Welcome to the US Morning Crypto Briefing—your daily dose of chaos, caffeine, and crypto. ☕

Grab your coffee (or whiskey, no judgment) and let’s dive into how Bitcoin is out here flexing while Wall Street trips over its own shoelaces. Trump’s tariffs are shaking things up, the Fed’s printing money like it’s Monopoly, and crypto’s just chilling like, “What’s next?” From Ethereum’s existential crisis to the rising odds of a US recession, here’s your cheat sheet to staying ahead of the madness.

Bitcoin’s New Era: Risk-Dynamic or Just Really Good at Pretending?

Bitcoin’s reaction to Trump’s tariffs has been so calm, it’s almost suspicious. While Wall Street’s having a meltdown, Bitcoin’s just sitting there like, “This is fine.” 🐶🔥

Nexo Dispatch Editor Stella Zlatarev told BeInCrypto that this isn’t just resilience—it’s proof that Bitcoin might actually be growing up. (Cue the collective gasp.)

“A 2–3% drop in crypto is basically a rounding error compared to the drama of past cycles,” she said, adding that Bitcoin’s stability suggests it’s no longer just a speculative gamble. “Institutional investors are treating it less like a lottery ticket and more like a strategic asset,” Zlatarev explained.

Analysts also pointed out that Bitcoin doesn’t fit neatly into traditional asset categories. Shocking, I know.

“It’s not gold, and it’s not the yen. Bitcoin is emerging as a risk-dynamic asset—something that thrives in chaos but doesn’t completely fall apart when the market freaks out,” Zlatarev said.

So, Bitcoin’s basically the cool kid who doesn’t care about the drama but still somehow ends up on top. Got it.

Zlatarev also noted that Ethereum’s next move will be crucial.

“If ETH mirrors Bitcoin’s performance, it’s a sign that top-tier crypto assets are maturing. If ETH wobbles, it’s proof that Bitcoin is still the MVP,” she said.

Meanwhile, Trump’s “Liberation Day” tariffs are causing global panic. Polymarket now gives a 50% chance of a US recession this year—because why not add more fuel to the fire? 🔥

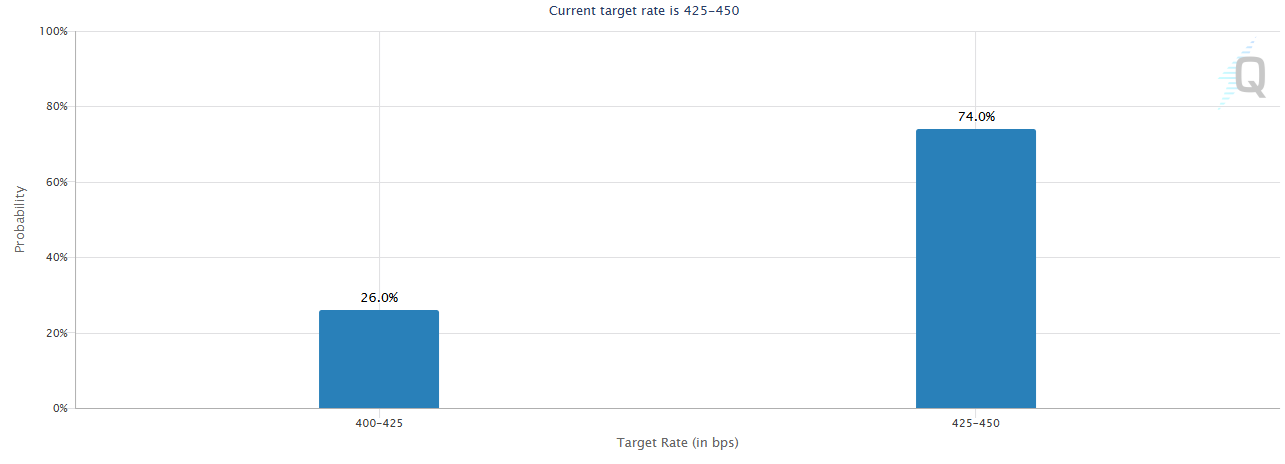

Also, the CME FedWatch tool shows traders are betting on four rate cuts this year. Translation: the Fed might start printing money like it’s going out of style, which could be good news for Bitcoin.

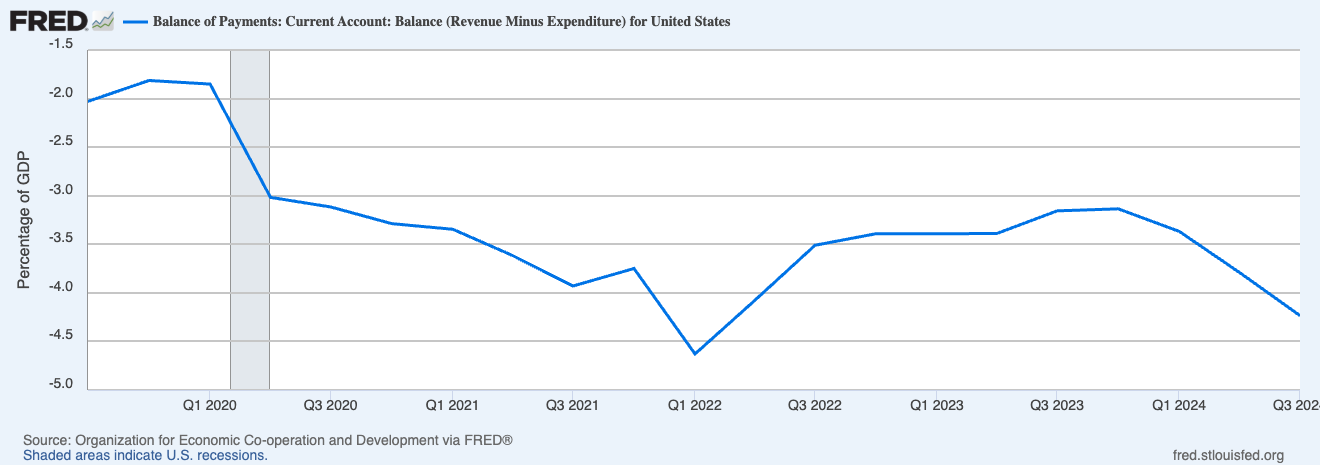

Former BitMex CEO Arthur Hayes pointed out that Trump’s tariffs could mess with the US bond market. In other words, the Fed might have to step in and turn on the money printer. Brrrr. 💸

Trump’s tariff formula is further evidence he is laser focused on reversing these imbalances. The problem for treasuries is that without $ exports foreigners can’t buy bonds. The Fed and banking system must step up to ensure a well functioning treasury mrkt, which means Brrrr.

— Arthur Hayes (@CryptoHayes) April 3, 2025

All of this puts Bitcoin in a new spotlight. Its steadiness is no longer being dismissed as a fluke. It might actually be the first sign that crypto is growing up and stepping out of the shadows of speculation. 🎭

Chart of the Day

Trump’s tariffs might force the Fed to inject more liquidity, which could weaken the dollar and boost Bitcoin as an alternative store of value. Because, of course, it would.

Byte-Sized Alpha

– Trump’s “Liberation Day” enforces 10%+ tariffs on all imports, hitting China, the EU, and Israel, triggering market drops and recession fears. 🌍💥

– According to Standard Chartered, Bitcoin may hit $500,000 by Trump’s term end, AVAX could 10x by 2029, and Ethereum’s 2025 target drops to $4,000. 🚀

– The STABLE Act of 2025 advances with bipartisan support, aiming to tighten stablecoin rules as competition and regulatory pressure intensify. 🏛️

– Bitcoin ETFs see $221 million in April inflows led by ARKB, but BTC derivatives cool with falling futures interest and bearish options sentiment. 📉

– DXY hits a 2024 low after “Liberation Day” tariffs, fueling short-term Bitcoin surge hopes amid global tensions and policy uncertainty. 🌐

– Bitcoin struggles below $85,000 amid weak sentiment, but long-term holders stay firm, keeping capitulation fears at bay. 💪

– Polymarket sees almost 50% chance of US recession as Trump’s tariffs spark market fears and trade tensions. 📊

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2025-04-03 17:32