- Uniswap whales have accumulated more than 1.68M tokens this week amid rising interest in DeFi tokens.

- UNI’s weekly chart also shows bullish signs that could push UNI to $27 if buying activity strengthens.

As a seasoned crypto investor with a knack for spotting trends and patterns, I find myself intrigued by the recent moves of Uniswap [UNI]. The accumulation of UNI tokens by whales, including Galaxy Digital, coupled with bullish signals on its weekly chart, paints a promising picture. However, the surge in exchange supply ratio and the increase in long liquidations have me slightly worried.

At the moment of reporting, Uniswap [UNI] was being exchanged for approximately $17.47, following a fall of over 6% in the last 24 hours. However, it’s important to note that UNI has experienced an increase of nearly 40% since the beginning of this month. Additionally, its market value has grown from $7.81 billion at the start of the current month to a staggering $10.48 billion as we speak.

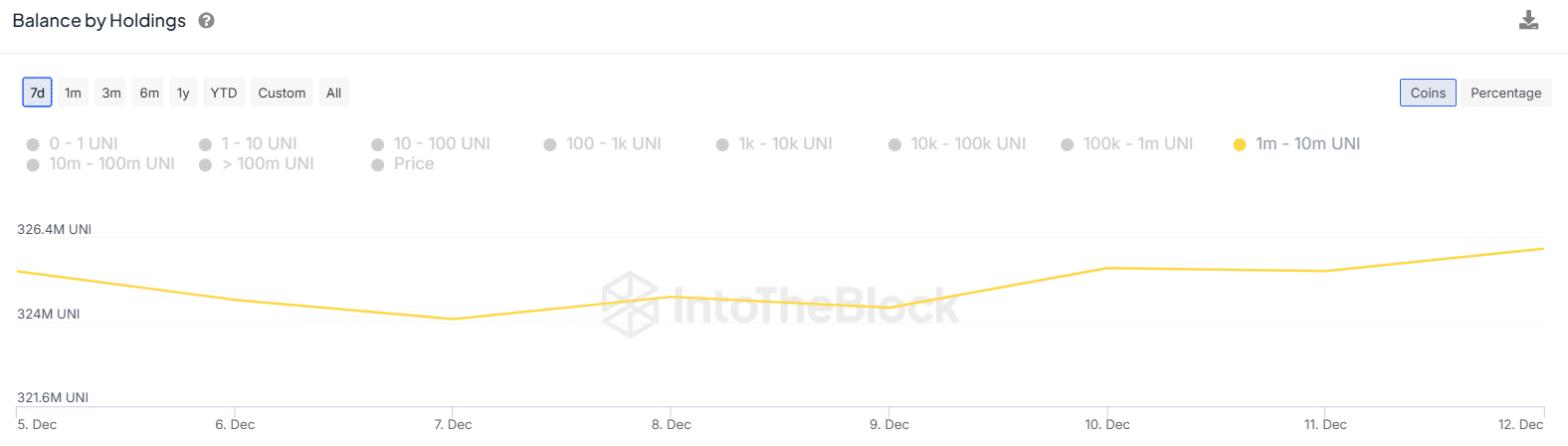

It appears that the ‘big fish’ or influential investors in Uniswap are expressing a positive outlook on future profits, as it has been observed that significant accounts holding between one million and ten million UNI tokens have added approximately 1.68 million UNI tokens to their holdings over a span of four days.

Among the entities amassing UNI tokens, one is Galaxy Digital. Based on data from Lookonchain, this digital asset manager transferred out approximately 1.07 million UNI from exchanges on December 12th, possibly due to growing attention towards Decentralized Finance (DeFi) token assets.

The whale’s activity on this platform seems to align with optimistic trends observed on Uniswap’s weekly graph, implying a possibility of a bullish turnaround even after the recent decline.

UNI’s price analysis

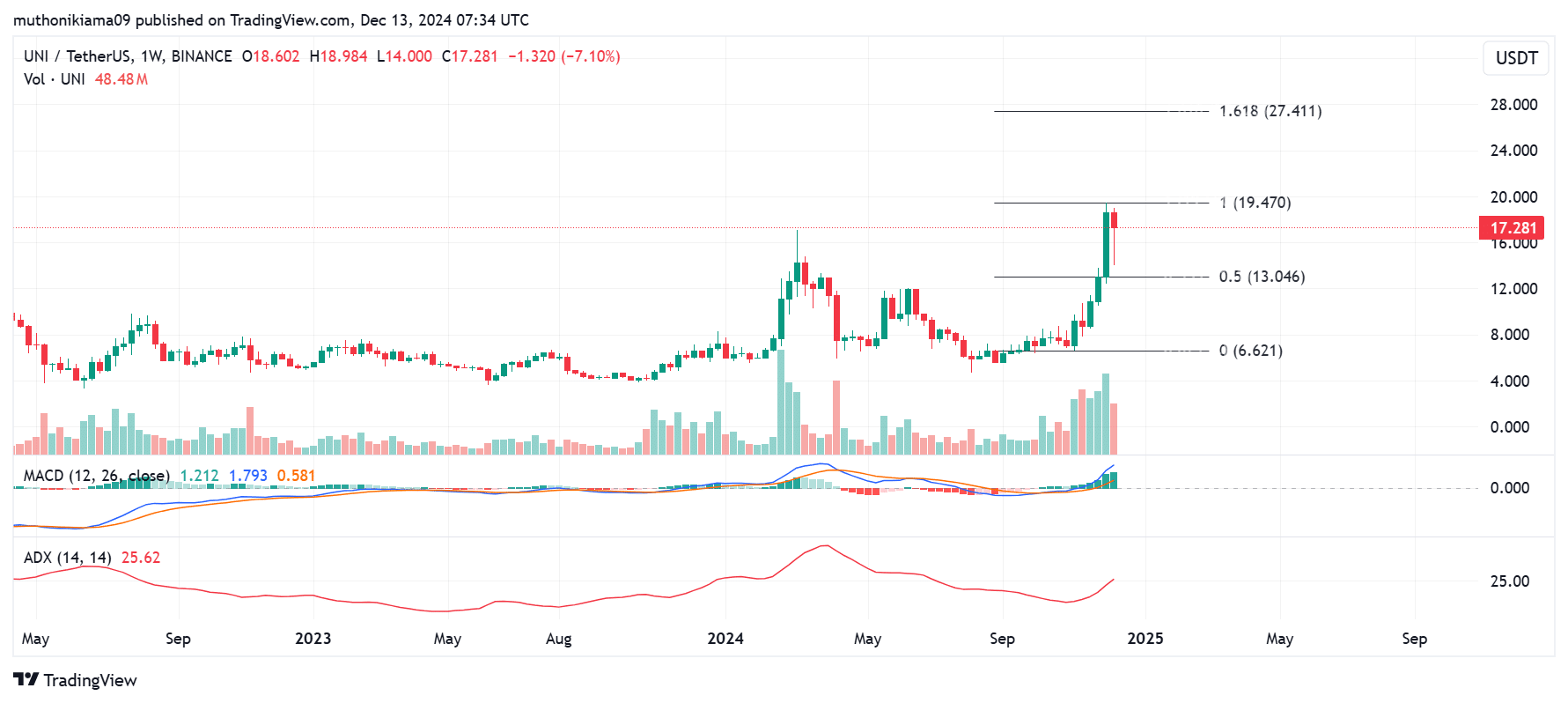

As a researcher, I’ve been analyzing Uniswap’s price trends and noticed an intriguing development. The weekly chart reveals a shift towards a bullish trend following the break above the resistance line, which forms part of a rounding bottom pattern. This upward movement suggests that the buying pressure has significantly increased, implying stronger market sentiment in favor of Uniswap.

As an analyst, I observed a bullish trend in the Moving Average Convergence Divergence (MACD), characterized by the emergence of green histogram bars and the MACD line consistently residing above the signal line, signifying potential growth ahead.

The ADX line appeared to be leaning more towards the upper region, suggesting a robust ongoing upward trend.

If UNI can recover from the temporary pullback from multi-month highs and the momentum remains bullish, the next target for price is the 1.618 Fibonacci level at $27.41.

Exchange supply ratio surges

On UNI’s weekly chart, the growth in whale holdings and bullish tendencies haven’t been sufficient to counteract the increased selling pressure following the surge in exchange supply ratio, which reached its highest level in the past week.

As reported by CryptoQuant, the supply ratio for UNI has climbed up to 0.0025, suggesting more of this cryptocurrency is being kept on exchanges. If trading activity continues to be subdued, it may point towards a bearish market trend.

As an analyst, I’ve been considering potential reasons for the recent uptick in a certain ratio. One possible factor could be profit-taking behavior among traders. According to IntoTheBlock, the proportion of UNI wallets showing a profit has surged to 62%, marking the highest level since 2021. This suggests that traders who were previously struggling might now be choosing to cash out and secure their gains.

Derivatives’ data suggests…

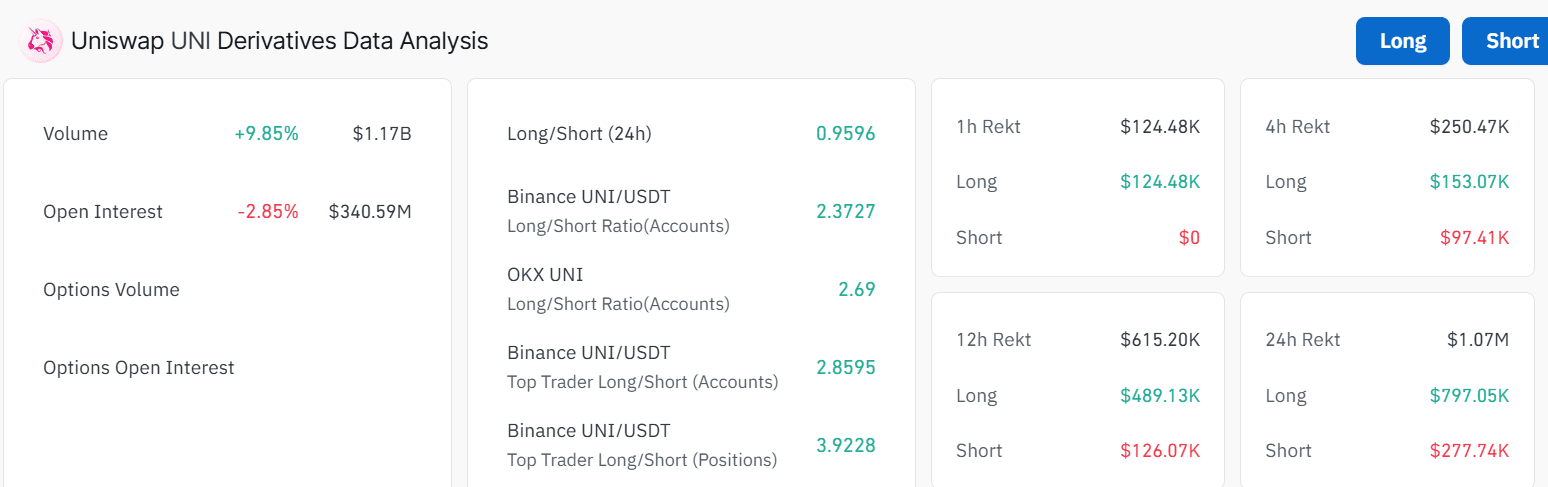

Data from Uniswap’s derivative market indicates that the recent price fall led to a surge in long positions being liquidated. Furthermore, the Long/Short ratio has decreased to 0.959, implying that there were slightly more short sellers compared to long buyers in this period.

The decrease in Open Interest by 2% coincided with the price drop, yet it still hovers at a substantial level of $340 million, indicating that active involvement in the market is significant.

Read Uniswap’s [UNI] Price Prediction 2024–2025

The surge in derivative trading activity suggests that even with the drop in prices, there’s still considerable enthusiasm for UNI among speculators, implying that a rebound might be possible.

Read More

2024-12-13 20:08