- UK High Court classified Tether (USDT) as property, setting a legal precedent

- Bill before British parliament expands the definition of ‘property’ to include digital assets like NFTs and cryptocurrencies

As a seasoned analyst with years of experience navigating the complex world of digital assets, I find the recent developments in the UK regarding Tether (USDT) and other cryptocurrencies intriguing. The High Court’s ruling classifying USDT as property under English law is indeed a significant milestone, setting a precedent for future cases and potentially paving the way for greater acceptance and regulation of stablecoins.

Daily changes are shaping the way cryptocurrencies are being accepted worldwide, as demonstrated by the most recent Global Crypto Adoption Index report from Chainalysis. This report indicates that India and Nigeria are currently leading in global adoption, while the United Kingdom ranks 12th among the top 20 nations in this area.

On the other hand, the latest developments in the UK’s regulatory system may signal a positive change ahead.

A landmark ruling

In a groundbreaking decision, the British High Court has categorized the digital currency known as Tether (USDT) as a type of property. This marks the very first time in English legal history that a cryptocurrency has been classified in this way, based on extensive court proceedings.

On September 12th, during a court hearing at the High Court of Justice, Deputy Judge Richard Farnhill made the following comment:

“USDT attract property rights under English law.”

He added,

USDT isn’t tied to any specific asset or physical item (like a chosen-in-action or chosen-in-possession), but rather it represents its own unique form of ownership. It can be tracked, much like other types of property, and in certain circumstances, it can also be considered trust property.

As a researcher delving into the realm of digital assets, I’ve come across Judge Farnhill’s significant ruling reinforcing the fact that cryptocurrencies fall under the category of property rights. This assertion was substantiated by referencing a 2019 judgment from the same court, which remarkably went unchallenged during the trial proceedings.

Is there more to it?

As a researcher delving into the realm of digital assets, I align my perspective with the findings of the 2023 report by the Law Commission of England and Wales. In this report, they classified digital assets as a form of property, mirroring my understanding and approach to this dynamic field.

In this context, it’s important to note that the recently announced decision was made concurrently with a U.K government bill presented the previous day. The intention behind this bill is to legally categorize non-fungible tokens (NFTs), cryptocurrencies, and carbon credits as tangible items or personal property under existing property laws.

This legislation aims to broaden the conventional understanding of what constitutes “property.” Currently, this term refers to both tangible objects we can physically possess and intangible things we can act upon. If approved, it will introduce a new classification for “things” – specifically digital assets that grant personal rights.

This adjustment intends to clearly account for and include digital properties within our existing property structure. This move reflects the increasing importance of this asset category and the demand for legal certainty regarding their management.

USDT legal status questioned?

In a recent case, it has become significant to discuss the legal standing of Tether (USDT), a popular cryptocurrency, as proceeds from stolen cryptos, among them USDT, were laundered using crypto mixers and trading platforms. This was in an instance where Fabrizio D’Aloia, a fraud victim, lost his cryptos.

D’Aloia failed to prove that his stolen USDT reached the Thai exchange BitKub.

In his ruling, Judge Farnhill admitted the presence of fraud but stated that the employment of cryptocurrency tumblers made it impossible to trace the USDT back to BitKub’s digital wallet. Consequently, Judge Farnhill dismissed D’Aloia’s allegations of breach of trust due to this inability to link the funds to the wallet.

USDT emerges the winner

In the meantime, Tether has emerged as a dominant force in the stablecoin sector.

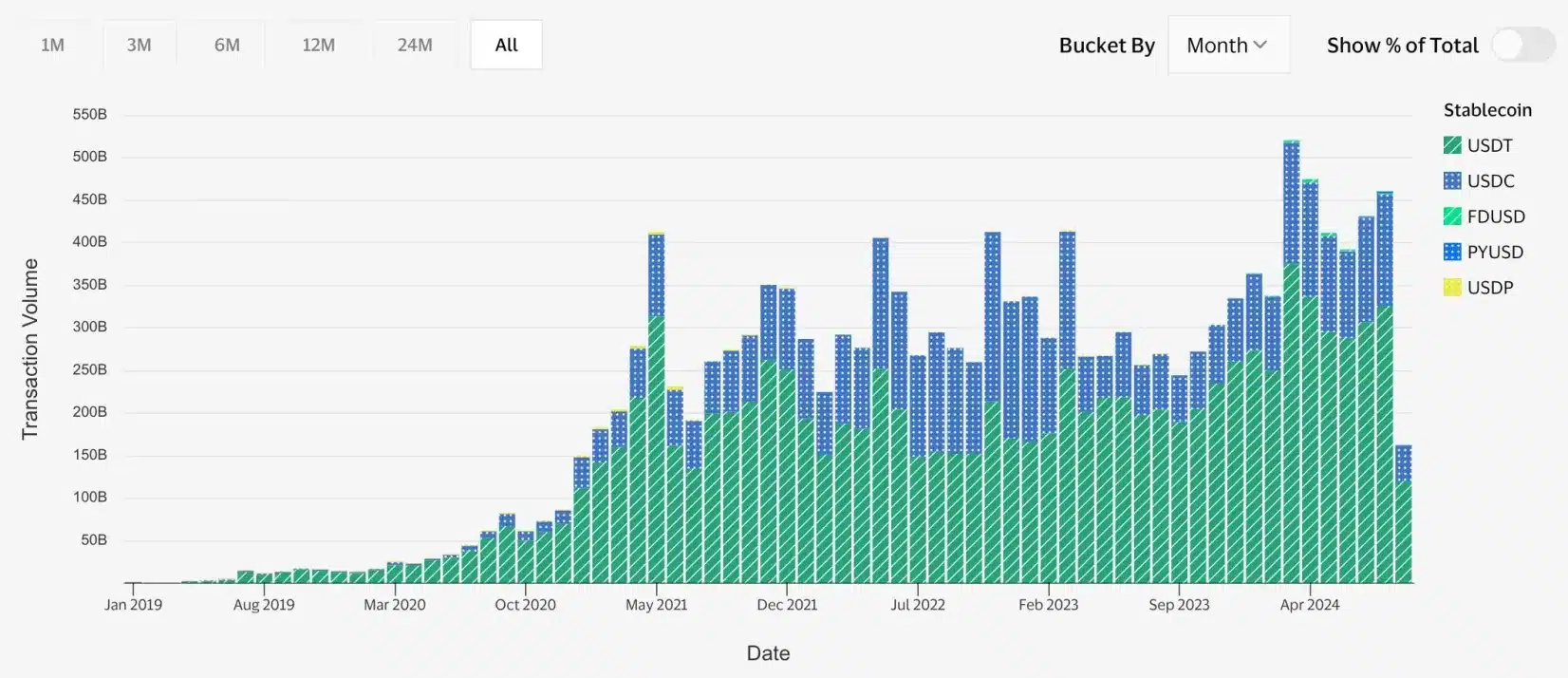

Based on data from Visa’s on-chain analysis, USDT (Tether) has noticeably surpassed USDC (Circle) in terms of transaction volume, further solidifying its dominance within the market.

As expected, USDT has significantly contributed to the recent expansion of the stablecoin market.

Since January 2024, Tether has experienced consistent growth, starting with a market capitalization of approximately $91.69 billion. Interestingly, this digital currency’s market cap surged to more than $117.84 billion by August.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Masters Toronto 2025: Everything You Need to Know

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

2024-09-13 18:16