- Gary Gensler to step down as SEC Chair soon

- Paul Atkins’ appointment as SEC Chair and David Sacks as crypto czar could change things for good

As a seasoned crypto investor with over a decade of experience navigating the volatile world of digital assets, I have witnessed firsthand the rollercoaster ride that is the cryptocurrency market. From the exhilarating highs to the gut-wrenching lows, I’ve seen it all.

The year 2024 has been a remarkable one, with milestones such as the introduction of Spot Bitcoin and Ethereum ETFs, Bitcoin surging past $100k, and the historic fourth Bitcoin halving. However, the regulatory scrutiny from the U.S. Securities and Exchange Commission (SEC) under Chair Gary Gensler has cast a dark cloud over these achievements.

Gary Gensler’s aggressive crypto crackdown, which escalated with numerous legal disputes involving key players in the industry, sparked widespread criticism and calls for his resignation. While some legal battles began as early as 2020 or 2023, the full force of these actions was felt in 2024, with companies like Uniswap, Ethereum, ConsenSys, Robinhood, and Crypto.com receiving Wells Notices from the SEC.

The narrative shifted during Donald Trump’s presidential campaign, as he pledged to create a more crypto-friendly regulatory environment. His appointment of Paul Atkins as the incoming SEC Chair and David Sacks as the White House’s artificial intelligence and “crypto czar” has sparked optimism across the cryptocurrency industry.

As a long-time investor, I am cautiously optimistic about the changes that will unfold under the Trump administration. While some critics express concerns about investor protection, I believe that Atkins’ balanced approach—ensuring strong enforcement while fostering innovation—is the key to promoting trust and avoiding unnecessary rule-making beyond the SEC’s authority.

I am looking forward to 2025 with renewed optimism, as I watch the crypto market make headlines with surging prices and a more favorable regulatory environment. And, just like the market itself, who knows what surprises are in store? Maybe even a Solana ETF will become a reality!

As they say in crypto circles, “Beware of geeks bearing regulations.” But I’m ready to embrace the change and keep riding this wild ride.

2024 stood out as a pivotal year in the world of cryptocurrencies, characterized by significant advancements including the debut of Spot Bitcoin [BTC] and Ethereum [ETH] Exchange Traded Funds (ETFs), Bitcoin’s record-breaking climb above $100k, and the election of a president known for his pro-cryptocurrency stance, namely Donald Trump.

That’s not all either, with the year also noting the highly anticipated fourth Bitcoin halving.

SEC overview – 2024 snapshot

Meanwhile, this period of significant advancements has come alongside increased regulatory oversight. Notably, many cryptocurrency exchanges have faced legal issues with the U.S. Securities and Exchange Commission (SEC).

2020 and 2023 saw the commencement of certain legal disputes, like those with Ripple Labs and Coinbase, while others gained momentum and became more prominent in 2024.

Some organizations such as Uniswap, Ethereum, ConsenSys, Robinhood, and Crypto.com are said to have been sent Wells Notices by the United States Securities and Exchange Commission (SEC), according to reports.

These actions ignited a broad discussion among cryptocurrency enthusiasts, leading some to demand the resignation of SEC Chairman Gary Gensler.

Role of Gensler in Biden’s political exit

Worries grew that Gary Gensler’s tough stance on cryptocurrencies might negatively affect President Joe Biden’s administration, sparking concerns about potential wider political and financial consequences. Yet, despite encountering strong criticism, Gensler continued to stand firm in his views regarding cryptocurrencies, asserting:

“I remain committed to my stance on digital currencies.

Though cryptocurrencies only make up a minor portion of our total market, they represent a disproportionately large share of the scams, deceitful activities, and issues that plague the financial markets.

During Donald Trump’s presidential run, I found myself closely watching his promises. One of them that caught my attention was his vow to swiftly remove Gary Gensler from office once he assumed the presidency.

“I didn’t know he was that unpopular. Let me say it again, on day 1, I’ll fire Gary Gensler.”

Trump’s supportive stance towards cryptocurrencies sparked broad approval among the crypto enthusiasts, causing a significant wave of political change.

Although Vice President Kamala Harris was chosen as the Democratic candidate instead of President Biden for the election on November 5th, the Democrats struggled to attract many votes from the cryptocurrency community, which ultimately supported Donald Trump and the Republican party.

In simpler terms, it appears that the strong backing for Donald Trump’s policies within the cryptocurrency community significantly influenced the storyline of voters.

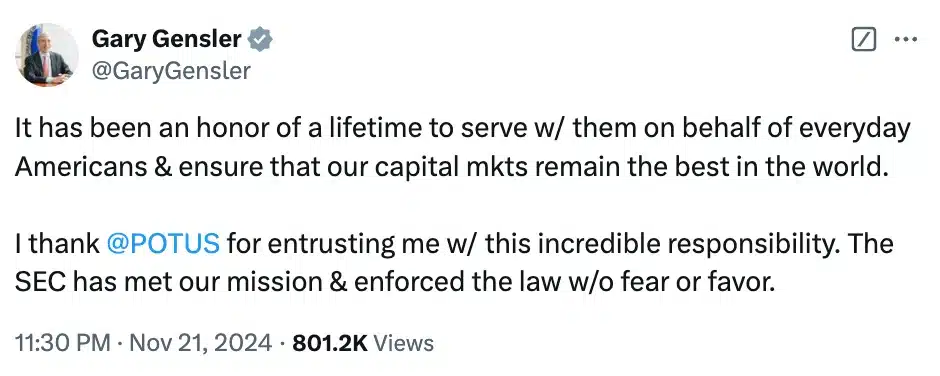

Gensler decides to step down

Under mounting criticism and changing political currents, Gary Gensler, the contentious head of the U.S. Securities and Exchange Commission (SEC), announced his intention to resign in the near future.

On platform X, Gensler announced his intention to step down from his position as SEC Chairman, with the departure taking place on January 20, 2025.

Trump nominates Paul Atkins as SEC Chair

It came as a shock that Wall Street generally approved of President-elect Donald Trump’s choice of experienced D.C. lawyer Paul Atkins to head the SEC. During the George W. Bush presidency, Atkins served as an SEC commissioner, earning a reputation for his pro-market and forward-thinking stance.

Trump’s declaration emphasized Atkins’ recognition that digital assets are crucial for “Making America Great Again and Beyond,” suggesting a major change in the regulatory stance.

Remarking on the same, Asymmetric CEO and CIO Joe McCann said,

This individual excels at completing tasks effectively, ensuring the safety of both citizens and consumers. He seems to be an ideal fit for the SEC due to his practical approach, which has been positively recognized within the crypto industry, particularly by entrepreneurs and U.S. investors.

Trump creates a new role – ‘Crypto Czar’

In this strategic shift, I find myself serving as an analyst, reporting that President Donald Trump has chosen David Sacks for a significant role: the White House’s AI and “crypto czar.” Known for his entrepreneurial prowess and tech investments, Sacks is tasked with leading policies in our fast-paced artificial intelligence and cryptocurrency sectors.

The combination of this announcement and Donald Trump’s selection of Paul Atkins for the position of SEC Chairman has ignited hope throughout the cryptocurrency sector.

Under the expected shift in leadership within the administration, there is optimism that the regulatory climate for cryptocurrencies may become more accommodating. This could open doors for advancements such as a Solana Exchange Traded Fund (ETF) and further ETF approvals over the next few years.

Atkins’ potential SEC Chair role sparks debate

Remarking on the same, Bloomberg analyst James Seyffart noted,

Based on my years of experience working within the financial industry and closely following the regulatory landscape for cryptocurrencies, it is clear that Gensler’s SEC has been quite critical towards crypto. They have shown no willingness to create clear guidelines or rules, which I believe is a major setback for the industry. However, if the SEC becomes less confrontational and more open-minded about the space in the future, I think it would be a significant positive development, as it could lead to greater certainty and stability within the crypto market, ultimately benefiting investors like myself.

On the other hand, although the cryptocurrency community is thrilled about it, some skeptics argue that the lax regulatory approach advocated by Atkins could potentially expose investors to certain risks regarding their protection.

Furthermore, figures such as Senator Elizabeth Warren have voiced apprehensions regarding his business ties and a perceived preference for lenient regulations.

What to expect in 2025?

Although harboring some doubts, Atkins has made it clear that he doesn’t plan on completely revamping the Securities and Exchange Commission (SEC). Instead, his focus seems to be on making improvements rather than a full-scale transformation.

Rather than relying solely on strict enforcement, his vision advocates for a harmonious strategy. This involves enforcing rules stringently to safeguard public interests, all the while encouraging innovation without imposing excessive regulations that exceed the SEC’s jurisdiction.

Furthermore, Atkins intends to boost openness across the SEC and autonomous regulatory bodies, working towards a regulatory structure that fosters trust while avoiding unnecessary hindrances in advancement.

Given my years of experience in the financial world, I have observed that when a new president takes office, there is often a ripple effect on various markets, including cryptocurrency. In light of Donald Trump’s upcoming inauguration on January 20, 2025, I am noticing a significant increase in activity within the crypto market. The surging prices and renewed optimism are making headlines, leading me to believe that this could be an exciting time for investors.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2025-01-03 19:05