- Mr. Trump’s executive decree doth call for the establishment of a U.S. Bitcoin reserve, employing the existing cryptocurrency assets held by the government.

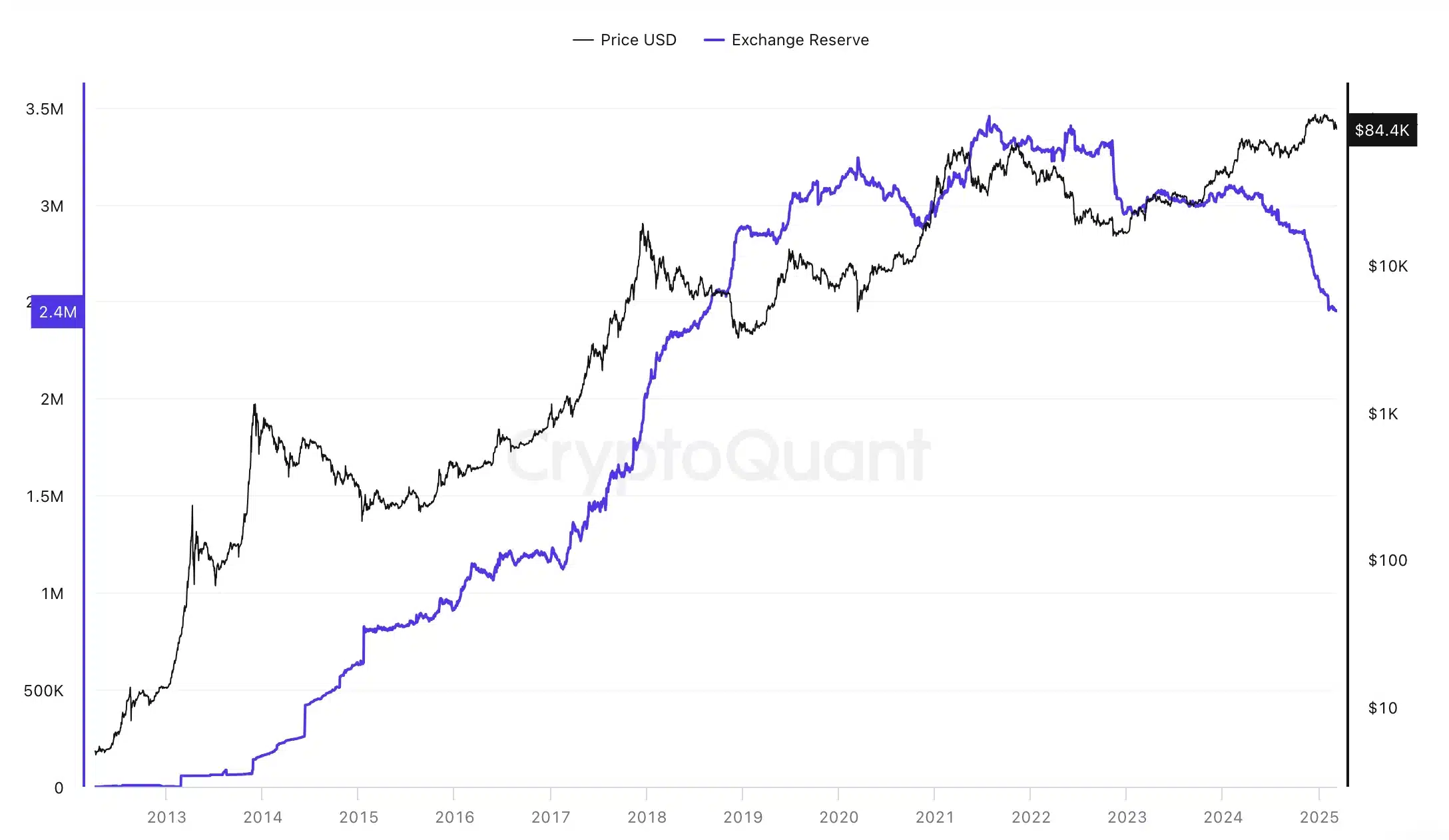

- The dwindling exchange reserves do signal a bullish sentiment, yet they raise eyebrows regarding market liquidity.

In a most audacious maneuver, the President of the United States, Mr. Donald Trump, hath embarked upon a momentous journey to entwine cryptocurrencies within the very fabric of the nation’s financial stratagem. One might say, “What a time to be alive!” 😄

Trump’s Bitcoin Reserve plan takes shape

On the sixth day of March, Mr. Trump did affix his signature to an executive order, thereby establishing a strategic reserve of digital assets, making use of tokens already in the government’s possession, rather than indulging in the acquisition of new ones—much to the chagrin of market expectations for fresh purchases. Alas!

In a display of utmost exclusivity, Mr. Trump convened a summit at the White House, inviting the crème de la crème of cryptocurrency leaders, to expound upon his vision for a government-backed crypto stockpile. One can only imagine the delightful conversations that ensued over tea! ☕️

This unprecedented engagement doth signal a shifting regulatory landscape, with potential ramifications for Bitcoin [BTC] and the broader digital asset market. How thrilling! 🎉

Moreover, the prospect of the U.S. establishing a Bitcoin reserve hath gained considerable momentum, with market predictions shifting from a modest 24% to a more ambitious 32%, as per the data from Polymarket.

This burgeoning speculation hath ignited discussions across several states, with Utah, Arizona, and Ohio actively pondering the implications of a government-backed Bitcoin reserve. Yet, not all states are inclined to join this merry band—South Dakota, Montana, and others have resolutely rejected such legislative endeavors. How very contrary! 😏

As opinions continue to diverge, the anticipation surrounding a U.S. Bitcoin reserve doth intensify, much like the suspense in a well-crafted novel.

Why are exchange reserves declining?

Meanwhile, exchange reserves are plummeting, indicating a potential supply squeeze, as noted by the astute Moon Whales. One might wonder if they are indeed whales or merely very large fish! 🐋

“The US is creating a Strategic #Bitcoin Reserve. Meanwhile, exchange reserves are in free fall.”

Data from CryptoQuant further reinforces this trend, revealing that exchange reserves continue to decline. A curious affair, indeed!

Investors are increasingly transferring their holdings to private wallets, demonstrating a preference for long-term storage over the immediate allure of selling. How prudent! 🧐

A shrinking exchange reserve often indicates bullish sentiment, as a reduced supply may create a potential supply squeeze should demand rise. Quite the conundrum!

This trend also reflects a growing interest in DeFi, staking, and cold storage solutions for enhanced security and alternative yield opportunities. One must always be prepared for the unexpected!

While lower reserves may indeed boost prices, they may also diminish market liquidity, thus increasing volatility due to fewer tradable assets. A double-edged sword, if ever there was one!

What lies ahead?

Meanwhile, Bitcoin’s price remains under pressure, trading at $84,557.57, at the time of this writing, after a 1.89% drop in the past 24 hours, according to CoinMarketCap. How very dramatic! 🎭

Additionally, certain segments of the market continue to exhibit bullish optimism, anticipating long-term gains, yet the overall momentum appears rather fragile. A delicate balance, indeed!

As one might expect, these shifts have kept traders in a state of delightful suspense, with Bitcoin’s next move likely hinging upon broader adoption trends and institutional interest. How thrilling it is to be a part of this unfolding drama!

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Rick and Morty Season 8: Release Date SHOCK!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

2025-03-10 08:16