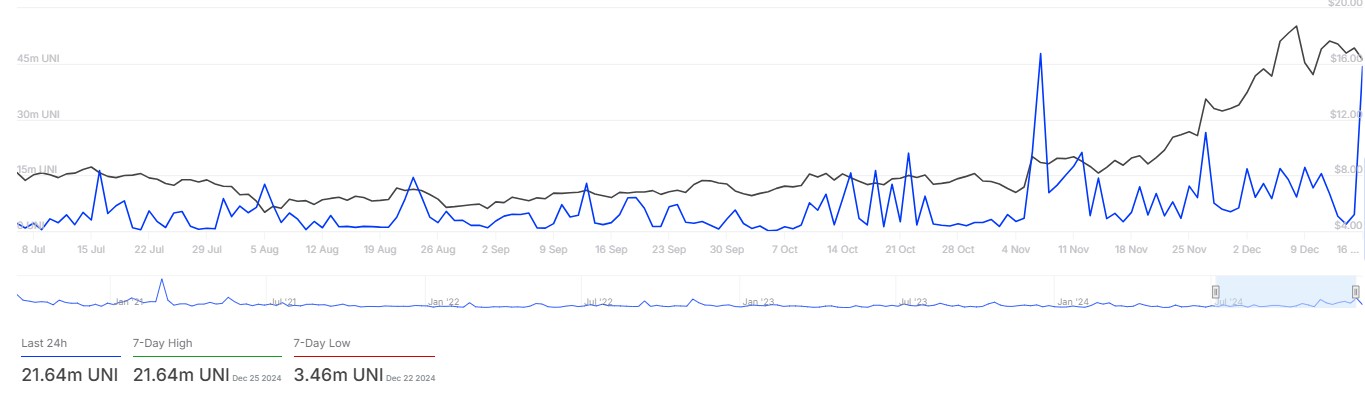

- Uniswap’s large transactions surged by 200% in just 24 hours.

- Exchange inflows dropped steadily over the last three days as the altcoin’s price plunged by 9% in less than 48 hours.

As a seasoned researcher with years of experience navigating the cryptocurrency market, I can’t help but find this Uniswap [UNI] situation intriguing. The surge in large transactions by 200% within 24 hours is reminiscent of a game of cat and mouse, where whales are making their moves, leaving us all guessing their intentions.

The recent activity in the Uniswap market (UNI) is providing conflicting indications, causing market participants to ponder about its possible direction in the coming days.

Over the past day, I’ve observed a significant surge in large transactions associated with the altcoin, indicating a notable increase in whale activity by approximately 200%.

Contrary to expectation, UNI exchange inflows have decreased for the past three days straight. Additionally, it’s important to note that the price of Uniswap has plummeted significantly, shedding approximately 9% of its value within just 48 hours.

What does this conflicting data mean for the altcoin’s future? Let’s break it down.

Uniswap whale activity skyrockets, but why?

Historically, big transactions tend to resemble ‘whale’ activities, and as per IntoTheBlock’s data, there has been a significant increase in these large transactions on Uniswap.

Over the past 24 hours, a significant surge of 200% in substantial transactions involving the altcoin suggests that major market players are orchestrating substantial actions.

This kind of activity can stir excitement since it often foreshadows strategic market positioning.

From my perspective as an analyst, it remains uncertain if I, myself, am acquiring Uniswap tokens with the intention of a bullish move or simply preparing to dispose of these assets.

The absence of clear information makes it difficult for market players to make informed decisions, causing them to proceed cautiously amidst the ambiguity.

Shrinking exchange inflows add to the mystery

As whale behavior becomes more active, inflow to exchanges appears to be decreasing significantly, based on recent data from CryptoQuant.

In general, this downtrend is a sign that traders are holding, not preparing to sell their assets.

However, a reduction in inflows could also suggest waning retail interest.

The increasing number of whale activities versus the decreasing inflows presents a perplexing picture, leading to speculation: Are whales seizing chances that retail traders are overlooking, or is there something significant coming up in the market?

Uniswap price plunges despite market activity

Over the past 48 hours, the value of Uniswap has dropped significantly by 9%. This rapid decrease indicates that bears seem to be taking control of the market.

Hence, the question arises — are whales supporting this market or using its relative weakness?

On extended time periods, Uniswap’s price movements showed a generally upward trajectory, implying a potential temporary downturn followed by a strong surge in the long run.

As an analyst, I’m observing a potential scenario where the price could dip to challenge the significant support level at $12. This level, interestingly enough, was once a resistance level during our latest bullish surge but seems poised to play a supportive role in this context.

Read Uniswap’s [UNI] Price Prediction 2025–2026

Analysis by AMBCrypto, using data from Coinglass, could potentially give us the long-awaited insights. If the value of UNI continues to fall and reaches approximately $12, it’s important to note that roughly 818K units might be forced to liquidate.

There’s a possibility that the value of this altcoin could decrease to around $12, but if the whales continue to buy more, it might trigger a surge or rally in its price later on.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2024-12-27 06:15