- Tron network has experienced a meme-wave, reducing stablecoin dominance to 75%.

- In short, the network may be exposed to higher volatility.

As an analyst with over two decades of experience in the crypto market, I’ve seen my fair share of trends come and go. The recent surge in memecoin activity on the Tron network is intriguing, but it also raises some concerns about the network’s stability.

Over the last week, the price of Tron (TRX) has dropped by over 6%, primarily due to Bitcoin‘s (BTC) falling trend. At the moment of reporting, TRX is being traded at approximately $0.15.

It’s worth noting that following the introduction of SunPump, a platform built on Tron for memecoins, TRX experienced a notable increase. Now, it seems that transactions involving memecoins have surpassed those of stablecoins on the network in terms of activity.

Since memecoins are known for their extreme price fluctuations, the fact that they’re becoming more popular than stablecoins leads us to wonder: Might this trend in usage potentially threaten TRX‘s future worth?

Memecoin culture threatens Tron stability

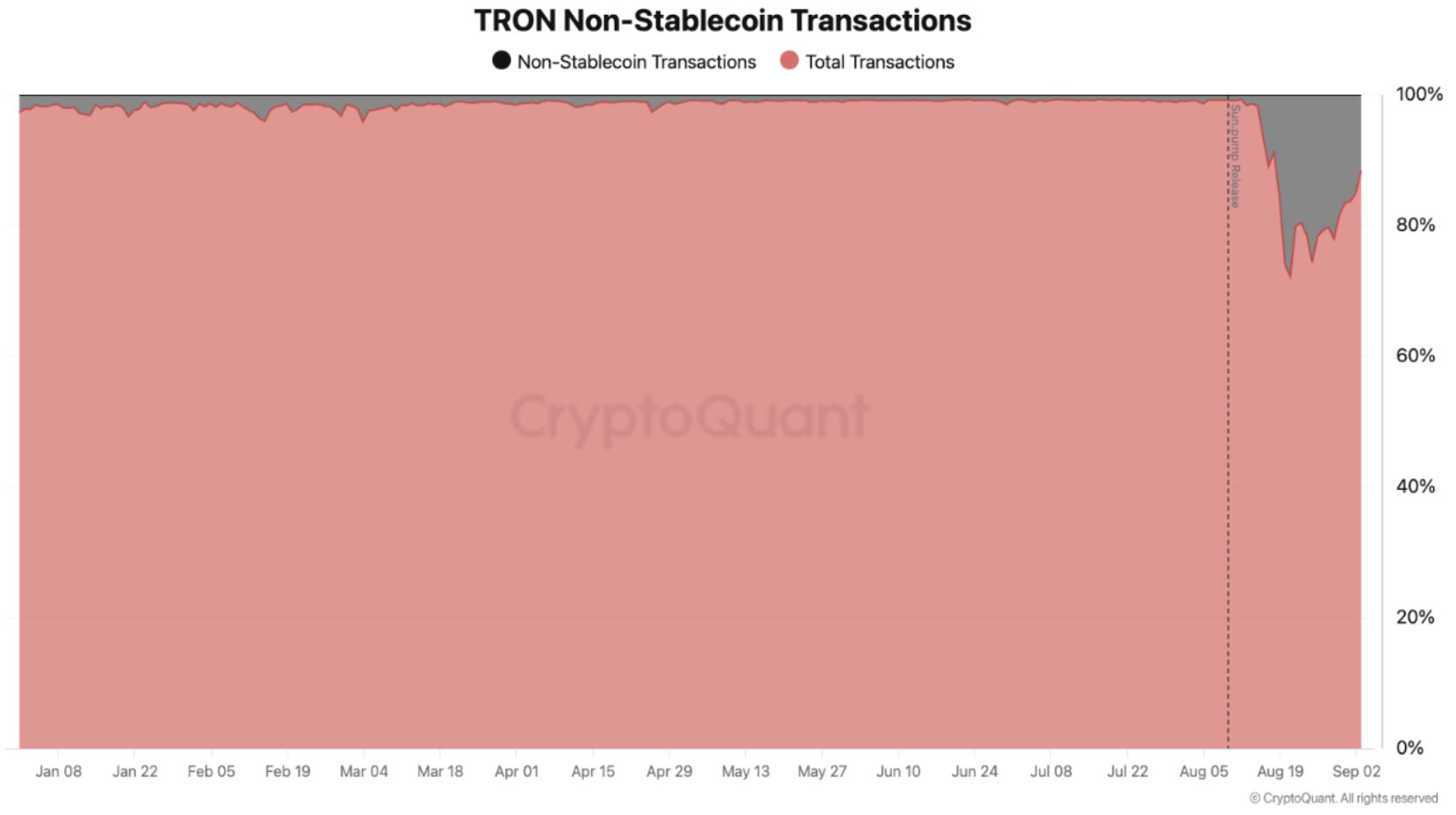

Source : CryptoQuant

In the earlier part of this year, approximately 98% of all transactions on the Tron network were associated with stablecoins, indicating their significant prevalence.

Yet, following the launch of SunPump on the 9th of August, there’s been a significant change. Now, around 75% of the network’s transactions are associated with stablecoins.

It’s clear that there’s a notable pattern emerging as many Tron users seem to be gravitating towards more volatile tokens, making the value of TRX less stable over time.

In a brief span of 20 days, the number of investors owning SUNDOG, the top memecoin on the Tron blockchain in terms of market value, has significantly increased to approximately 220,269.

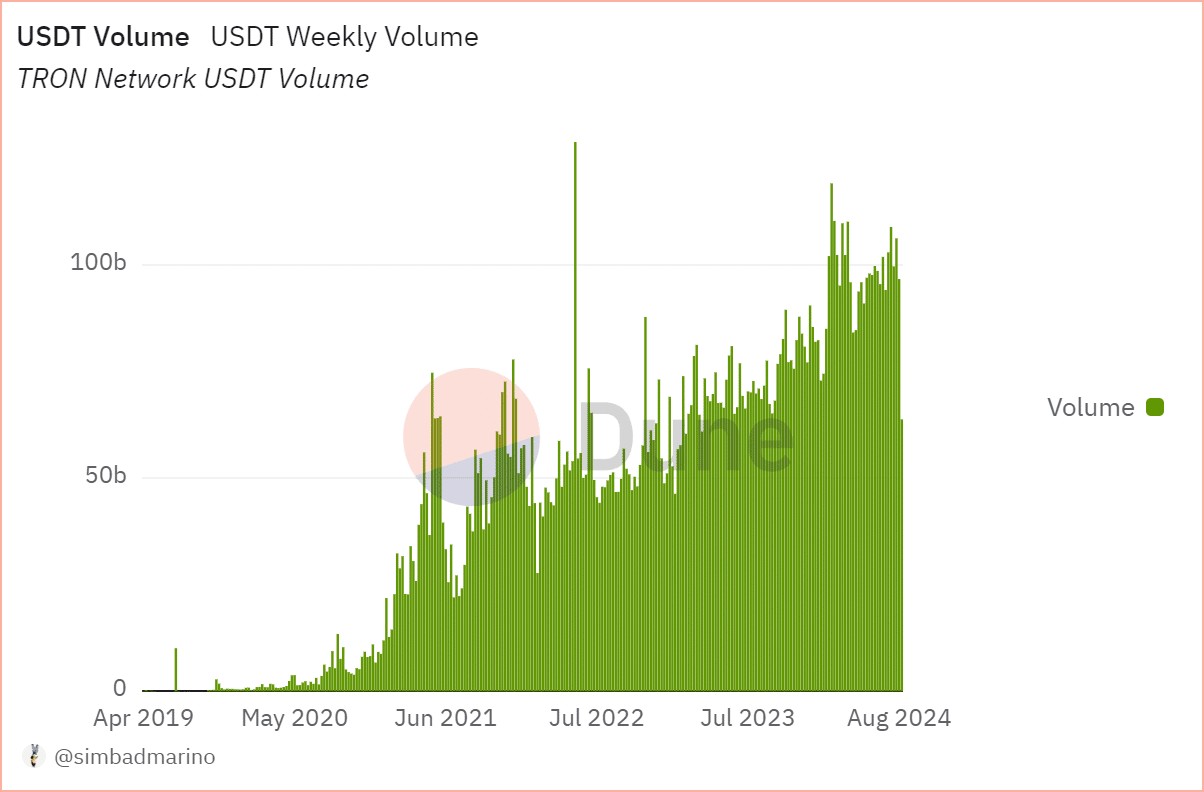

As a researcher, I’ve noticed a substantial drop in the daily trading volume of Tether (USDT) on the Tron network. Prior to the launch of SunPump, USDT volume peaked at an impressive $100 billion, but it has now dipped to $63 billion – a decrease of approximately 37%. This is quite a remarkable decline in such a short period.

Source : Dune

Based on AMBCrypto’s report, it seems there could be an internal instability within the Tron system. A decrease in stablecoin usage alongside growing popularity of meme coins may result in heightened market volatility, potentially causing the price of TRX to drop.

So, has it?

USDT net flow has the answer

It’s not unexpected that SunPump has increased TRX‘s worth for two straight weeks following its early August debut, with the aim of challenging the $0.17 resistance level.

Initially, there was optimism, but it didn’t last long. Instead, TRX experienced a downturn, plunging below the $0.15 price range, indicating a bearish trend.

Put simply, even memecoin dominance couldn’t shield TRX from the effects of Bitcoin’s volatility.

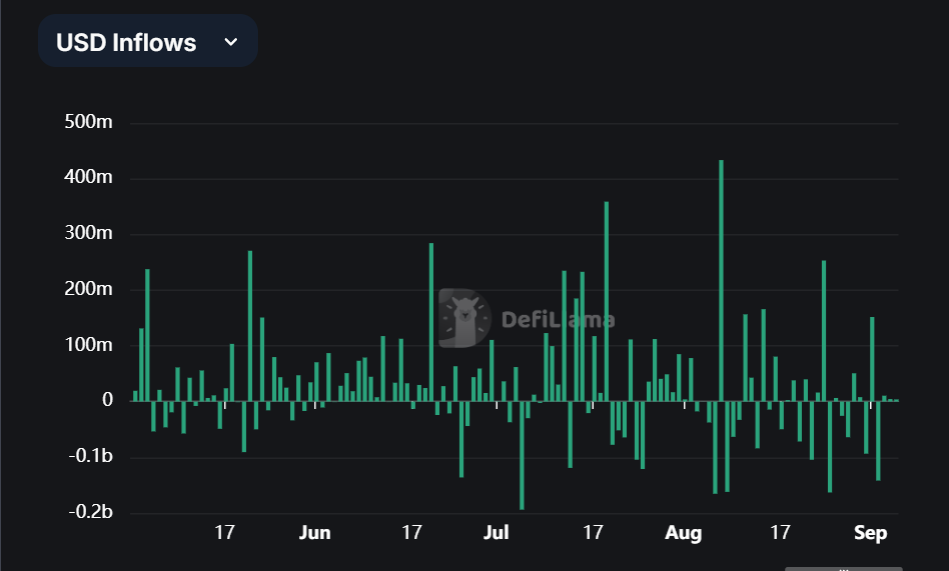

It’s quite remarkable to note that the graph demonstrates an impressive $0.142 billion withdrawal of USDT from the Tron network, suggesting a boost in investor trust towards stablecoins.

Source : DefiLlama

An uptick in withdrawals of stablecoins might trigger a adjustment in the TRX price, suggesting that more investors are swapping USDT for TRX during market downturns or when they have reached a lucrative point.

Realistic or not, here’s TRX’s market cap in BTC’s terms

Overall, TRX might be heading towards a reversal if these exchanges occur.

If investors choose to invest in meme coins rather than TRX, it might lead to unpredictability for TRX, since the majority of meme coin investors tend to be short-term traders seeking immediate profits.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-09-06 17:44