- TRX recorded gains of over 26.17% in the last 30 days

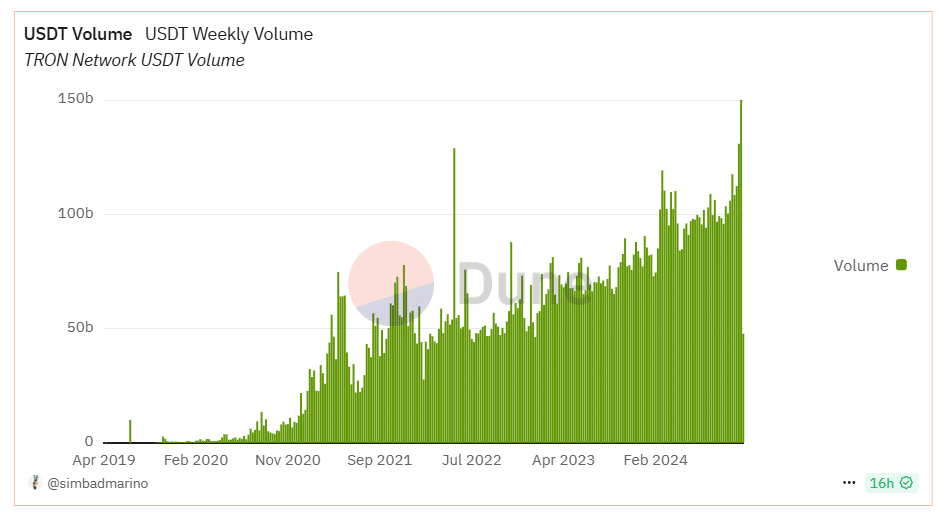

- TRON’s USDT weekly volume surpassed 150 billion – A sign of strong adoption

As a seasoned researcher with over a decade of experience in the crypto space, I can confidently say that the recent surge in TRON’s performance is noteworthy and promising. The 26.17% gain in just 30 days, coupled with the impressive weekly USDT volume of 150 billion, is a clear sign of strong adoption and investor confidence.

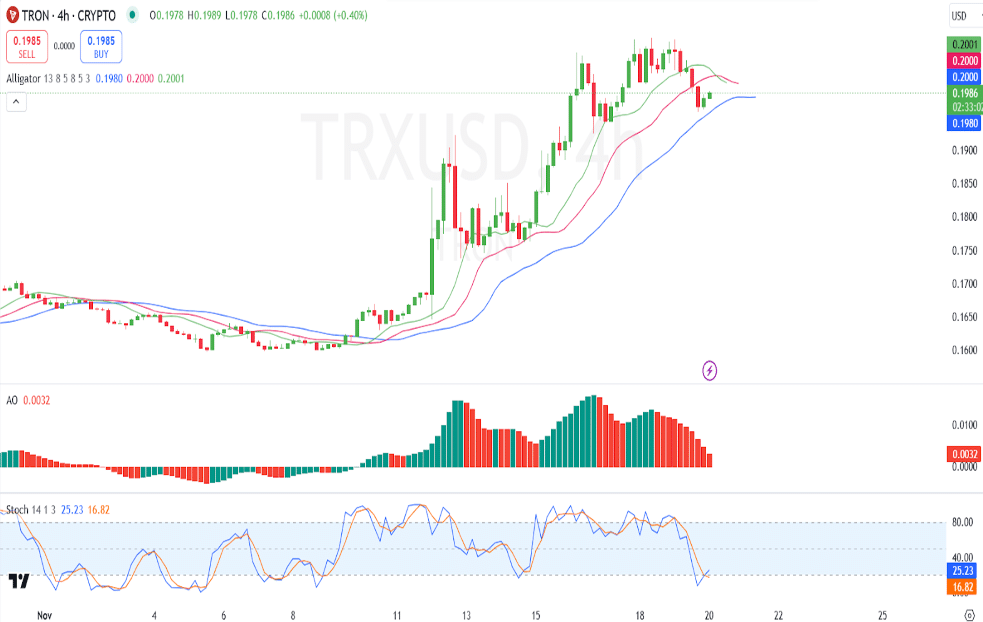

As a crypto investor, I’m excited to share that at the moment, TRON is worth approximately $0.1986, and its market capitalization has soared beyond the impressive figure of $17 billion. Over just the last seven days, this altcoin has shown remarkable strength, rising by an impressive 12.13% on the charts. This significant increase suggests a high level of investor confidence and a bullish outlook in the market.

Additionally, it’s worth mentioning that while focusing on pricing may overlook other significant aspects. In terms of TRON’s network activity, there has been a notable surge in the volume of USDT (Tether) transactions since 2019. This increase has been particularly evident in recent months.

In fact, weekly USDT volumes have now surpassed 150 billion – Underscoring TRON’s growing adoption as a preferred platform for stablecoin transactions.

TRON’s influence in the market could potentially grow stronger due to USDT’s status as the most prominent stablecoin, accounting for about 70% of the overall stablecoin market value. At the moment of reporting, this figure equated to a staggering $184 billion.

Previously mentioned, the hike in popularity of this trail is primarily due to TRON’s effective transaction handling, reasonable costs, and capacity to manage large transfer volumes. These aspects make it a compelling choice for those looking for both affordability and swiftness.

Through its high volume of transactions totaling $61.7 billion, TRON plays a pivotal role and is a key facilitator within the stablecoin market infrastructure.

Although USDC enjoys regulatory favor, USDT has surpassed other competitors by seeing an increase of 7.64% in market capitalization, a significant surge of 31.55% in monthly transfer volume ($1.95 trillion), and a rise of 7.99% in the number of active addresses (22.09 million) within the last month.

TVL’s recovery marks a robust year for TRON

TRON’s Total Value Locked (TVL) has shown substantial improvement since early November. Toward the end of last month, the numbers began to gain speed following a two-month decrease that started in September.

The bounce-back could be seen as evidence that investors are regaining trust and optimism towards the TRON network’s environment, as market circumstances improve.

At the beginning of the year, TRON’s Total Value Locked (TVL) was approximately $8 billion. It reached its highest point, $10 billion, in April. However, there were some ups and downs in the middle of the year.

Even though there was a decline from September to October, the strong rebound seen in November demonstrates TRON’s resilience to regain its footing. As I write this, the Total Value Locked (TVL) has settled around $7 billion.

Stochastic RSI points to a price rebound

According to the price graphs, Tron (TRX) appeared to be holding steady near approximately $0.1986. The significant support level was at $0.1930. If TRX dropped below this level, it might indicate the start of a temporary downtrend.

If the price surpasses $0.2070, it could potentially trigger a rise, aiming at the $0.2200 level which serves as a resistance point.

As the Alligator lines drew closer together, suggesting a slowdown in market movement and possibly impending consolidation. Keep an eye out for a crossover to verify if a potential trend reversal might occur. The Accumulation/Distinction Oscillator, on the other hand, hinted at decreasing bullish strength with the emergence of red bars – A clear signal of weakening buying interest. If it continues below the zero line, it could confirm a temporary bearish momentum.

To put it simply, the Stochastic RSI indicator indicated an oversold state at 25.23. This suggests that there could be a possible price shift or reversal ahead.

A bullish crossover here could trigger a recovery rally.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- Peter Facinelli Reveals Surprising Parenting Lessons from His New Movie

- Viola Davis Is an Action Hero President in the ‘G20’ Trailer

- 10 Must-Read Romance Manhwa on Tapas for Valentine’s Day

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-11-21 05:44