- TURBO is testing a descending trendline; a breakout could initiate strong bullish momentum.

- Open interest is rising, signaling growing speculation, but elevated NVT and bearish onchain signals suggest caution.

As a seasoned researcher who has witnessed countless market ebbs and flows, I can confidently say that TURBO is at a critical juncture. The descending trendline it’s testing could either pave the way for a strong bullish momentum or lead to consolidation or even a pullback.

The digital currency TURBO is currently testing a significant downward trendline that has previously served as a robust barrier for resistance. At this moment, it’s being traded at $0.007741, representing a 3.22% growth over the past 24 hours.

In the most recent trading periods, this trendline has persistently functioned as a barrier, preventing the token’s price from rising significantly.

Currently, traders are eagerly anticipating a possible breakthrough that might trigger a 11% to 15% surge. As speculation mounts, this potential breakthrough could mark a significant turning point for TURBO. However, the question remains: can this momentum be sustained?

Turbo chart analysis: A critical trendline to break

On the two-hour chart, TURBO is found below a falling trendline, which has been shaping its recent decline. Overcoming this trendline barrier could prove challenging for the token.

Should TURBO successfully shatter and surge beyond its current level, it might ignite an upward momentum aiming for possible gains between 11-15%. Yet, until a definitive breakout is verified, the trendline may persist in exerting downward influence on its price.

A significant surge (breakout) could potentially fuel more upward price movement, possibly leading to reaching important price points. This break in the trendline is pivotal; it might shift market sentiment and attract extra buying activity.

If TURBO doesn’t manage to breach the trendline, there’s a risk that it could revert to consolidation or even experience a decline.

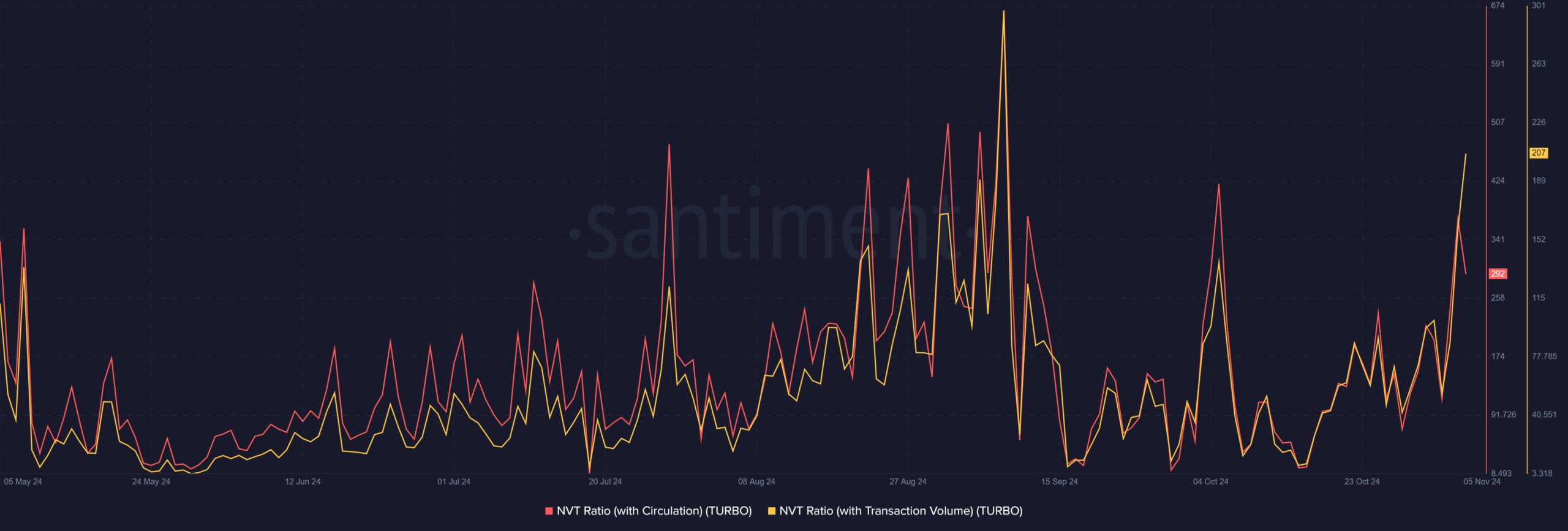

Elevated NVT ratio signals overvaluation risk

However, while technical indicators lean bullish, the Network Value to Transactions (NVT) ratio suggests caution. Currently, TURBO’s circulation-based NVT is at 292.54, and its transaction volume-based NVT is 207.15.

These high figures suggest that the asset could potentially be more expensive than it should be, given its actual network usage.

A high NVT ratio suggests that although the price is approaching a potential breakout, the on-chain action may not be strong enough to maintain long-term profits. So, it’s important for traders to strike a balance between enthusiasm and cautious analysis to avoid potential overvaluation issues.

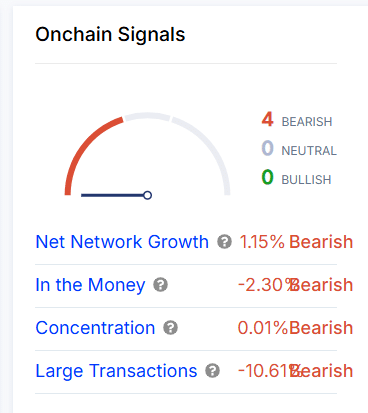

Onchain signals add bearish pressure

From the data on TURBO’s blockchain, it appears that overall sentiment is leaning towards bearishness, reinforcing a sense of caution. The network’s growth, measured in terms of new participants, has seen only a small uptick of 1.15%, which remains quite modest compared to usual levels.

The “In the Money” metric is down by 2.30%, indicating fewer holders are in profit — a factor that may dampen investor enthusiasm.

As an analyst, I’ve noticed a decrease of 10.61% in large transactions, indicating a potential decline in interest from wealthy individuals and financial institutions. This downward trend suggests caution, as a sudden surge might yield temporary profits. However, the overall on-chain sentiment appears to be subdued, implying a longer-term bearish outlook.

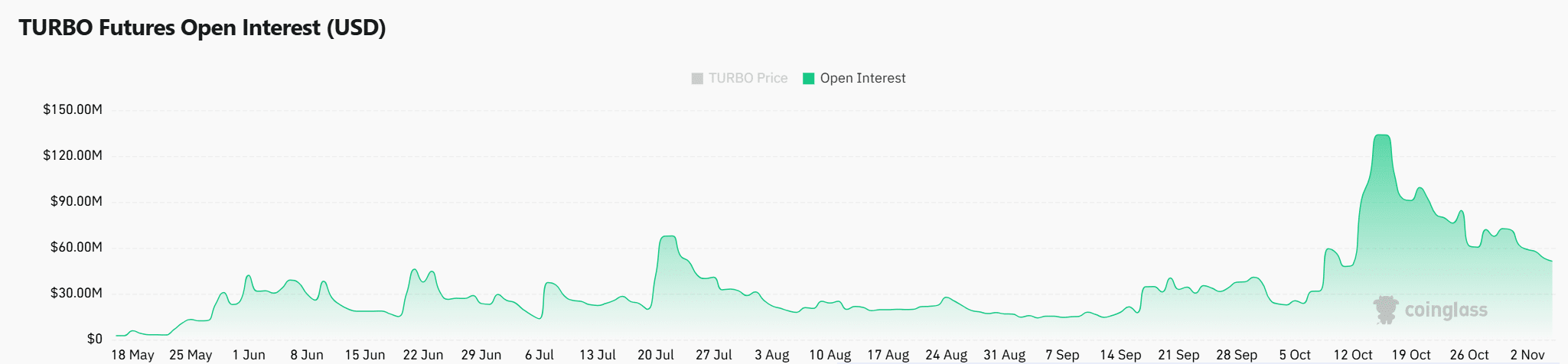

Open interest points to rising speculation

As a crypto investor, I’ve noticed something interesting about TURBO. Despite the gloomy on-chain indicators, the open interest has surged by 2.33%, amounting to $53.45 million. This upward trend suggests that traders are getting more speculative, gearing up for a potential breakout of the trendline. Usually, an increase in open interest signals a belief among traders that a significant price shift is imminent.

Consequently, this growing interest might lead to increased market turbulence, particularly if TURBO surpasses its trendline.

Realistic or not, here’s TURBO’s market cap in BTC’s terms

TURBO poised for a breakout but with caution

Approaching a significant turning point, TURBO seems poised for a possible breakout, potentially yielding a 11% to 15% surge. Yet, high NVT ratios and bearish onchain indicators urge caution. This implies that while a breakout may spark temporary profits, maintaining the momentum could prove difficult.

As a researcher, I would advise that I personally prioritize monitoring the trendline closely while carefully weighing the optimistic outlook against the potential risks stemming from network vulnerabilities. This balanced approach will help in making informed decisions when navigating market trends.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-11-06 06:16