-

More institutions held and increased positions in the US spot BTC ETFs in Q2.

Morgan Stanley and Goldman Sachs are now the top five holders of BlackRock’s IBIT.

As a seasoned researcher with over two decades of experience in financial markets, I have witnessed numerous trends and shifts that have shaped our economic landscape. The recent developments in US spot Bitcoin ETFs have been particularly intriguing.

Despite the volatile decline of U.S. spot Bitcoin ETFs in Q2 due to market fluctuations, institutional investor interest remains robust.

As a crypto investor, I’ve noticed that the upward trend observed following the product launches in Q1 persisted through Q2, as evidenced by a significant 30% rise in the number of holders, based on Bitwise’s CIO Matt Hougan’s observations.

“In total, there are now 1,924 ETF pairs spread across all 10 ETFs, which represents a significant 30% rise from the 1,479 pairs seen in Q1. This increase is noteworthy, given that prices declined in Q2. Furthermore, institutional investors have shown a growing interest in Bitcoin ETFs during Q2, indicating that the trend remains strong.”

Institutions held BTC ETFs despite Q2 dump

Professional investors who purchased the products during Q1, accounted for 66%, maintained or boosted their investments in Q2, as observed by Hougan.

Approximately four out of ten companies that filed Q1 reports increased their investments in Bitcoin Exchange-Traded Funds (ETFs) during Q2. Around one fifth kept their existing positions unchanged, while another fifth reduced their investments, and about one seventh chose to withdraw entirely. This trend is quite favorable compared to the performance of other ETFs.

This went against the perceived notion that they would capitulate and dump upon any slightest volatility or plunge. For context, BTC plummeted 12% in Q2, dropping from $72K to $56K before closing above $60K.

Consequently, those who held strong during turbulent times were labeled by Bitwise as having “diamond” grips, symbolizing resilience.

13F filings recently disclosed that Goldman Sachs and Morgan Stanley are among the top five entities holding shares in BlackRock’s Bitcoin Trust, known as the iShares Bitcoin Trust (IBIT).

As of the 30th of June, Goldman Sachs held $238.6M of IBIT, while Morgan Stanley held $187M.

It’s important to mention that Morgan Stanley and Goldman Sachs, being significant brokerage firms, are anticipated to lead the way in adopting Bitcoin ETFs starting from the third quarter of this year, contributing to the second wave of acceptance.

Morgan Stanley has started suggesting Bitcoin Exchange-Traded Funds (ETFs) to certain clients, a move that might accelerate wider acceptance of these investments.

The trend could also rally institutional investors’ contribution to the BTC ETF’s AUM (assets under management).

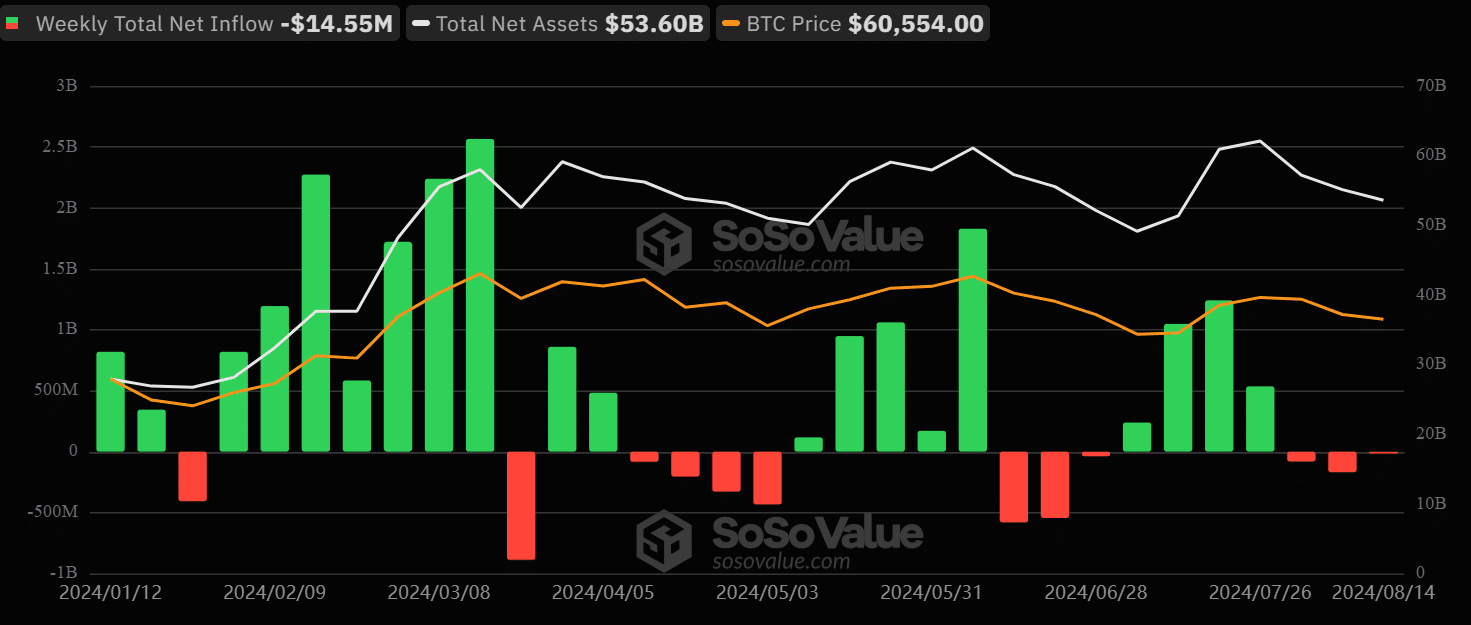

In Q1, institutions contributed between $3 billion and $5 billion (approximately 7% to 10%) to the Bitcoin ETF’s total Assets Under Management (AUM), which were around $50 billion at that time. Currently, the total AUM of the Bitcoin ETF stands at approximately $53.6 billion.

Interestingly, institutional investors’ accumulation of BTC ETF has picked momentum in Q3, too.

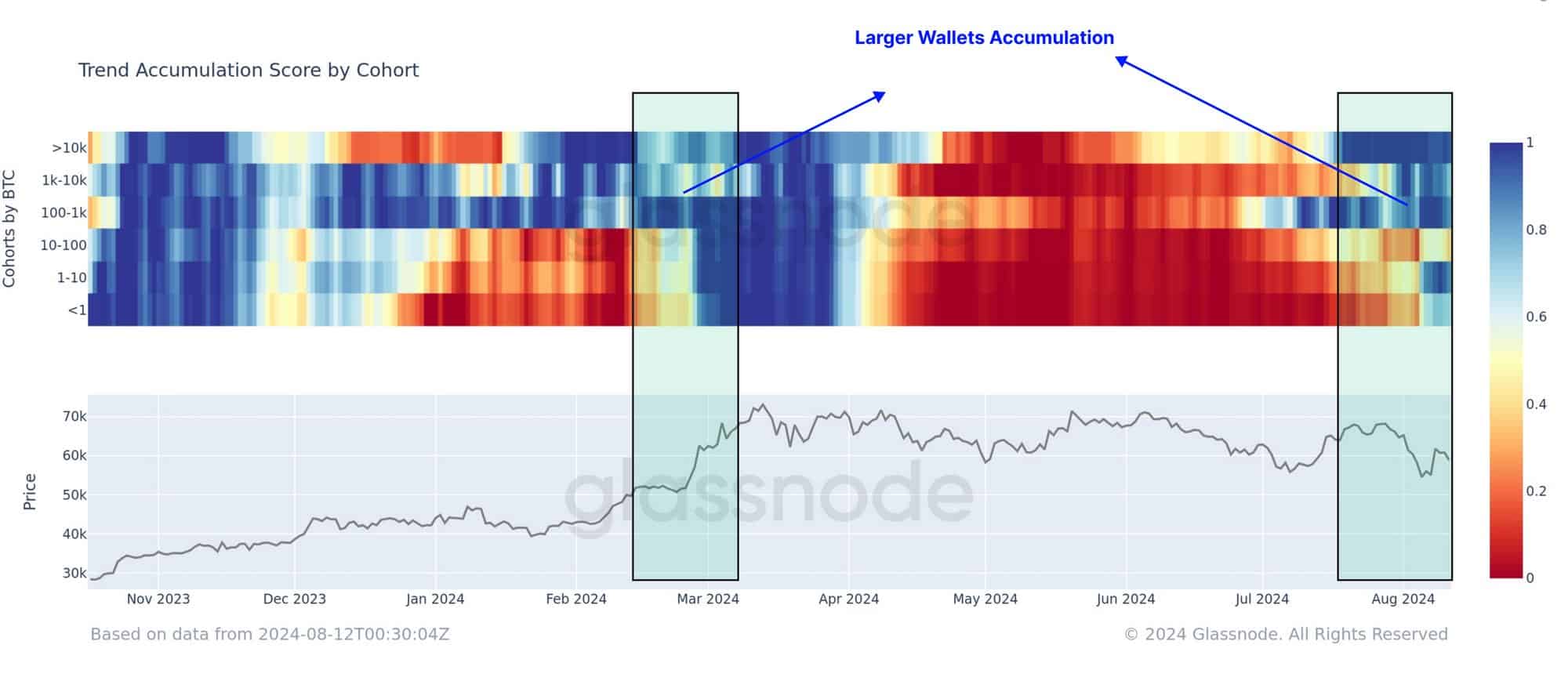

As a researcher, I’ve noticed an intriguing pattern based on Glassnode data: Major ETF wallets have significantly increased their holdings, a trend reminiscent of March that propelled Bitcoin to reach its all-time high (ATH) of $73K.

Lately, there’s been a shift in the pattern of supply distribution, particularly noticeable among the biggest digital wallets, many of which are associated with ETFs. These large wallets are once again moving towards amassing or accumulating assets.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- You Won’t Believe Today’s Tricky NYT Wordle Answer and Tips for April 30th!

2024-08-15 19:57