- UNI’s charts flashed strong bullish momentum after breaking out of a descending channel with rising volume

- Positive on-chain metrics and falling exchange reserves could serve altcoin well

As a seasoned researcher with years of experience tracking digital assets, I find myself intrigued by Uniswap’s [UNI] recent breakout from its descending channel. The bullish momentum it has exhibited is reminiscent of a well-timed Olympic dive, where the athlete leaps off the board with perfect form and lands gracefully in the pool – in this case, the ‘pool’ being the cryptocurrency market.

Looking at the on-chain metrics, I see strong investor confidence in UNI, with 20% of addresses “in the money” and a steady network growth. However, it’s important to remember that the crypto world can be as unpredictable as a roller coaster ride, so we must keep an eye on key resistance levels such as the $16 mark.

The falling exchange reserves suggest that holders are becoming more confident in UNI and may not be looking to sell immediately, which could potentially reduce selling pressure. But, like any good magician, unexpected changes can turn market sentiment upside down faster than a rabbit from a hat!

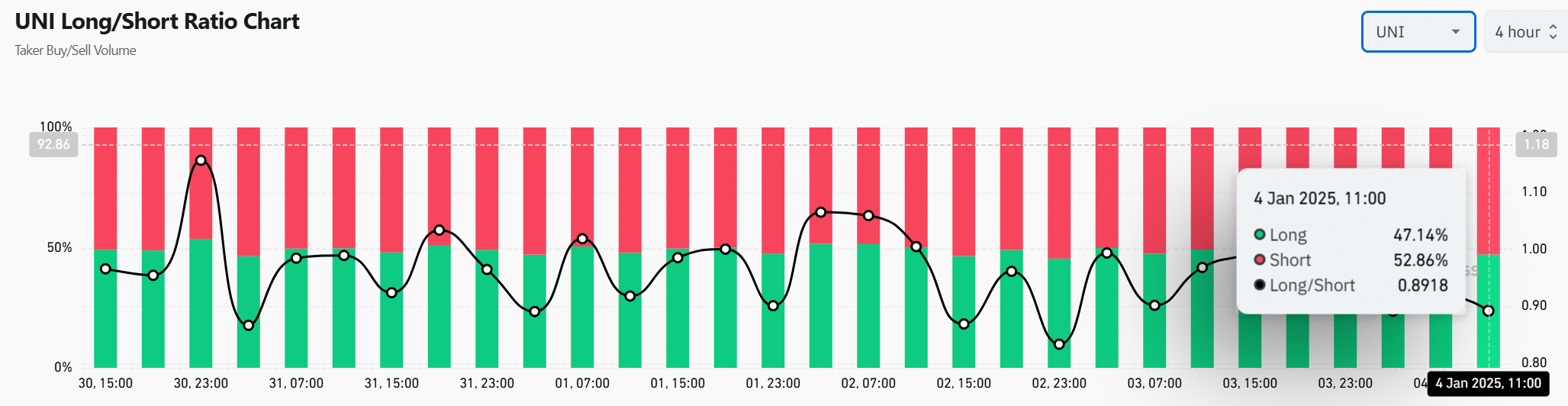

Lastly, the long/short ratio reveals a split among traders, but if bullish momentum accelerates, it could result in a short squeeze. Much like how a cat chasing its tail can suddenly spin around and catch you off guard, market dynamics can shift quickly in the cryptocurrency world.

In conclusion, while I see potential for UNI’s sustained growth if it manages to break the $16 resistance level, traders must always remain vigilant and adapt to evolving trends. After all, the only certainty in the crypto market is uncertainty!

And just like they say in the crypto world, “Never invest more than you can afford to lose… but remember, it’s all fun and games until someone loses their keys!

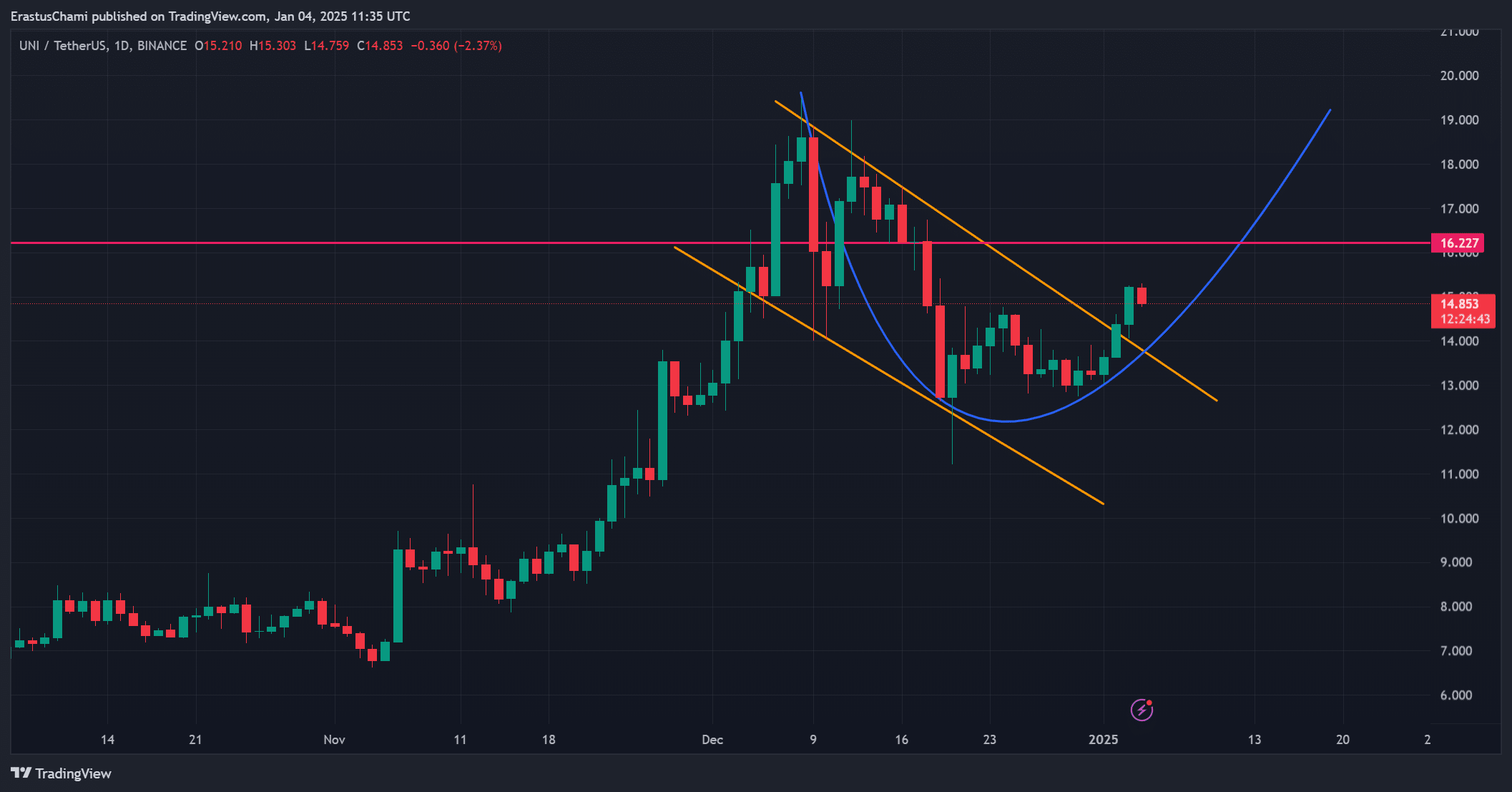

Today, Uniswap [UNI] is making headlines as it burst out from a downward trending channel after several weeks of stability, suggesting a possible change in direction. Currently trading at $14.85 following a 2.32% increase, the token has garnered much interest due to its round base pattern – an indicator of bullish energy.

Furthermore, it’s worth noting that UNI’s 24-hour trading volume also increased by 30.48%, indicating a growing market interest. So, the question arises – Will this momentum result in continued growth or not?

UNI price analysis highlights key resistance

The upward trend in UNI’s price suggests increasing enthusiasm among traders, as it has successfully exited a downward trending channel. Moreover, the chart shows a rounded base, which strengthens the case for continued positive movement.

Moreover, the surge in trading volume for the token appears to bolster investor confidence, suggesting increased market engagement.

It’s important to point out that the $16 resistance could play a significant role in deciding if UNI will keep rising or encounter some short-term obstacles. Therefore, it would be wise for traders to pay close attention to this critical point.

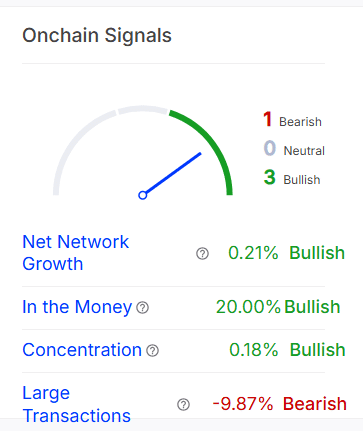

On-chain signals show growing investor confidence

Data from on-chain analysis reinforces a bullish trend for UNI, as indicated by:

1. Approximately one fifth of all addresses are currently profitable (or “in the money”), suggesting optimistic investor attitudes.

2. The network has experienced growth in user adoption, with an increase of 0.21% in new participants. This is a positive sign indicating consistent growth.

The increase in focus or attention, specifically a 0.18% bump, can be attributed to larger investors buying more. Yet, the number of significant transactions dropped by 9.87%, which hints at a certain level of institutional wariness.

And yet, despite everything, overall on-chain data supported UNI’s potential for further growth.

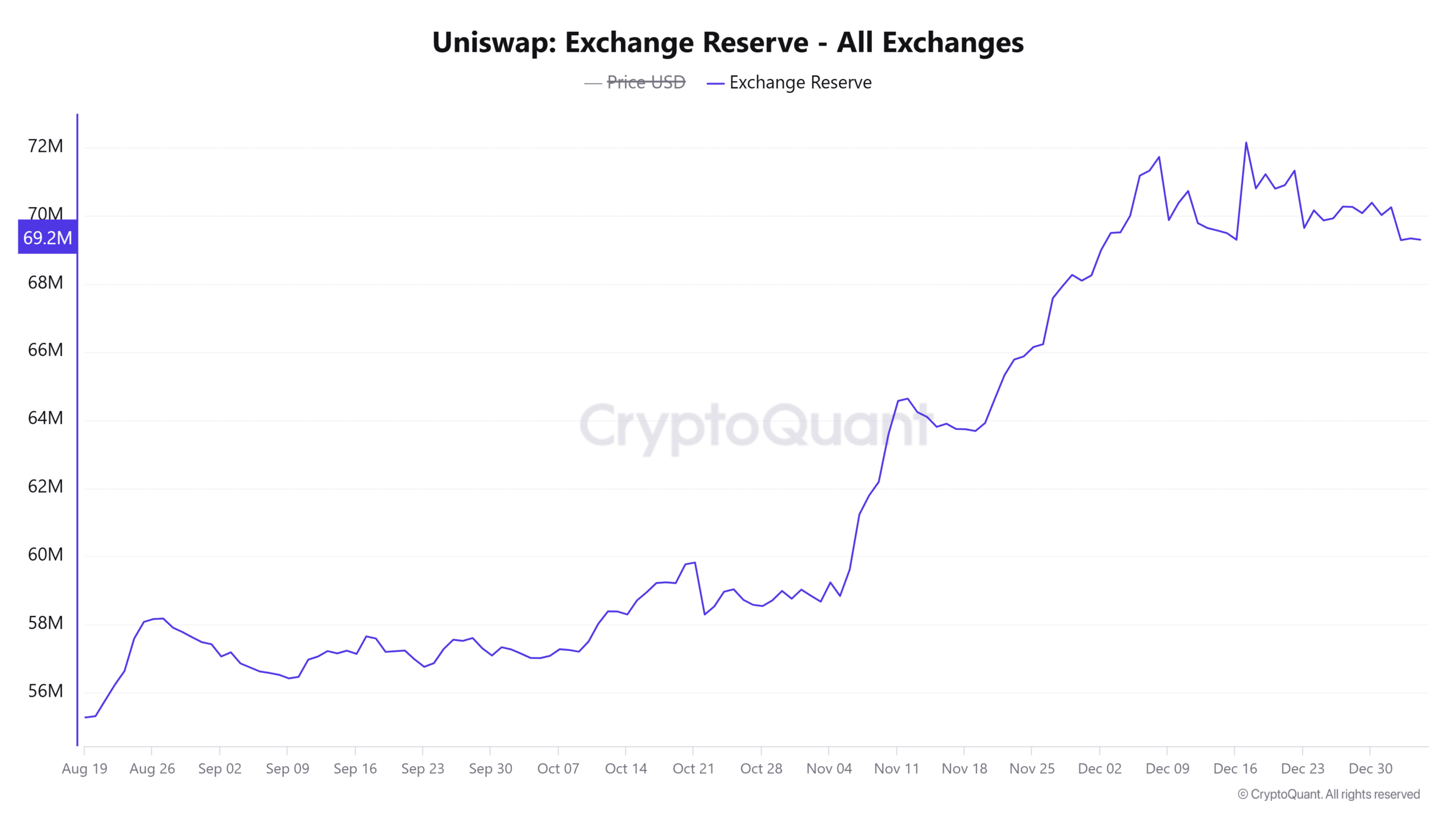

UNI exchange reserves hint at falling selling pressure

Currently, the reserve of UNI on exchanges is around 69.2996 million units, representing a minimal decrease of 0.07% over the past day. This decline suggests that more token holders might be moving their assets away from exchanges, thereby lessening the immediate urge to sell.

Furthermore, it appears that this pattern suggests an increasing trust in the token, rather than quick profit-making. Yet, unforeseen fluctuations in reserves might affect market opinion. Therefore, it’s crucial to keep a close eye on this situation.

Traders divided as long/short ratio reveals a split

Ultimately, the balance between buying and selling UNI showed some ambiguity, as approximately 52.86% of traders opted to sell, while around 47.14% chose to buy. Yet, this slightly negative stance could lead to a ‘squeeze’ if the bullish trend intensifies further.

Additionally, the approaching price movements around $16 are expected to significantly influence market behavior. As a result, traders need to stay alert and adjust strategies according to changing patterns.

Read Uniswap’s [UNI] Price Prediction 2025–2026

UNI has the potential to sustain its bullish momentum if it breaks the $16 resistance level.

Based on robust blockchain data and increasing investor curiosity, prospects seem promising. Yet, it’s crucial for traders to keep a close eye on significant thresholds.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Michelle Trachtenberg’s Mysterious Death: The Unanswered Questions

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SUI’s price hits new ATH to flip LINK, TON, XLM, and SHIB – What next?

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

2025-01-04 21:11