- In a move that could only be described as both audacious and bewildering, Trump’s Executive Order has birthed a federal task force, tasked with the dual mission of regulating and promoting the wild frontier of cryptocurrency markets.

- Bitcoin, ever the drama queen, responded with a rollercoaster of price movements, oscillating between optimism and sheer panic, as if it were auditioning for a part in a tragicomedy.

Ah, the illustrious President Donald Trump, in a whirlwind of activity, signed a series of executive orders within the first three days of his reign. On the 23rd of January, after what felt like an eternity of speculation, he finally unveiled his Executive Order on cryptocurrency. The air was thick with anticipation, and one could almost hear the collective gasp of investors pondering the fate of their digital fortunes.

Key highlights of the Executive Order on cryptocurrency

Dubbed “Strengthening American Leadership in Digital Financial Technology,” this executive order is nothing short of a watershed moment, laying the foundation for a more structured approach to the adoption of digital assets. Among its ambitious objectives, the order seeks to:

- Establish a federal task force to oversee cryptocurrency regulations, ensuring consumer protection while simultaneously encouraging innovation—because who doesn’t love a good paradox?

- Promote the development of U.S. dollar-backed stablecoins, a strategic maneuver to assert dominance in the global financial arena, as if waving a flag that reads, “We’re still in charge!”

- Prohibit the introduction of a U.S. central bank digital currency (CBDC), citing risks to monetary sovereignty—because who needs a digital dollar when you can have a good old-fashioned paper one?

- Explore a reserve system for cryptocurrencies acquired through enforcement actions, hinting at a willingness to embrace digital assets within the hallowed halls of government finance.

These provisions reveal a delicate dance, blending support for innovation with a watchful eye on the lurking specters of fraud and market volatility. Quite the balancing act, wouldn’t you say?

How the market reacted to the executive order on cryptocurrency

The announcement of this executive order sent ripples through the market, a mix of excitement and trepidation. Bitcoin (BTC), the reigning monarch of cryptocurrencies, experienced immediate volatility, as if it were caught in a tempest of emotions. Some investors viewed this as a beacon of regulatory clarity, while others hesitated, gripped by the uncertainty of what lay ahead.

A detailed look

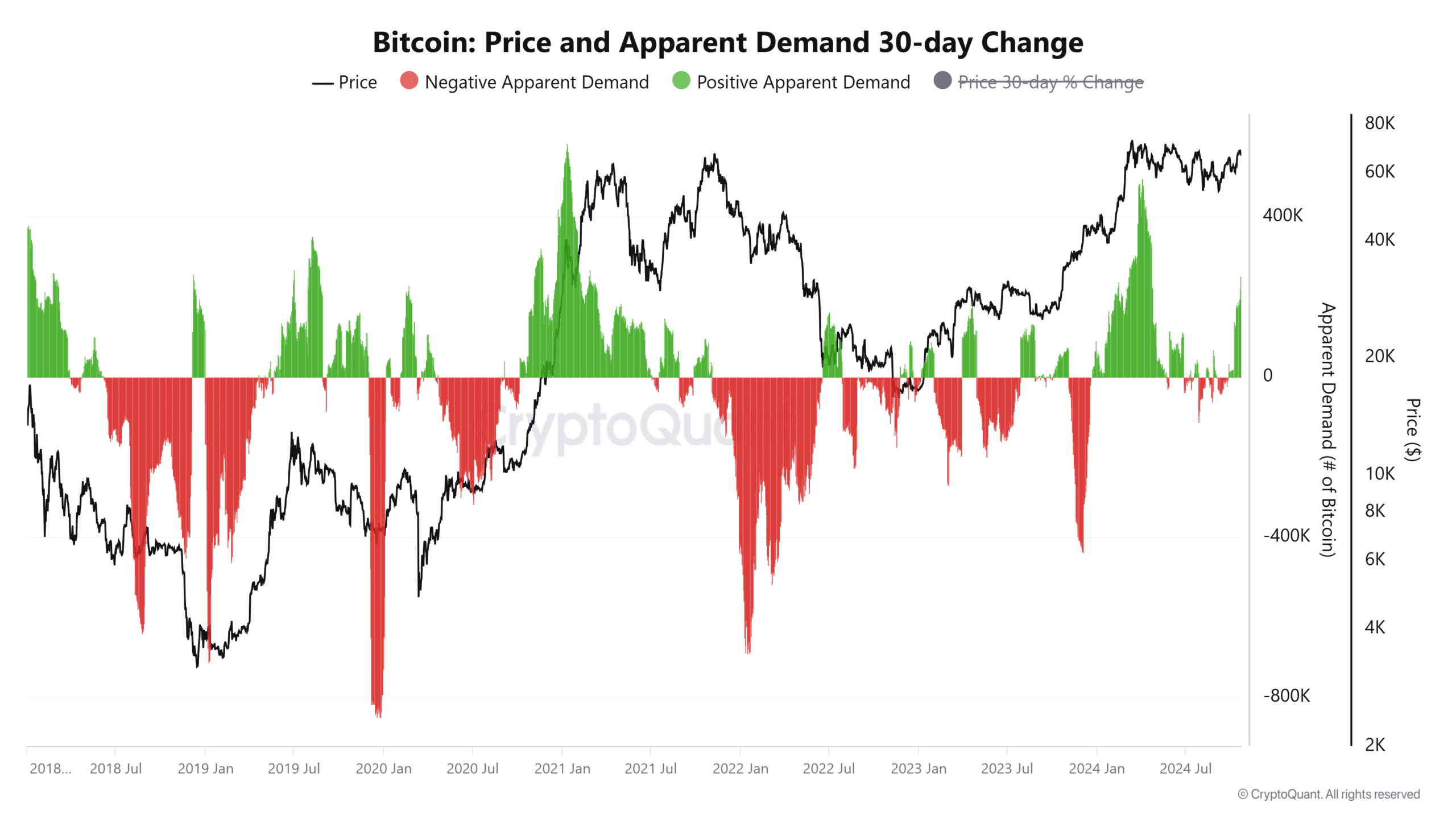

The chart, a veritable tapestry of Bitcoin’s price trajectory, reveals the tumultuous 30-day changes in apparent demand. In the days surrounding the Executive Order, Bitcoin’s price danced with heightened volatility, a performance worthy of the grandest stage.

The initial announcement sparked a flicker of optimism, a slight uptick in price, as traders momentarily basked in the glow of potential regulatory clarity. Yet, as the dust settled, the price retraced, leaving many to ponder the long-term implications of this newfound oversight.

Simultaneously, a sharp increase in positive apparent demand coincided with the order’s release, hinting at a surge of buying interest. It seemed investors were momentarily convinced that clearer regulations might just lure institutional capital into the fray. However, the chart also revealed periods of negative apparent demand, a reflection of profit-taking and uncertainty among retail investors. Ah, the sweet irony of optimism battling apprehension!

Implications for the cryptocurrency ecosystem

Trump’s Executive Order on cryptocurrency could herald a significant turning point for the industry. By prioritizing stablecoin development and opposing CBDCs, the order seeks to protect U.S. economic interests while fostering blockchain innovation. Yet, the market’s mixed reaction underscores the necessity for more detailed implementation plans to soothe investor anxieties.

For Bitcoin, this executive order serves as a barometer of market sentiment, its price movements and demand dynamics underscoring the cryptocurrency’s sensitivity to policy changes. In this ever-evolving landscape, regulatory predictability emerges as the holy grail for nurturing long-term growth. Who knew that the world of digital currency could

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2025-01-24 16:09