- An RSI finding of 56 suggested UNI was trading below the overbought zone

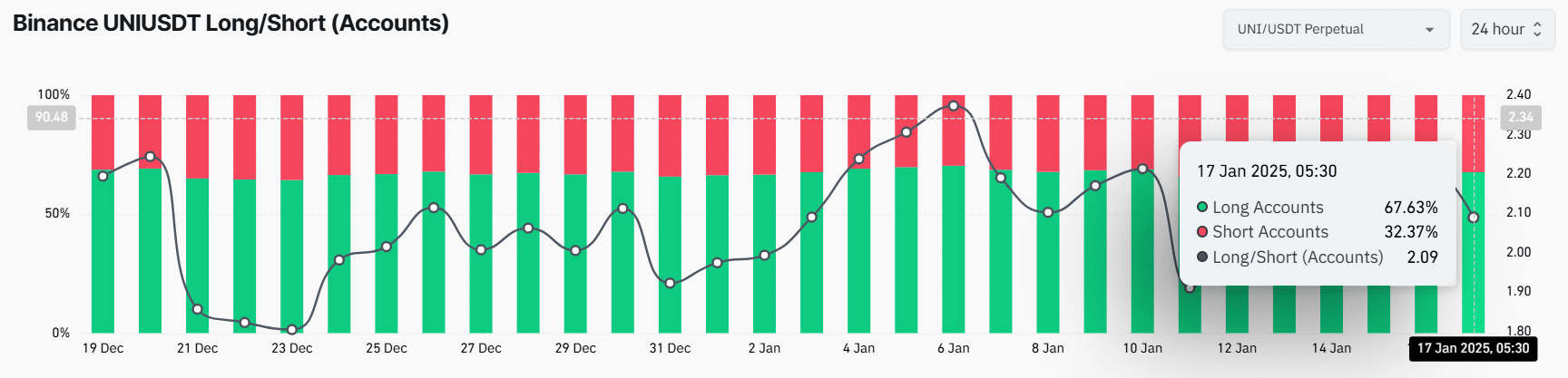

- At press time, 67.63% of top UNI traders on Binance held long positions, while 32.37% held short positions

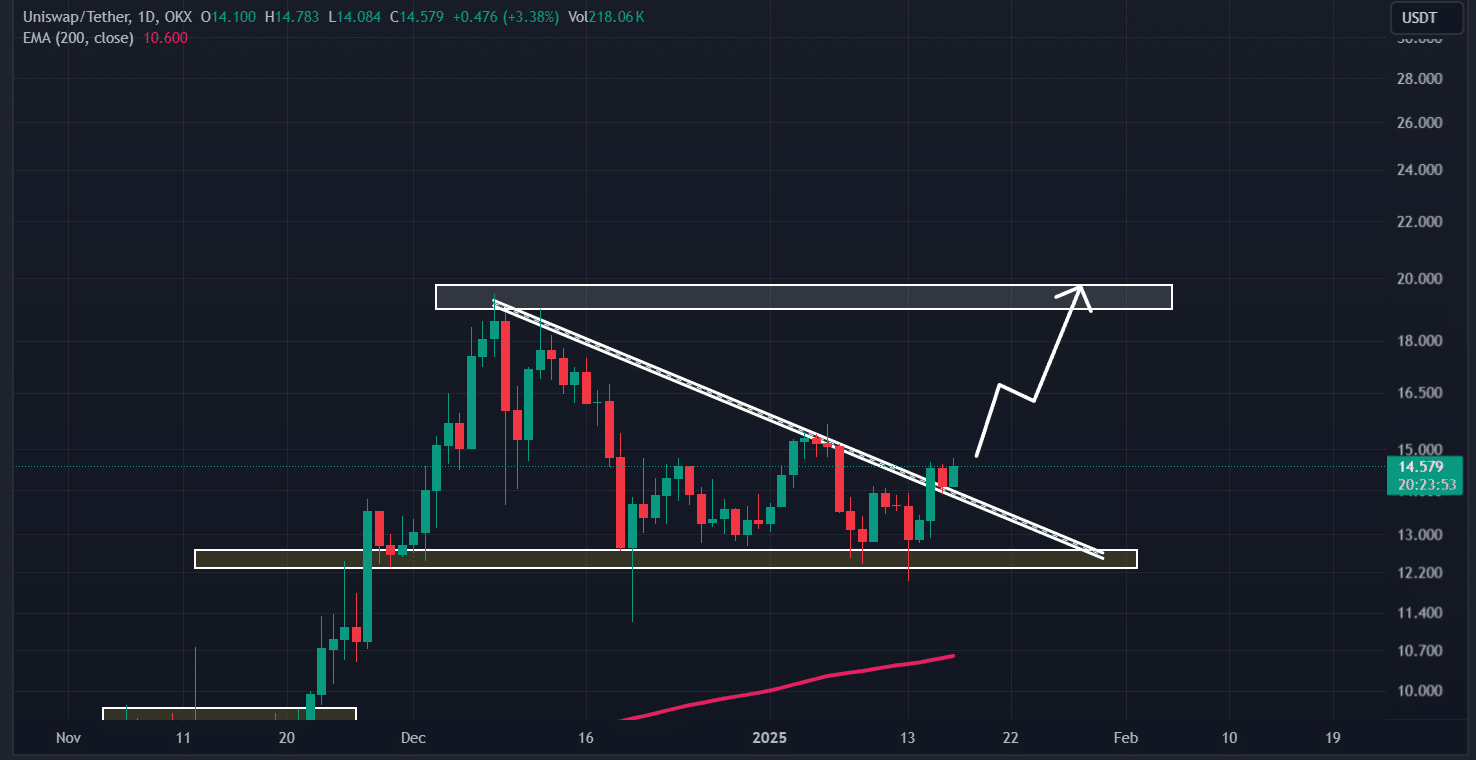

As the broader cryptocurrency market is on an uptrend, Uniswap’s native token, UNI, burst through a bullish price trendline. This indicates a possible increase in value, as this breakout follows a lengthy battle the asset has been experiencing since December 2024.

Uniswap (UNI) technical analysis

Based on AMBCrypto’s technical assessment, UNI has broken free from a downward-sloping triangle formation observed over the daily chart, reaching the resistance point of around $15.20 for the third occasion since late 2024.

Nevertheless, the resistance level for this cryptocurrency didn’t seem to be advantageous for the “bulls” (those who believe prices will rise), given its past performance.

UNI price prediction

Looking at the current trend of UNI, if it manages to break through its current horizontal price point and end the daily trade above $15.50, there’s a high likelihood that it could surge by approximately 30%, potentially reaching the next resistance level of around $20 in the coming days.

On the other hand, UNI has shown remarkable progress during the recent span of days. Notably, the data indicates a significant increase of more than 16% for this asset within just the past three days.

As a crypto investor, I’ve observed that top performers like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) have experienced substantial price increases independently. The performance of these assets has been shaping the overall market sentiment, which in turn, influences the perception of UNI as well.

From a favorable perspective, since UNI’s Relative Strength Index (RSI) stands at 56, it appears to be noticeably lower than the overbought zone. This could potentially indicate that there is still some headroom for potential growth.

67.63% of top UNI traders bet long

As I write this, there seems to be a significant surge in trader enthusiasm and trust within the past day, according to the insights provided by Coinglass, an on-chain analysis company.

To put it simply, the balance between long (buy) and short (sell) positions for UNI/USDT on Binance was heavily skewed towards buying, with a ratio of 2.09 – indicating a robust optimism among traders that the market will continue to rise.

Moreover, about two-thirds (67.63%) of the most active UNI traders on Binance were holding long positions, whereas slightly over a third (32.37%) were in short positions. This trend suggests a generally optimistic outlook or bullish sentiment among the market.

By blending these blockchain indicators with traditional chart assessment, it appears that the bulls have the upper hand in the market right now. Consequently, they might propel UNI past its $15 barrier to reach the anticipated goal.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2025-01-18 08:07