- Bitcoin’s market buzz intensified ahead of Trump’s inauguration, signaling a pivotal moment for investors

- Crypto market cap declined by over 3% in the last 24 hours

In anticipation of a notable event, Bitcoin investors are keeping a keen eye on Donald Trump’s inauguration scheduled for January 20, 2025. Given his recent stance favoring cryptocurrencies, Trump’s second term in office might bring about substantial shifts within the digital currency sector.

There’s a lot of discussion going on right now, wondering if this political occurrence might lead to an increase in Bitcoin value (a new rally) or cause some people to sell their Bitcoin for quick gains (short-term profit-taking).

Market optimism surrounding Trump’s inauguration

The second term of Donald Trump as U.S. President has sparked renewed hope within the cryptocurrency market. His supportive stance on cryptocurrencies, a marked contrast from his previous doubts, has fueled anticipation for policies that may benefit digital assets. After Trump’s victory in the 2024 elections, Bitcoin experienced a substantial surge, reaching $73,000 and peaking at $108,000 as investor confidence flourished.

This optimism arises because of the possibility for more defined regulations and increased institutional support during his term. These elements have fueled increased discussions about Bitcoin’s upward trend possibly continuing, particularly given the prospect of enhanced institutional involvement.

Bitcoin’s post-election performance and investor sentiment

After Trump’s potential win in 2024, the price of Bitcoin has soared over $90,000, demonstrating strong investor confidence. Institutional investments have significantly impacted this rise, with the approval of Bitcoin spot ETFs acting as a major factor accelerating the bullish trend.

As an analyst, I’ve observed a substantial withdrawal of funds (net outflows) from cryptocurrency exchanges, suggesting that large-scale investors like whales and institutions are actively amassing Bitcoin (BTC). This trend underscores my faith in the long-term viability of BTC.

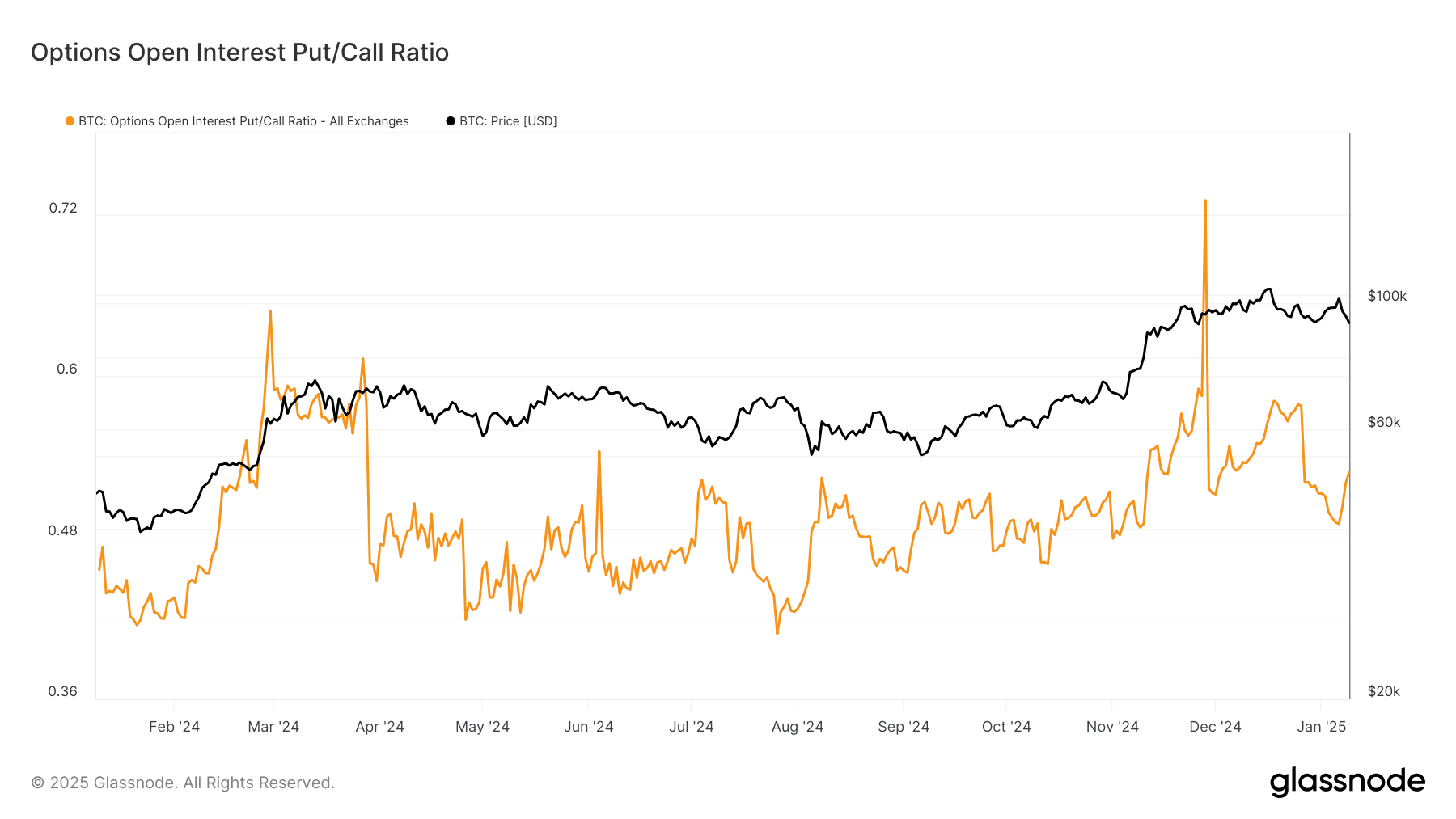

It appears that a change in investor mentality has been hinted at by the Options Open Interest Put/Call Ratio. The increased demand for call options suggests a surge in market optimism, indicating expectations of continued price increases. This inclination aligns with predictions of beneficial policies and technological advancements under President Trump’s administration.

BTC’s correlation with Gold and DXY

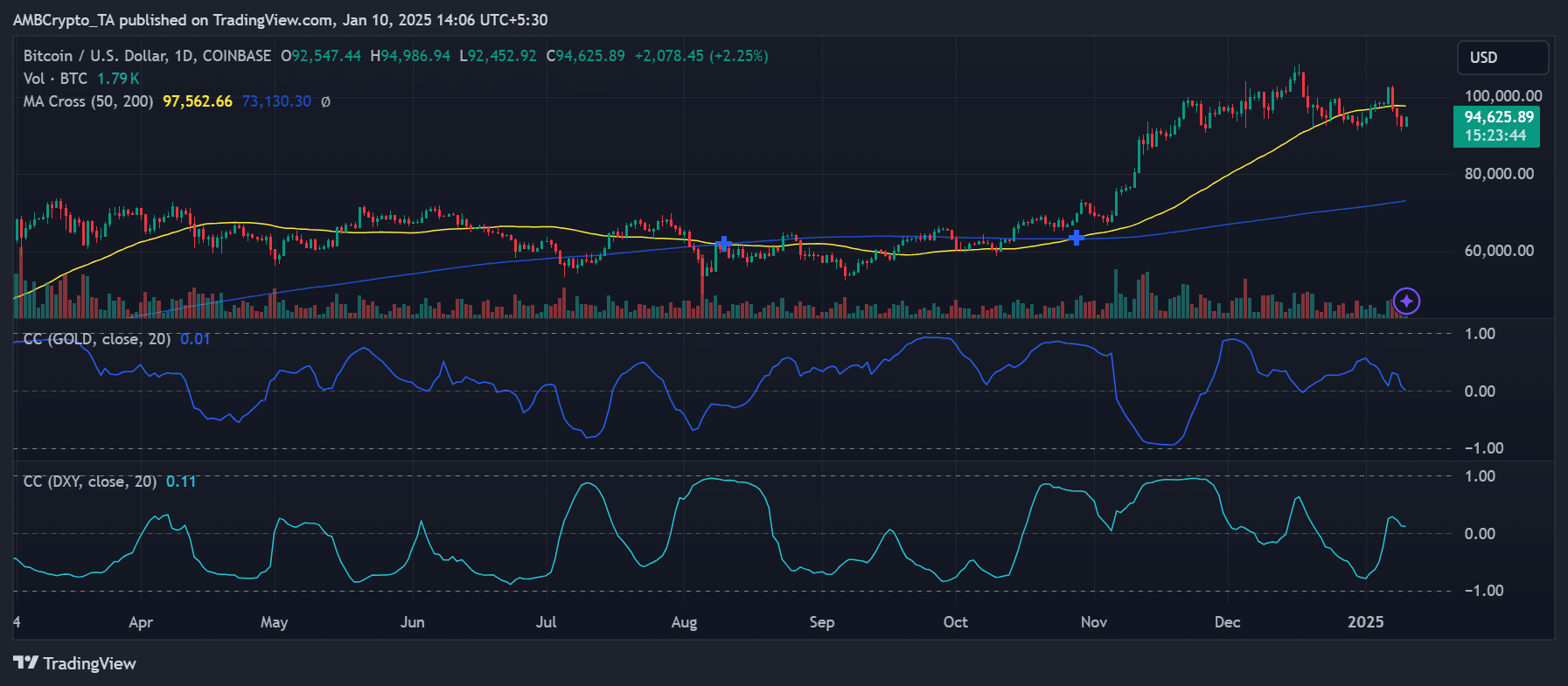

Examining the relationship between Bitcoin, Gold, and the U.S. Dollar Index (DXY) provided valuable perspectives on its recent market behavior. The graph demonstrated that Bitcoin tends to rise when Gold does, suggesting it functions as a protective asset during uncertain economic conditions.

At the same time, the decreasing relationship with the DXY index showed that Bitcoin reacted to changes in the U.S. dollar’s value. In other words, a falling U.S. dollar might boost Bitcoin’s growth, acting like a favorable wind behind it.

The connections between Bitcoin and various economic factors highlight its developing story as an asset that can function both as a safe haven during turbulent times and a speculative investment, based on broader economic circumstances. This two-sided nature makes Bitcoin stand out in the financial marketplace, drawing interest from numerous investors.

Cautious optimism – A ‘buy the news’ or ‘sell the news’ event?

While there’s excitement about Trump’s positive stance on cryptocurrencies, it’s crucial to exercise caution. Past patterns show that major events can trigger profit-taking, causing temporary market fluctuations. The possibility of a “sell the news” event should not be disregarded, considering the speculative purchases fueling Bitcoin’s recent surge.

Furthermore, there’s a lot of uncertainty about the policies that President Trump will actually put into action. Although his campaign statements suggested a positive stance towards cryptocurrencies, investors are eagerly waiting for concrete actions to confirm these expectations. If he takes any steps that are perceived as missteps, it could dampen the current excitement in the market.

What lies ahead for Bitcoin and the crypto market?

As Trump’s inauguration approaches, there’s a blend of hopefulness and apprehension in the air. Factors like regulatory guidelines, institutional actions, and economic trends will determine Bitcoin’s path. Although Trump’s administration may offer a favorable environment for digital currencies, the longevity of the current surge hinges on how the market reacts to these upcoming changes.

As a researcher, I find the interplay between Bitcoin’s value and gold, as well as the U.S. Dollar Index (DXY), fascinating in shaping its price movements. In light of the forthcoming policies under President Trump in 2025, there’s a compelling argument to be made that Bitcoin could outshine other assets. This unique digital currency seems to straddle the lines between traditional safe-havens like gold and high-growth assets, making it an intriguing prospect for investors.

The question remains: will President Trump’s inauguration serve as the catalyst for a prolonged crypto era or merely a brief speculative surge? The answer could very well determine the trajectory of Bitcoin in 2025 and beyond.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2025-01-11 06:19