-

BTC surged to $62K as the Fed’s easing cycle began.

Analysts remained cautious after the Fed’s ‘aggressive’ 0.50% rate cut.

As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous cycles of monetary policy changes and their impact on various asset classes. The recent surge of Bitcoin [BTC] to $62K following the Fed’s 0.50% rate cut is a clear example of how these policies can influence cryptocurrencies.

On September 18th, the global leader in digital currencies, Bitcoin (BTC), spiked to approximately $62,000 following an unexpected 0.50% reduction in interest rates by the Federal Reserve.

BTC hit $62.5K, a two-week high that increased September’s recovery gains to nearly 18%.

Surprisingly, the larger-than-anticipated interest rate reduction left many economists who were surveyed by Bloomberg taken aback. The Bloomberg poll indicated that the majority of economists favored a 25 basis point decrease, with only nine out of one hundred and fourteen predicting a 50 basis point cut.

Although the Fed Fund Futures accurately predicted the Fed’s 50 bps cut, the higher odds for aggressive cuts only changed earlier in the week.

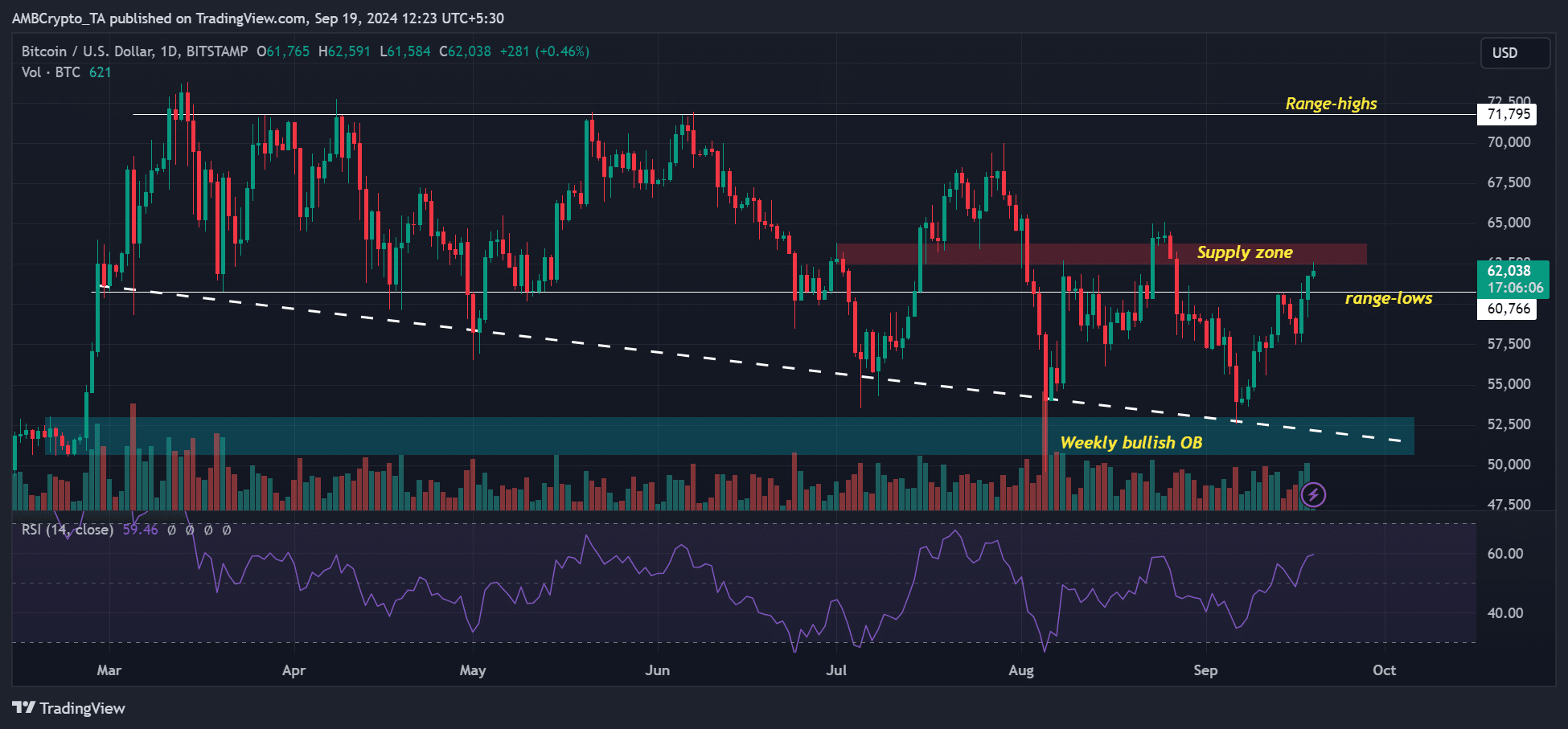

What’s next for BTC?

In response to the 0.50% reduction in interest rates, Chair of the Federal Reserve, Jerome Powell, explained that this move aimed to preserve current low levels of unemployment as inflation has subsided.

The change in policy marked the commencement of a monetary policy relaxation phase, potentially favoring high-risk investments like Bitcoin.

However, market pundits remained cautious as the aggressive cut signaled recession worries.

Arthur Hayes, the founder of BitMEX, expressed that the 50 basis point reduction was an alarming disaster for financial markets, suggesting a more profound decay within the global financial infrastructure.

He added that assets might rally in the first or second day, followed by depressed prices afterward.

21Shares’ Crypto Research Strategist, Mett Mena, shared a similar cautious perspective. Yet, he emphasized to AMBCrypto that the easing cycle could be favorable for Bitcoin in the long run.

As a researcher, I am exploring how economic indicators might influence the digital asset market. In the immediate future, a 50 basis point reduction in interest rates may serve as a sign to the market that the economy is decelerating. However, over an extended period, history suggests that Bitcoin and other digital assets have prospered in environments characterized by low-interest rates.

One factor causing anxiety in the Bitcoin market is the appreciation of the Japanese Yen compared to the US Dollar (USD). This is significant because a large-scale sell-off occurred in early August following the unraveling of the carry trade, which could have an impact on the value of BTC.

As the Bank of Japan’s decision is set for September 20th, Hayes advises monitoring this event closely to predict Bitcoin’s price trend.

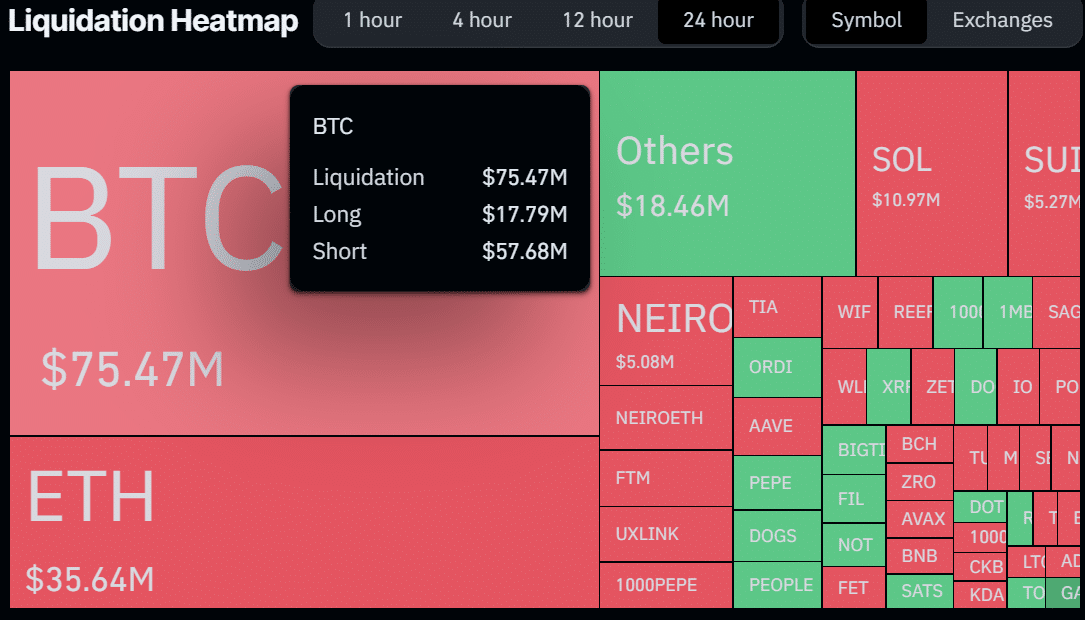

During that period, an increase caused approximately $57 million in short positions, which were valued at $75.5 million in total, to be liquidated and closed. This event strengthened a temporary optimistic outlook among traders in the Futures market.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2024-09-19 16:07