- Whales are splashing around, and reserves are drying up faster than a puddle in the desert. Rebound? Maybe. Drama? Definitely.

- Active addresses are popping up like daisies, but long liquidations are raining on the parade. Bears, bulls, and a whole lot of confusion.

Well, well, well, if it ain’t the whales making waves in Uniswap’s [UNI] pond. One particularly ambitious whale just snapped up 290,212 UNI for 1,000 ETH ($1.97M) after a 3.5-month nap. That’s like waking up from hibernation and buying a small island. 🐋💸 This kind of splashy move suggests someone’s feeling bullish about UNI, and the market’s buzzing like a beehive.

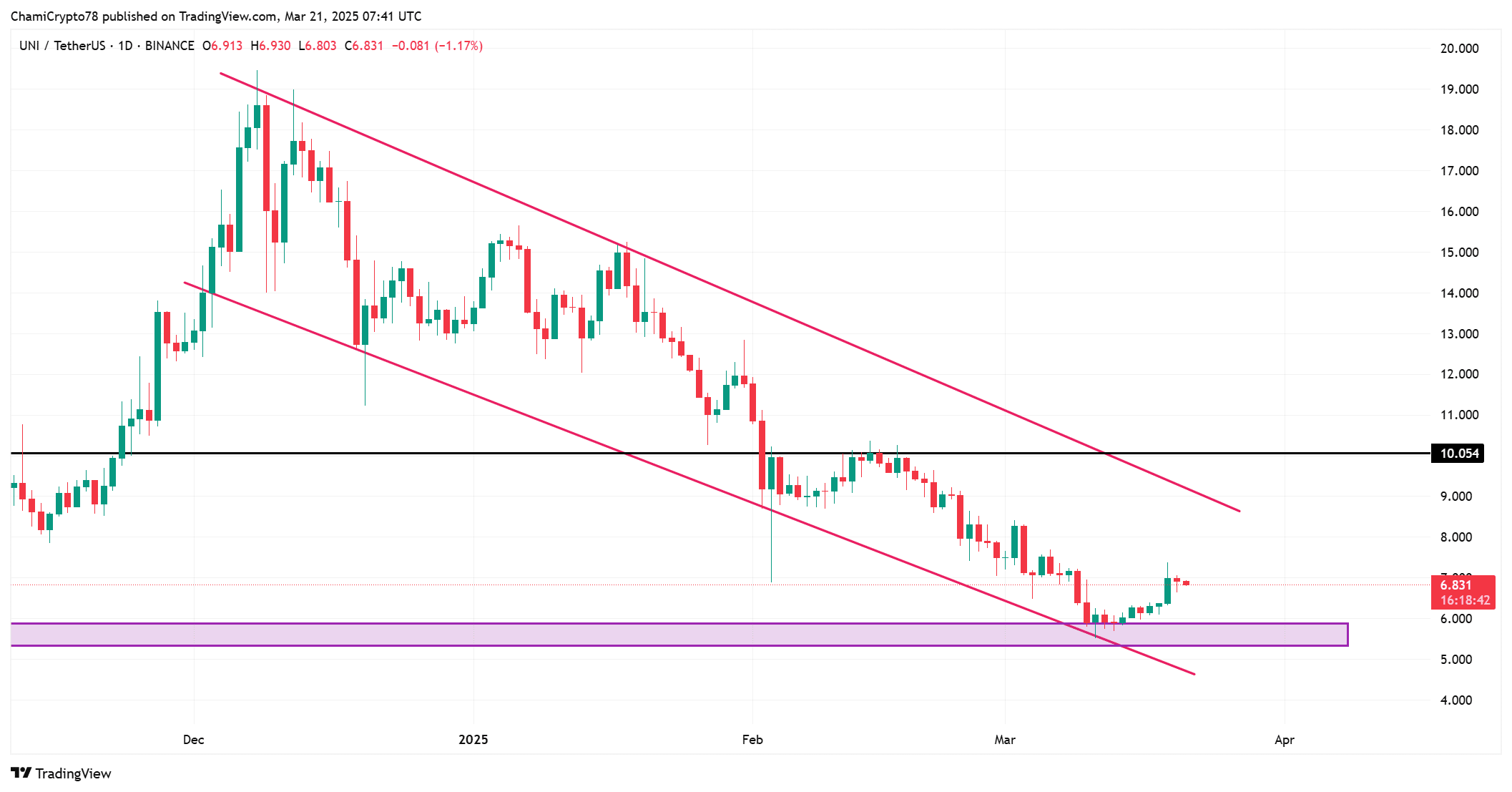

At the time of writing, UNI was trading at $6.82, up a whopping 0.13% in 24 hours. That’s not exactly a moonshot, but hey, Rome wasn’t built in a day. Whale movements like this often signal a shift in the market, and when the big fish swim, the little fish better pay attention.

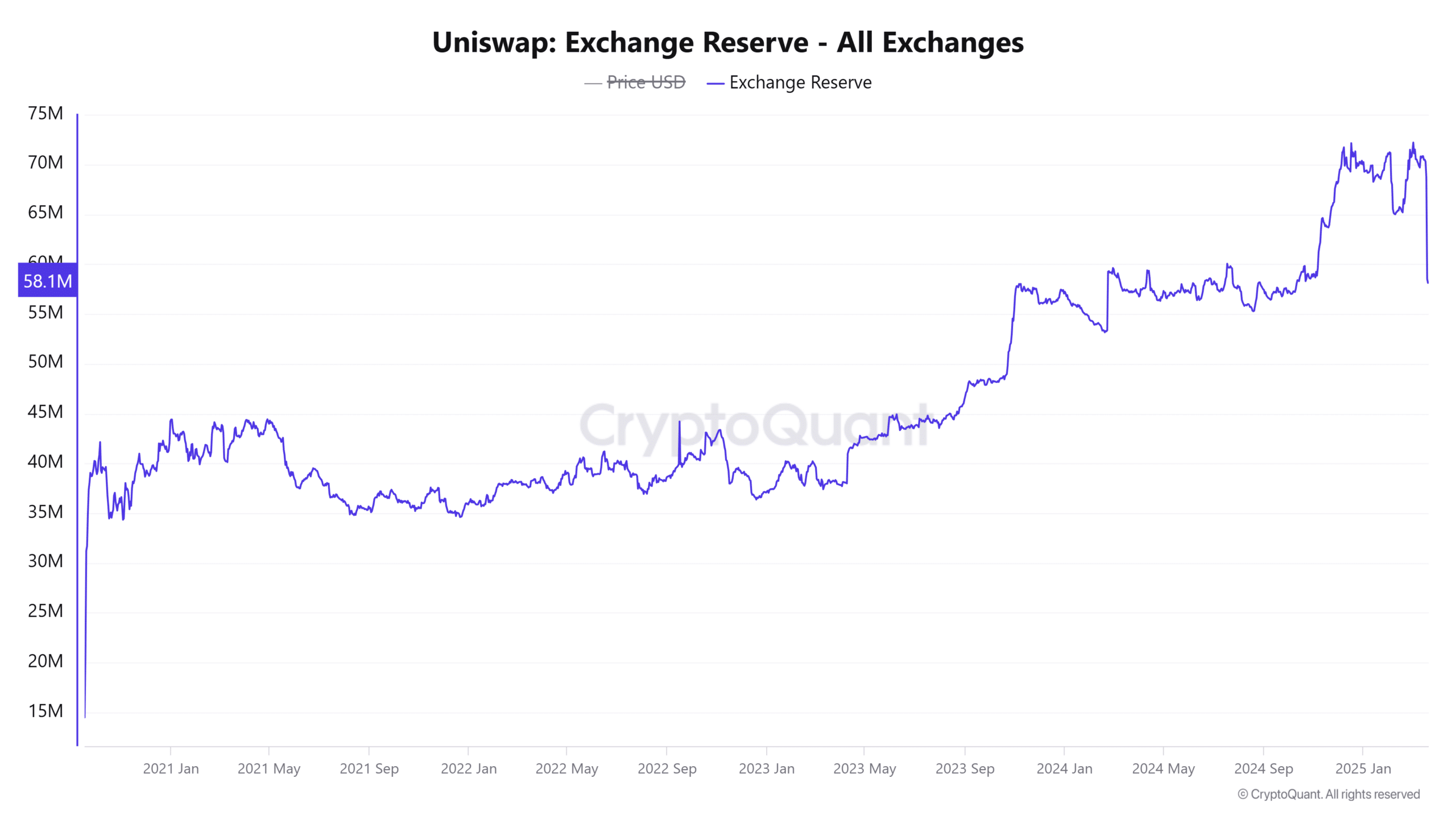

UNI’s exchange reserves dropped by 15% in the last day, which means fewer coins are up for grabs. Less supply usually means higher prices, assuming folks still want to buy the darn thing. So, this could be a sign of price stability or even a rebound, especially if demand keeps climbing.

Is UNI About to Pull a Phoenix? 🔥

Looking at the charts, UNI’s price has been bouncing around like a kid on a trampoline. It recently hit a key support level and has been inching upward. If it can hold its ground, we might see a climb toward the upper boundary of its descending channel. A break above $10.05 could signal a stronger bullish trend. So, while the market’s as unpredictable as a cat on a hot tin roof, there’s a glimmer of hope for a rebound.

Address Stats: The People Are Talking 🗣️

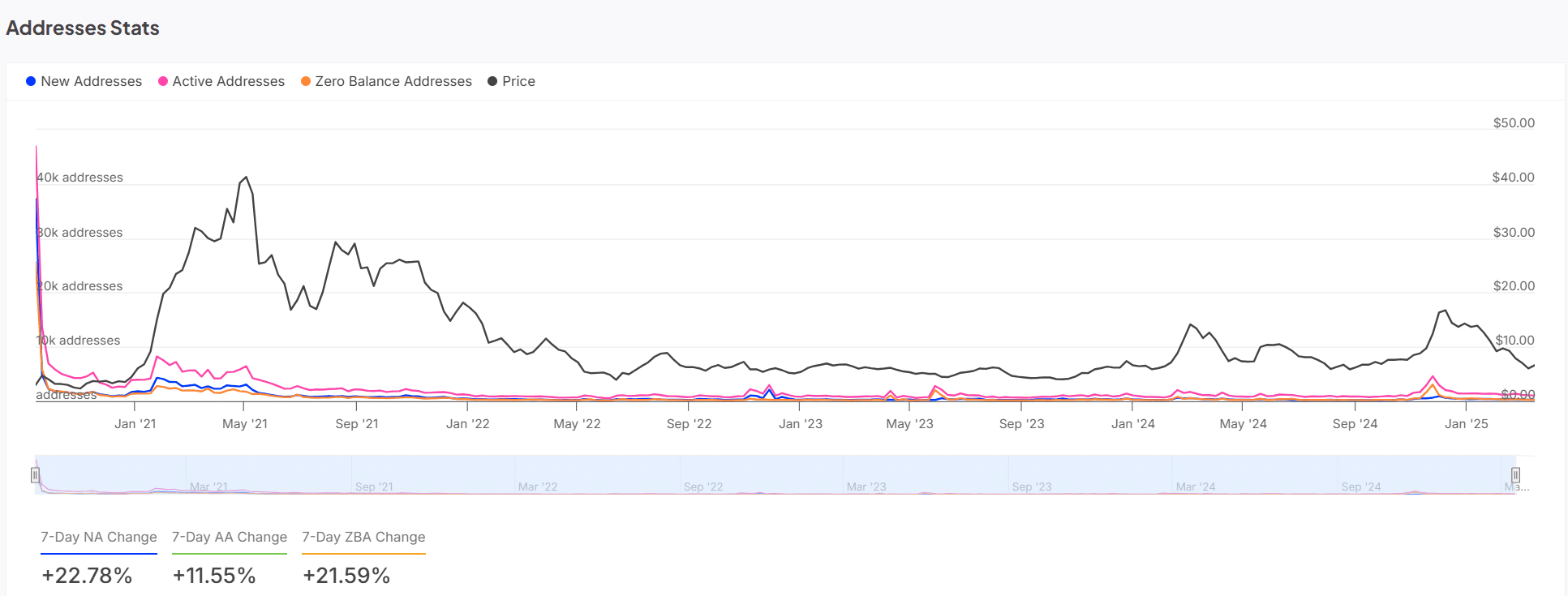

UNI’s address stats are looking rosier than a summer sunset. New addresses jumped by 22.78% in the past week, and active addresses climbed by 11.55%. More addresses mean more folks are jumping into the UNI pool, which could help buoy the price. Demand is rising, and that’s a good sign for a potential rebound.

Liquidations: The Bearish Hangover 🍻

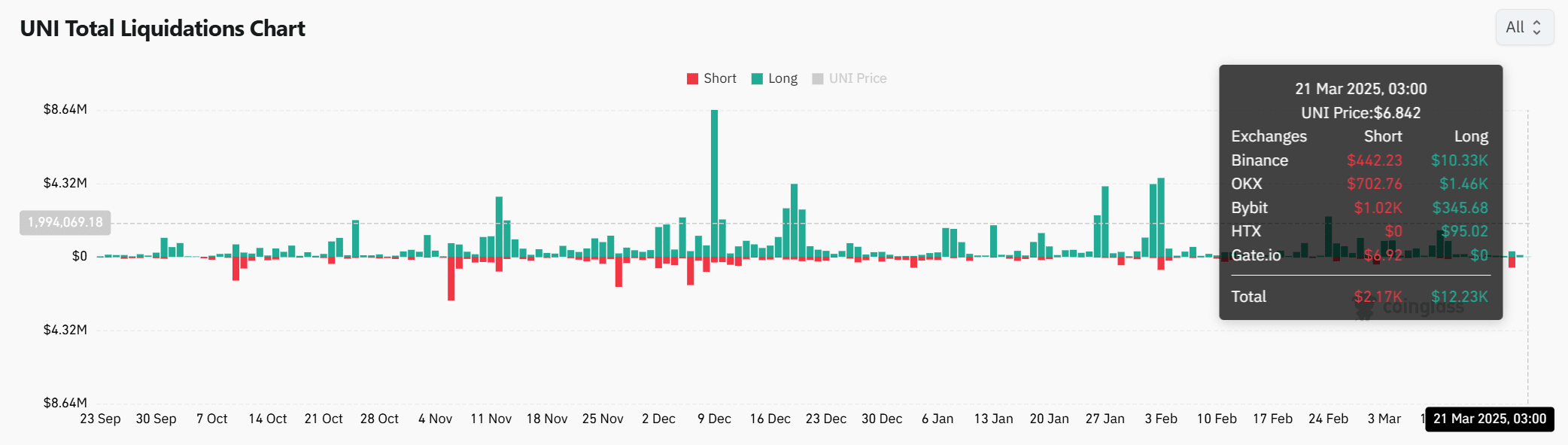

Liquidation data shows that long positions are getting squeezed harder than a lemon in a margarita. Long liquidations hit $12.23k, while short liquidations were a measly $2.17k. This suggests the market’s leaning bearish, with more traders betting on price hikes getting forced to cash out. But don’t count UNI out just yet—the rise in active addresses and falling reserves could still stabilize the price or even spark a rebound.

At the time of writing, UNI’s showing some promising signs of a potential rebound, despite the usual market chaos. Whale activity, rising address stats, and liquidation data all point to renewed interest in UNI. With more investors jumping in, support levels are likely to hold, paving the way for a price recovery. So, keep your eyes peeled—UNI might just be gearing up for a comeback. 🚀

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2025-03-22 04:12