- SUI’s milestone in DEX volume could attract more liquidity providers and investors to its ecosystem

- SUI is consolidating between $4.86 and $4.61, with a decisive move potentially triggering a 10% swing

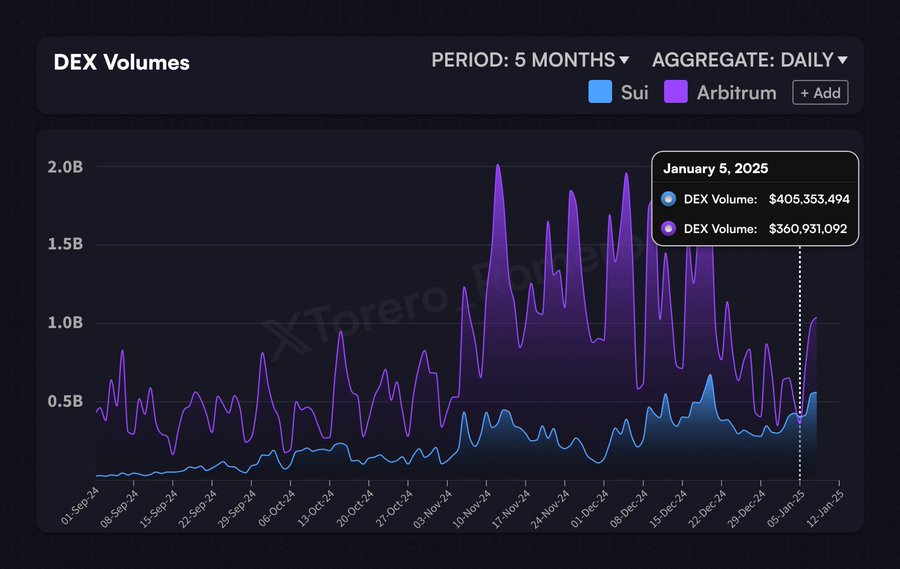

For the first time, SUI has outpaced Arbitrum in terms of DEX volume, demonstrating its increasing dominance within the DeFi sector. Yet, the price behavior of the token suggests a different narrative. At present, it’s holding steady between $4.86 and $4.61, indicating that it may soon make a substantial move that could potentially impact its value by approximately 10%.

At this important crossroads, the outcome of SUI’s surge (or dip) might shape its short-term direction and reinforce its position in the market.

Why this flip matters for SUI

Achieving higher Decentralized Exchange (DEX) volume than Arbitrum signifies a significant milestone for SUI. The volume of DEX transactions is an essential metric that demonstrates the network’s liquidity and user interaction, indicating the level of activity among participants as they engage in trading and various financial activities on the protocol.

As an analyst, I am thrilled to announce that the successful flip of our system, SUI, symbolizes our capacity to compete with industry giants, thereby inviting a surge of developers, liquidity providers, and investors into our thriving ecosystem. This monumental achievement also underscores the scalability and practical application of SUI, which serves to boost market confidence. Consequently, this increased trust could fuel a more sustained adoption rate and demand for our tokens.

SUI – The no-trade zone

Based on the analysis of crypto expert Ali Martinez, the value of SUI has been fluctuating between approximately $4.86 and $4.61. This range, known as a “no-trade zone,” is typically shied away from by traders because it’s hard to predict which direction the price will move due to its uncertain bias.

In this area, we see uncertainty in the market as neither buyers nor sellers are in control. If the price surpasses $4.86, it may suggest a bullish surge. Conversely, if the price closes below $4.61, it could signal more bearish activity.

Investors are keeping a close eye on the price range between $4.86 and $4.61, as a breakout beyond this area might lead to substantial market fluctuations, possibly causing a 10% price shift in either direction. This crucial range will help decide SUI’s future trend direction. At present, it’s important to exercise restraint, as the market is waiting for a clear movement to establish its direction and offer more favorable trading possibilities.

Key scenarios – What could happen next?

At a crucial juncture, SUI has three possible directions. If it surpasses the $4.86 mark, it might head towards $5.10, provided there is sufficient buying activity.

If SUI drops below $4.61, it risks a pullback to $4.42 – A key support level.

Additionally, it’s possible that SUI could stay within a narrow band, roughly between $4.61 and $4.86. This suggests that the market is uncertain about its direction. Keep an eye out for significant increases in trading volume as these might indicate a breakout from this range.

Implications for SUI token’s price

Increased trading volumes on decentralized exchanges suggest growing engagement and curiosity around the SUI token. This trend might affect its price dynamics. This fundamental shift could coincide with the current technical arrangement, potentially leading to a price surge or further market stabilization.

An increase in Decentralized Exchange (DEX) transactions might signal increased market involvement, potentially causing more price fluctuations. For immediate trading, it’s crucial to focus on significant volume changes. As for the mid-term perspective, it hinges on continuous market involvement and adjustments in investor sentiment.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

2025-01-10 18:15