- TURBO rallied by over 40% on Thursday against an overall choppy market

- Market sentiment was positive, but can it drive bulls further?

As a researcher with experience in cryptocurrency markets, I find the recent surge of Turbo Crypto intriguing. The memecoin rallied by over 40% on Thursday, decoupling from the choppy market and breaking above its consolidation range. However, it’s important to consider where the market might head next.

As a crypto investor, I’ve noticed that many memecoins deviated from the broader market trend and experienced significant rallies on Thursday. Among them was Turbo Crypto, an AI-inspired and frog-themed meme coin that caught my attention. Excited by this trend, I decided to invest in Turbo Crypto. Consequently, the coin not only surged by over 40% but also broke through its recent price consolidation range.

At the moment of composition, the bullish trend had noticeably weakened. Now, let’s examine the significant levels for potential future developments.

Turbo crypto price prediction: What are the next targets to watch?

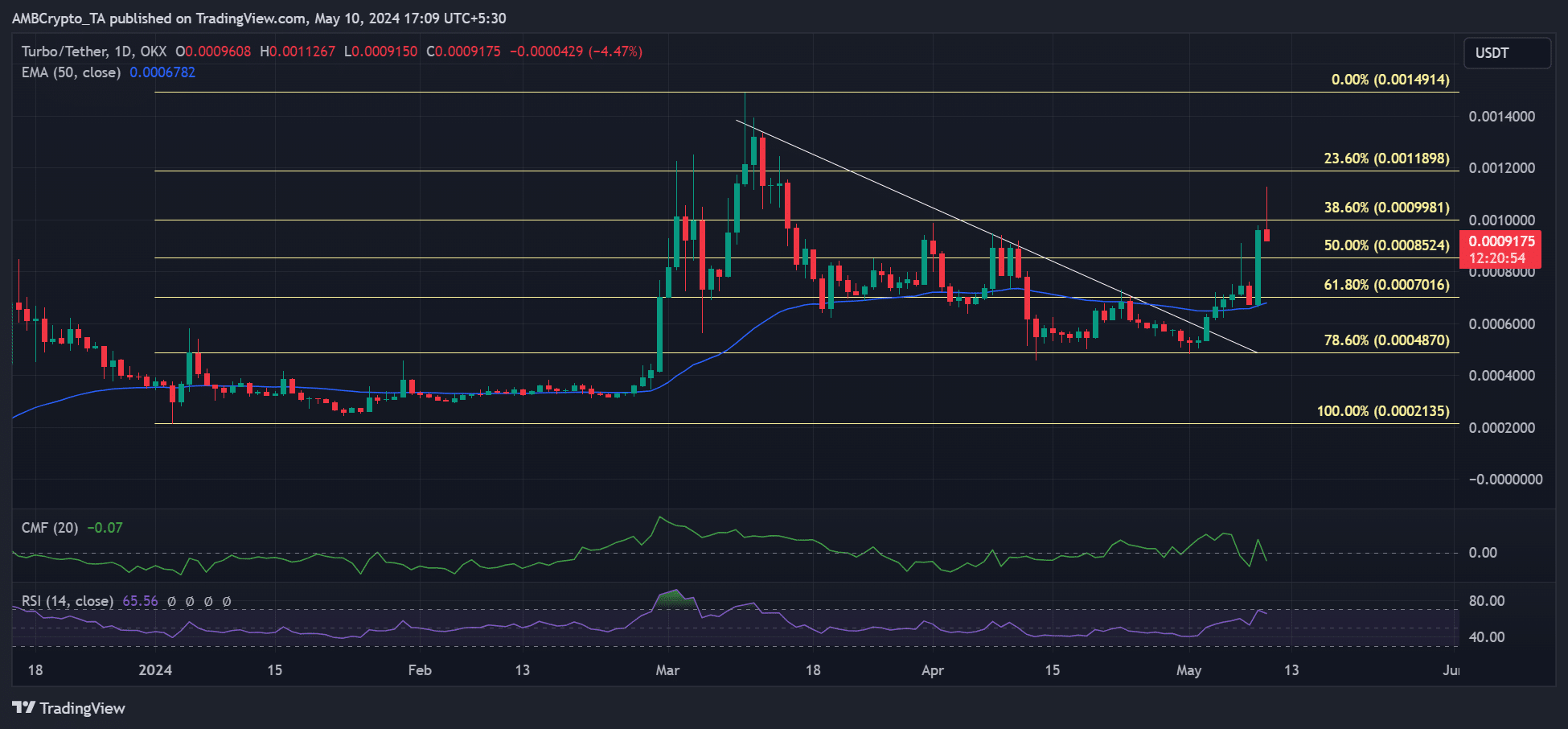

A Fibonacci retracement level was drawn connecting the January low of $0.0002129 and the high of $0.001488 reached in 2024. According to this analysis, TURBO underwent a price correction within the bounds of the 61.8% to 78.6% mark between mid-April and early May.

During Thursday’s rally, the memecoin surpassed its resistance level, shifting the market trend towards optimism. While there was a slight decrease in upward momentum as of now, the bulls maintained control over the market dynamics.

In simpler terms, the RSI, or Relative Strength Index, was higher than normal, meaning buying activity was robust. However, the volatile Chaikin Money Flow, or CMF, might disrupt a more powerful uptrend due to weakened inflow of funds.

For investors who have been sidelined from buying bullish positions on stocks, it may be worthwhile to consider re-entering the market once the price reaches key support levels such as the 50% or 61.8% Fibonacci retracement levels. With a risk-managed approach, potential targets for profit-taking could lie at the 38.6% or even the more aggressive 23.6% Fib levels.

A return to the prior price range, particularly if it falls beneath the blue 50-EMA, may encourage sellers to become more active in the market.

Turbo price prediction: A liquidity grab in play?

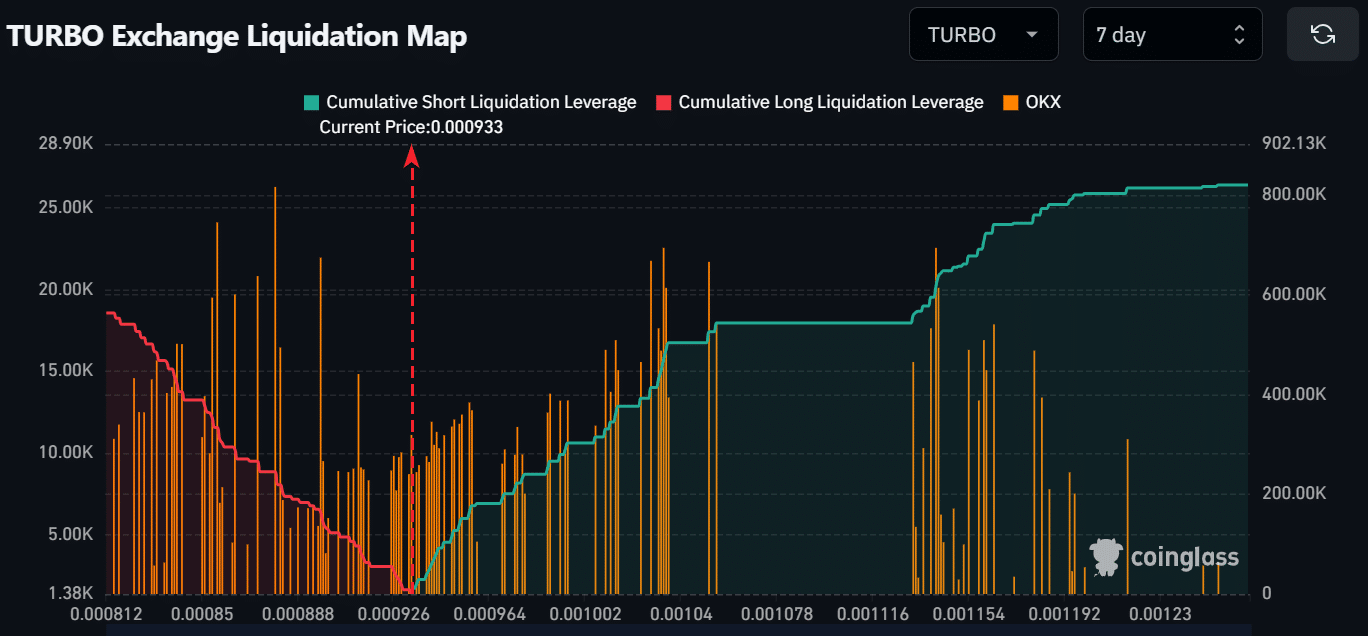

According to Coinglass’s findings, there was a significant amount of trading activity at both high and low price points. The liquidity chart reflects the placement of stop losses by many leveraged traders, and the market price often swings towards these thresholds in search of liquidity before eventually settling down.

If the standard market response occurs, TURBO may seek liquidity around $0.00085 and then look for more at $0.001 and $0.00115. These prices align with the 50% and 23.6% Fibonacci levels on the price graphs.

Read Bitcoin [BTC] Price Prediction 2024-2025

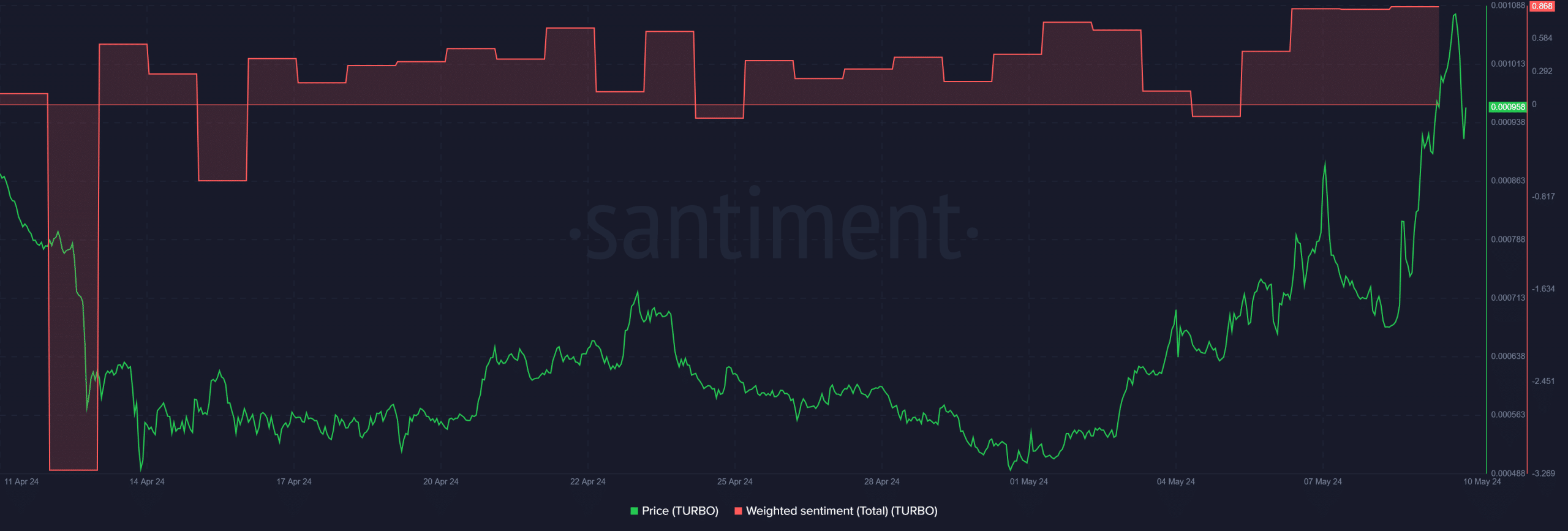

In simpler terms, a cent at $0.00085 could serve as significant support for the memecoin, while a rise to $0.0011 would be an important bullish objective if there’s a rebound. The market sentiment, as indicated by a positive value, also backed this hypothesis since more traders held bullish views on the cryptocurrency.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-05-11 05:11