-

UNI’s price rose by 8.4% over the past 24 hours.

Uniswap’s trading volume increased by 126% amidst increased buying activity.

As a seasoned researcher with a decade of experience in the crypto market, I’ve seen my fair share of volatility and unpredictability. However, the recent surge of Uniswap (UNI) has caught my attention, and I must admit, it’s a breath of fresh air amidst the market turbulence we’ve been witnessing lately.

Over the past week, much like other alternative coins (altcoins), Uniswap (UNI) has shown significant price fluctuations. The cryptocurrency market as a whole has seen increased turbulence, reaching peak levels of instability in August.

Regardless of its volatility, UNI‘s prices have skyrocketed during the last week due to a surge in trading activity.

Currently, the value of UNI stands at $6.99 following a 11.11% rise in its daily price chart. The upsurge has led to a significant boost in trading volume, which has jumped by approximately 126% to reach around $178.6 million.

Prior to this increase, Uniswap had experienced a downward trajectory, hitting a low of $4.7.

Although there’s been a rise lately, Uniswap prices still fall short of the peak in June 2024 at $11.5. Some financial experts are keeping a close watch for a spike surpassing the $8 mark.

Prevailing market sentiment

At the moment, the market situation is prompting traders to consider a potential purchasing point, setting up an altcoin for potential future growth. Analyst Nite foresees a 21.62% increase in this coin, as shared on their X (previously known as Twitter) platform, expressing such optimism.

“$UNI Buy Signal Confirmed on Daily. 21% move to overhead resistance.”

As per Nite’s interpretation, if the value of UNI stays above $6, it could continue to surge. Additionally, based on AMBCrypto’s examination of Market Prophit, it appears that the altcoin is currently experiencing favorable market opinions as we speak.

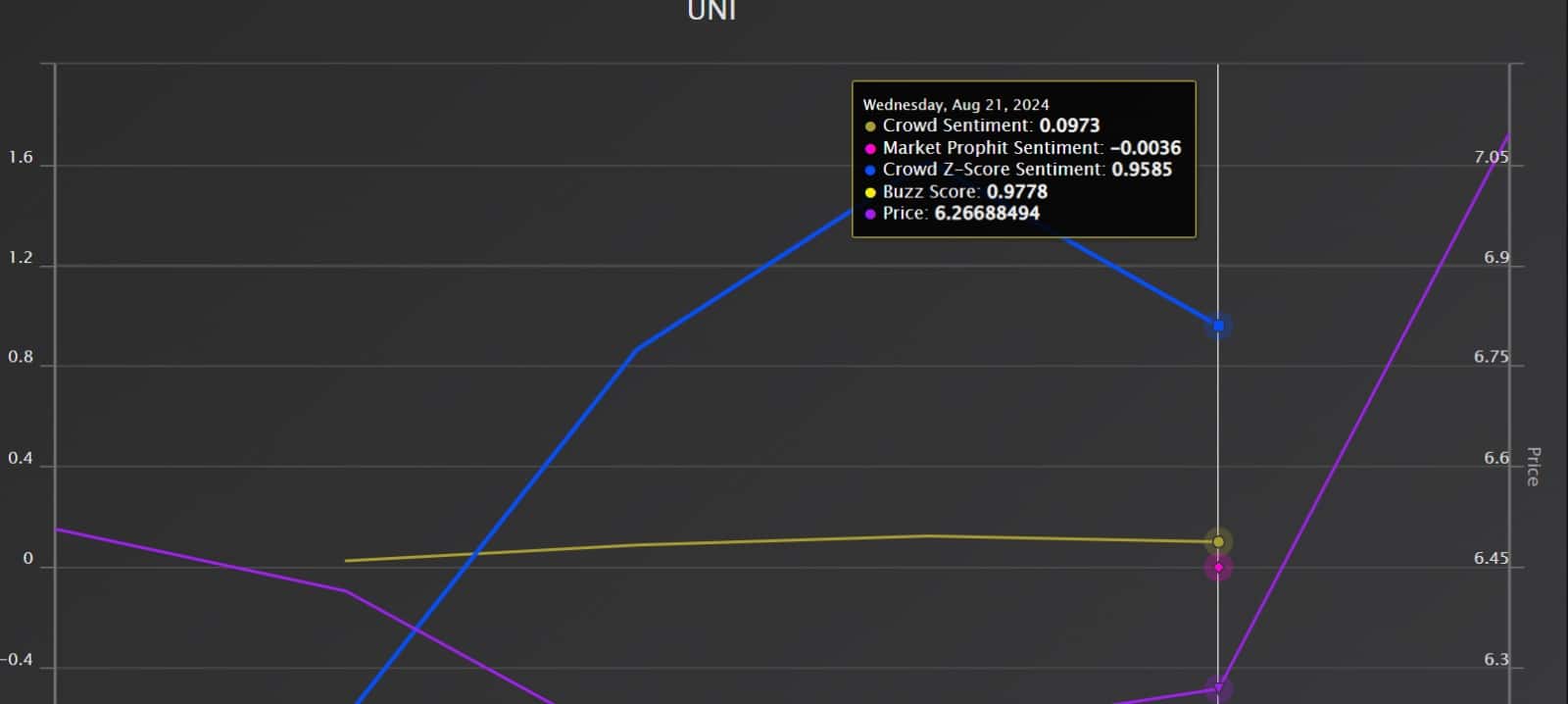

As a crypto investor, I’ve been keeping an eye on the market trends, and according to Market Prophit, the collective sentiment towards Uniswap is quite optimistic, with a score of 0.09. Moreover, there’s a high level of chatter or buzz surrounding Uniswap, as indicated by a buzz score of 0.97.

Uniswap: What price charts suggest

In the last day, the price of UNI climbed by 8.8%, breaking free from its downward trending pattern. At this moment, as reported by AMBCrypto, the cryptocurrency is experiencing a robust uptrend.

Furthermore, the Simple Moving Average (SMA) stood at $6.4, higher than the day’s closing price of $6.99. This indicated a buildup of buying demand for Uniswap, potentially causing a rising trend.

Also, the CMF was positive at 0.15, further conforming to increased buying pressure.

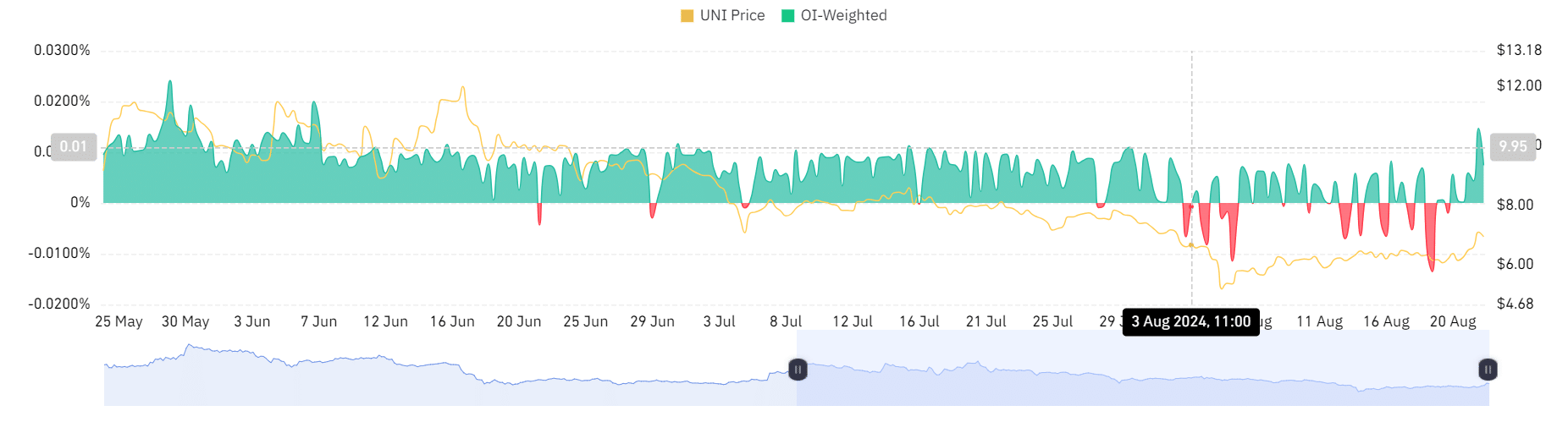

Over the past 48 hours, as observed from Coinglass data, the OI-Weighted Funding Rate has remained positive. This implies that a higher number of traders have been taking the long position (predominantly betting on price increases).

A high Funding Rate suggested that those holding long positions were prepared to pay extra to maintain their investment positions.

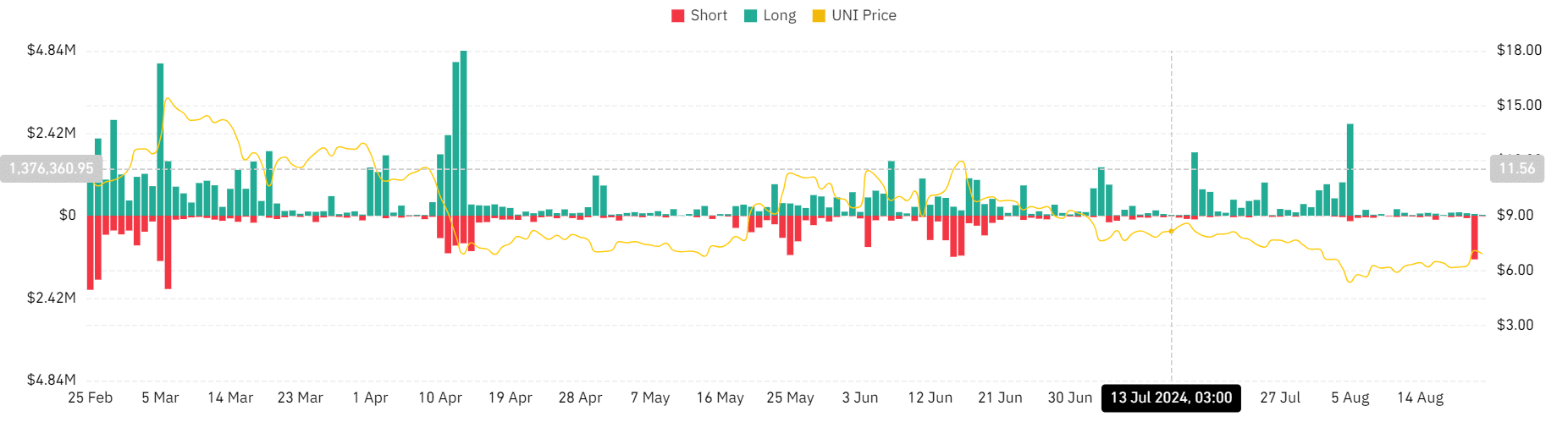

Since the 5th of August, the amount of long position liquidations has significantly dropped, going from a peak of approximately $2.6 million to just around $26,000 as we speak.

Based on my years of investing experience, I can attest that a high demand for long positions is evident when investors are confident that prices will rise. This strategy has proven effective in my own investments, as I’ve seen firsthand how the market responds to increased demand for long positions. It’s all about anticipating trends and making informed decisions based on the data available.

Consequently, should the current market situation persist, it’s likely that UNI will try to surpass its former resistance at around $8. A successful breach of this level could provide UNI with the momentum needed to push its price upwards, potentially reaching $12.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Gold Rate Forecast

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-08-23 00:08