- Futures Open Interest retreated from the $1 billion milestone

- Liquidation patterns hinted at balanced market sentiment

In simple terms, the analysis of Binance Coin (BNB) showed notable changes in market dynamics as the amount of Futures contracts held by institutions pulled back from hitting a $1 billion mark in December. As institutional investors are adjusting their investment strategies, the current market setup presents intriguing trends that deserve closer inspection at this moment.

Derivatives market signals mixed sentiment

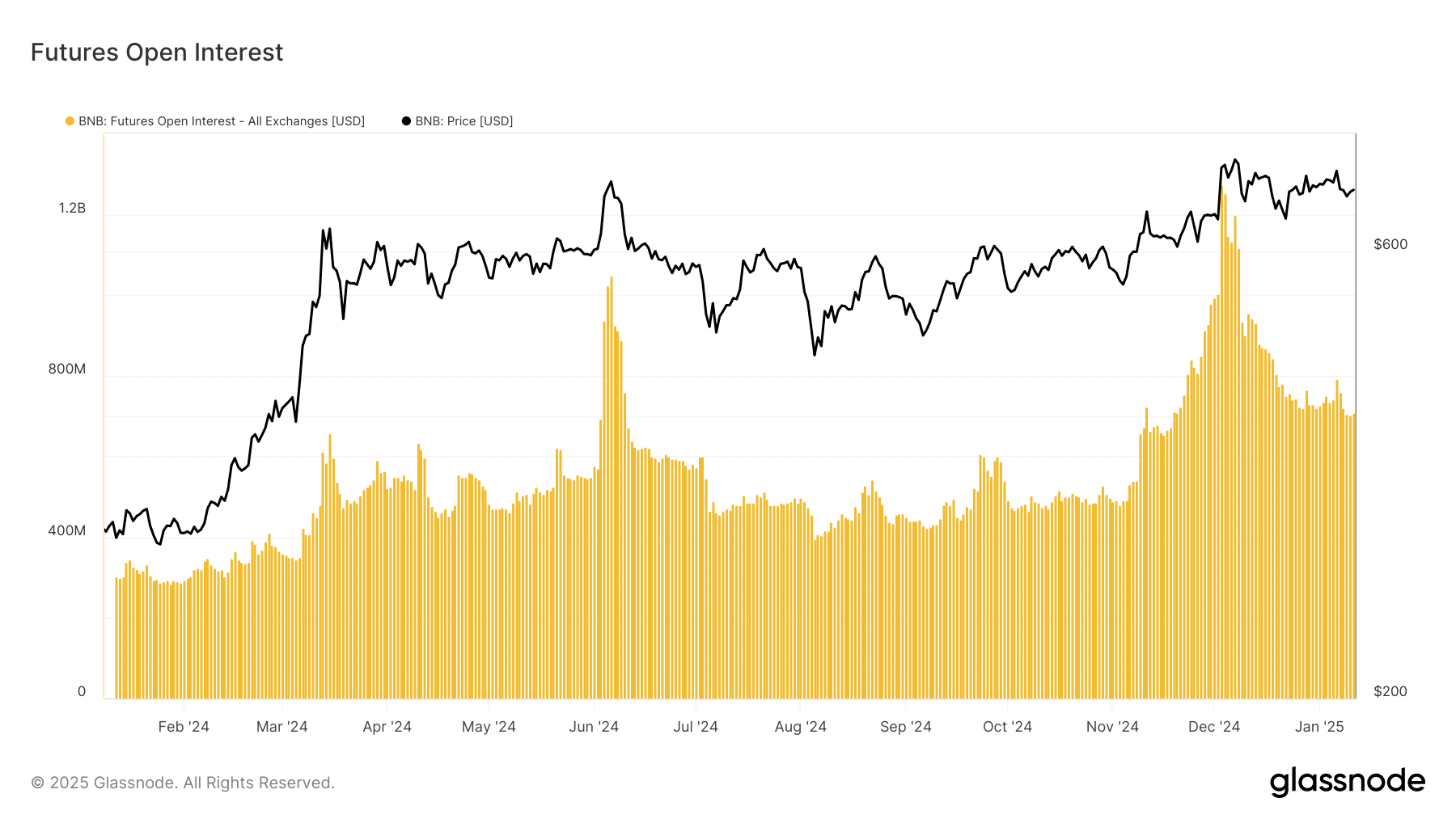

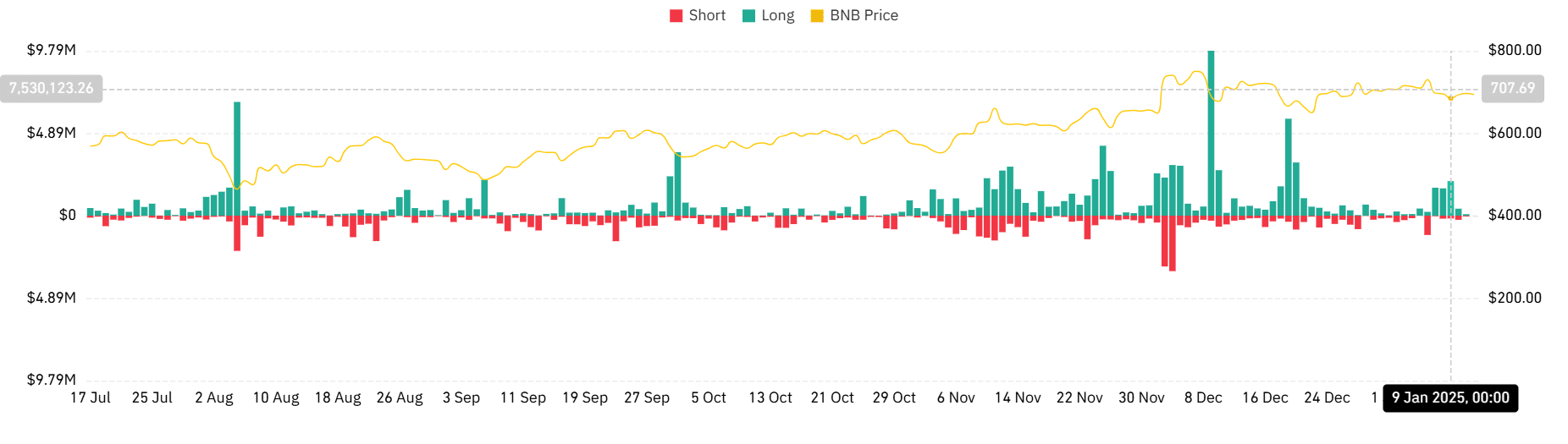

As reported by Glassnode, the open interest for BNB’s futures contracts has decreased significantly after reaching its highest point, with less money being locked in these contracts overall. In December, long liquidations were more frequent and peaked at $9.79 million, but in recent times, liquidation patterns have become more balanced between long and short positions – indicating a market position that is neutral.

The trading volumes portrayed a captivating scene, showing consistent action even as open interest decreased. Additionally, the balance between long and short liquidations has returned to normal levels, suggesting a decrease in systemic leverage – A sign that could point towards an improvement in BNB’s market layout.

BNB’s price action holds steady, despite OI decline

BNB’s spot price has demonstrated remarkable resilience, despite the cooling derivatives market.

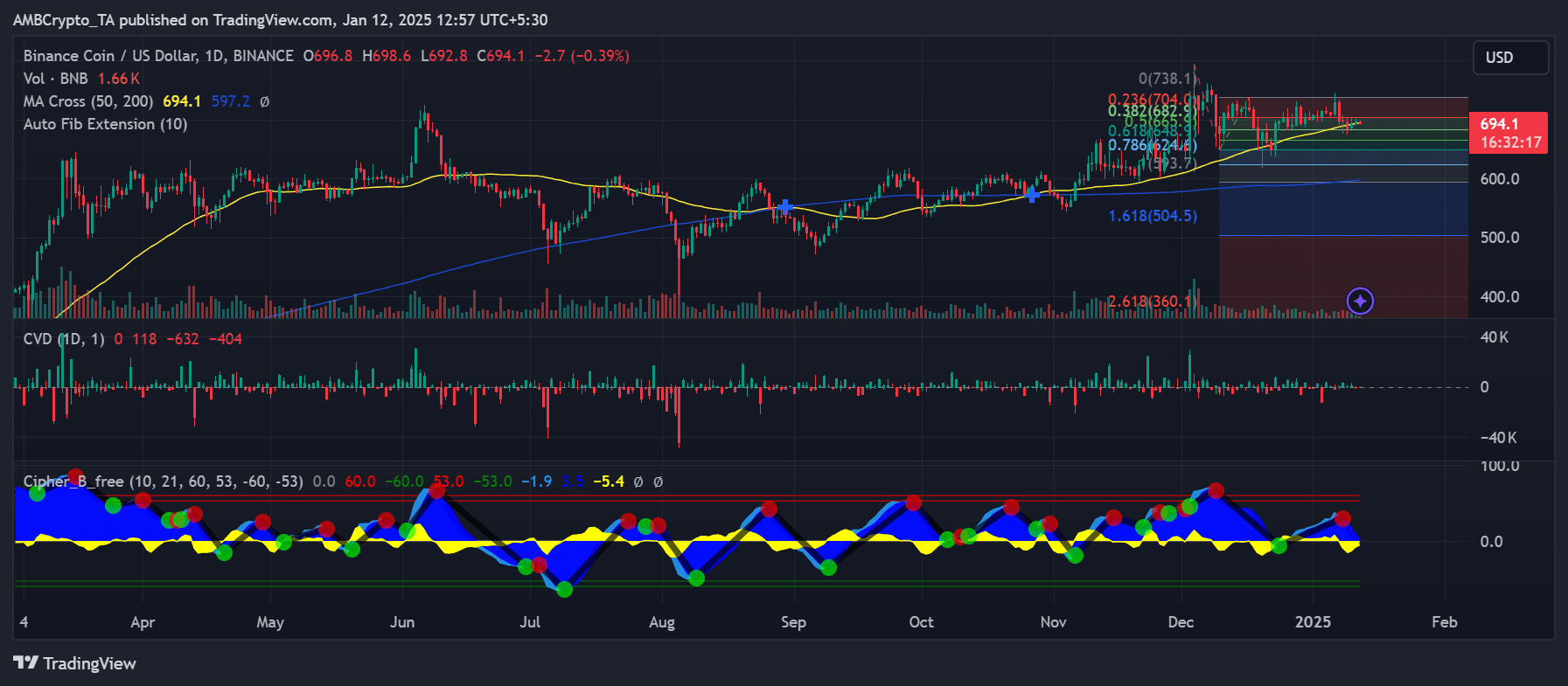

Currently priced at $694.1, the token appears to be holding its ground above significant moving averages. Specifically, the 50-day moving average aligns with the current price, while the 200-day moving average sits slightly lower at $597.2. This arrangement creates what’s known as a “golden cross” on the charts, indicating a potential bullish trend.

The Cumulative Volume Delta (CVD) indicator suggests a steady, yet somewhat restrained, institutional accumulation of shares, compared to the heavy buying in December. In other words, it appears that savvy investors are still showing interest, but are adopting a more conservative approach with their investments.

BNB market structure shows strength

Highlighted Fibonacci extension levels marked significant points of interest, and the 0.786 retracement levels around $624.8 offered robust support. The altcoin’s recent price movements have formed a sequence of higher bottoms, signifying hidden resilience even amidst the drop in open interest.

Additionally, the structure of BNB’s market has stayed positive above the $680 support level. The decrease in open interest along with steady price movements hints at a possible transition from speculative trading using leverage towards price determination based on spot trades – A change that often indicates a more robust market behavior.

– Read Binance Coin (BNB) Price Prediction 2025-26

Although hitting the $1 billion Open Interest (OI) mark was the talk of the town in December, it’s the current market setup that might offer a more lasting base for BNB’s next step. Traders would be wise to keep an eye on the alignment of spot and derivative indicators as they could signal a clear inclination.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-01-12 19:03