-

Bitcoin and Ethereum ETFs experienced significant outflows on the 1st of October, totaling millions.

U.S. election results could shape the regulatory landscape for XRP and SOL ETFs.

As an analyst with over a decade of experience navigating the ever-evolving financial landscape, I find myself intrigued by the current state of the crypto ETF market and its potential ties to the U.S. presidential election.

On October 1st, there were substantial withdrawals from Bitcoin [BTC] and Ethereum [ETH] investment funds that trade on exchanges (Exchange-Traded Funds, or ETFs).

BTC ETFs saw withdrawals totaling $242.6 million and ETH ETFs recorded outflows of $48.6 million.

Can Trump boost SOL and XRP ETFs?

In today’s volatile exchange-traded fund (ETF) market, there are growing conversations about how the results of the upcoming U.S. presidential election might shape the regulatory environment for crypto ETFs, notably those dealing with digital assets such as Ripple [XRP] and Solana [SOL].

There’s a lot of discussion about how the hypothetical win of Donald Trump could influence the future approval process and performance of digital asset ETFs.

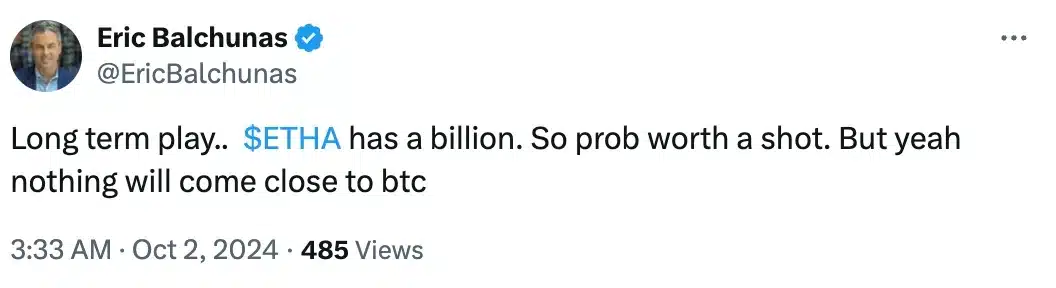

As a researcher delving into the latest discussions, I’ve noticed that Eric Balchunas, an analyst at Bloomberg, has shed light on the hurdles confronting freshly minted cryptocurrency ETFs, including those pertaining to SOL and XRP. These challenges stem from the stringent regulatory scrutiny under the watch of SEC Chairman Gary Gensler.

Balchunas pointed out that Gensler’s strong position regarding cryptocurrencies makes it more challenging for Exchange-Traded Funds (ETFs) to gain approval, affecting prominent crypto market participants such as Binance and Coinbase significantly.

In a post dated October 2nd, Balchunas reaffirmed his belief that Trump would dismiss Gensler once he assumes office.

“The Fed Put is similar to a ‘Trump Call’. Investing in altcoins like XRP or Solana can be seen as a low-cost bet on a Trump victory, because if he wins, these investments could potentially skyrocket due to the departure of Gen Z and other factors. However, if someone else like Harris wins, these investments are unlikely to gain approval, and therefore would be worthless.

Bitwise’s move to launch XRP ETF

Following Bitwise’s latest action to set up an XRP-focused Exchange Traded Fund (ETF), they have registered a trust organization in Delaware. Here is the updated version: In response to Bitwise’s recent decision to create an XRP ETF, they have recently established a trust entity within the state of Delaware by registering it.

The timing is crucial because it coincides with the Securities and Exchange Commission’s upcoming deadline to contest Judge Torres’ decision, which classified secondary XRP sales on exchanges as not being considered securities.

Execs weighing in…

Alex Thorn, who leads Galaxy Digital’s research department, offered additional perspectives on the topic, highlighting the following points.

However, there was another X user who urged an important question to Balchunas and said,

“If there has been no demand for Ethereum ETF, why would there be demand for XRP ETF?”

However, in defense Balchunas noted,

What’s lies ahead for Trump and Harris?

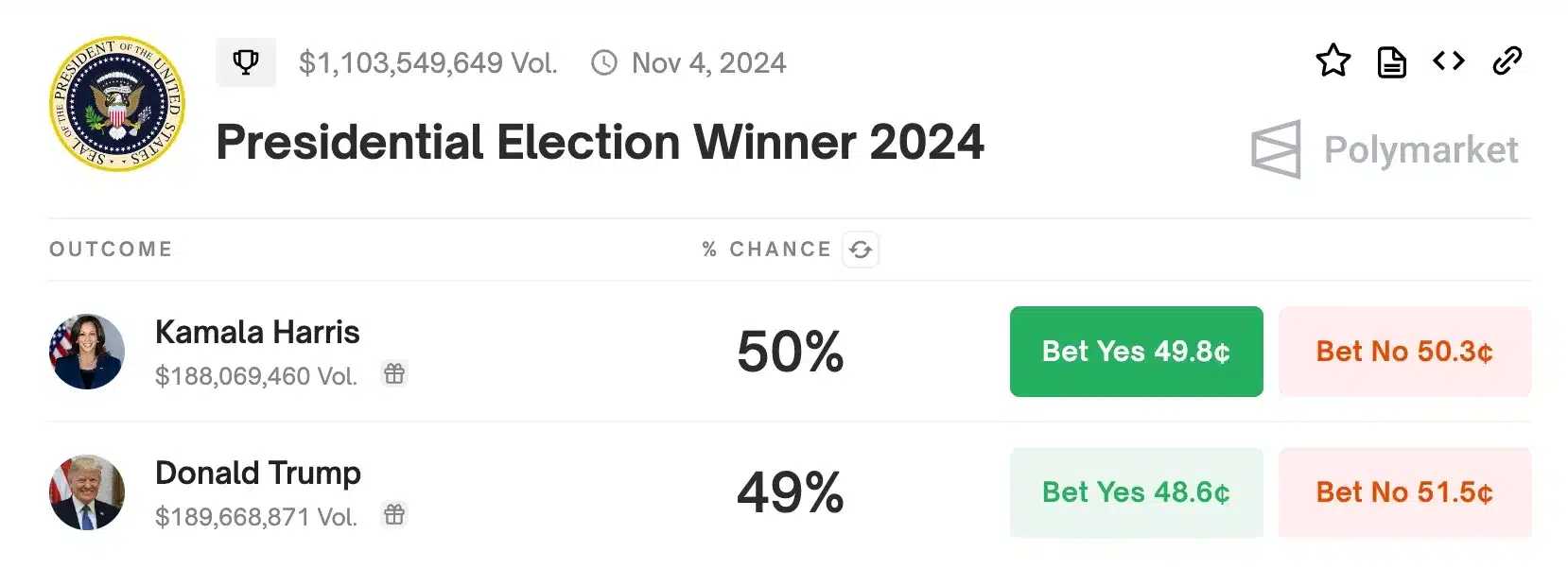

Regardless of the fluctuations in voting trends as shown by Polymarket data, where Kamala Harris is slightly ahead of Donald Trump, the experts at VanEck are reassured about Bitcoin’s ability to withstand these changes and maintain its strength.

According to Mathew Sigel’s perspective, no matter who wins the 2024 U.S. elections, Bitcoin is likely to stay relatively unchanged.

In contrast, it was pointed out that a presidency led by Kamala Harris might provide more advantageous circumstances for Bitcoin’s expansion as opposed to one led by Donald Trump.

It’s fascinating to consider who will emerge victorious in these last 33 days before the election, and what effect their victory might have on the cryptocurrency market.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Michelle Trachtenberg’s Mysterious Death: The Unanswered Questions

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

2024-10-02 14:16