- UNI’s price formed a bullish triangle, indicating potential for a significant breakout

- Bullish on-chain metrics and growing long sentiment hinted at strong upward movement

As a seasoned crypto investor with a decade of experience under my belt, I’ve seen more than my fair share of market fluctuations and trends. The recent developments surrounding Uniswap [UNI] have caught my attention, and I must say, I’m intrigued by its potential for growth.

With its dominance in the decentralized exchange (DEX) market soaring from 36.8% to an impressive 91.3%, it’s clear that Uniswap is making a strong play for the top spot. The influx of over 45.3 million users speaks volumes about its appeal and user-friendly approach, solidifying its position as the leading DEX for user acquisition.

The recent whale purchase of 100,000 UNI at $14.24 is a testament to strong investor confidence in Uniswap’s future prospects. At press time, with UNI trading at $13.07 and down by 4.07%, I’m keeping a close eye on key price levels that could dictate its next direction.

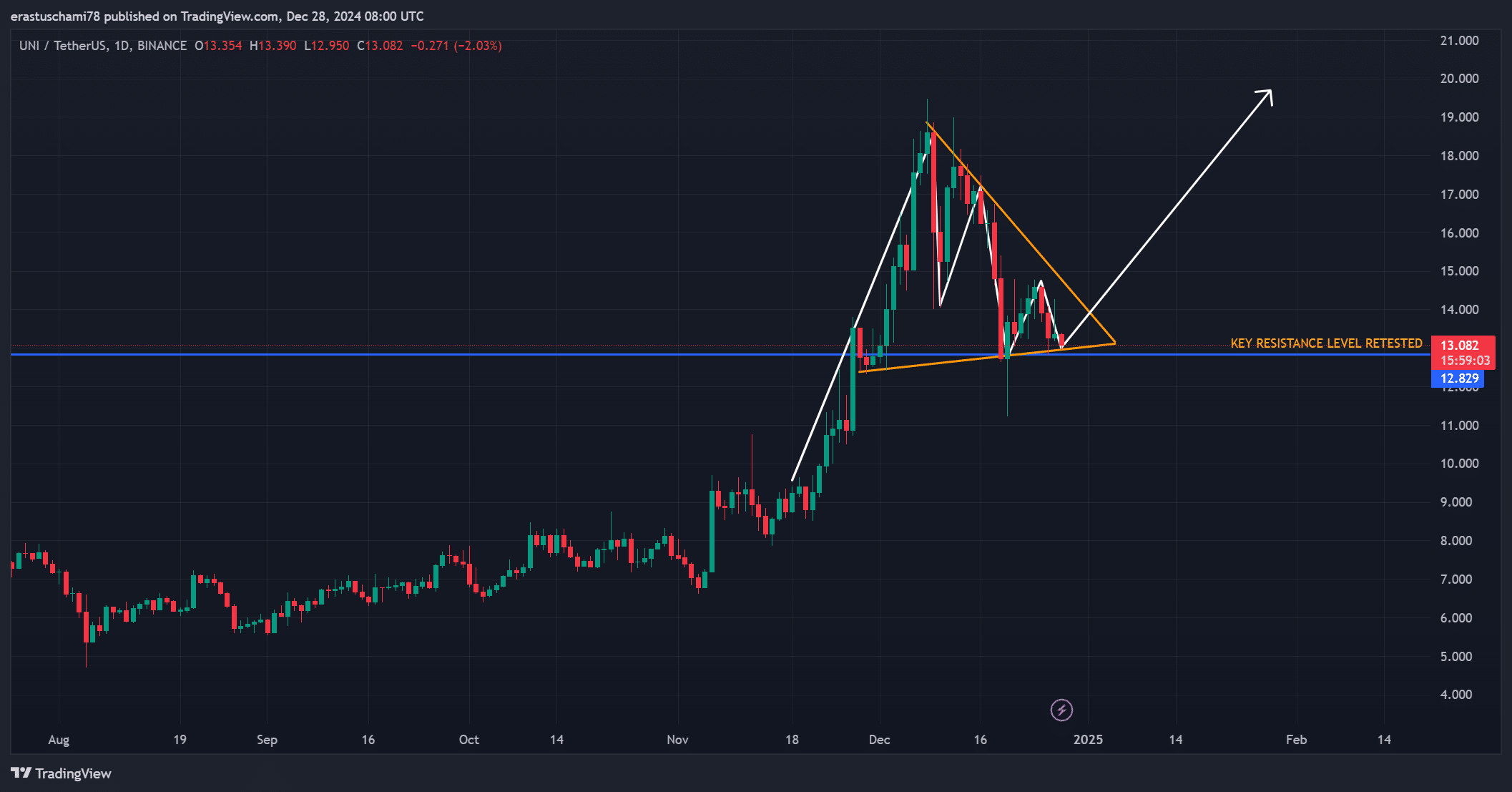

The symmetrical triangle pattern forming on the chart suggests a significant breakout, which could propel Uniswap towards $20 or higher if the resistance at $12 is successfully breached. However, sustained buying momentum will be crucial to ensure a successful breakout and avoid any potential selling pressure.

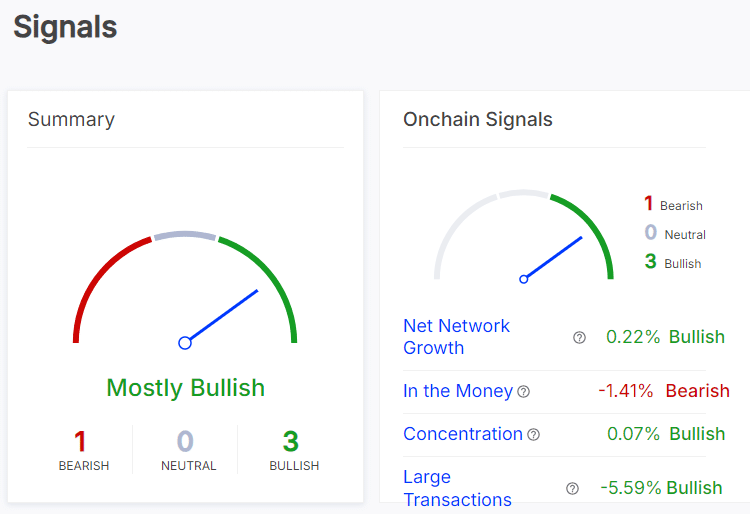

While I’m bullish on Uniswap’s prospects based on these signs, it’s essential to keep an eye on mixed signals like the decline in the “In the Money” metric and large transaction drop, which could hint at profit-taking behavior among some holders. Monitoring whale movements and broader market sentiment will help me gauge Uniswap’s trajectory more accurately.

One thing I’ve learned over the years is that crypto markets can be unpredictable, so I always keep a sense of humor close by. After all, in this wild world of digital assets, who knows what surprises might come our way? As they say, the only constant in crypto is change!

The influence of Uniswap’s [UNI] within the decentralized exchange (DEX) sector keeps expanding significantly, with network activity escalating from a substantial 36.8% to an impressive 91.3% in 2024. This rapid growth has attracted more than 45.3 million users, establishing it as the foremost DEX in terms of user acquisition.

Currently, a whale’s investment of $1.42 million USDC in buying 100,000 UNI tokens at $14.24 underscores the strong faith of investors. As we speak, UNI is being traded at $13.07, and it has dropped by 4.07%. The direction that UNI will take next is probably going to be determined by crucial price points.

Key levels to watch for a breakout

The University Coin’s price graph suggested a possible substantial surge, with the emergence of a symmetrical triangle pattern. Typically, this shape indicates a significant price shift, and the recent test of the $12 resistance level further boosted optimistic forecasts.

Reaching beyond the current level might catapult UNI to $20 and potentially even more, providing a significant profit opportunity for traders. Yet, the noticeable downward trend in the chart emphasizes the necessity of consistent upward market movement for further growth.

What do metrics reveal about network activity?

The on-chain indicators suggest a predominantly optimistic view for UNI, as the network saw a 0.22% increase in user growth and whale activity continued at a steady pace, with a slight rise in concentration by 0.07%.

Conversely, the “In the Money” indicator fell by 1.41%, suggesting that some holders were taking profits. Additionally, large transactions decreased by 5.59%, indicating a short-term sense of caution. These conflicting signs underscore the necessity of keeping an eye on whale activity and overall market sentiment to predict UNI’s direction.

UNI exchange reserve analysis

Exchange reserves experienced a small, yet noticeable rise of 0.21%, pushing the overall count to approximately 70.22 million tokens. This increment, though hinting at some sell-off activity, indicates that many token holders are keeping their investments steady.

It appears this situation aligns with the general market downturn, but a notable increase in reserves could indicate a bearish outlook.

Or more informally:

This fits with the broader trend of the market going down, but a big jump in reserves could mean people are getting bearish.

Building momentum or losing steam?

At the current moment, technical indicators provided additional understanding about Uniswap’s condition. Specifically, the Average Directional Index (ADX) was at 26.77, suggesting a moderately strong trend. Furthermore, the 9-day moving average fell below the 21-day moving average, which hinted towards potential short-term bearishness.

In other words, the symmetrical triangle suggested that a bullish crossover could spark increased demand from buyers in the near future.

Long/short ratio – Is the market leaning bullish?

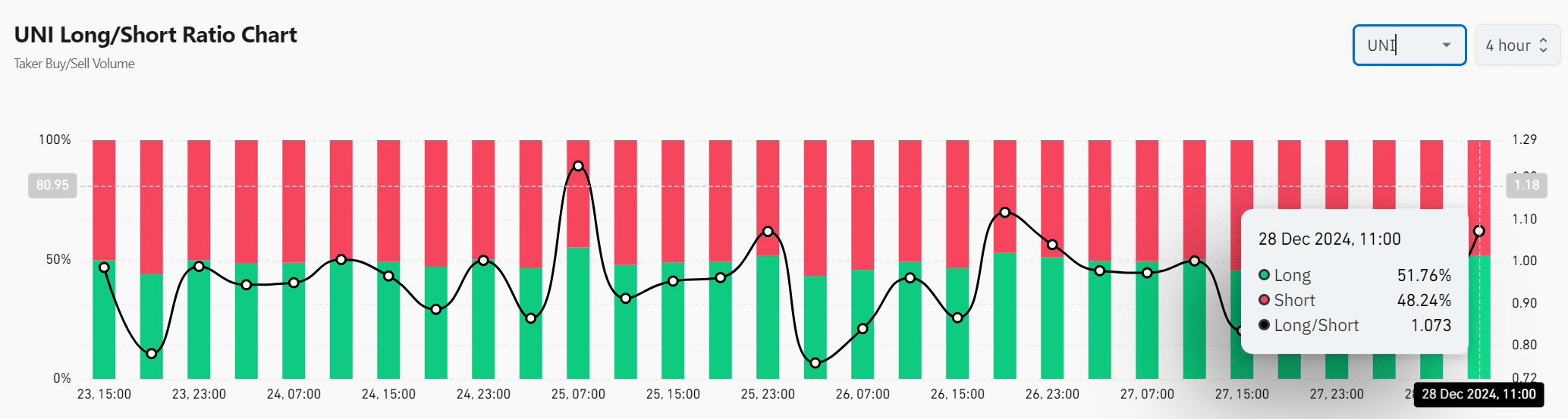

As I examine the current market data, I find that the long/short ratio for UNI is at 1.073 as we speak, indicating that a majority (51.76%) of traders are leaning towards long positions. This increasing bullish sentiment implies that many traders are positioning themselves for a potential price surge or breakout. Moreover, this trend aligns with broader market expectations of a positive price movement for UNI.

In order for this feeling to persist, UNI needs to overcome crucial resistance points and continue its progress in the upcoming trading periods.

Read Uniswap’s [UNI] Price Prediction 2025–2026

Is Uniswap primed for a breakout?

The charts from the University of Nicosia (UNI) indicate a promising outlook for an upsurge, bolstered by optimistic on-chain indicators and technical configurations.

If UNI manages to convincingly surpass the $14 mark, it’s plausible that it could surge towards $20, solidifying its position in the DeFi sector. This suggests a potential strong upward trend for UNI, especially if crucial indicators and overall market sentiment point in the right direction.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-12-29 07:07