- UNI’s tightening Bollinger Bands and RSI nearing overbought suggest a potential breakout above $8.38.

- Market sentiment remains positive as large transactions and open interest show bullish momentum.

As a seasoned crypto investor with over a decade of experience navigating the tumultuous waters of digital assets, I’ve learned to read between the lines when it comes to market trends and on-chain signals. And looking at UNI right now, things are shaping up quite nicely for a potential breakout.

Uniswap (UNI) has solidified its position as a frontrunner in the world of decentralized finance, handling trading volumes exceeding $2.4 trillion and generating over $8 billion in economic returns. Furthermore, it has paid an impressive $2.7 billion in gas fees, underscoring its undeniable importance within Ethereum‘s ecosystem.

At present, UNI is trading at $8.02, marking an increase of 3.23%. This growth has sparked interest among traders. However, there’s a lingering query: Will UNI manage to surpass its current range, potentially igniting a bullish surge?

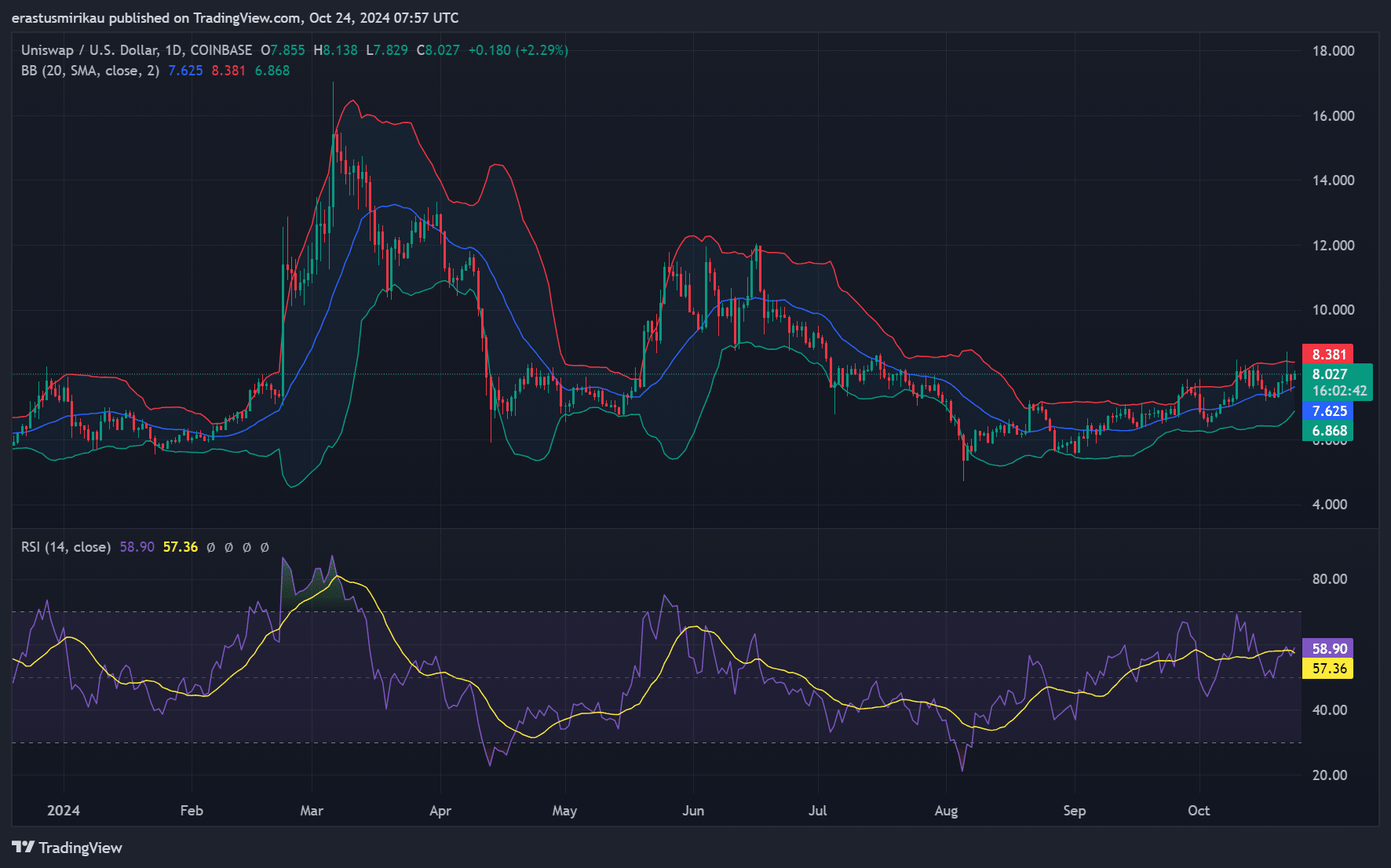

UNI chart analysis: Nearing a critical point?

Over the last several months, UNI’s daily price movements have mainly stayed within a restricted bandwidth. The Bollinger Bands hint at the narrowing of these prices, which typically suggests an upcoming breakout may occur soon.

Moreover, the Relative Strength Index (RSI) stands at 58.90, which is close to the threshold for overbought conditions. This implies that UNI might experience additional gains if buying momentum continues.

If the token doesn’t manage to surpass the $8.38 barrier, it might experience more sideways movement, or even potentially reverse its gains.

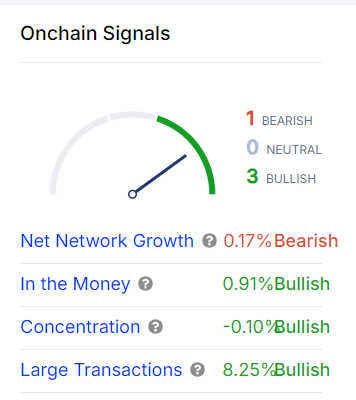

On-chain signals: Mostly bullish, but is it enough?

The on-chain data for UNI presents a compelling, mostly bullish case. The “In the Money” metric shows that 0.91% of all addresses are profitable, indicating positive sentiment among investors.

Moreover, there’s been a 8.25% rise in significant transactions, suggesting heightened involvement from major investors. This trend could be a positive signal pointing towards potential upward price movement.

However, there’s a slight hiccup—net network growth, though only down 0.17%, shows some hesitation in new participants joining the network. Therefore, while the on-chain data supports a bullish outlook, this slight dip in growth is something to watch.

Open interest analysis: A surge in activity

At UNI, the number of active contracts has increased by 3.91%, now standing at approximately $122.69 million in total. This rise indicates that more traders are entering into new trading positions, which can frequently signal an upcoming surge in market volatility.

As open interest grows, supported by both technical signals and blockchain data, it’s more and more probable that we will witness an upward price trend.

Considering the technicals and on-chain signals, UNI appears poised for a breakout.

Although a minor decrease in network expansion causes some concern, the rising engagement and robust results in other key areas imply that UNI could imminently surpass its existing resistance thresholds.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-10-24 17:43