- Data indicated that BTC is now in an oversold region, which could signal an imminent price rebound

- Total supply in profit revealed that BTC is not yet at the cycle’s low, leaving room for a significant upward move

recently, the overall market outlook has been becoming more optimistic. In fact, in just the past day, Bitcoin has increased by around 2.57%, which currently values it at about $97,500 per coin as of now. Yet, this price surge doesn’t seem to be backed up by strong market dynamics, as the momentum itself has dropped by nearly 23.23% over that same timeframe.

An examination of past patterns suggests there’s room for more expansion, implying Bitcoin could potentially reach a new record peak within the near future.

An ‘undervalued’ position

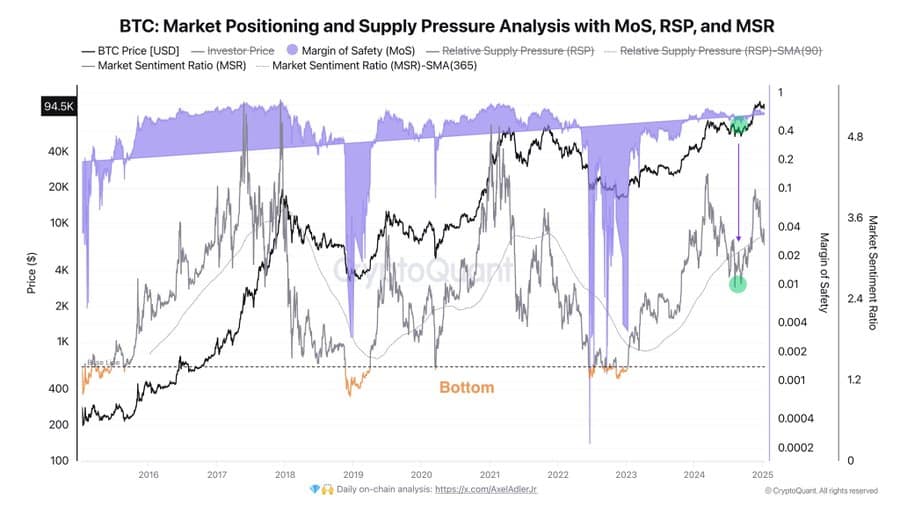

According to the insights derived from CryptoQuant’s Market Position and Supply Pressure metrics, it appears that Bitcoin (BTC) could potentially be priced lower than its true value. This inference is supported by the Margin of Safety (MoS) and Market Sentiment Ratio (MSR) indicators.

The Margin of Safety (MoS) compares Bitcoin’s current value to a crucial benchmark to determine if it’s overpriced or under-purchased. If the MoS moves above this line, it signals that Bitcoin might be overvalued. Conversely, when the MoS falls below the line, it suggests that Bitcoin could be undervalued.

Currently, as I’m typing this, the Moving Average of Smares (symbolized by the purple cloud) is running below its baseline and hovering around the $90,000 region. This suggests that Bitcoin has entered an oversold state, indicating a potential rally could occur in the near future.

In simpler terms, the Market Sentiment Ratio (MSR) gauges the overall feeling in the market, whether it’s optimistic or pessimistic, by comparing its current value to its yearly average (Simple Moving Average – SMA). As of now, it stands at 1.4.

At the current moment, the Moving Average (MSR) is sitting below the annual Simple Moving Average (SMA). This suggests a prevailing sense of market pessimism.

Historically, when the Maker of Supply (MoS) drops beneath the normal level and the Moving Sum of Realized Volatility (MSR) goes below its yearly Simple Moving Average (SMA), as shown by green dots on CryptoQuant’s chart, these circumstances have typically offered a robust buying opportunity. In these instances, Bitcoin has frequently experienced substantial price increases, as depicted in the charts.

It appears that a familiar pattern is emerging in the market once more, which might suggest that Bitcoin is preparing for an upswing again.

Far from the market top?

According to the data from Glassnode’s Total Supply of Bitcoin in Profit, which helps identify potential peaks and troughs in the market, it appears that Bitcoin has not yet reached a point where its market peak might occur.

Based on what we’ve seen before, BTC hasn’t reached the red line trend yet, a point in the past that signified significant turning points.

If Bitcoin (BTC) reaches the indicated red trendline, it signals that most investors are currently experiencing a profit. In the past, these types of situations have often led to significant market declines. As traders start to cash out their gains, this can lead to a decrease in price due to increased selling pressure.

At present, Bitcoin is currently sitting comfortably above the trendline, suggesting that it may continue to rise due to its current holders being motivated by potential future profits to keep their positions intact.

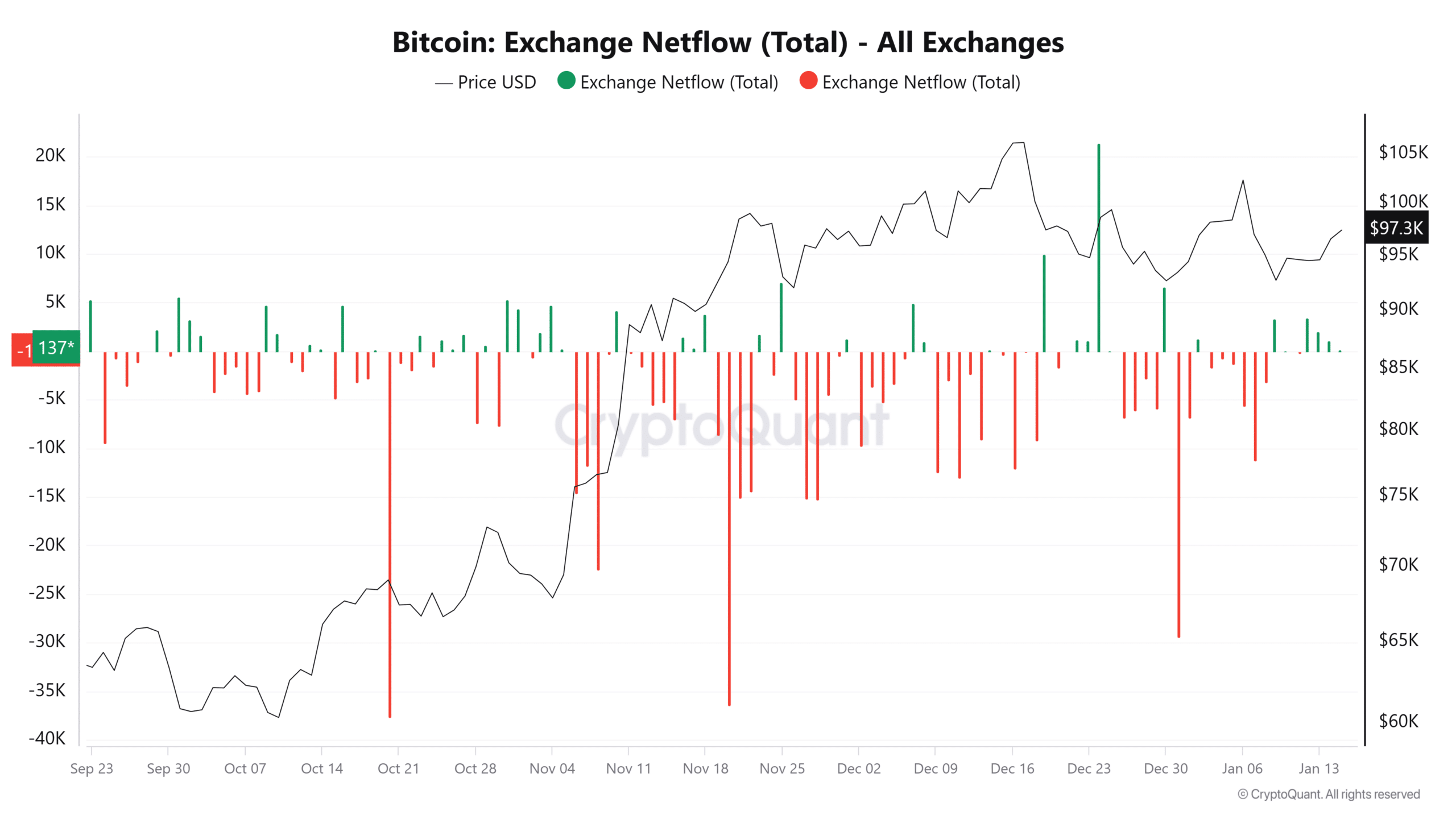

Exchange netflows’ findings

Ultimately, the analysis of the exchanged bitcoins (netflows) showed a steady decrease since January 12th, with the amount dropping dramatically from around 3,431.69 BTC to only 137 BTC.

A continuous decrease in outgoing Bitcoin transactions on exchanges indicates less selling activity, since investors are transferring their BTC to personal wallets. Such actions may signal increasing confidence among owners.

As a researcher observing the market dynamics, I’ve noticed that when the net flow of exchanges shifts negatively, it often indicates growing confidence among spot traders. This positive sentiment, as history has shown us, tends to coincide with an upward trend in Bitcoin prices.

Essentially, Bitcoin appears robust as it continues to climb, boosted by decreasing sell-offs and growing investor trust.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2025-01-15 13:11