- TROY was trading near levels last seen in July 2023.

- The intense demand in recent days, if it continues, could push prices much higher.

As a seasoned crypto investor with over a decade of experience under my belt, I must say that the recent surge in TROY has caught my attention. Having witnessed numerous market cycles and trends, I can confidently say that this bull run is unlike any other. The 72% gain since Monday and the 300% increase in just ten days are numbers that rarely grace the crypto world.

Over the past few days, the value of the TROY [TROY] token has significantly increased. It rose approximately 72% since the trading session on Monday began. The previous week was particularly bullish as well, with the token climbing an impressive 259%. However, there was a slight correction over the weekend.

Despite the uncertainties surrounding the U.S. elections, many investors and traders have chosen to stay on the sidelines. However, the TROY token, with a market capitalization of $38.7 million, has remained undeterred. This token, which has been in circulation since January 2020, has seen a significant surge, rising approximately 300% over the past ten days.

Traders should prepare for more gains

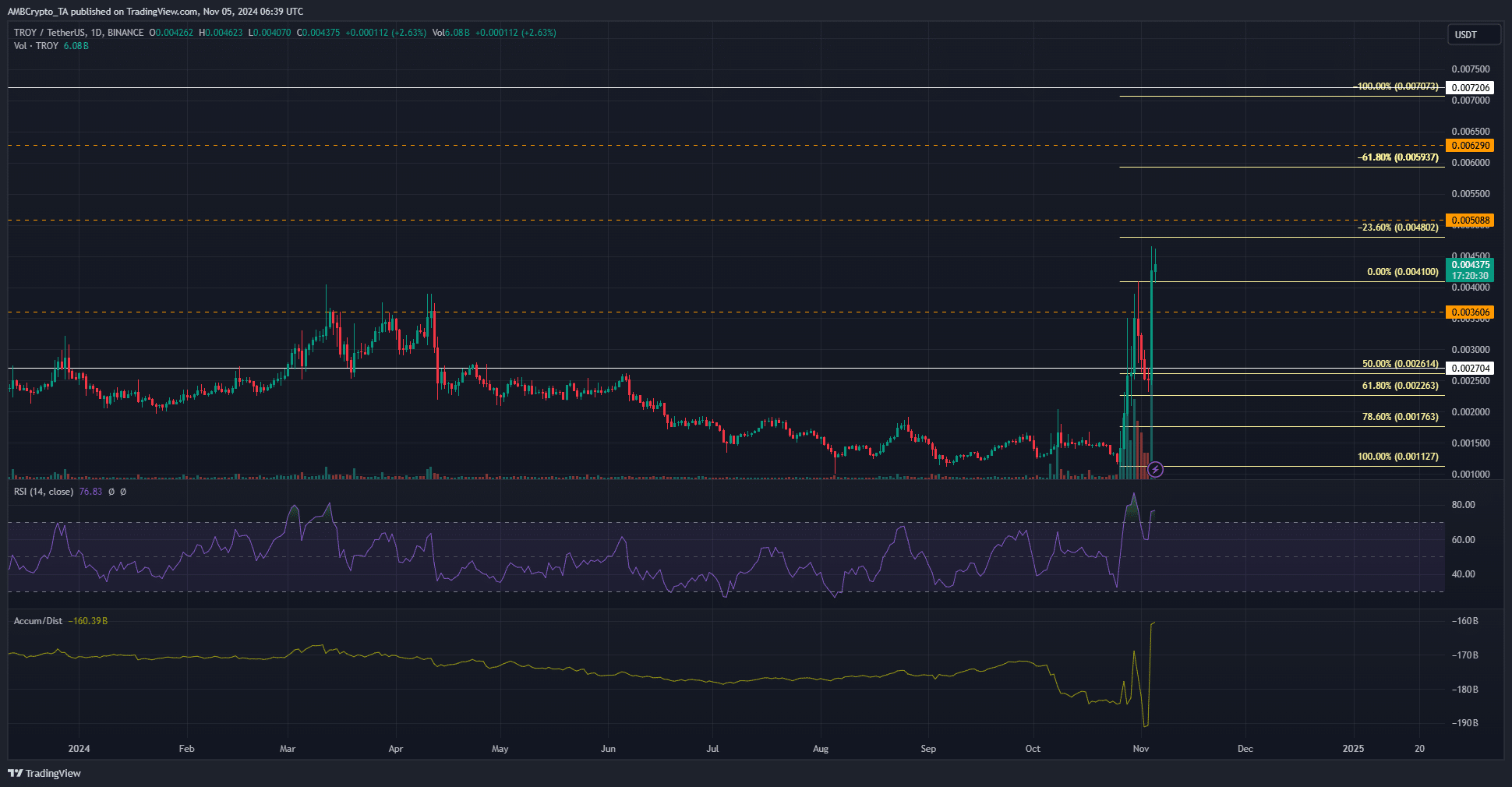

Over the past six and a half months, beginning from May, the TROY token has been moving downward. This decline took its peak on April 24th and hit its lowest point on October 25th, resulting in a loss of approximately 58.88%. However, recent price increases have pushed the value to levels not seen since July 2023.

On the daily chart, the A/D indicator showed clear signs of robust bullish sentiment and elevated buying interest. Despite the Relative Strength Index (RSI) exceeding the overbought level, it doesn’t automatically mean that a reversal or pullback will occur immediately.

As an analyst, I might express this strategy like so: “When I notice a bearish divergence occurring between the price action and the Relative Strength Index (RSI) of TROY, I find it advantageous to consider selling the stock. After observing a pullback in the price, I then look for an opportunity to re-enter the market.

The Fibonacci levels highlighted the $0.0048 and $0.0059 as the next bullish targets.

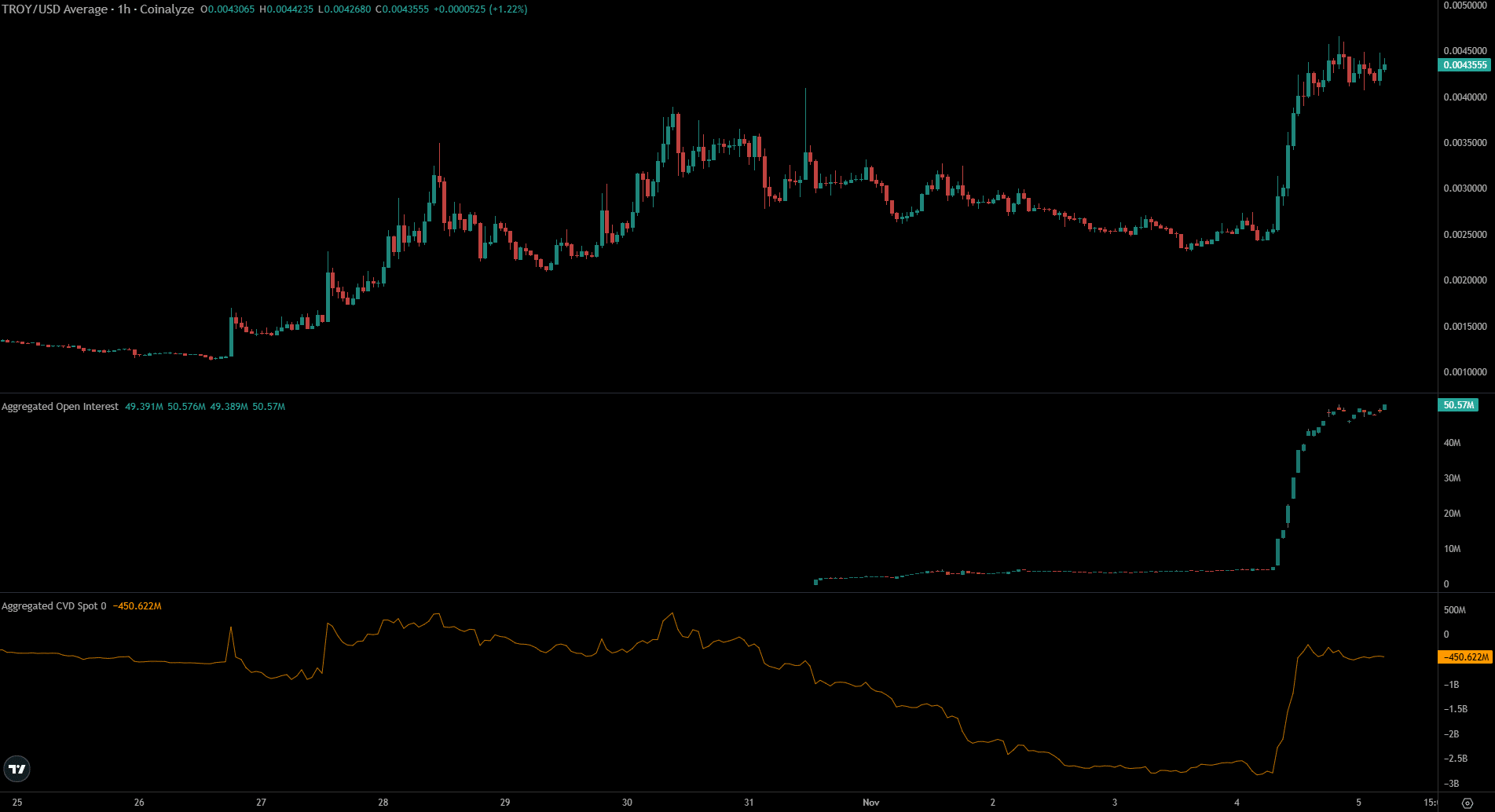

The high influx of Open Interest could see long positions hunted

Over the past ten days, the price has increased by almost three times (300%). Furthermore, within the last 24 hours, Open Interest grew by approximately $40 million, escalating from $4.3 million to about $50.57 million – a significant surge of around twelve times the initial amount.

This suggested that speculators were extremely optimistic, yet it also implied a potential situation where market participants might need to sell off aggressively to counteract overconfident buyers.

Is your portfolio green? Check the TROY Profit Calculator

The spot CVD also jumped higher. The demand in the market was high and the low market cap of the asset meant further growth was likely, but holders will need conviction. New entrants must be careful to limit their risk and not get caught bag holding TROY token.

Read More

2024-11-05 17:11