- Bullish expectations for Uniswap are high for this cycle

- Network metrics have been well under their 2021 highs, suggesting that further growth is possible

As a seasoned analyst with over a decade of experience in the crypto market, I find myself increasingly bullish about Uniswap [UNI]. The current upward trend, coupled with strong technical and on-chain indicators, suggests that we might be witnessing the early stages of a significant growth phase for UNI.

At the current moment, Uniswap (UNI) appears to demonstrate robust bullish enthusiasm. Over the past 20 days, it has surged by a significant 97%, while simultaneously breaking multiple crucial resistance levels. Additionally, its Open Interest saw an increase of 12% within the last 24 hours – a clear indication of heightened bullish anticipation.

Based on both technical analysis and blockchain data, it’s clear that Uniswap is currently experiencing a significant increase in value. It’s likely that further growth will continue over the next few months. However, it’s important to note that even with this upward trend, the price of UNI remains 61% lower than its peak of $44.9 from May 2021.

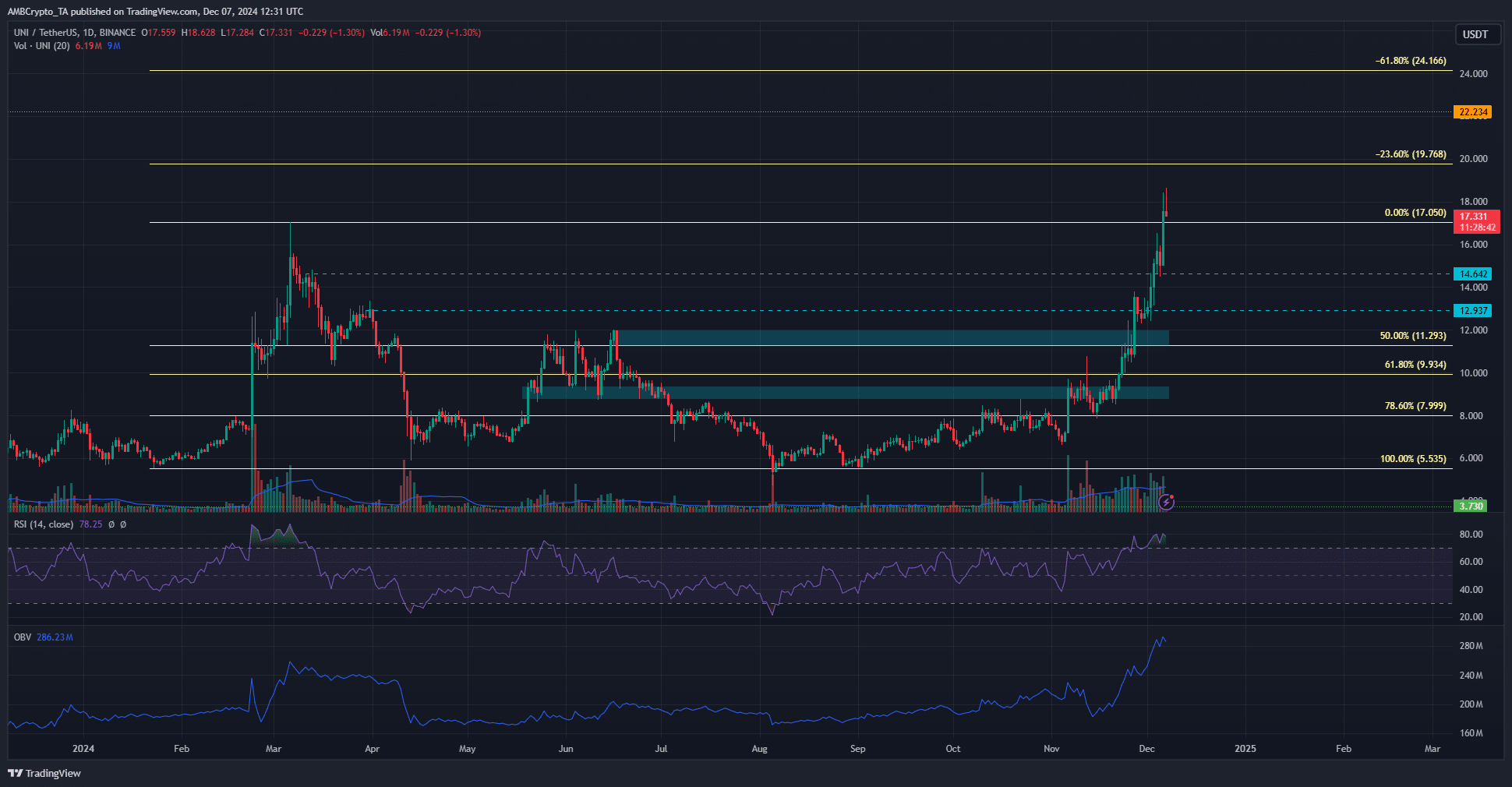

Key lower highs have been retested as support

In simpler terms, the enthusiasts of Uniswap managed to push its price beyond the peak of $17.05 reached in March 2024. During this rise, they revisited and reinforced the lower resistance levels previously established at $12.93 and $14.64 as support.

The On-Balance Volume (OBV) and the price have both been significantly increasing, indicating a high level of demand. At this point in time, the Relative Strength Index (RSI) was above its overbought threshold, but it hasn’t shown any bearish divergence yet. In the coming weeks, there might be a period of consolidation around $16 to $17 before the next phase commences.

If the price of UNI takes a downward turn, it’s probable that the range between $15.45 and $15.95 will act as a strong support zone, indicating stable demand.

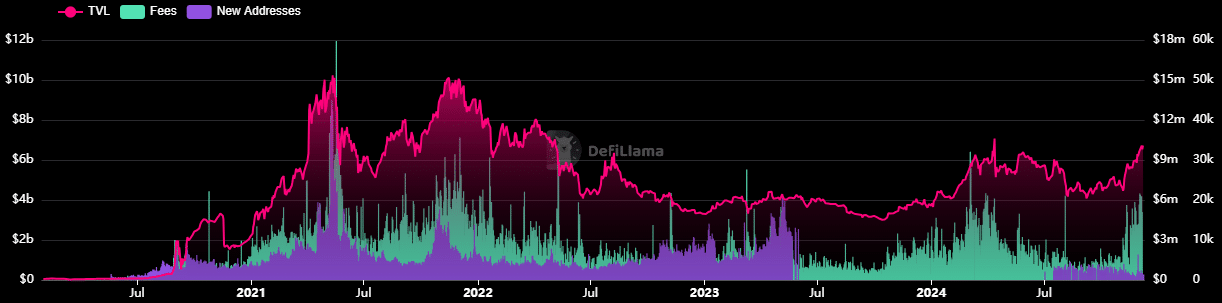

New addresses yet to begin uptrend

In my experience during the last crypto cycle, I witnessed a surge of small-cap coins being launched on the Ethereum blockchain. This led me to numerous new addresses as I joined the crowd attempting trades for these tokens on Uniswap, the leading decentralized exchange (DEX). Today, something quite similar is unfolding on the Solana network, where the memecoin craze is in full swing.

An increase in new user registrations and heightened involvement tends to cause higher transaction fees, particularly towards the peak of a market rally. Contrasting 2021 with 2024, the number of new users and network fees were lower than their respective peaks.

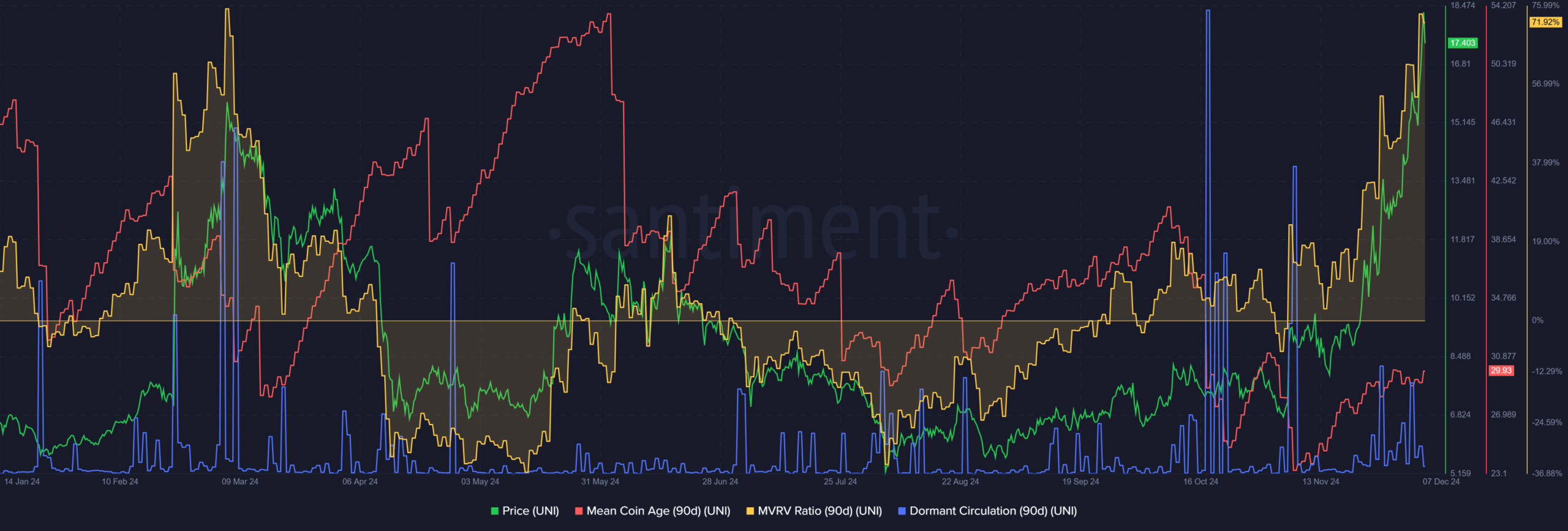

Although the data indicated potential long-term expansion ahead, it also hinted at an imminent brief downturn. In October and early November, Uniswap experienced a period of distribution, marked by the decrease in the average age of coins.

Read Uniswap’s [UNI] Price Prediction 2024-25

Currently, the MVRV (Maker’s Value Realized to Market Cap) ratio is escalating and has reached levels last seen in March, indicating an increase in profitability among token holders. This suggests that the UNI token might be excessively overpriced. Therefore, traders and investors should consider taking profits now and wait for a price drop before making additional purchases of UNI.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-12-08 05:11