-

The U.S. government moved some BTC from its portfolio to Coinbase Prime.

Will this spark another government-induced wave of sell pressure?

As a seasoned researcher with extensive experience in the crypto market, I have closely followed the developments surrounding the U.S. government and its Bitcoin holdings. The recent transfer of 58.74 BTC from the U.S. government’s wallet to Coinbase Prime raised some alarming concerns in the Bitcoin community.

Based on current information, is it plausible that the US government is considering selling off its Bitcoins [BTC]? Such a move could potentially trigger significant selling activity within the market.

The backing of U.S. presidential candidate Donald Trump for Bitcoin could have instilled trust in the public about the existence and potential value of Bitcoins held by the American government.

Following the German government’s announcement of selling their Bitcoins, which drew criticism from many, a new turn of events hints at the United States potentially doing the same.

According to on-chain investigation, the U.S. government transferred 58.74 Bitcoin from its official site to Coinbase Prime, a move that is likely aimed at cashing out these digital assets.

Approximately $3.9 million worth of funds were transferred, while the government’s Bitcoin stash amounts to around 213,239 coins, currently valued above $14 billion.

Will the U.S. government betray Bitcoin?

A relatively insignificant quantity of Bitcoins was transferred recently, having little impact on Bitcoin’s market price at present. Nevertheless, this transaction may serve as a precursor to a series of similar transactions that could unfold imminently, causing potential concern among the Bitcoin community.

But what about Trump’s favorable Bitcoin stance?

The US elections are yet to take place, which is three months from now. Consequently, the current administration possesses sufficient time to sell off their Bitcoins before the election.

To date, there hasn’t been any verification of that intention. However, the more recent transfer of funds could potentially provide some clues.

What could be the extent of the potential fallout?

Germany’s disposal of approximately 50,000 Bitcoins provided a rough estimation of potential future occurrences. This European nation held a significant amount of Bitcoin to sell, which undeniably left its mark on the market.

The United States possesses roughly five times the amount of Bitcoin that is currently being discussed for sale. Consequently, the implications of offloading all or even half of this hoard would be significantly more profound.

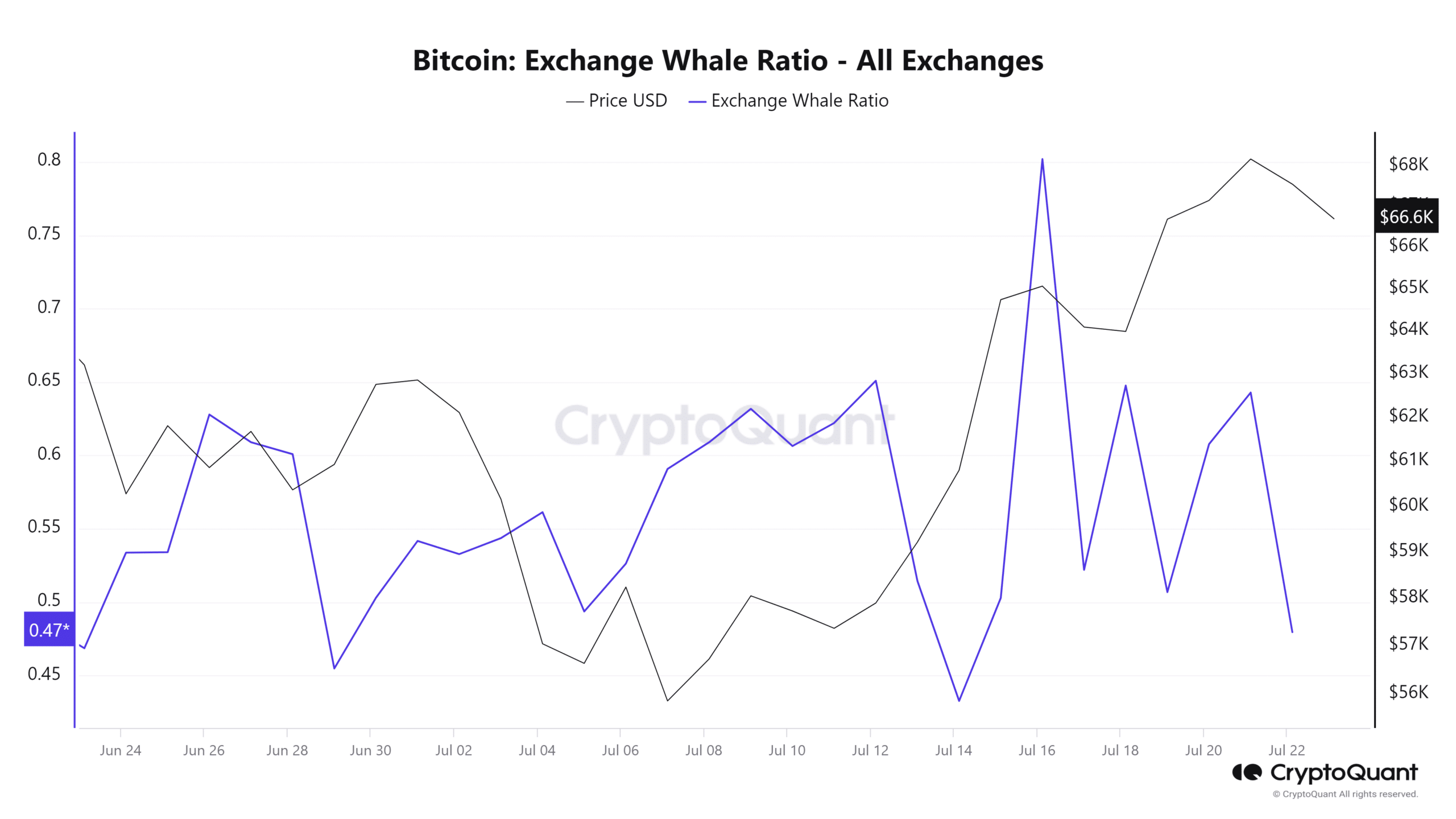

As a crypto investor, I’ve noticed that recent news of the U.S. transferring Bitcoin from its digital wallet has the potential to spark reactions among the larger players in the market, or what we call “whales,” if it signifies a significant sell-off. The Bitcoin price action over the past 48 hours suggests that the excitement surrounding the cryptocurrency may have begun to wane.

The proportion of Bitcoin transactions involving large traders, or “whales,” has decreased slightly over the past two days. This could signify a decrease in trading activity from these substantial investors following the notable increase in July’s mid-month.

An alternate perspective holds that there are reasons why the United States might choose to keep their Bitcoin holdings instead of selling them off.

CNBC pondered the possibility of Bitcoin serving as a reserve currency. The American financial news source posited that transferring Bitcoins to the U.S. treasury could provide an advantage in the competition for cryptocurrency supremacy.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a reserve currency asset for the United States, holding Bitcoin would position it among the largest hoarders. Alternatively, this designation could increase Bitcoin’s allure and boost demand.

At present, it’s unclear which of these two possibilities will come to pass regarding Bitcoin’s future interaction with the United States. The outcome remains undecided.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- Peter Facinelli Reveals Surprising Parenting Lessons from His New Movie

2024-07-23 22:15