- Expectations for an Ethereum spot ETF has gotten significantly low in the community.

- Ethereum’s market performance continues to lag behind the majority of its peers.

As a researcher with experience in the cryptocurrency market, I’ve noticed that the expectations for an Ethereum spot ETF have significantly decreased within the community. Ethereum’s market performance continues to lag behind its peers, and the SEC, led by Gary Gensler, has been notoriously slow in approving crypto-related applications.

The Securities and Exchange Commission (SEC), headed by Gary Gensler, has a reputation for exerting significant influence over the cryptocurrency sector through deliberate and lengthy review processes for crypto-related applications.

They eased up a bit this year with the approval of eleven spot Bitcoin [BTC] ETFs.

Ethereum Spot ETF, when?

Currently, the focus has shifted towards Ethereum [ETH], Bitcoin’s closest relative in the cryptocurrency world. For some time now, regulatory filings have been submitted with the hope that Gensler will favorably consider an Exchange-Traded Fund (ETF) specifically for this crypto community favorite.

From my perspective as an analyst, no Ethereum-based Exchange Traded Fund (ETF) has been given the green light by the SEC yet. The regulatory body has remained conspicuously silent on the matter. Just recently, Grayscale decided to pull back their application for an ETH ETF, choosing not to disclose the reasons behind this move.

As a researcher studying the regulatory landscape of Exchange-Traded Funds (ETFs) and their application process with the Securities and Exchange Commission (SEC), I’ve noticed an intriguing development: The SEC’s silence on ETF issuers’ applications, coupled with Grayscale’s recent withdrawal of its Bitcoin Trust from becoming an ETF, has stirred up widespread conjecture within the community. Some speculate that approval may not be imminent.

Last week, outflows amounting to $14 million were observed in the market, as reflected in the data provided by CoinShares.

Ark Invest and 21Shares have made adjustments to their proposed Ethereum ETF application. They are now abandoning the initial plan to participate in Ethereum staking.

In the most recent submission made on Friday, the provision enabling 21Shares to hold a portion of the fund’s assets with external providers was removed.

Eric Balchunas, an analyst at Bloomberg ETF, noted that this modification might be a response to potential suggestions from the SEC in the United States.

However, there have been no official statements.

As a analyst, I would suggest that Balchunas proposed a possible approach for minimizing the specifics that the Securities and Exchange Commission (SEC) could employ to reject an application based on this amendment.

Ethereum’s market movements

Regarding Ethereum’s current market standing, it’s experiencing some turbulence as the second largest cryptocurrency globally.

Despite a minor uptick for most cryptocurrencies in the top ten over the last 24 hours, Ether has remained largely unchanged. As of now, its value falls significantly short of the crucial support threshold of $3,000.

Data from Santiment reveals that there is a lot of bearishness among Ethereum traders.

As an analyst, I would interpret the current market conditions differently. While trading volumes have decreased and liquidations remain limited, it’s essential to consider alternative explanations beyond investors merely staying put. It’s more plausible that a lack of excitement or interest may be contributing to this trend. In simpler terms, boredom could be driving some investors away from the markets for now.

This year, Ethereum hasn’t experienced significant price fluctuations like Bitcoin. The bullish sentiment towards it has waned.

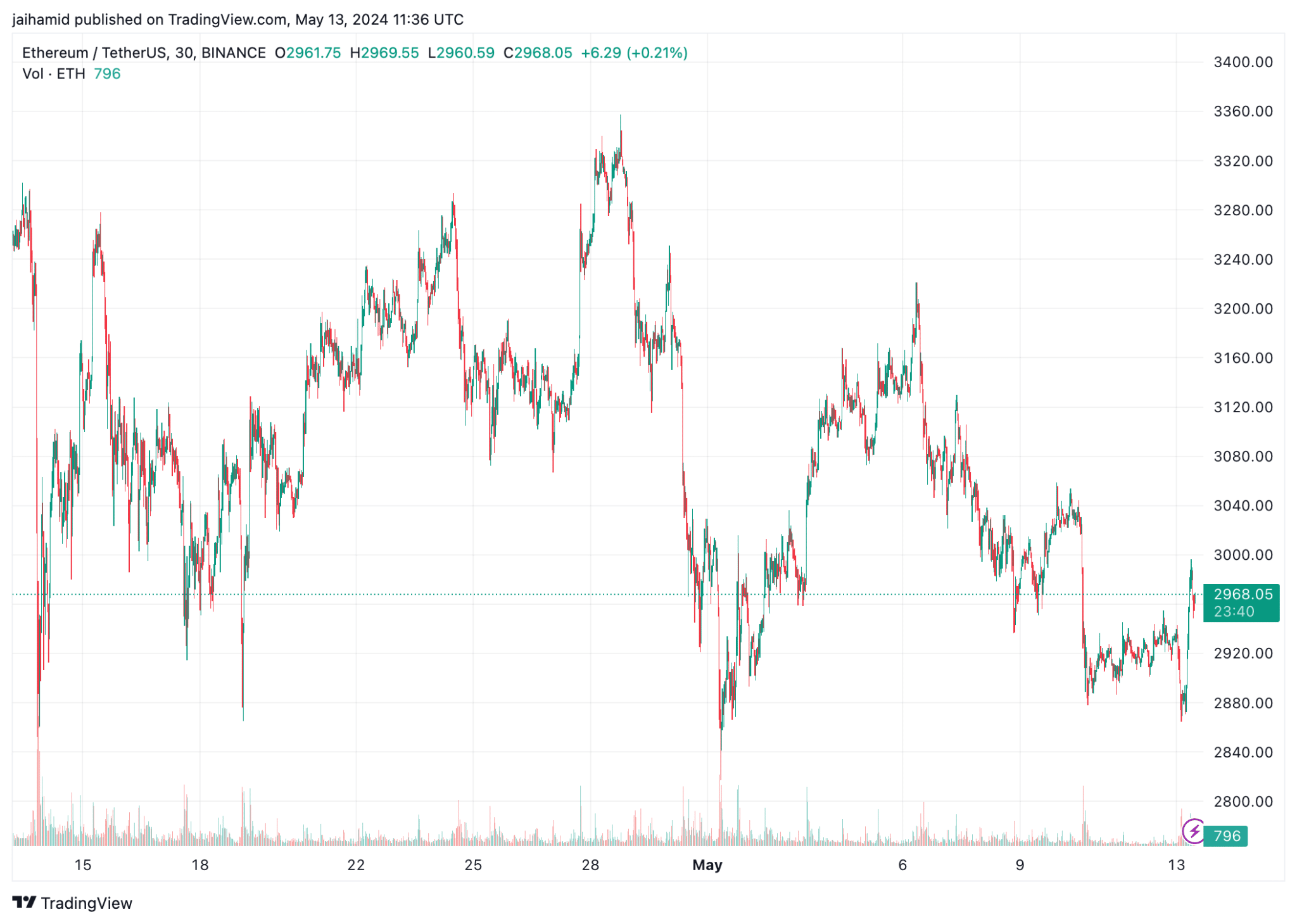

As an analyst examining the ETH/USDt pair on TradingView, I observed noticeable volatility characterized by frequent price swings in both directions.

Reaching towards $3,340, the summit represents robust purchasing demand. Conversely, at around $2,840, selling activity becomes more pronounced.

This past month, the price demonstrated significant resistance at the $2,900 mark, repeatedly bouncing back after touching this level without managing to fall below it.

Read Ethereum’s [ETH] Price Prediction 2024-25

Lately, the price has been inching up towards $2,968, potentially indicating a recuperation or stabilization period. However, this upward trend didn’t hold, and Ethereum was priced at $2,958 at the time of reporting.

Based on the current situation, it seems likely that Ethereum will experience further downturns in the near term.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-05-14 09:11