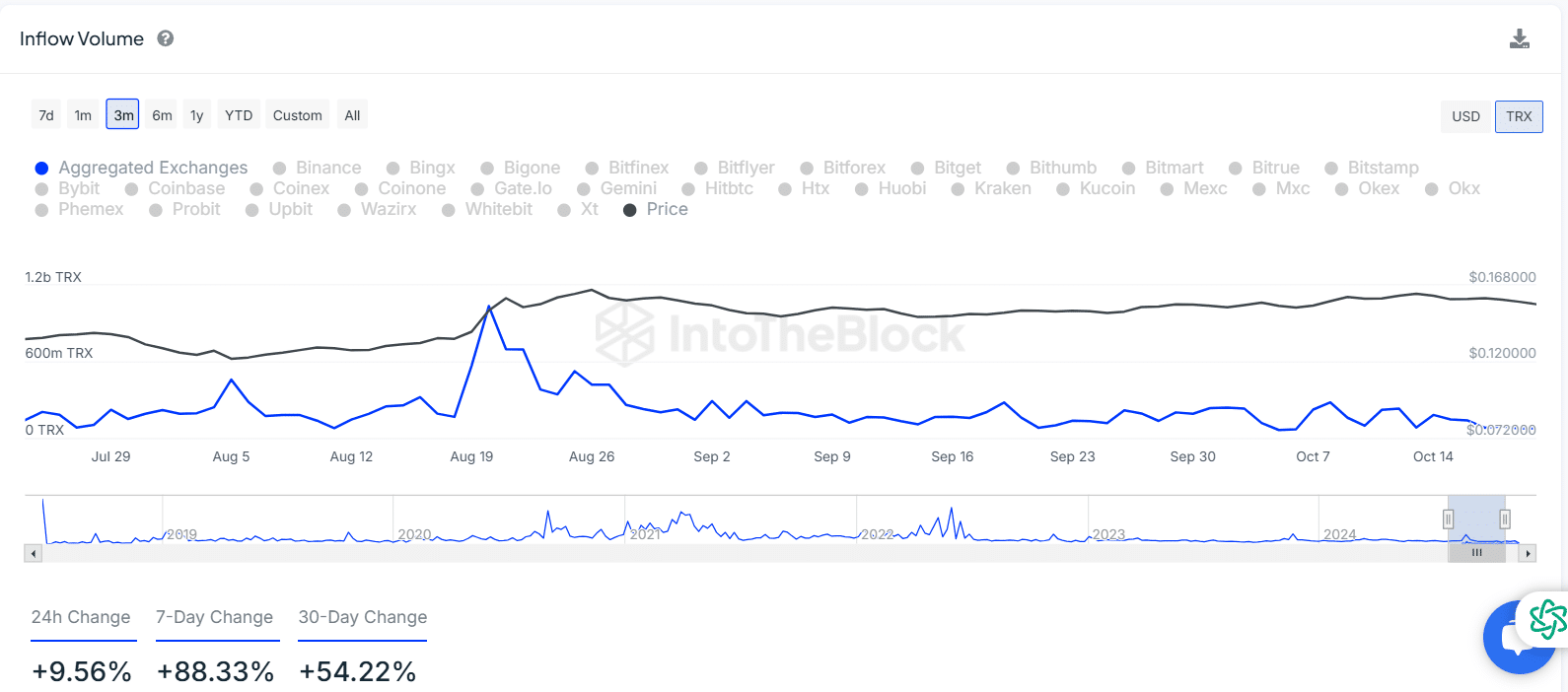

Steady TRX volume growth since August signals renewed market interest

Over the past few months, particularly since August, there’s been a steady increase in the amount of TRX being brought into transactions. This inflow has shown significant surges, notably around mid-August, when both volume and price experienced sharp increases almost concurrently. This pattern indicates robust buying demand and heightened trading activity.

After reaching its highest point in August, the inflow volume started to decrease gradually, though it remained at a consistent level throughout September and October. During this period, the price too experienced stability.

During this timeframe with fewer inflows and less price fluctuations, it seems we’re experiencing a phase of consolidation or decreased speculation in the TRX market.

The latest figures indicate a significant surge in incoming data flow. In just the past 24 hours, there’s been a 9.56% spike, a 88.33% escalation over the last week, and a notable 54.22% upsurge over the past month.

The increasing number of people investing in TRX suggests a resurgence of interest, and if this pattern continues, it might stimulate additional price fluctuations. If so, it could potentially exceed its previous range and reach the record highs set in 2018.

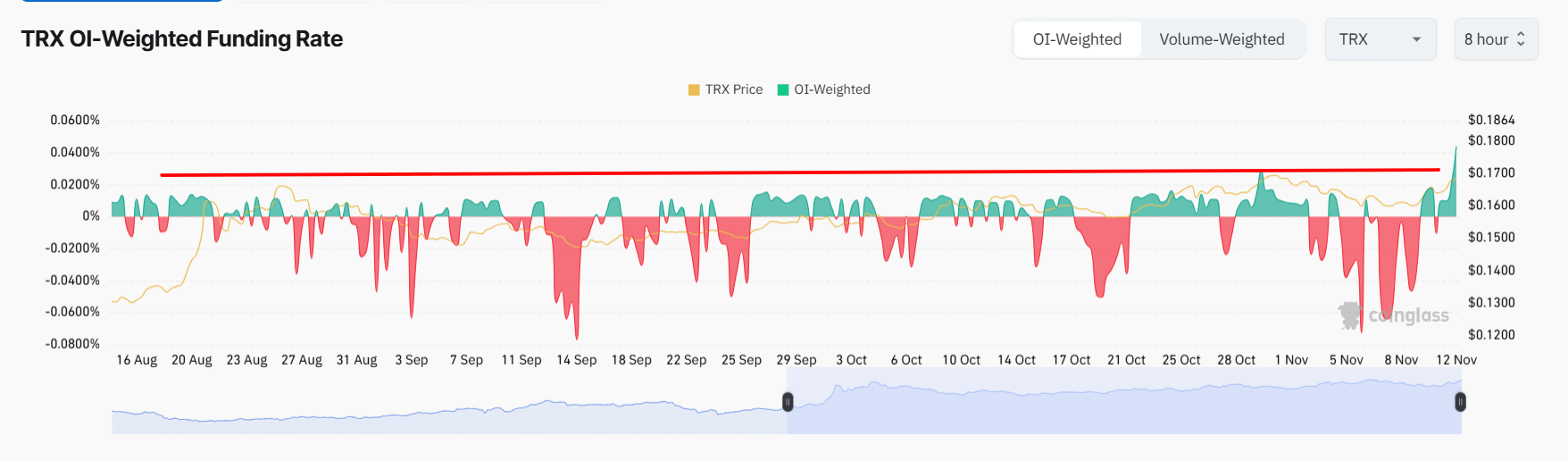

Sustained positive funding rate in TRX hints at price rally

The current TRON funding rate indicates a significant increase in optimistic outlook, as it has reached 0.04% – its highest point since August.

During August and September, the funding rate generally stayed near a balance, moving back and forth between -0.02% and 0.02%. This suggests that traders had conflicting opinions, as the rate could swing either way.

Read TRON’s [TRX] Price Prediction 2024-25

More recently, data from early November indicates a consistent upward trend. The funding rate has remained above 0% and has even surged to 0.04%, coinciding with the rise in Tron’s price approaching $0.2.

A prolonged rise in the funding rate implies that traders are more frequently purchasing high-value contracts for long positions, which indicates growing optimism about future price increases.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-11-13 11:04