- Uniswap retested key resistance levels as bullish indicators pointed to a potential breakout

- Market sentiment has been aligning positively with reduced selling pressure and Open Interest

As a seasoned analyst with years of market observation under my belt, I find myself quite intrigued by Uniswap’s recent performance and potential growth prospects. The price action, network activity, and market sentiment all point towards a bullish outlook for UNI.

The decentralized exchange platform Uniswap [UNI] has sparked intrigue in the market due to its significant price fluctuations and increased network activity, leading to discussions about its promising future prospects within the DeFi sector. Currently, UNI is being traded at approximately $14.60, representing a 14.33% increase over the past day.

The surge in prices along with increasing user interaction suggests a revival of energy. But, will Uniswap maintain its upward trend?

Price action signals potential breakout

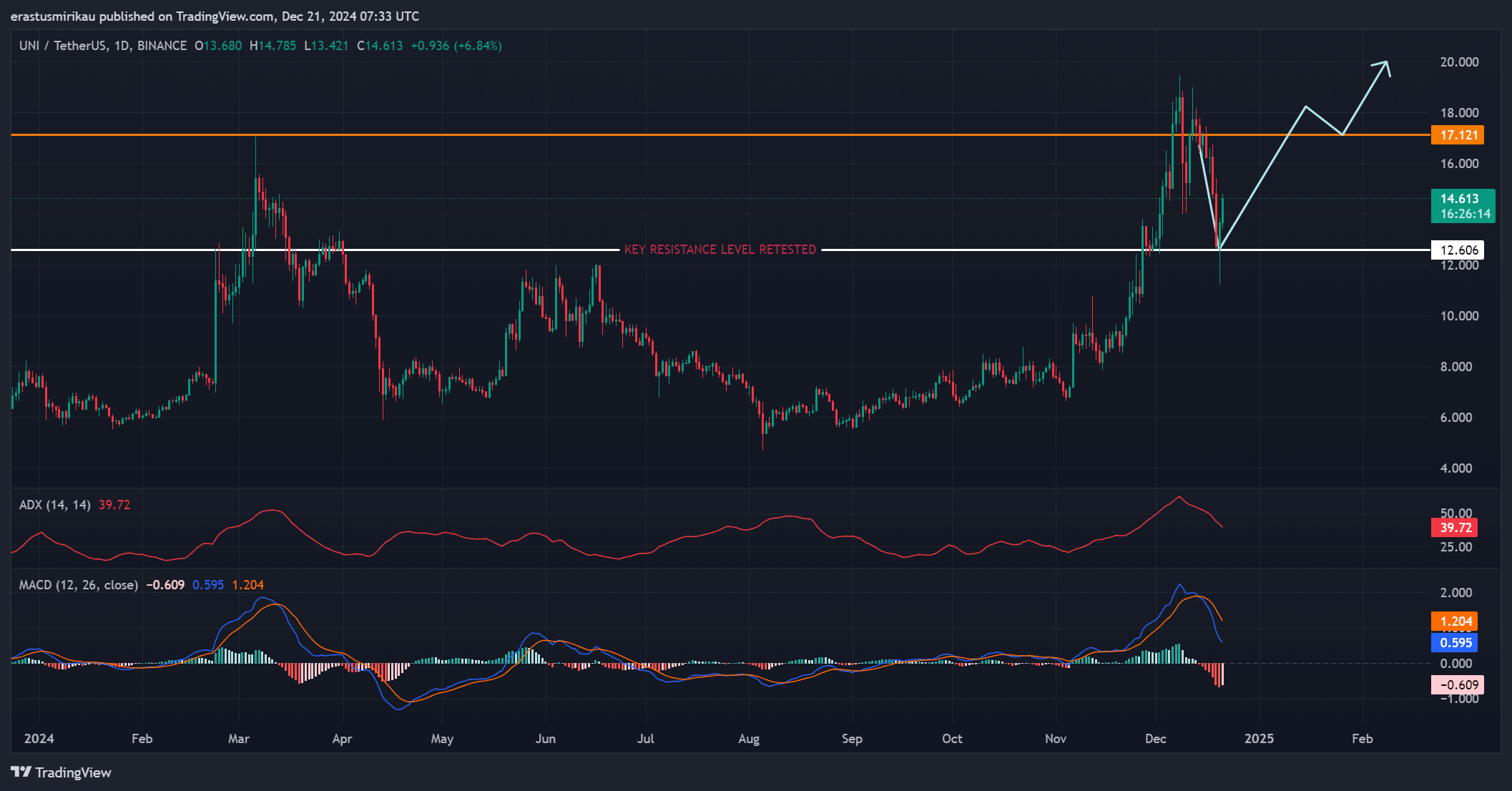

Uniswap’s price graph shows a noticeable increase, as UNI temporarily tested a significant resistance level of $17.12 before maintaining its strength at a support level of $12.60. The Average Directional Index (ADX) stands at 39.72, signaling a robust trend, while the Moving Average Convergence Divergence (MACD) suggests a minor bearish discrepancy.

Nevertheless, there remains a generally optimistic outlook as projections indicate a possible surge toward $20 for UNI. If UNI manages to convincingly overcome this resistance level, it might suggest the commencement of a prolonged upward trend.

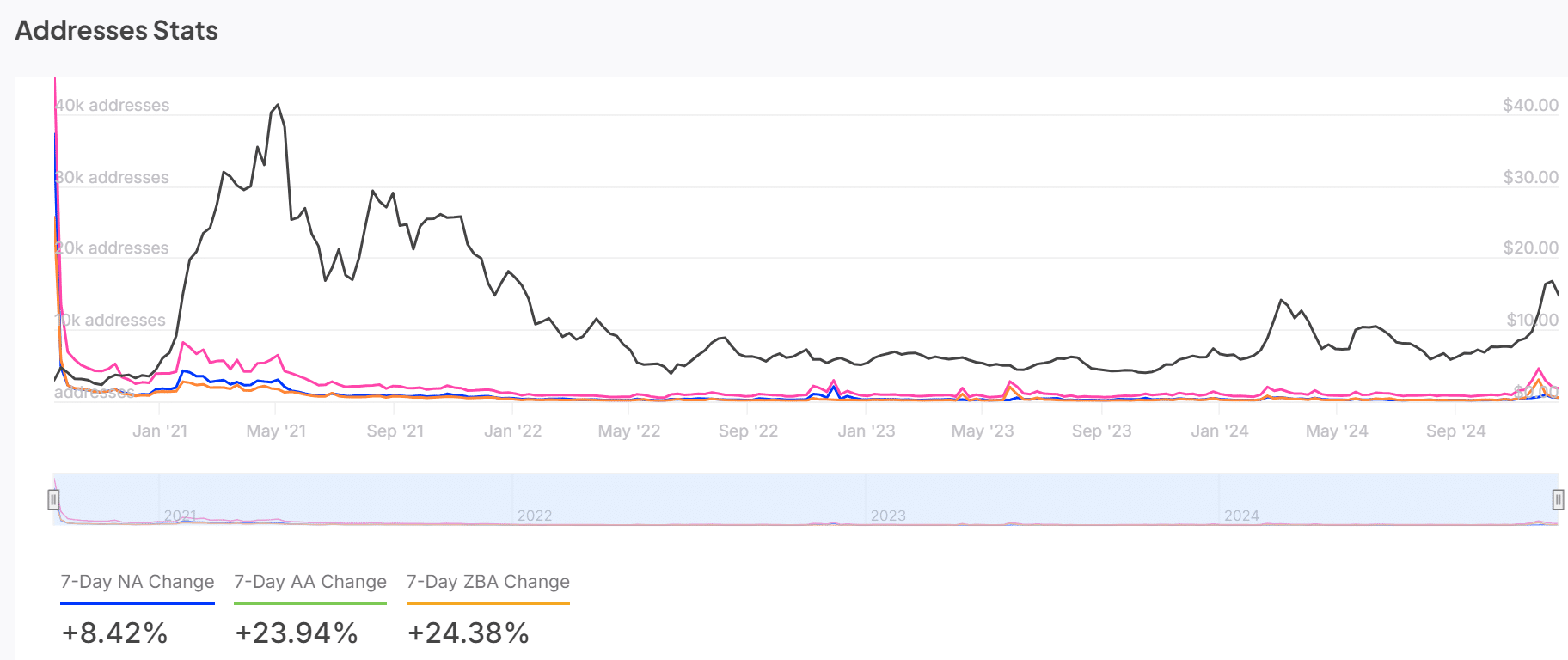

Address stats show growing adoption

The statistics show a significant rise in network activity over the last week. Active addresses have soared by 23.94%, and the number of new addresses has grown by 8.42%. This increase suggests a growing enthusiasm for UNI, fueled by its relevance within the DeFi sector, where it is being utilized more frequently.

Consequently, it appears that the high level of involvement corresponds well with the trend in pricing, suggesting a shared confidence between users and investors.

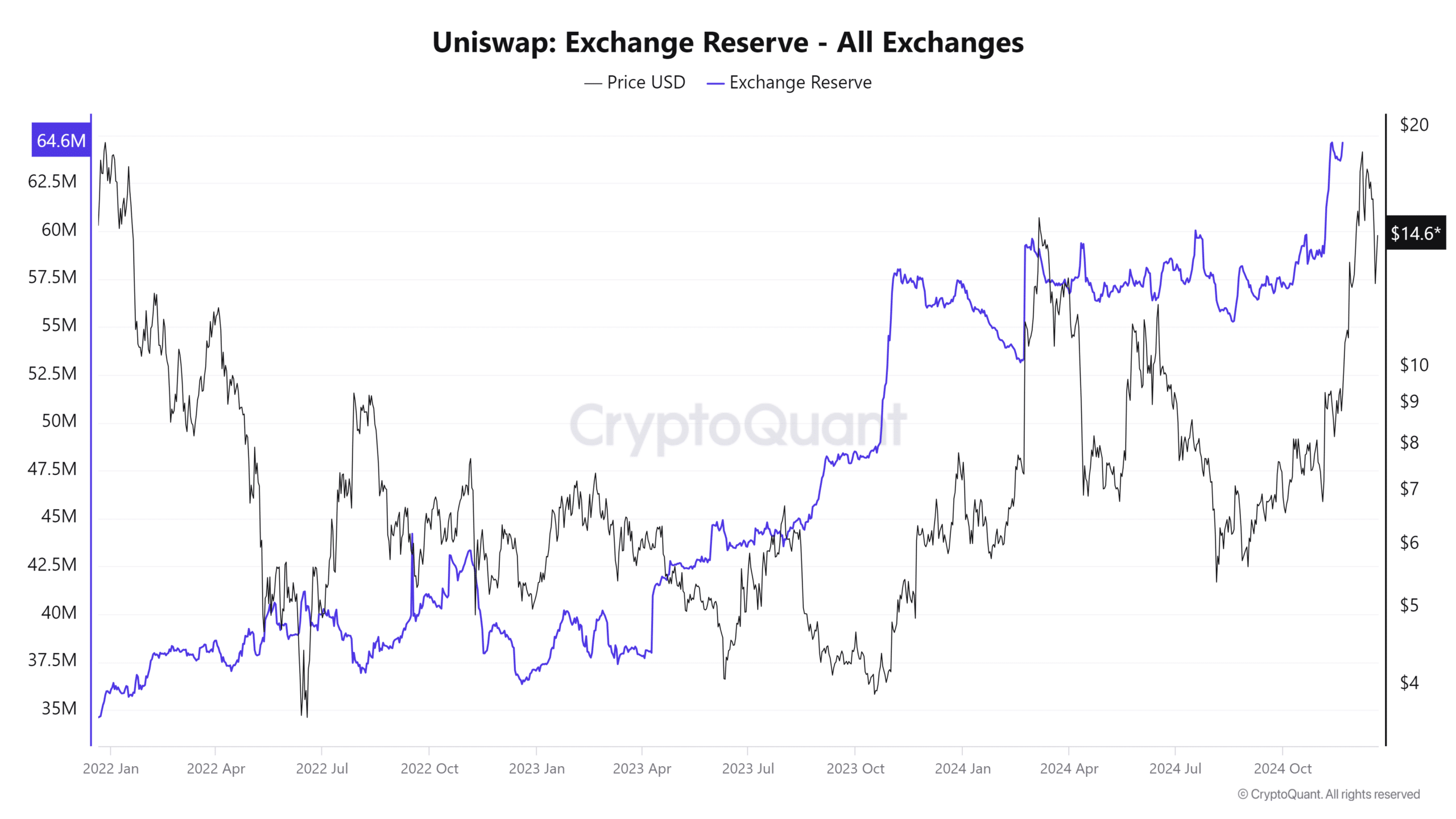

UNI transactions and exchange reserves indicate positive trends

Uniswap’s total transaction count grew by 1.12% over the last 24 hours, hitting 6.7K as per CryptoQuant’s analytics. While this change is modest, it reflected consistent activity on the network. Additionally, exchange reserves fell by 0.64% over the same period, signaling reduced selling pressure.

This decrease indicates that token holders are hopeful about possible profits and have chosen not to sell their tokens. As a result, the diminished stockpile increases the probability of a continuous price surge.

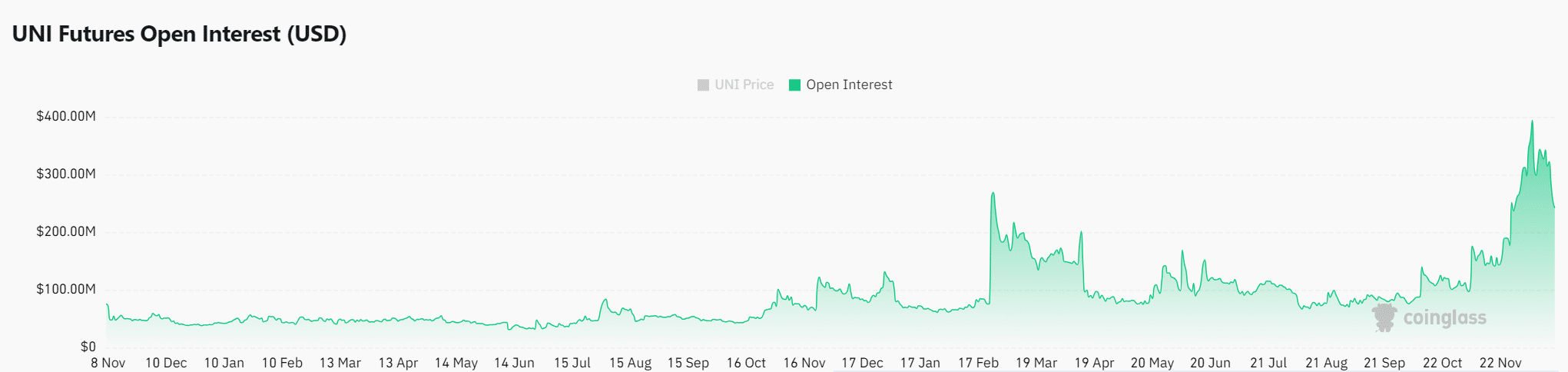

UNI market sentiment and Open Interest

As a researcher, I’m observing an upward trend in market sentiment, as evidenced by the surge in Open Interest by 5.67%, reaching $264.24 million. This increase suggests that there’s a growing interest and confidence among speculators regarding UNI’s short-term prospects, signaling bullish sentiments towards its potential growth.

Furthermore, this increasing curiosity frequently aligns with substantial changes in value, lending support to the idea that this trend will continue.

Read Uniswap’s [UNI] Price Prediction 2024–2025

Can uniswap sustain its momentum?

As a researcher, I find myself optimistic about the potential growth of Uniswap. The strong market movements, coupled with growing user engagement, seem to indicate that we might see Uniswap’s price breach the significant resistance level at $17.12, given the decreasing selling pressure.

If this happens, a hike towards $20 or higher seems highly likely.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Quick Guide: Finding Garlic in Oblivion Remastered

- BLUR PREDICTION. BLUR cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

2024-12-22 06:16