- Supreme Court’s refusal to review allows the U.S. to sell seized 69,370 Bitcoin.

- Trump proposes retaining Bitcoin as a strategic reserve if re-elected.

As a seasoned crypto investor with a decade of experience under my belt, I can’t help but feel a mix of emotions as the U.S. Supreme Court refuses to review the case allowing the sale of 69,370 Bitcoin. On one hand, it’s disappointing to see such a significant amount of BTC potentially entering the market, which could pressure prices and impact my investment strategy. However, on the other hand, I find myself intrigued by the political discourse surrounding Bitcoin, with figures like Trump proposing retaining Bitcoin as a strategic reserve if re-elected.

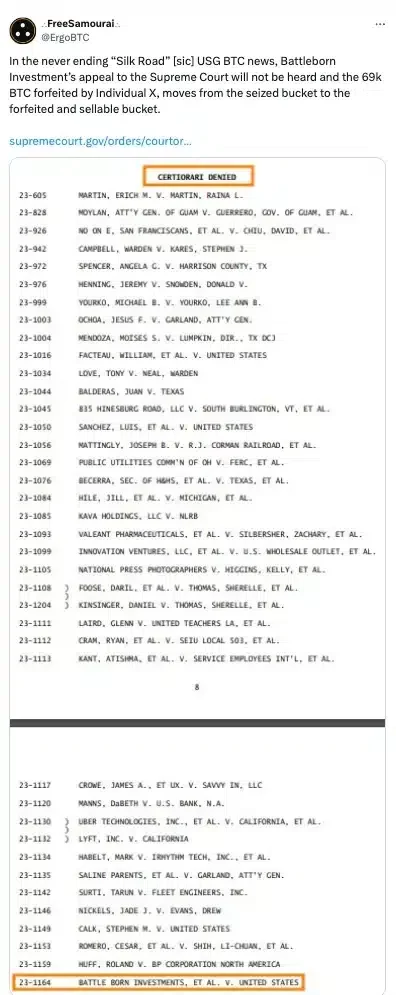

Recently, it was decided by the United States Supreme Court that they would not intervene in a case concerning the ownership of approximately 69,370 Bitcoins, which were initially seized from the underground online marketplace known as Silk Road.

As a crypto investor, I’ve made a move based on the recent Supreme Court decision not to hear the appeal filed by Battle Born Investments against the U.S. government. In simpler terms, they chose not to review this case, which could have implications for my investments in digital currencies. Therefore, I am adjusting my strategy accordingly.

Since the Supreme Court chose not to intervene, the U.S. authorities are free to move forward with auctioning off the confiscated possessions, thus ending this courtroom struggle.

What happened back in 2022?

In case you didn’t know, a California federal court discarded Battle Born Investments’ claims last year. They claimed they obtained ownership of the Silk Road’s seized Bitcoins due to those assets being part of a bankruptcy estate.

In their statement, Battle Born asserted that the debtor, Raymond Ngan, is referred to as “Person Y,” who is accused of embezzling vast quantities of Bitcoin, estimated at billions, from the online marketplace known as Silk Road.

In the absence of strong supporting evidence, the initial verdict went against Battle Born, and this ruling was subsequently confirmed by an appeals court in San Francisco.

Consequently, since the Supreme Court chose not to reconsider the case, Battle Born no longer has any legal options available, enabling the government to proceed with the sale of the confiscated Bitcoins.

How will this impact Bitcoin?

It’s proposed that if the U.S. government were to sell its confiscated Bitcoin, this action might cause a substantial stir in the cryptocurrency market, potentially influencing the future value of Bitcoin.

As anticipated, the recent announcement appears to have triggered a downward shift in Bitcoin’s price, a trend that had previously been climbing steadily. From my perspective as an analyst, this event seems to have caused a bearish reaction.

According to CoinMarketCap, Bitcoin (BTC) is currently being traded at approximately $62,651, representing a 1.36% decrease in its value over the last 24 hours.

Transfers made to date

Without a doubt, prior to this point, the U.S. government has moved large amounts of Bitcoin confiscated from Silk Road into fresh digital wallets.

During the month span between July and August, approximately $2.6 billion in Bitcoin transactions were made, often suggesting that these holders might be planning to sell their Bitcoins.

Yet, these transactions might not signal immediate sales, since the U.S. Marshals Service holds a custody agreement with Coinbase Prime. This implies that the digital assets were transferred for safekeeping instead of being sold off.

As a researcher, I always ensure that before any transaction takes place, I strictly adhere to the established regulatory guidelines, just like the U.S. Marshals and other agencies do.

Alternative uses for the seized Bitcoin

Some U.S. officials are proposing alternative uses for the seized Bitcoin.

In other words, Democratic Representative Ro Khanna proposed that the government keep these resources for future strategic use as a reserve.

Furthermore, should he become the next president, Republican nominee Donald Trump has shown an inclination towards establishing a Bitcoin reserve as well.

At a recent cryptocurrency gathering in Nashville, Trump made a promise to accumulate a “strategic reserve of Bitcoins” should he regain the presidency.

He asserted,

Should I get elected, my administration’s plan is to retain 100% of the Bitcoin that the U.S. government already owns and any additional Bitcoin it may acquire in the future.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-10-08 13:44