- Tron saw a strong rebound as it broke above a crucial resistance level.

- However, the altcoin struggled to back its recent rally with high volumes.

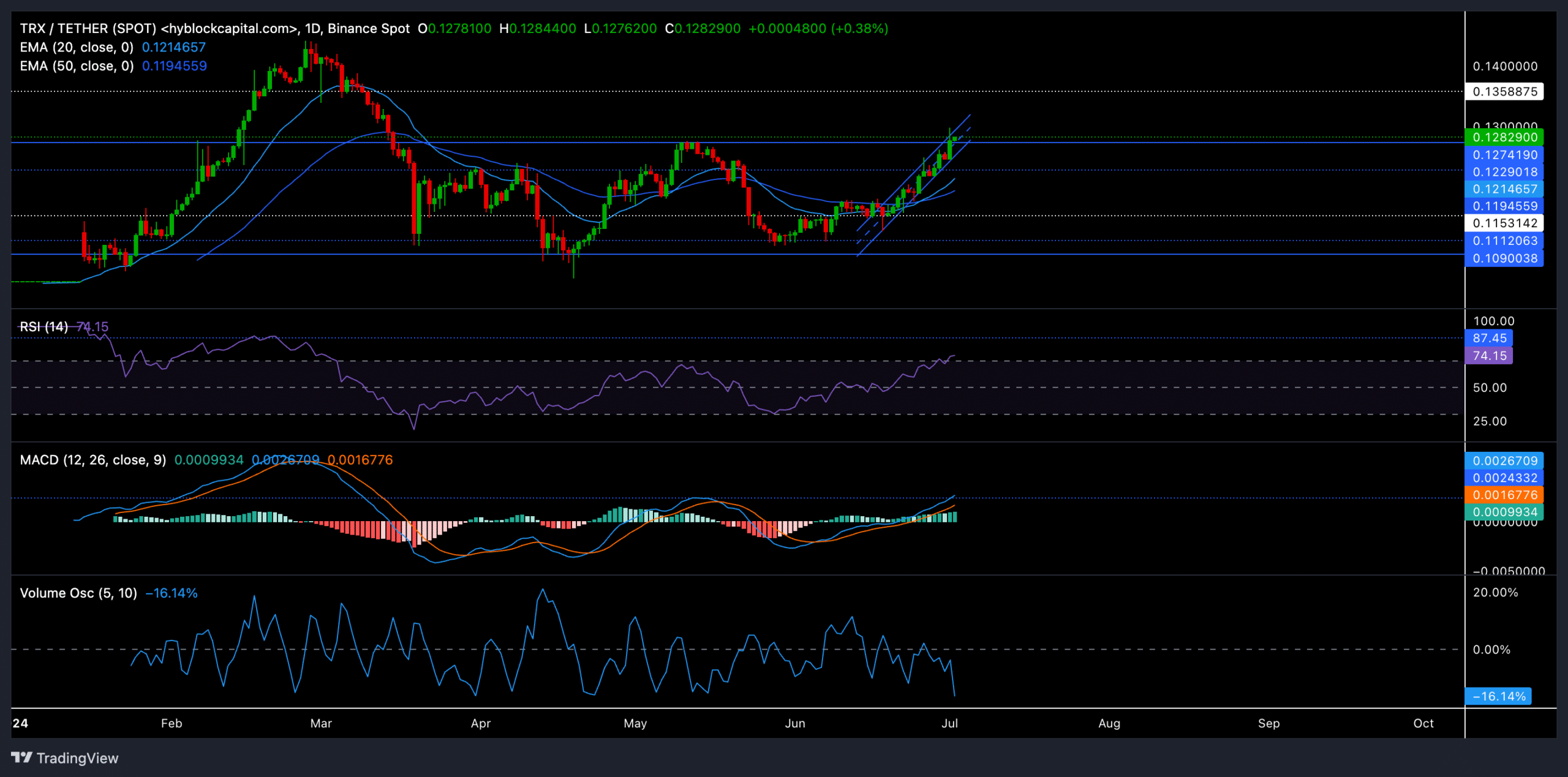

As an experienced analyst, I have closely monitored Tron’s (TRX) recent price action and observed its strong rebound above a crucial resistance level. However, I must note that the altcoin has struggled to back up its recent rally with high trading volumes.

Over the past two weeks, TRX (Tron) experienced significant growth, exceeding 10% increase, following a robust recovery from its supportive level at $0.115. This bounce-back gave rise to a bullish configuration on the daily chart.

As an analyst, I would interpret the current situation for TRX as follows: If the bullish trend persists, TRX could experience a prolonged price increase before eventually encountering a potential bearish reversal. Presently, the altcoin is priced at almost $0.128, reflecting a rise of more than 2% in the previous day.

Can TRX bulls continue this uptrend?

During the second and third weeks of May, the price of TRX took a dip due to bearish sentiment among traders. This downturn coincided with a broader market decline. Nevertheless, TRX bulls managed to regain strength around the $0.111 support level.

I’ve experienced an impressive surge of over 11% in the value of my TRX altcoins within just two weeks. This upward trend became apparent when the coin successfully breached the significant resistance level at $0.127, as reported currently. Consequently, on the daily chart, TRX concluded the session above both its 20-day and 50-day Exponential Moving Averages (EMA).

As a crypto investor observing the market trends, I’ve noticed that the recent price fluctuations have formed an uptrend channel on the TRX chart. Should the bulls successfully maintain control and keep the price above the crucial $0.127 support line, it is likely that TRX will continue its upward momentum.

The $0.135 region could be the first major resistance in this case.

Contrary to the current upward trend, a sudden drop could soften the bullish momentum. The initial support lies around the 20 Exponential Moving Average (EMA) at approximately $0.11. Subsequently, there is another potential support at $0.109.

As a market analyst, I can explain that when the Moving Average Convergence Divergence (MACD) line surpasses the zero line, it indicates a significant change in momentum favoring the bulls.

In simpler terms, if the MACD line consistently stays above its current resistance, it might prolong the upward trend but is expected to eventually reverse.

The Volume Oscillator displayed a series of decreasing peaks and valleys, indicating a bearish divergence with TRX‘s price trend.

A decrease in Funding Rates

Based on the data from Coinglass, I’ve noticed that the funding rate for TRX has been trending downward and even dipped into negative territory over the last 24 hours. This shift suggests that demand from investors in the Futures market has been waning.

Read Tron’s [TRX] Price Prediction 2024-25

Despite a rise of more than 12% in Open Interest during the past 24 hours, the price surge occurred concurrently.

As a researcher studying the cryptocurrency market, I would advise keeping a close watch on Bitcoin‘s [BTC] price trends and evaluating how those movements may influence the overall sentiment towards investing in the digital currency. Subsequently, this assessment can help inform your decision to buy or wait for better opportunities in the market.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-07-03 06:21