-

Uniswap has surged by more than 6% in the last 24 hours amid rising trading volumes.

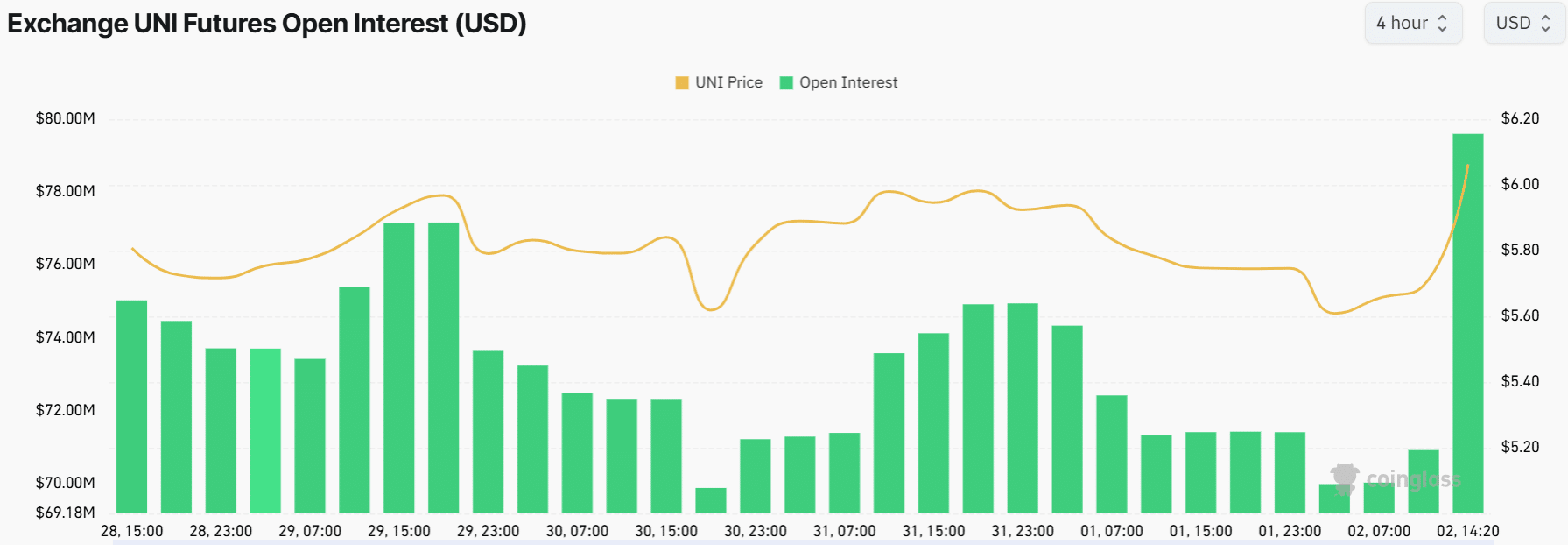

UNI’s Open Interest has surged by more than 11% as bullish sentiment grows.

As a seasoned researcher with years of experience in the cryptocurrency market, I’ve seen my fair share of bull runs and bear markets. However, the recent surge in Uniswap (UNI) has caught my attention. With a 6% increase in just 24 hours, it’s clear that UNI is leading the altcoin recovery.

⚡ Flash Forecast: Trump Tariffs Could Wreck EUR/USD Stability!

Analysts sound alarms on major forex disruptions coming soon!

View Urgent ForecastAfter a quiet weekend, it appears that the cryptocurrency market is starting to rebound. Bitcoin [BTC] has surged past $58,000, and other digital currencies are following its lead. Uniswap [UNI] is leading the recovery with an almost 6% increase.

At the moment, UNI was being exchanged for approximately $6.06. These increases follow a growing market fascination with this particular altcoin. According to CoinMarketCap, the volume of UNI trades has increased by more than 60% within the last day.

Additionally, there’s a surge in transactions happening on the futures market, much like the growing enthusiasm seen in the spot market.

According to Coinglass, there’s been a substantial rise in Open Interest (OI) figures. Specifically, within the past day, the Open Interest for Uniswap has climbed by approximately 11%, reaching an impressive total of around $79 million.

Such an increase tends to show a bullish momentum, especially if it coincides with rising prices.

However, will UNI extend its gains or will the bears regain control?

Bullish indicators emerge

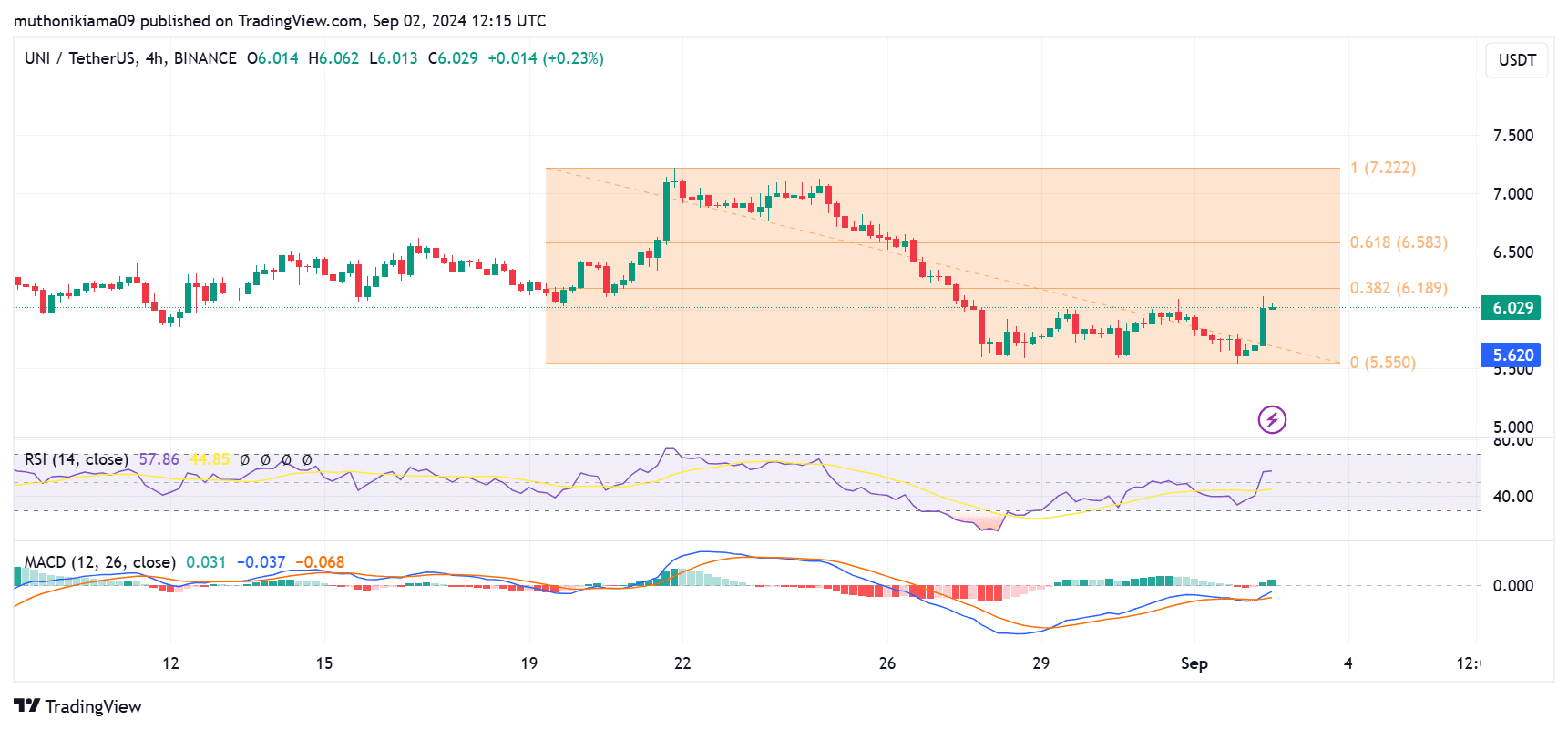

Several technical indicators confirm that UNI is in a bullish momentum.

The Relative Strength Index (RSI) is indicating a bullish turnaround, marked by a significant rise. Furthermore, it’s surpassed the signal line, suggesting that buyers are currently dominating the market, pushing prices upward due to their increased activity over sellers.

The bullish thesis is further confirmed by the Moving Average Convergence Divergence (MACD) line that has moved above the signal line. The MACD histogram bars have also shifted to green showing the dominance of the bulls.

However, to confirm the strength of the uptrend. The MACD line needs to cross above the zero line.

Should the positive trend persist, investors expecting a rise (bulls) may aim for the subsequent significant resistance point at around $6.18. Overcoming this level could open up opportunities for additional growth.

If the uptrend doesn’t hold up, however, the UNI coin might fall further to retest the significant support level of $5.62. It has been maintaining this support level since the previous week.

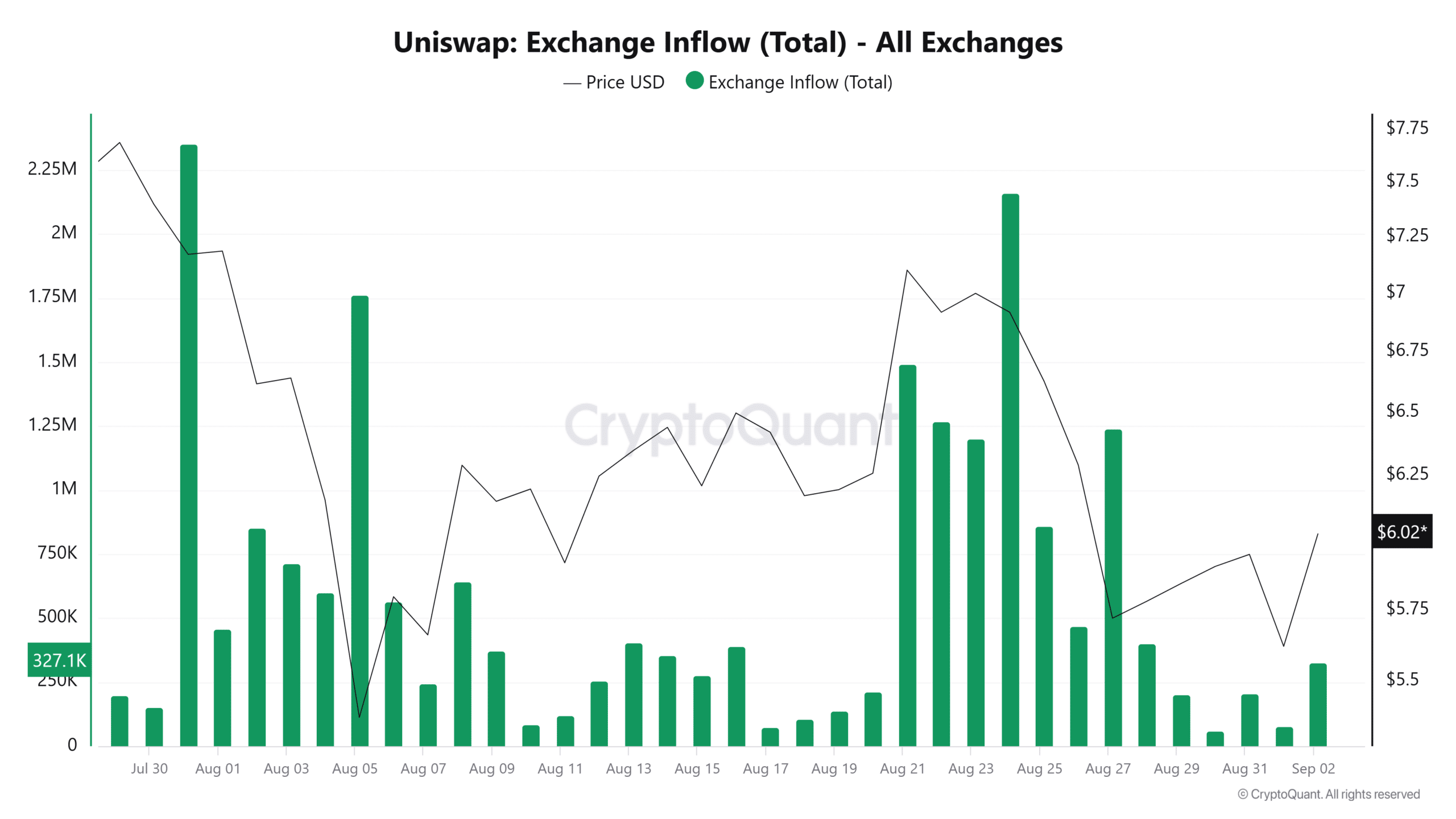

It’s possible that the increase in UNI prices we’ve seen recently might be due to an absence of sellers. According to information from CryptoQuant, the flow of UNI into exchanges for trading reached its peak for the month on August 24th.

These inflows have since slowed down, with buyers now having room to drive further gains.

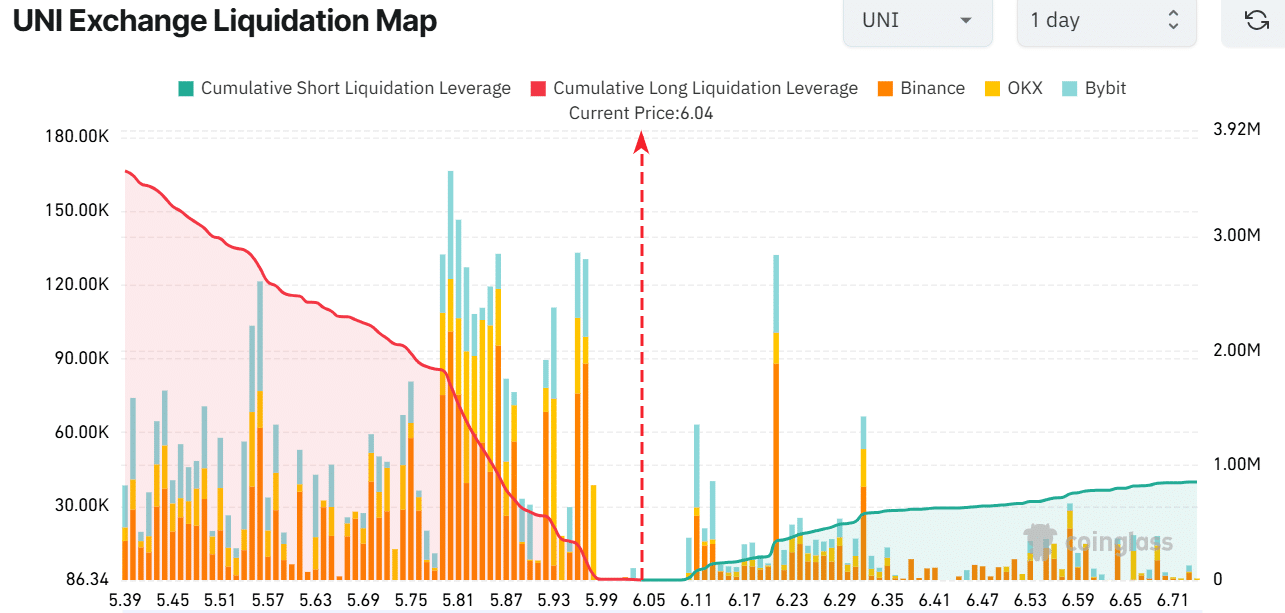

Keep an eye on the UNI chart, as the significant level to focus on is around $6.21. Many short sellers could face forced buy-backs if the price of UNI reaches this point, leading to a ‘short squeeze’. This event could fuel additional upward momentum for UNI.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Elevation – PRIME VIDEO

2024-09-03 09:43