Ah, the inefficiency zone-a place where dreams of bullish breakouts go to die. This range, marked by analysts with furrowed brows and trembling fingers on their keyboards, is now the battlefield for Uniswap’s fate. The next decisive move? Well, let’s just say it could make or break your portfolio. Or at least give you something to complain about on X (formerly Twitter).

The Resistance Zone: A Bearish Soap Opera 🎭🐻

In a recent post that reeked of overconfidence, analyst Swarmik described UNI’s trajectory as if he were writing a Greek tragedy. The altcoin, stubbornly clinging to hope like a gambler eyeing one last chip, suggests a gradual recovery into the resistance band, only to face rejection. Ah, the cruel irony of markets! It’s almost poetic how this aligns perfectly with bearish order flow.

But wait, there’s more! Whale activity-because what’s a market analysis without mentioning whales?-adds another layer of drama. Large wallets are behaving like teenagers at a boring family reunion: minimal engagement, zero enthusiasm. Their lack of aggressive buying makes retail traders look like lost sheep following a wolf in disguise. Spoiler alert: rejection at resistance is likely.

If the asset reverses from this inefficiency zone, brace yourself for a cascade of targets on the downside: $8.68, $8.47, $8.17, and finally, $7.86. These aren’t just numbers; they’re tombstones marking the graves of bullish hopes. Traders eyeing short positions should sharpen their pitchforks. 🪓

Market Conditions: Cautious Whispers in the Dark 🤫📉

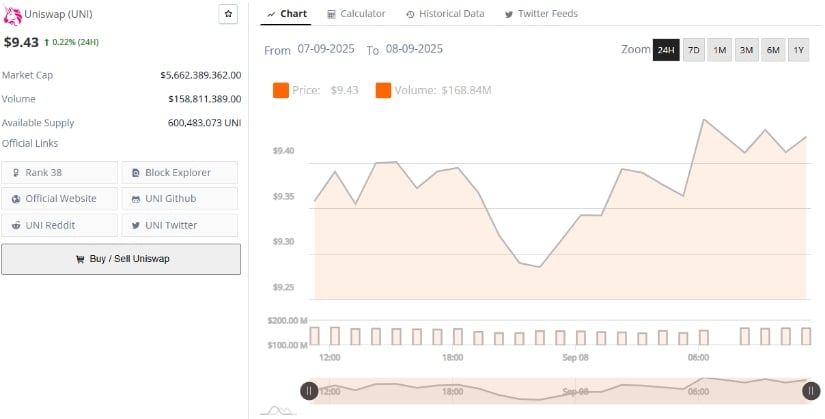

BraveNewCoin data reveals the coin hovering near $9.43, up a measly 0.22% in 24 hours. Market capitalization stands at $5.66 billion, with daily turnover at $158.8 million. Steady? Yes. Exciting? Absolutely not. It’s like watching paint dry while someone whispers, “What if it falls?”

The price sits just below the $9.8-$10.3 range, where rebalancing is expected. If rejection occurs here, downside targets will activate faster than you can say “sell.” And let’s not forget the 200-day moving average looming above like an ominous cloud. Uniswap exchange may boast strong liquidity, but the mood is as defensive as a cat hiding under the bed during fireworks. Rallies? More like setups for short trades. 🐱🏍

Indicators and Momentum: A Tale of Woe 📉💀

According to TradingView, Uniswap trades around $9.48, with a session high of $9.54. Consolidation? Check. Hesitation? Double check. Traders are weighing resistance against support like a chef deciding between salt and sugar. Spoiler: neither tastes good right now.

The Relative Strength Index (RSI) stands at 44.58, leaning slightly bearish but not yet oversold. Its alignment with the RSI-based moving average at 44.14 screams balance-but balance on the edge of a cliff. Room for weakness? Oh, plenty.

Meanwhile, the MACD indicator shows the MACD line at -0.257, below the signal line at -0.196, with a histogram value of -0.061. Mild bearish momentum? Yes. A rollercoaster ride? Not quite. But if rejection takes hold, Uniswap could slide toward $8.17 and potentially $7.86 before year-end. Buckle up, folks-it might get bumpy.

Overall, the asset remains in limbo, teetering between despair and defiance. Will resistance spark another leg down, or will bulls rise like phoenixes from the ashes? For now, caution reigns supreme, and technicals favor the bears. After all, why cheer for bulls when bears have such sharp teeth? 🐻✨

Read More

- When Is Hoppers’ Digital & Streaming Release Date?

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Sunday Rose Kidman Urban Describes Mom Nicole Kidman In Rare Interview

- 10 Movies That Were Secretly Sequels

- 5 Best Superman-Centric Crossover Events

- 10 Great Netflix Dramas That Nobody Talks About

- PlayStation Plus Game Catalog and Classics Catalog lineup for July 2025 announced

- 10 Best Anime to Watch if You Miss Dragon Ball Super

- Did Churchill really commission wartime pornography to motivate troops? The facts behind the salacious rumour

- 10 Best Pokemon Movies, Ranked

2025-09-09 02:58