-

Insights revealed that U.S. investors are actively acquiring ETH despite its recent decline.

While mixed signals from various metrics cast uncertainty on the potential for a rally, technical patterns point to an upswing.

As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market volatility and trends. The current state of Ethereum [ETH] is intriguing, to say the least.

Over the past day, there was a major downswing affecting various cryptocurrencies, resulting in Ethereum [ETH] dropping by about 8.41%. This decline has caused its weekly performance to slip into negative territory, currently standing at a loss of approximately 4.76%.

Nevertheless, more detailed examination indicated that this dip might not last long since it appeared that U.S. investors were prepared to boost ETH prices significantly.

U.S. investors are behind ETH despite market volatility

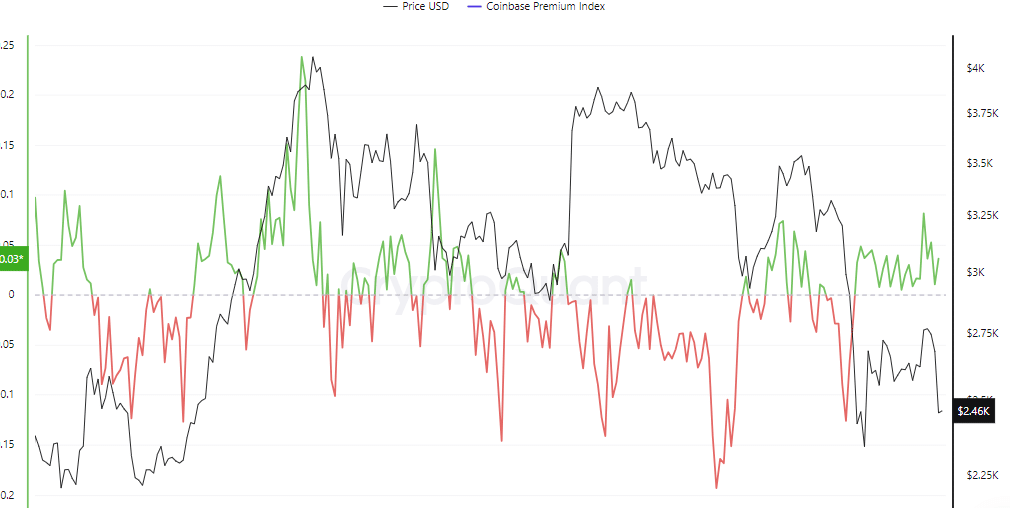

Data from Crypto Quant’s Coinbase Premium Index for Ethereum, which compares the price of Ethereum on domestic exchange Coinbase Pro with that on international exchange Binance [BNB], suggests increased demand from American cryptocurrency investors even amidst a recent market slump.

As a researcher, I observed an upward trend in the index we’re studying, indicating that the price of Ethereum was significantly higher on Coinbase Pro than on Binance. This disparity suggests robust demand and strong buying interest from U.S. investors on the former platform.

As I write this analysis, the index is sitting comfortably at a 0.03 positive, an indication of sustained investor faith in the market despite the wider financial turbulence. Should this optimistic buying trend persist, it’s reasonable to expect Ethereum’s price to climb accordingly.

After examining further, AMBCrypto found that although there’s optimism among U.S. investors for a market surge, opinions in other areas are mixed.

Mixed sentiment among retailers for ETH’s prospects

Although certain merchants are still optimistic towards Ethereum, the signs point to varying possibilities regarding its potential price trend.

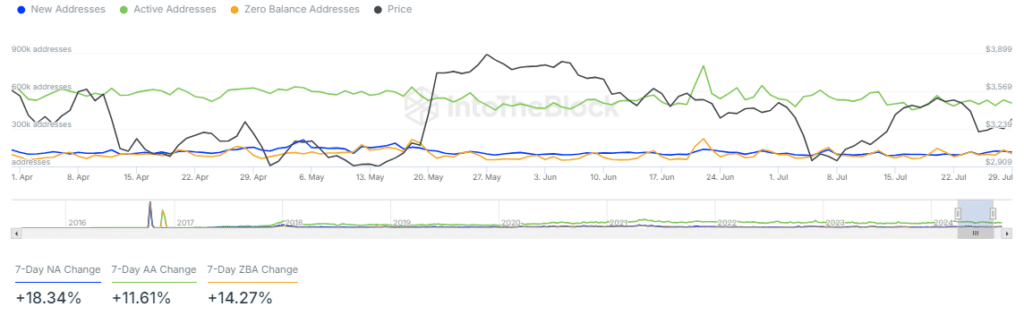

The growing number of active and new addresses points to bullish sentiment.

Over the last few days, there has been a significant surge: a 18.34% boost in newly created addresses and a 11.61% upswing in active ones. This trend indicates a strong user interaction with Ethereum.

Over the past day, we’ve seen a total of 114,920 new addresses added, with currently 507,150 active ones. This significant level of activity suggests that optimism among investors is on the rise in the market.

From my perspective as an analyst, the unfavorable Funding Rate for Ethereum offered a striking counterpoint. This rate suggested that most retail traders forecasted a potential price decrease and were willing to shell out extra fees in order to sustain their short positions.

Maintaining a pessimistic view might prevent Ethereum from surging as expected, even with increased investment from the U.S. and rising numbers of active addresses.

Support level will determine ETH’s next move

Recently, Ethereum (ETH) has seen a breakdown after a period of consolidation, which is often characterized by large investors (whales) amassing coins in preparation for a price surge. The current decline might be due to a stop-run, where sell orders are triggered en masse.

In simpler terms, a “stop hunt” refers to big financial entities intentionally influencing the cost of a specific asset to trigger stop-loss orders en masse, leading to rapid fluctuations in its price.

With this approach, they can buy or sell substantial amounts at advantageous rates, often before the market rebalances itself.

“In this specific case, it facilitated large financial institutions to gather more Ether at reduced costs. Notably, these price points also line up with an area of high demand, which could trigger a surge upward.”

Read Ethereum’s [ETH] Price Prediction 2024–2025

The continuation of this rally depends on whether the current support level at $2,552.99 won’t transform into a barrier, preventing further increases in price.

Furthermore, surpassing the $2,723.83 barrier would strengthen the evidence of the market’s bullish trend.

Read More

2024-08-28 19:36