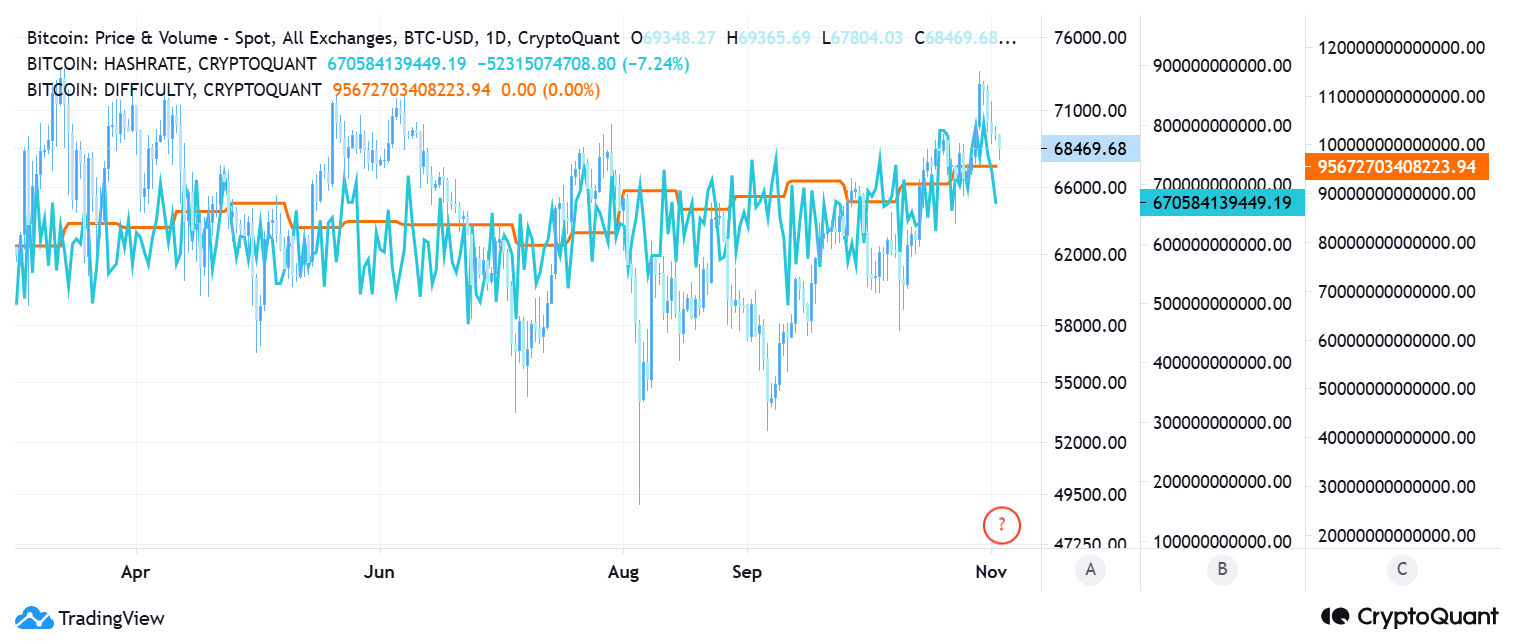

- BTC network difficulty has hit a record high and remained there.

- This is happening as BTC attempts to reclaim its ATH.

As a researcher who has been tracking Bitcoin’s network metrics since its early days, I can attest to the current surge in mining interest and the associated challenges it presents. The record-high network difficulty is a testament to the robustness of the Bitcoin network and underscores the confidence that miners have in its long-term potential.

The difficulty level within the Bitcoin network has persistently risen and reached unprecedented heights. This metric that gauges mining complexity leaves some investors questioning if the price trajectory will follow suit, or encounter a plateau instead.

As a data analyst, I delve into Bitcoin’s mining statistics, such as its hashrate and difficulty, to gain understanding about possible price fluctuations and the overall robustness of the network.

Rising network difficulty signals Bitcoin mining interest

The complexity level within Bitcoin’s network, a crucial indicator that typically adjusts roughly every fortnight, is surging to unparalleled heights. An examination of the network difficulty using CrypoQuant reveals that it hasn’t decreased even after climbing above 95 trillion.

The difficulty reflects how hard it is for miners to solve complex cryptographic puzzles and earn BTC rewards. As difficulty climbs, it implies that more miners are competing for Bitcoin, a sign of strong network participation and security.

As the level of challenge increases, it’s common to see higher computing powers (hashrates), which underscores confidence in Bitcoin’s future prospects, particularly as institutions pour resources into mining operations. The growing attention and financial commitment towards mining could bolster Bitcoin’s value by enhancing the network’s stability.

Bitcoin price correlation: Historical trends and current context

Over time, it’s been observed that a growing challenge could align with a bullish trend in Bitcoin’s price. This is because as the network becomes more secure, it tends to attract more users, which in turn strengthens investors’ confidence in Bitcoin’s robustness. Nevertheless, even with these strong network foundations, Bitcoin’s price has recently shown a minor dip.

It appears that Bitcoin has been consistently around $68,000, yet failed to maintain the significant surge predicted by many. Given the current high mining difficulty and persistent market volatility, it’s possible that Bitcoin could encounter temporary price obstacles near $70,000.

Multiple elements could be causing this perceived resistance. As the challenge of mining grows and costs rise, miners might find themselves compelled to sell more Bitcoin just to keep their operations going, thereby increasing the supply of Bitcoin in the market. This increased availability might put downward pressure on the market’s price.

In simple terms, even though Bitcoin’s network is functioning well, its price increases might be moderated temporarily due to its link with wider economic fluctuations.

Can BTC surpass resistance levels?

If Bitcoin’s institutional interest remains robust, it might push the price beyond its existing resistance. But, if the mining community persists in growing and maintaining tough difficulty rates, miners could opt to save their earnings instead of selling them, thus balancing their costs.

Read Bitcoin (BTC) Price Prediction 2024-25

Such behavior would reduce market supply, potentially driving up prices in the medium term.

To put it simply, although Bitcoin’s current price is facing temporary challenges, its growing network complexity suggests that its security and allure are on the rise. If this trend continues, particularly in conjunction with economic stability, we might expect Bitcoin to experience an upward trend.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Elder Scrolls Oblivion: Best Pilgrim Build

- Days Gone Remastered Announced, Launches on April 25th for PS5

- Elder Scrolls Oblivion: Best Thief Build

- Gold Rate Forecast

- Ludicrous

- Justin Baldoni Opens Up About Turmoil Before Blake Lively’s Shocking Legal Claims

- Elder Scrolls Oblivion: Best Sorcerer Build

- Yvette Nicole Brown Confirms She’s Returning For the Community Movie

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

2024-11-04 07:03