The eyes of the nation were glued to the president’s next move, like a curious child watching a magician’s trick that might just backfire. The Supreme Court, with a 6-to-3 verdict, declared that the president’s tariff powers were as real as a fairy tale, leaving the nation in a state of confused wonder.

Markets Bet on Trump’s Next Trade Move Following 6-3 Ruling

In a 6-to-3 decision, the justices concluded that IEEPA does not plainly grant a president the power to levy tariffs of unlimited scope, size and duration, and they dismantled most of his sweeping tariff program. The Court made it clear that Congress – not the president – holds the constitutional authority to impose taxes and duties. While that ruling may cool the flames of Trump’s ‘Liberation Day’ tariffs, plenty of insiders suspect the saga is far from finished.

Observers expect Trump to sidestep the Supreme Court’s guardrails by pivoting to other trade-law mechanisms – such as Section 301 investigations and a fresh 10 percent global tariff under Section 122 – to keep tariffs alive, just dressed in different legal attire. Many also expect he will continue challenging the Court’s decision in the public arena. All the commotion has nudged bettors toward prediction markets, where they are staking money on what comes next for Trump’s tariff playbook.

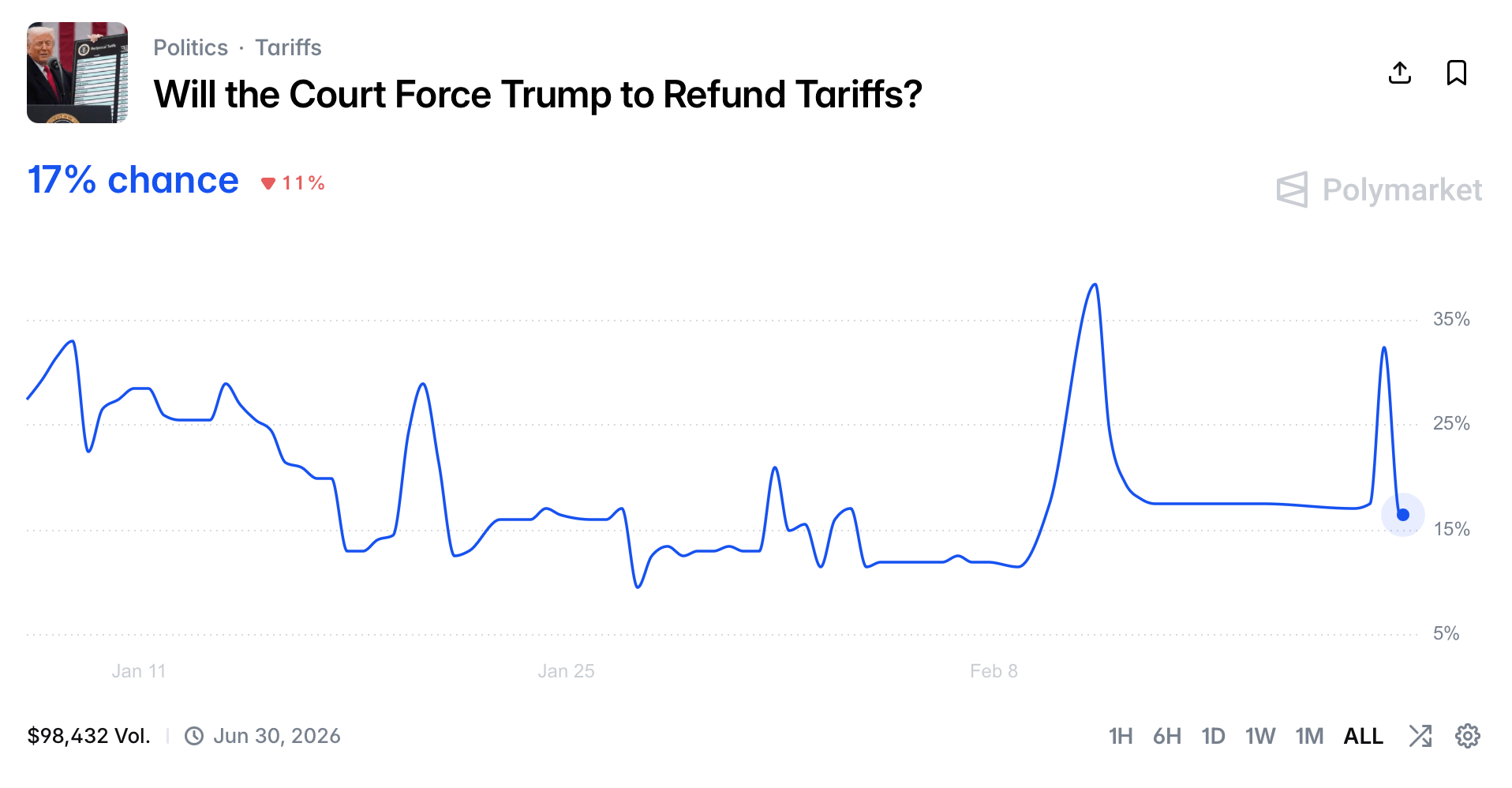

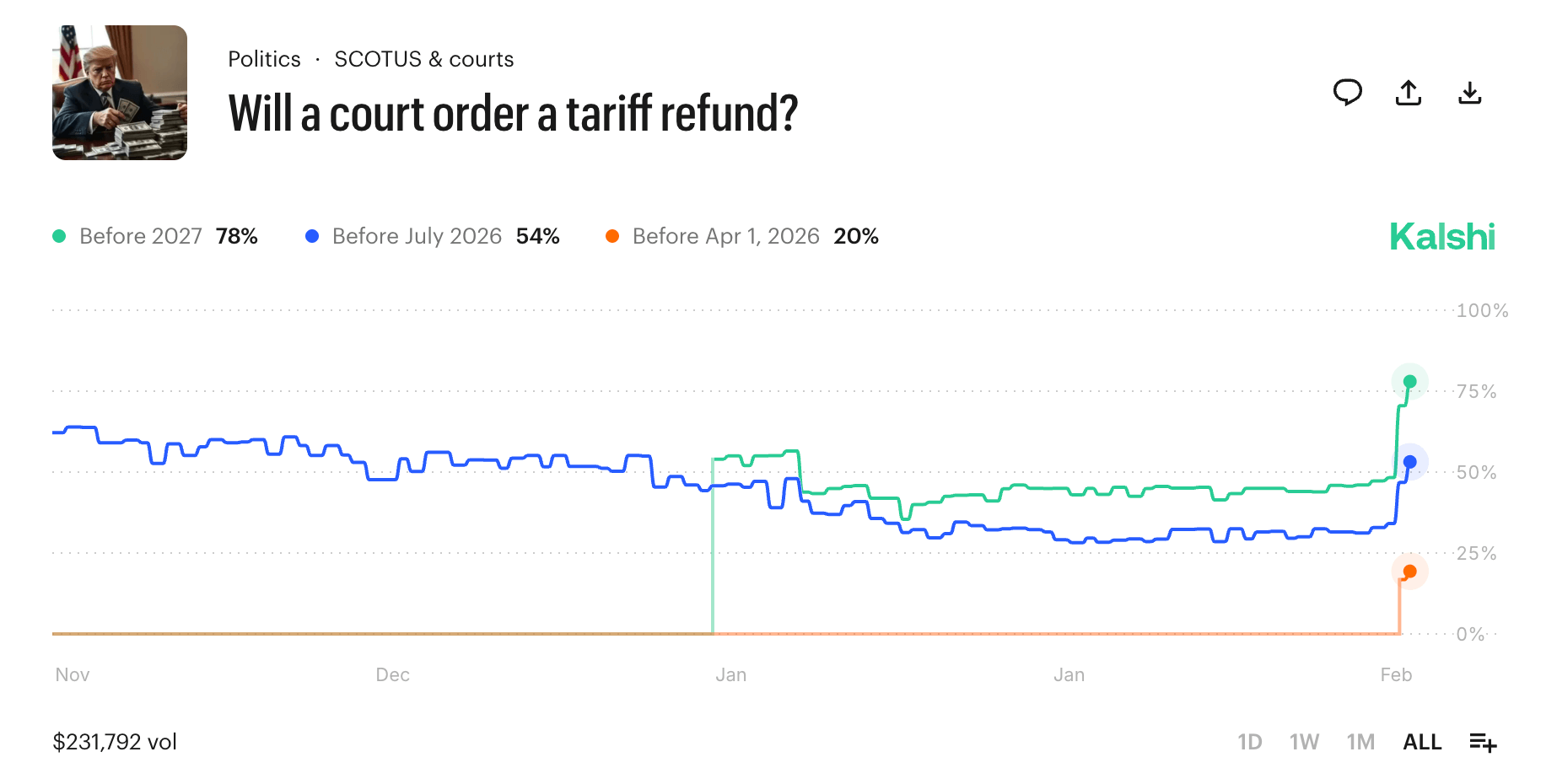

One particular Polymarket wager asks whether the U.S. government will be compelled to refund tariffs by June 30, 2026. Trading volume for the market this weekend sits at $98,432, with the crowd assigning a 17% probability to a “Yes” outcome (priced at 17 cents) and 84% to “No.” However, the Kalshi contract on whether a court will order a tariff refund has drawn $231,531 in total trading volume – and it presents a notably different set of odds.

On Kalshi, bettors peg the odds of a refund order arriving before April 1, 2026, at just 20% (priced at 19 cents), but confidence climbs to 54% by July 2026 (54 cents) and swells to 72% for the period before 2027 (75 cents). Recent price action has leaned heavily toward a “Yes” outcome, with the July 2026 and 2027 contracts advancing 15 and 23 points, respectively. Contracts like these are scattered across both marketplaces, giving traders plenty of ways to place their chips on how the tariff drama unfolds.

On Polymarket’s tariffs board, traders are leaning heavily toward broad action. A new 10% U.S. blanket tariff going into effect by Feb. 28 carries 95% odds with $36,300 in volume, and the question of whether that same 10% levy will still be in place on March 31 sits at 84% with $15,000 traded. Congress stepping in by March 31, however, barely registers at 6% and $2,500 in wagers.

When it comes to China, Polymarket bettors give a 63% chance that the tariff rate lands in the 5% to 15% range by March 31, backed by $21,100 in volume, while a Trump visit to China by April 30, 2026, commands 95% odds and a hefty $2 million in trades. North of the border, the appetite for escalation looks more restrained.

A tariff increase on Canada by June 30 carries 27% odds with $24,500 in volume, and the prospect of a dramatic 100% tariff by that date lingers at just 9%, matched by the same $24,500 traded. On the legal and policy front, bettors assign a 93% chance that Trump faces another lawsuit over tariff powers by March 31, with $5,200 on the line, while the court-forced refund contract stands at 17% and $98,400 in volume.

As for a so-called tariff dividend, the odds are modest – 10% by March 31 with $111,000 traded and 15% by June 30 with $5,200 – and looking further out, Indonesia leads the pack at 25% among countries Trump might strike a new trade deal with before 2027, drawing $216,000 in wagers.

Whether Trump recalibrates his trade agenda through alternative statutes, escalates the legal fight or opts for a political counteroffensive, the Supreme Court’s ruling has clearly not ended the tariff saga – it has simply shifted the battlefield. For now, prediction markets are serving as a real-time barometer of expectations, translating legal uncertainty and political brinkmanship into percentages, price swings and hard dollars as traders wager on how the next chapter of U.S. trade policy will unfold.

FAQ ❓

- What did the Supreme Court rule about President Trump’s tariffs? The Court ruled 6-3 that the 1977 International Emergency Economic Powers Act does not authorize a president to impose sweeping global tariffs without congressional approval. (Imagine a wizard who forgot his wand.)

- Can President Trump still impose new tariffs after the ruling? Yes, he could pursue alternative trade laws such as Section 301 or Section 122 to implement narrower or restructured tariffs. (Like a chef using a different recipe to make the same dish.)

- What are prediction markets signaling about tariff refunds? Traders on Polymarket and Kalshi assign relatively low short-term odds to court-ordered refunds, with probabilities rising into mid- and late-2026. (Like a weather forecast that says “maybe tomorrow, maybe never.”)

- How likely is a new 10% U.S. blanket tariff in 2026? Polymarket bettors currently price high odds that a 10% tariff could take effect and remain in place in the near term. (A 10% tax on everything? Sounds like a child’s idea of fairness.)

Read More

- Best Controller Settings for ARC Raiders

- Battlefield 6 Season 2 Update Is Live, Here Are the Full Patch Notes

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- The Best Members of the Flash Family

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Ashes of Creation Mage Guide for Beginners

- Duffer Brothers Discuss ‘Stranger Things’ Season 1 Vecna Theory

- ‘Crime 101’ Ending, Explained

- Dan Da Dan Chapter 226 Release Date & Where to Read

- Netflix’s Warner Bros. Acquisition In Trouble After Paramount Bid

2026-02-21 20:57