-

BTC hit a two-week high above $65K after Trump attack.

The macro and US political scenes look great for BTC, despite Mt. Gox’s supply.

As a seasoned financial analyst with over a decade of experience in the markets, I have witnessed numerous events that have shaped the crypto landscape. The recent surge in Bitcoin (BTC) price to a two-week high above $65K is an intriguing development, fueled by a confluence of factors.

Bitcoin‘s value rose by 7% over the past week, surpassing $65,000. This growth can be attributed to positive developments within the cryptocurrency market as well as significant news from the United States political sphere.

Last week, the German government cleared its $50K BTC supply pressure, which was a set-up for BTC’s recovery. After bottoming out below $55K, BTC recovered and reclaimed $60K, rallying 8.8% last week.

Trump boosts Bitcoin recovery?

During this week, the digital currency bounced back and surpassed $65,000 as its recovery continued. The bullish trend aligned with the unsuccessful assassination attempt against former President Donald Trump on July 13th.

The crypto community has welcomed Ohio Senator James David Vance, Trump’s Vice President pick, due to his pro-crypto stance. Reports indicate that Vance advocated for various crypto-related bills, such as the repeal of SAB 121, and personally holds Bitcoin.

Reacting to Trump’s VP pick, Ryan Adams of Bankless stated,

JD Vance, who is currently being considered as Donald Trump’s running mate for the upcoming presidency, has made it clear that he is a strong advocate for cryptocurrencies. He previously voiced his opposition to the repeal of SAB121 and owns a significant amount of Bitcoin – approximately $250,000 in 2022, likely holding more now. In multiple open letters, Vance has publicly criticized Gary Gensler’s actions regarding cryptocurrencies. This growing body of evidence suggests that a Trump administration under the leadership of JD Vance would be favorable towards the crypto sector.

It’s intriguing that Bitcoin experienced its greatest daily growth of the week, amounting to a 6% surge, concurrently with Trump’s vice presidential pick announcement on July 15th.

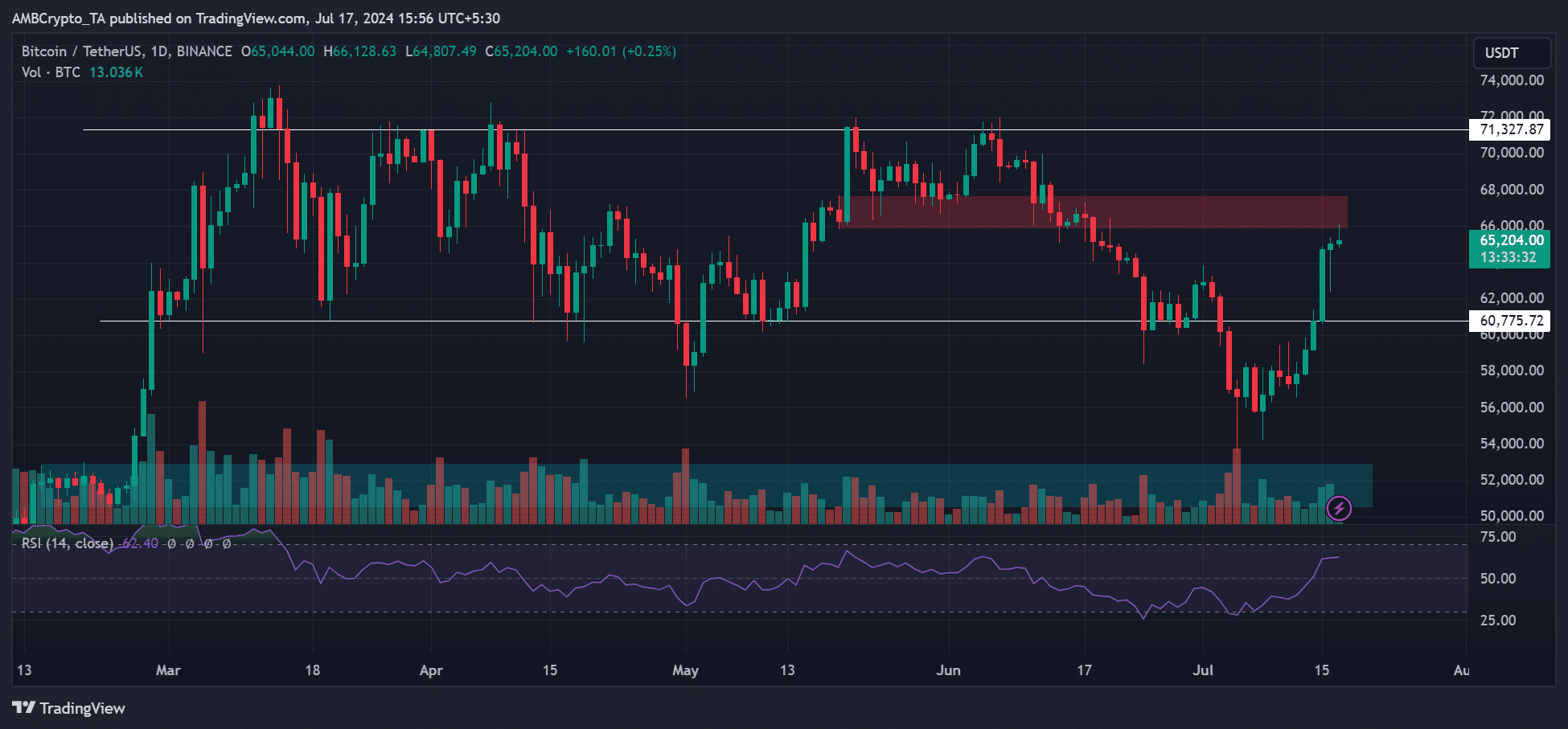

Can BTC push above $67K

Despite encountering a setback with the recovery approaching a roadblock around $67,000, as indicated by the red marker on the BTC price chart, Cryp Nuevo maintains an optimistic outlook. The analyst believes that the asset might still reach and even surpass the $70,000 level in the short term, despite this temporary obstacle.

Based on the observations of certain market experts, the ongoing Mt. Gox repayment process, involving over 30% of Bitcoin in circulation, may not significantly hinder the current recovery of Bitcoin’s price. At present, Bitcoin has managed to maintain its value above $65,000 despite this major transaction.

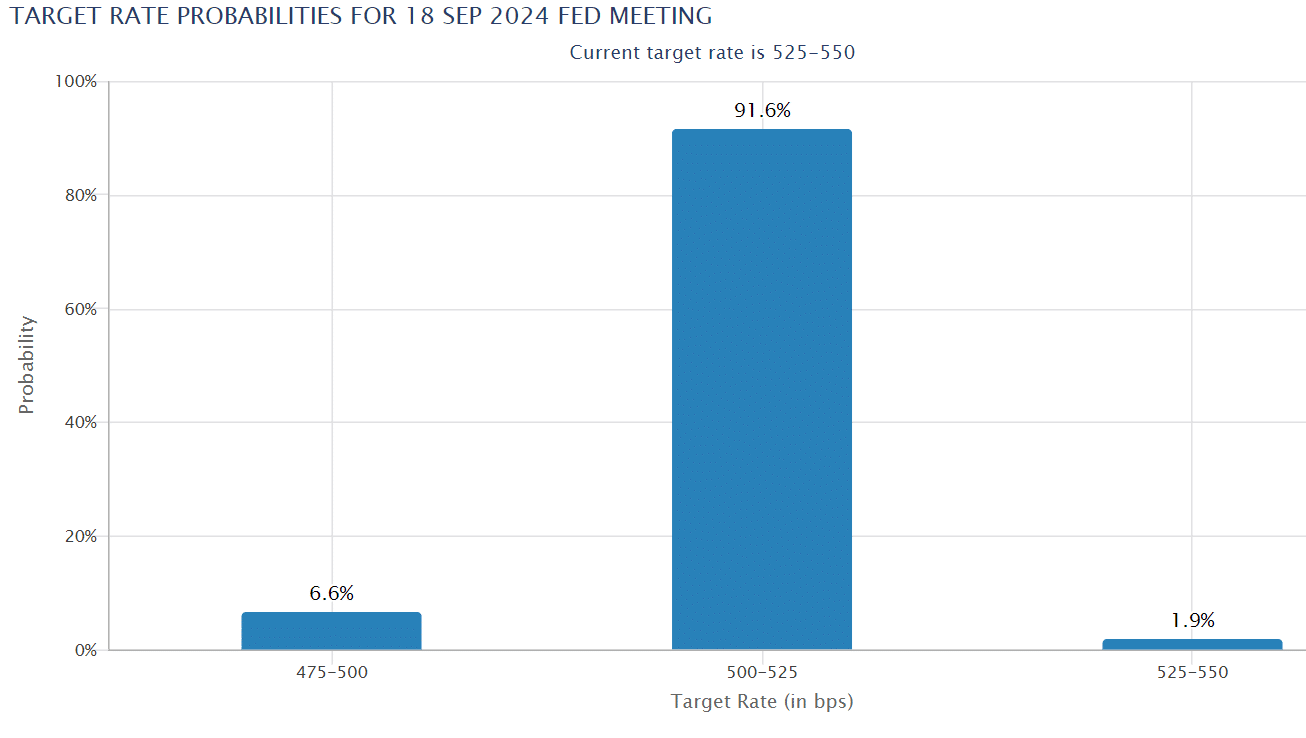

Currently, there’s a positive forecast for the future, with a strong bias towards growth from a broader viewpoint. Approximately 90% of experts on interest rates predict that the Federal Reserve will reduce rates in September. This potential reduction could stimulate various risk assets, including Bitcoin and the crypto market.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-07-17 19:03