- TURBO has a strong bullish outlook, provided it can defend $0.01

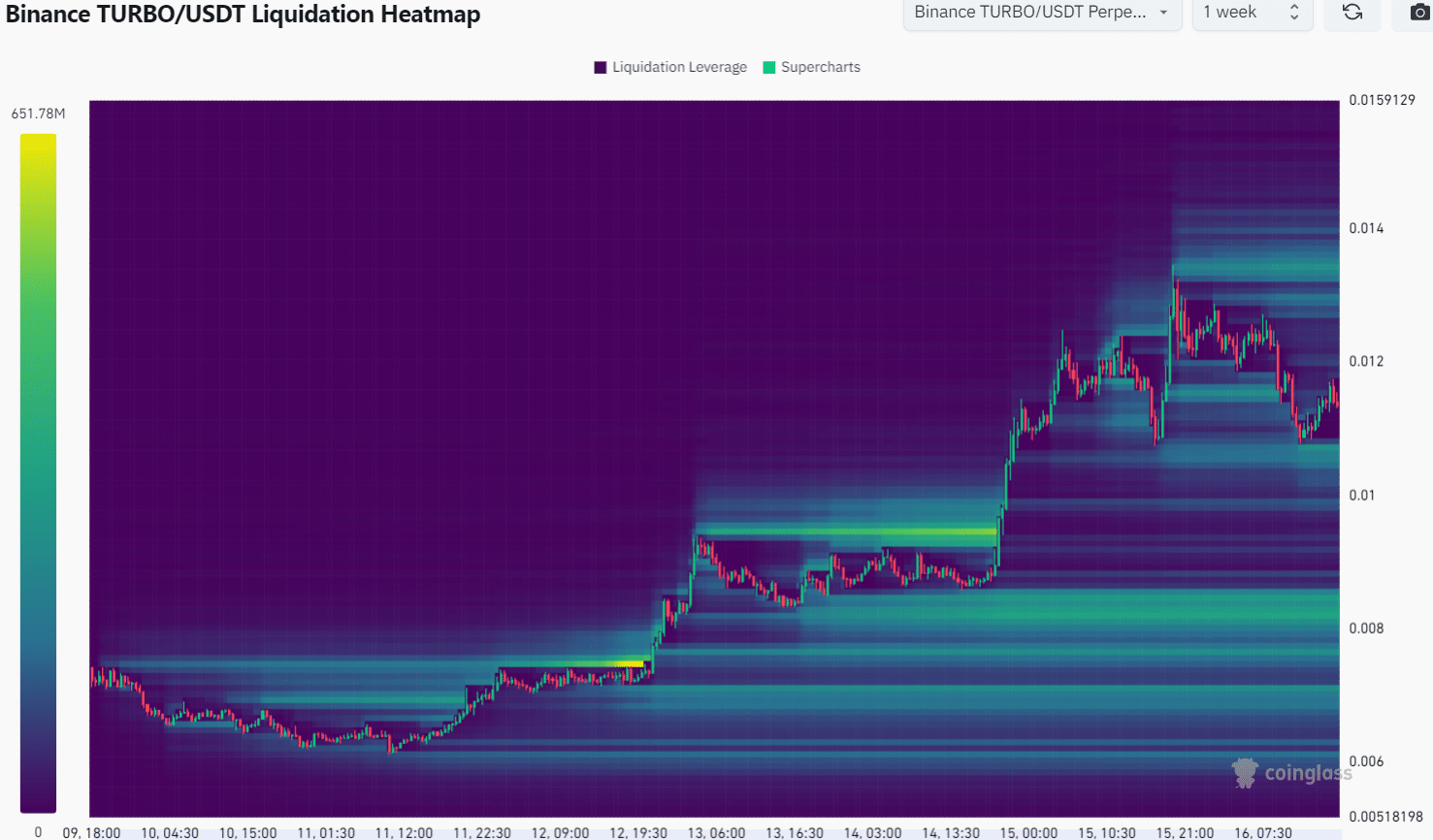

- Liquidation heatmap appeared to have confluence with the Fibonacci support levels

As a seasoned crypto investor with battle-tested nerves and a knack for spotting trends, I find myself intrigued by TURBO’s current trajectory. The token has shown impressive growth in recent days, propelling itself into the limelight. However, as we all know, what goes up must come down, and Tuesday’s volatility served as a reminder that even the mightiest of memecoins can be tamed.

In a remarkable surge, Turbo tokens have been soaring, fulfilling their speedy reputation with an impressive 140% increase over the past few days. Starting from October 3, this cryptocurrency embarked on a nearly 120% upward trajectory within just four days. However, Tuesday’s market volatility temporarily halted its bullish momentum.

Currently, it seems that the token’s decline below $0.013 might be a short-term obstacle. If the price were to drop beneath the $0.01 mark, it could prompt swing traders to adjust their strategy and potentially adopt a bearish stance.

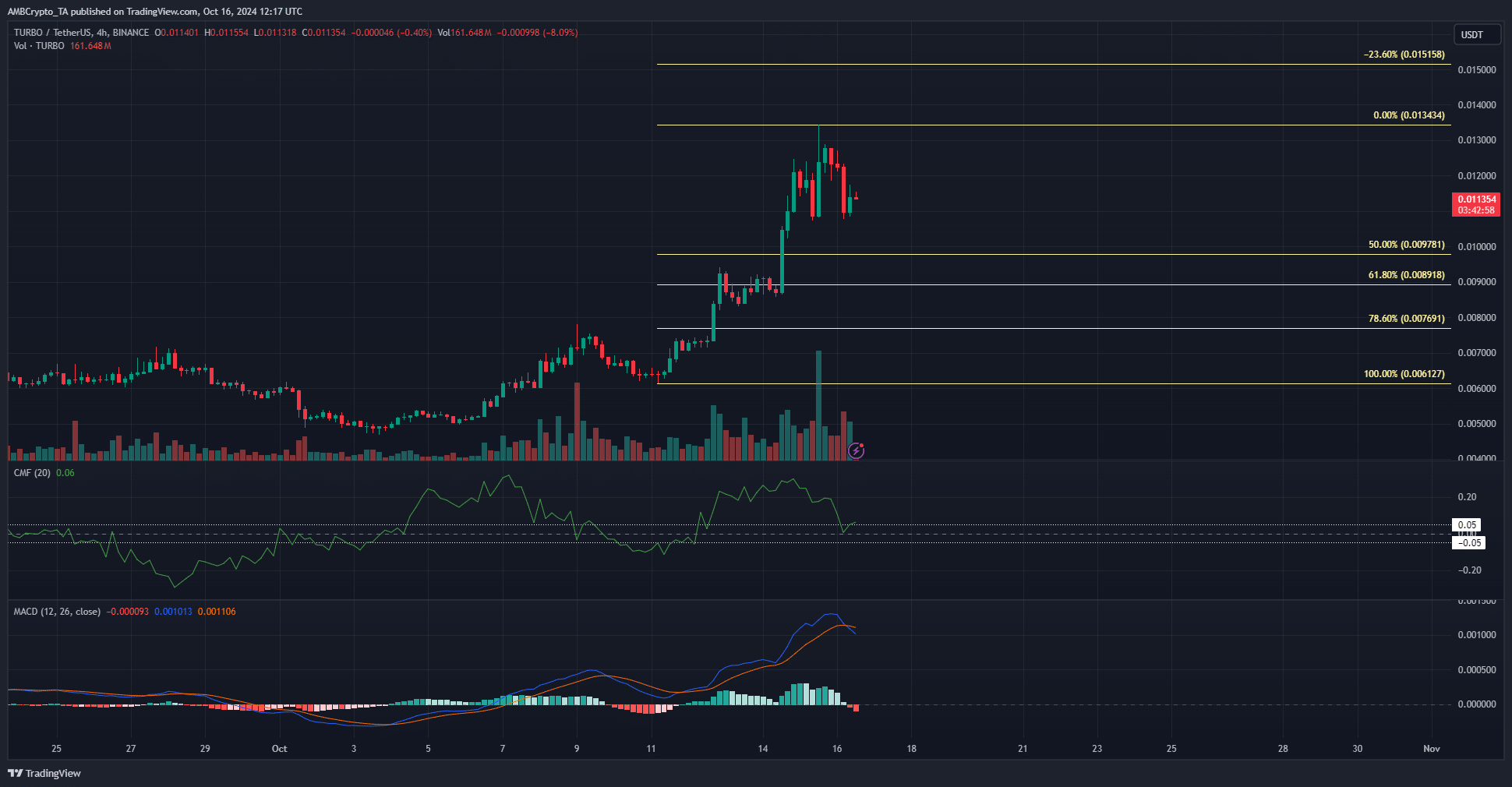

Uptrend showed some signs of weakness

In my analysis over the past few days, the Chaikin Money Flow (CMF) on the 4-hour chart was notably above +0.05. However, a rejection at the psychological $0.01 level on Tuesday appeared to shift this trend, pulling the CMF to its current value of +0.06 as I speak. This move suggested significant inflows, but they seemed to decelerate in comparison to what was previously observed.

The MACD formed a bearish crossover above zero – An early sign of a price drop. The size of the incoming dip is unclear though. The Fibonacci levels were plotted based on past week’s rally from $0.0061 to $0.0134.

If the 50% mark at $0.0097 is retested, it’s probable that it will trigger a bullish response. The $0.089 level might present a good buying chance for day traders. A more significant decline could alter the market structure to a bearish one on larger timeframes, potentially postponing a potential recovery.

TURBO price prediction from the liquidation heatmap

As a researcher, I’ve observed that despite the momentum and buying pressure, the advantage has not completely shifted towards the sellers yet. In the short term, the liquidation heatmap highlights the $0.0104-$0.0106 range as an area of potential liquidity interest.

Realistic or not, here’s TURBO’s market cap in BTC’s terms

An examination of this region might be proceeded by further significant increases, similar to those mentioned earlier. Investors ought to exercise caution when purchasing, as the $0.0083 mark also attracts interest. There’s a possibility that this could pull the cryptocurrency’s worth down during this week.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Serena Williams’ Husband’s Jaw-Dropping Reaction to Her Halftime Show!

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Oblivion Remastered – Ring of Namira Quest Guide

2024-10-17 10:15