- Trump advocates retaining Bitcoin, viewing it as a strategic asset for the U.S.

- Polls show Trump leading over Harris, influenced by crypto engagement.

As a seasoned crypto investor with a decade-long journey through the digital asset landscape, I find myself intrigued by Trump’s recent remarks on Bitcoin and its potential role in U.S. strategy. Having witnessed the meteoric rise of BTC from mere pennies to tens of thousands of dollars, I can attest to its transformative power and potential benefits for countries that embrace it.

⚠️ Market Meltdown? EUR/USD Braces for Trump Tariff Fallout!

Explosive analysis shows why EUR/USD could face extreme moves ahead!

View Urgent ForecastFollowing his support for Bitcoin [BTC] and the cryptocurrency sector during his presidential campaigns, the former President Donald Trump is back in the spotlight due to his recent comments about Bitcoin.

Trump weighs in on Bitcoin again

During a recent online chat with well-known personality Adin Ross, Trump cautioned the present government against offloading America’s Bitcoin reserves.

As a seasoned cryptocurrency investor with years of experience under my belt, I found myself intrigued by the recent news about the government transferring 29,800 Bitcoins, valued at around $2 billion, to an unknown address. Having closely followed Bitcoin’s meteoric rise and occasional falls, I couldn’t help but wonder about the implications of such a significant transaction.

Stressing on the importance of holding Bitcoin, Trump said,

As a seasoned investor with decades of experience under my belt, I strongly believe that we should focus our efforts on building something innovative rather than imitating others. The world is constantly evolving, and staying ahead of the curve is crucial for success. Take cryptocurrencies, for instance – they are a modern form of currency that is gaining widespread acceptance, and if we don’t jump on board, countries like China will leave us in the dust. It’s not just about keeping up with the Joneses; it’s about staying competitive and relevant in today’s fast-paced world. I’ve seen companies rise and fall based on their willingness to embrace change and take risks, and I don’t want to see our industry get left behind. So let’s put our heads together and come up with something that sets us apart from the rest, because if we don’t, someone else will.

In this context, it seems like he is of the opinion that holding Bitcoin could potentially offer strategic advantages for the nation. This could be in the form of a long-term investment or as a significant financial resource.

Election tactic?

In this context, it’s worth pointing out that since he is no longer holding office, his statements might be an effort to impact public sentiment or sway crypto-voters for the upcoming election.

Moving further in the live stream, he also appreciated Bitcoin by saying,

“This is a highly contemporary digital money. It’s a cutting-edge concept, and I’m acquainted with many intelligent and reputable individuals who are deeply involved in this field and market. They believe it holds great potential for growth.”

Yet, his explanation seemed insufficient to showcase his comprehensive knowledge about cryptocurrencies, sparking suspicions among some that it might have been a strategic political move instead.

It’s possible that his statements during his Fox Business interview might have influenced this perspective, suggesting it could be somewhat inaccurate.

“Perhaps someday, instead of owing the $35 trillion, we’d write a cryptocurrency check, perhaps in the form of Bitcoin, effectively eliminating that debt.”

In his speech, he highlighted differences between Bitcoin and conventional banking, proposing a hypothetical scenario where the United States might distribute a Bitcoin payment equivalent to $35 trillion to pay off the country’s debt.

Kamala Harris struggles to attract crypto voters

From my perspective as a researcher, it’s evident that Vice President Kamala Harris’s relatively scant interactions with the cryptocurrency community and her past skepticism towards cryptocurrencies have potentially provided an advantage to Donald Trump in our ongoing analysis of public sentiment regarding digital currencies.

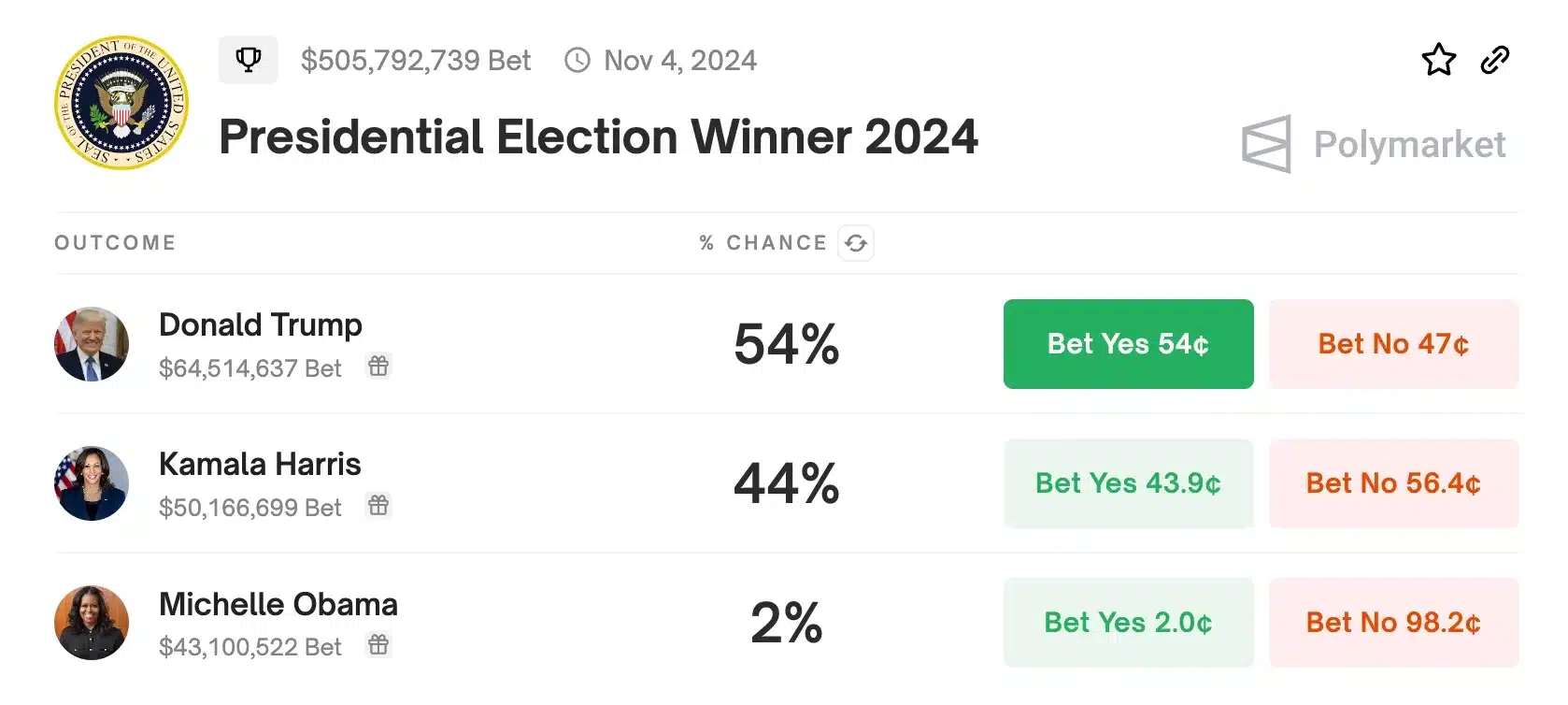

In other words, Polymarket’s forecast data underscored Trump having a significant lead in the polls with approximately 54% of the votes cast, contrasted by Harris who trailed behind with around 44% of the votes.

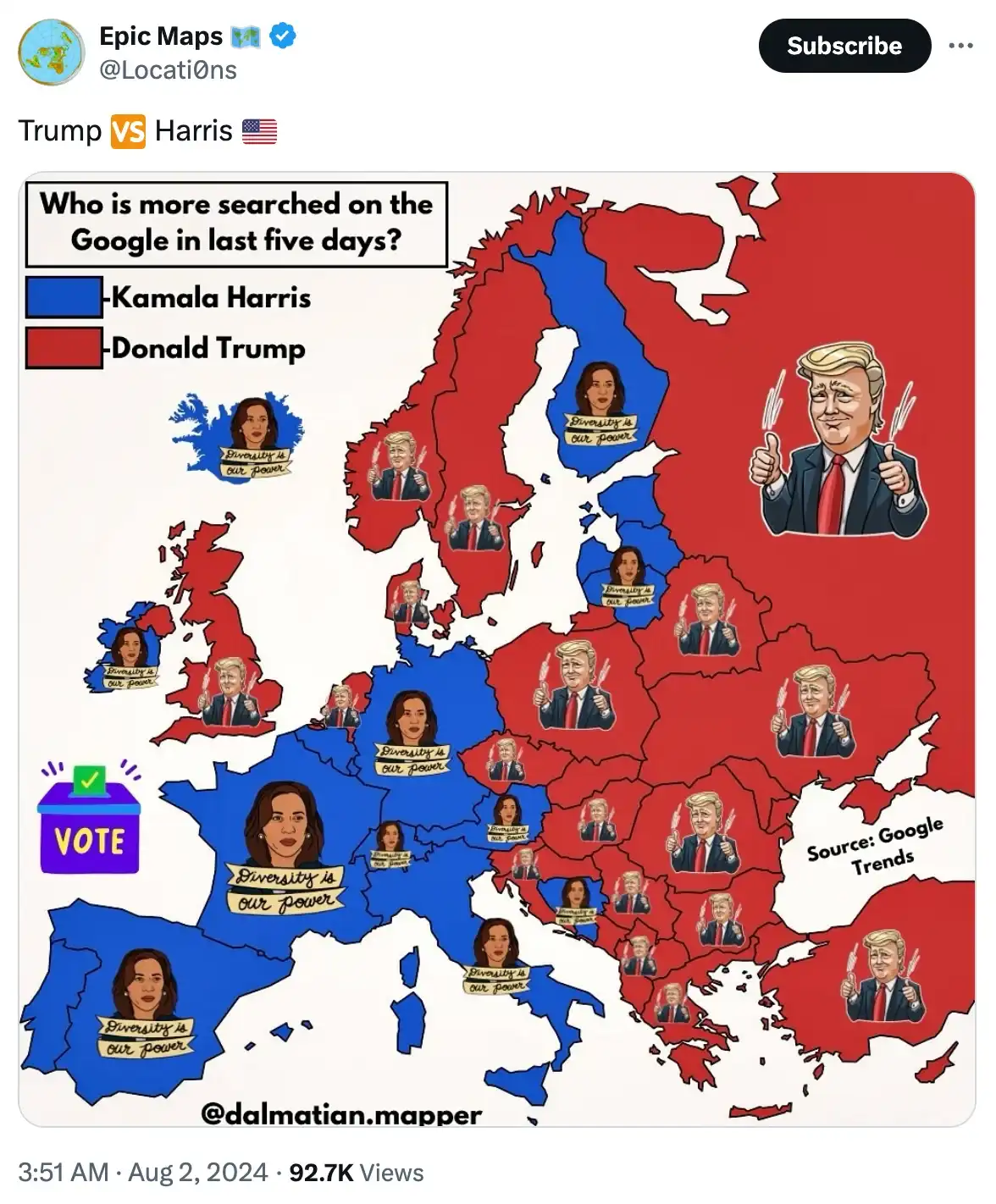

Amidst the latest update from Epic Maps, I find myself in a state of uncertainty regarding the election’s final result.

Regardless of who wins the 2024 elections, the prominence of cryptocurrency in the campaign underscores its possible benefits for America’s future.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Elon Musk’s Wild Blockchain Adventure: Is He the Next Digital Wizard?

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- BLUR PREDICTION. BLUR cryptocurrency

2024-08-06 16:08