- Ah, the TRON chain, a veritable fountain of revenue, suggests that the network is alive with the sound of trading, hinting at a possible price escapade!

- Yet, alas! The specter of selling pressure in the derivatives market looms large, casting a shadow over our dear TRX‘s aspirations for a rally.

TRX, that poor soul, has been on a rather dismal path of late, suffering a single-digit drop of 8.62% over the past month, and a 24-hour price decline of 1.47%. In the grand theatre of cryptocurrency, this decline is but a whisper.

Indeed, AMBCrypto’s astute analysis reveals that the fundamentals behind TRX’s modest drop are as strong as a well-brewed cup of tea, with whispers of a price pump in the air. However, the selling pressure from the derivatives market may well be the villain in this tale.

Spot traders: The Unsung Heroes of TRX Stability

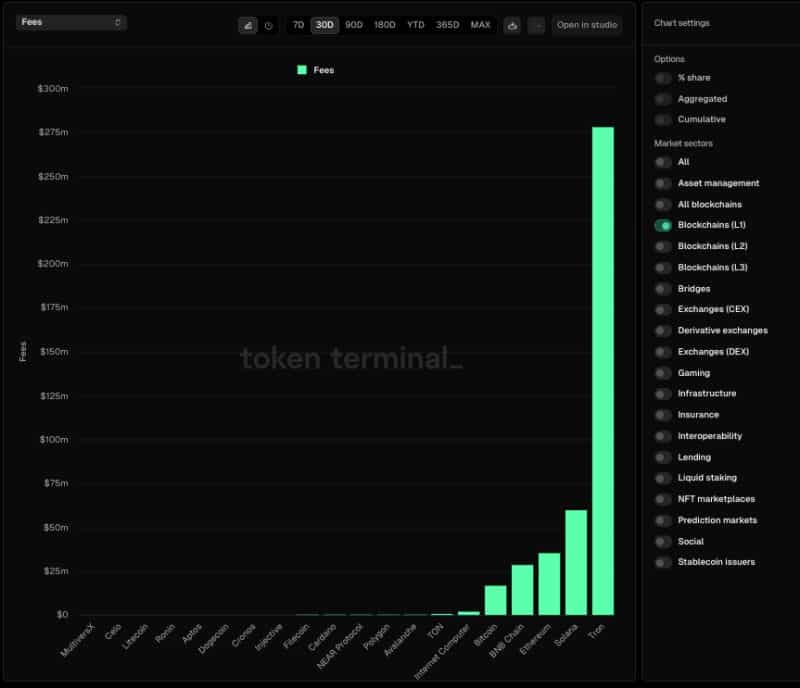

According to this delightful analysis, TRON has achieved a new revenue milestone, outshining other illustrious chains in the market over the past week. Ethereum, Solana, Bitcoin, and BNB Chain must be green with envy!

During this splendid period, TRON recorded a staggering $12.75 million in revenue, with the number of completed transactions rising by a modest 2.2% to 60.5 million. Bravo!

But wait, there’s more! Token Terminal’s data reveals that the network has generated the most fees among blockchains, a feat worthy of a standing ovation. This surge can be attributed to the influx of stablecoins, with a market cap of $62.27 billion. Quite the party, wouldn’t you say?

This growth appears to correlate with the number of active addresses reaching a new zenith. Currently, active addresses, those diligent little bees buzzing about the chain, have hit a record high of 127.5 million.

A rise in revenue, coupled with high user engagement, suggests that more active traders are accumulating the asset, buying from sellers, and preventing a major price decline. How noble!

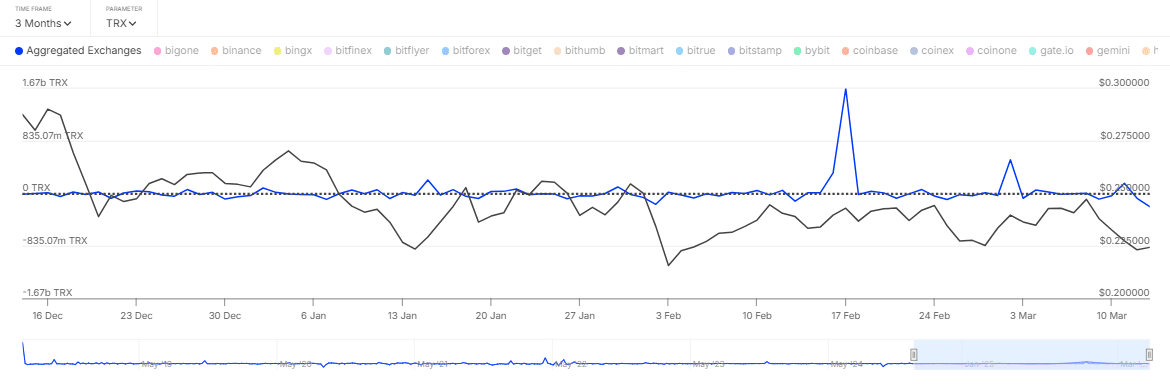

Analysis of exchange netflows on IntoTheBlock reveals that spot traders are the architects of this recent accumulation of TRX, keeping its price as stable as a well-balanced teacup. In the last 24 hours alone, this cohort of traders purchased a staggering 133.43 million TRX, worth approximately $29 million. Quite the shopping spree! 🛒

A purchase of this magnitude in a single day indicates a fervent interest in buying. If this sentiment persists into the coming week, TRX may very well experience a new wave of bullish gains. Fingers crossed! 🤞

However, while spot traders are indulging in their buying frenzy, not all market segments are singing in harmony. On the contrary, derivatives traders seem to have donned the cloak of sellers.

The Sellers: The Grumpy Gatekeepers of TRX’s Potential

The latest 24-hour decline in TRX’s price was likely orchestrated by the derivatives traders, those mischievous rascals!

At the time of writing, the amount of unsettled derivative contracts has notably dropped, accompanied by a simultaneous decline in trading volume. For instance, Open Interest fell by 3.38% to $156 million. A decline in both metrics is a clear sign that sellers are ruling the Futures market with an iron fist.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2025-03-15 12:11