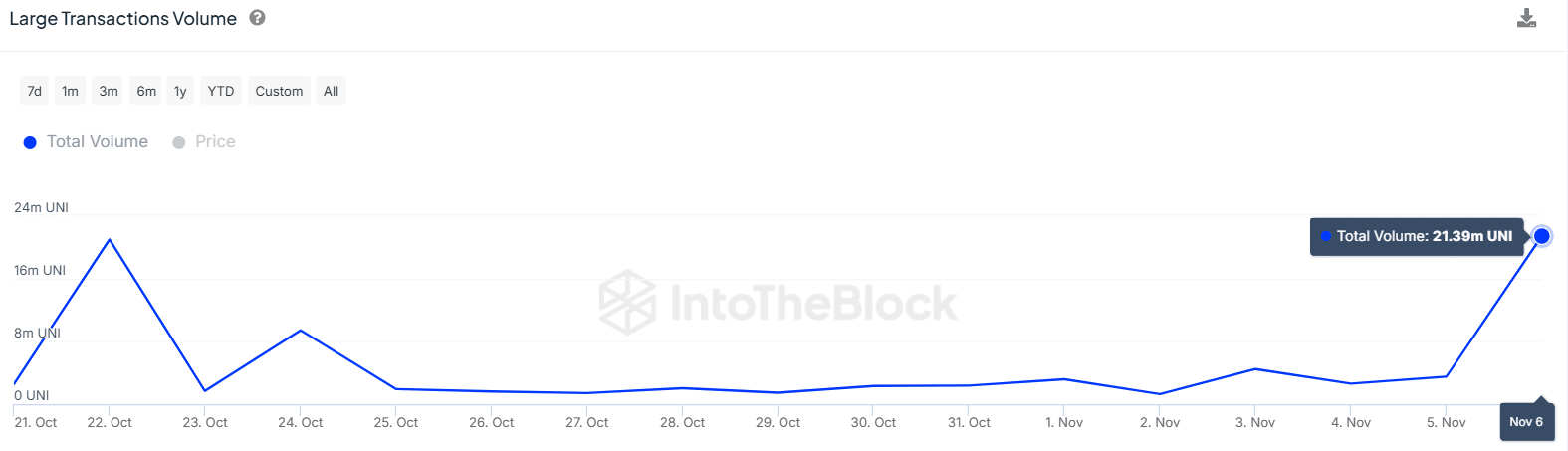

- Uniswap whale activity surged as large transaction volumes increased from 3.05M to 21.39M.

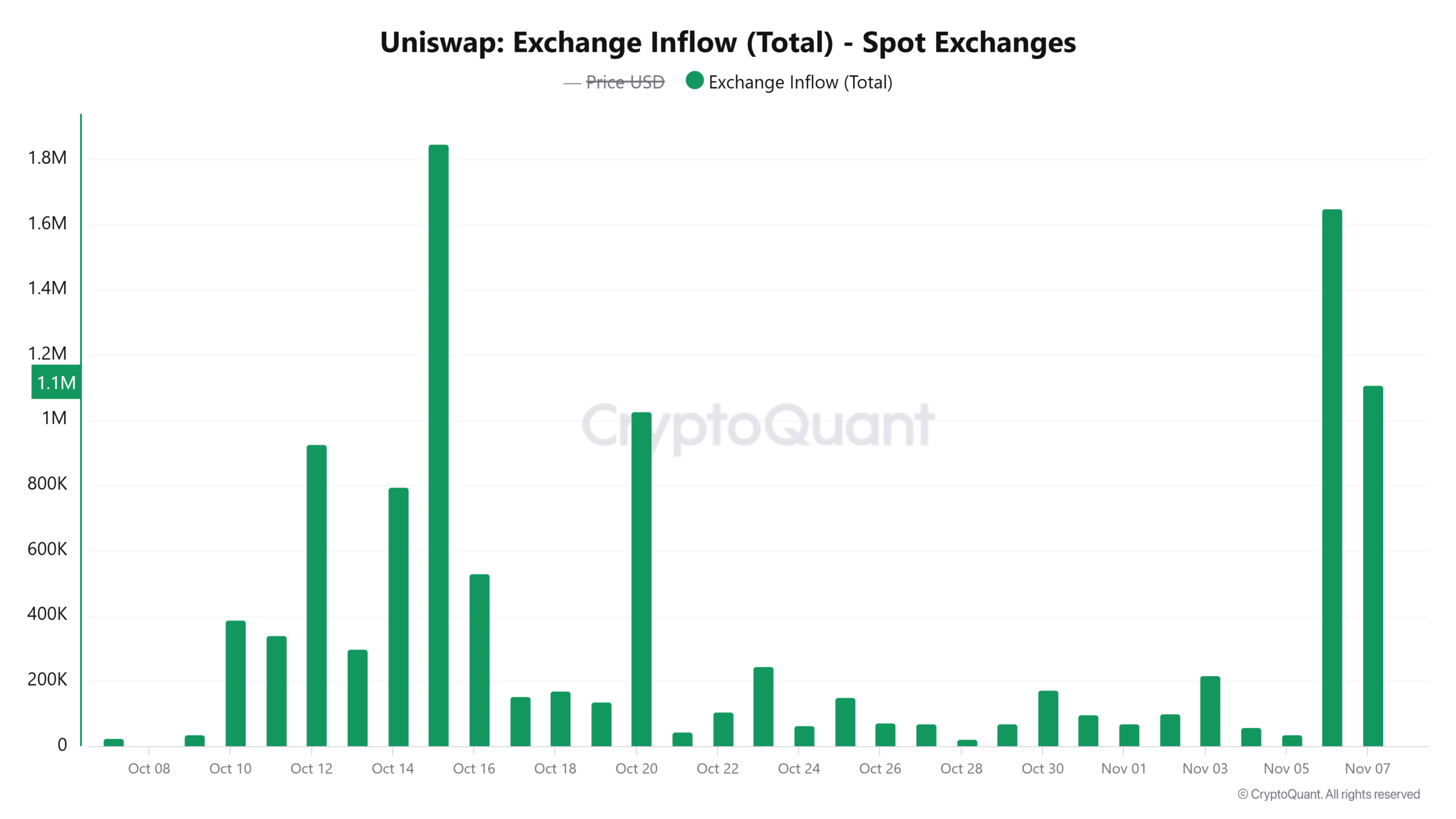

- UNI’s rally to a 4-month high stalled after more than 9M UNI were deposited to exchanges, increasing the selling pressure.

As a seasoned researcher with years of experience in the cryptocurrency market, I’ve seen my fair share of whale activity and its impact on various coins. The recent surge in Uniswap [UNI] transactions, particularly those by large traders, is nothing short of impressive. However, it’s also a double-edged sword that brings with it increased volatility.

Over the past 24 hours, there’s been a significant increase in the price swings of Uniswap [UNI], with its value moving from around $8.83 to $9.63. This volatility appears to be related to a surge in whale activity.

According to data from IntoTheBlock, the number of significant transactions (over $100,000) skyrocketed in a day’s time, jumping from 3.05 million to a staggering 21.39 million. This massive surge represented an increase of more than five times the original amount.

It’s highly probable that the increase in value we’ve seen recently is due to these major traders purchasing UNI, given that they own a significant portion (51%) compared to retail traders who hold just 16%.

Therefore, when whale transactions increase, it is bound to have an impact on volatility.

Is Uniswap primed for a 30% rally?

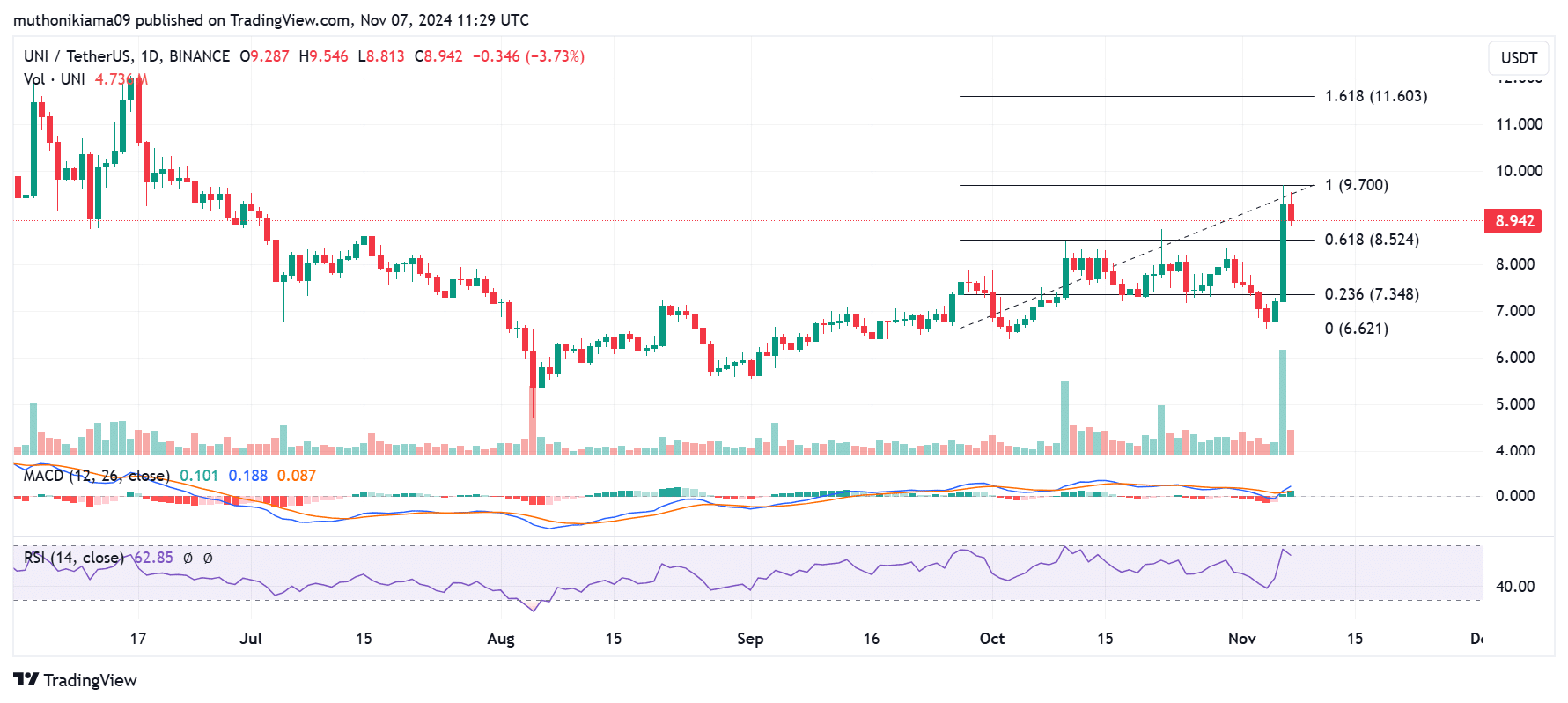

At the moment, UNI was priced at approximately $8.93. However, the ongoing surge in its value has paused because buyers have run out of steam following a peak at around $9.63 over the past four months.

On the daily chart, the histogram bars indicated a strong surge in buying activity. Additionally, the Relative Strength Index (RSI) rose to 62, hinting at an increase in buyer influence driving the market’s bullish trend.

As I observed the market’s recent downturn, interestingly, the Moving Average Convergence Divergence (MACD) suggested that the bullish trend persists. Specifically, the MACD line and the histogram bars have both turned positive, indicating the upper hand remains with the bulls.

To keep rising, Uniswap requires stronger backing from buyers. This might trigger a surge of up to 30%, taking it to the next potential resistance at approximately $11.60, according to the 1.618 Fibonacci level.

If purchasing momentum doesn’t increase, the upward trend may lose strength. It would be prudent for traders to keep an eye on $7.34 as a potential support level. A fall below this point might spark a downward trend.

Profit-taking presents headwinds

It appears that sellers are now able to potentially restart a downtrend, as per recent data from CryptoQuant, over the past two days, approximately 9 million UNI tokens have been transferred to exchanges by traders.

When traders place their tokens into active trading platforms (spot exchanges), it indicates they may be planning to offload those tokens, potentially hindering further price increases.

On the other hand, an uptick in funds transferred to derivative platforms for UNI was observed as well. Such a trend might lead to heightened market volatility should traders decide to expand their active positions on UNI.

Read Uniswap’s [UNI] Price Prediction 2024–2025

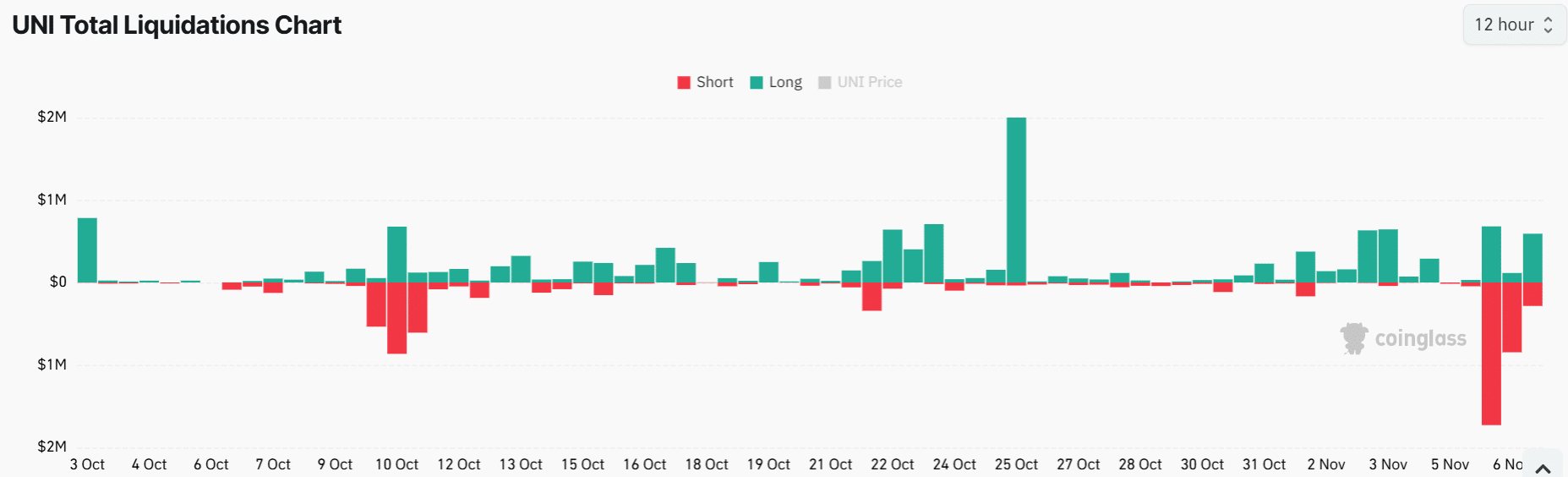

In the derivative market for cryptocurrencies like UNI, a significant increase was observed in compulsory closures of short positions. According to Coinglass, over $2.8 million worth of short UNI positions were forcibly closed within just 48 hours.

When short sellers are compelled to exit their positions due to strong buying pressure (a phenomenon known as “short liquidations”), it can stimulate further buying activity. If there’s a renewed optimism about UNI that leads to more forced liquidations, the price of this altcoin might increase.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-11-08 01:11