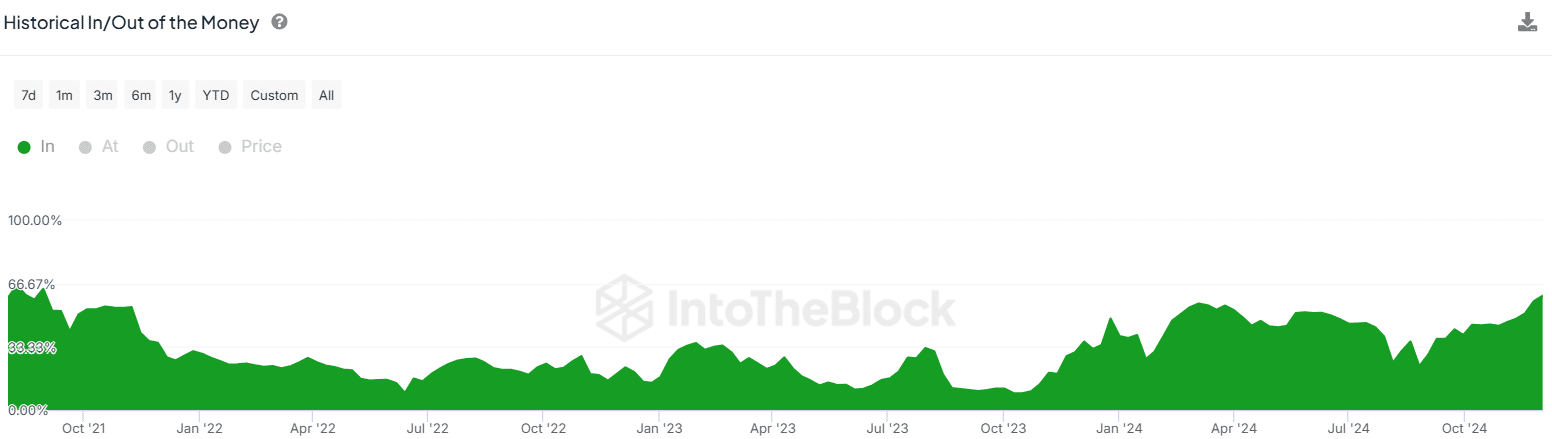

- 60% Uniswap investors are sitting in profits after a 122% gain in 30 days.

- Wallet profitability is at the highest level since 2021, increasing the likelihood of profit-taking activity.

As a seasoned researcher with years of experience in the crypto market, I have seen bull runs like this before and they always come with a mix of excitement and caution. The 124% gain in Uniswap [UNI] over the past 30 days is undeniably impressive, but it’s also a situation that often triggers profit-taking activity. With more than 60% of UNI holders currently in profit, it’s a clear sign that many investors are eyeing their exits.

Over the past month, Uniswap’s token [UNI] has shown a robust upward trend, notching up a 124% increase in value. Currently, UNI is being traded at approximately $15.55, and its daily trading volume surpasses $1 billion as per CoinMarketCap.

It seems that the momentum of the University of Nassau’s (UNI) rally is starting to slow down, as Bitcoin [BTC] has attracted focus away from other cryptocurrencies following its surge beyond $100,000. However, despite this shift in attention, altcoins continue to thrive in a bullish market due to an increase in wallet profitability.

According to data from IntoTheBlock, over 60% of UNI token holders are currently in a profitable position, which represents the highest level of wallet profitability for this cryptocurrency since the middle of 2021.

As the number of profitable wallets grows during a market rally, indicating potential exhaustion, traders often choose to cash out their gains. Such selling activity may slow down or even reverse the rally, potentially leading to a price drop.

UNI exchange inflows on the rise

Some traders are currently cashing in on UNI as a spike in investments pours into direct trading platforms. As per CryptoQuant, inflows to the Uniswap exchange peaked at 1.54 million UNI, worth over $24 million, on December 4th.

The surge in foreign currency inflows occurred at the same time as UNI reaching an 8-month peak of $16.52, possibly suggesting that this price point could mark a temporary peak.

On the contrary, since the daily inflows were actually negative, this might imply a high demand that could prevent a change in the current trend. Furthermore, traders continue to be active, lending support to the idea of continued growth.

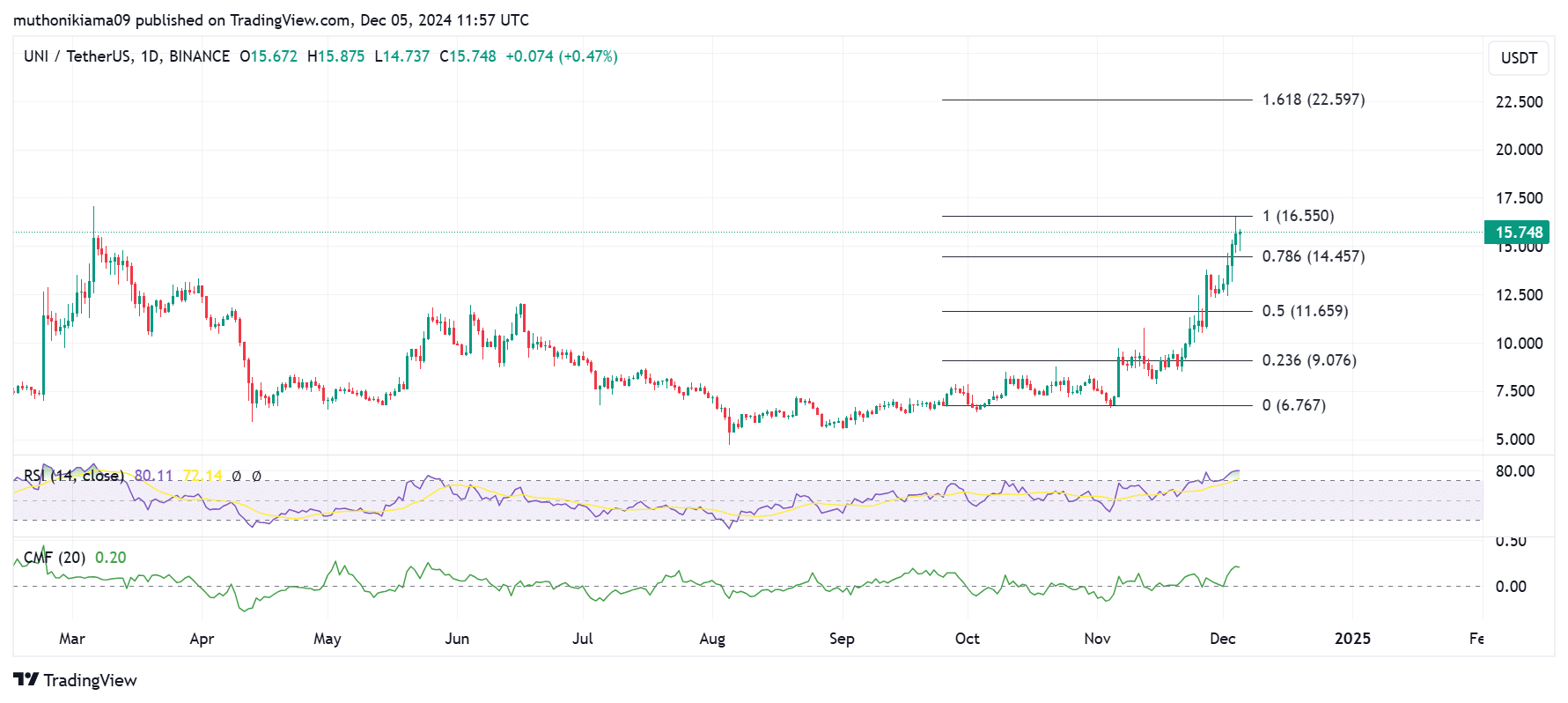

Uniswap’s RSI is at overbought levels

As an analyst, I’ve noticed that my analysis of Uniswap’s daily chart indicates we’re seeing overbought levels. The Relative Strength Index (RSI) has climbed up to 78, a sign often seen before a potential correction in the short term. Historically, similar RSI levels have led to adjustments in the market, so it might be wise to keep an eye on any subsequent price movements.

Currently, the Chaikin Money Flow (CMF) at UNI stands at 0.20, implying that buying actions are at their peak levels in quite some time.

If purchasers maintain their pace, UNI might climb towards the 1.618 Fibonacci ratio ($22.59), potentially reaching its peak since the start of 2022. On the other hand, a dip below $14.45 could spark another fall.

Read Uniswap’s [UNI] Price Prediction 2024–2025

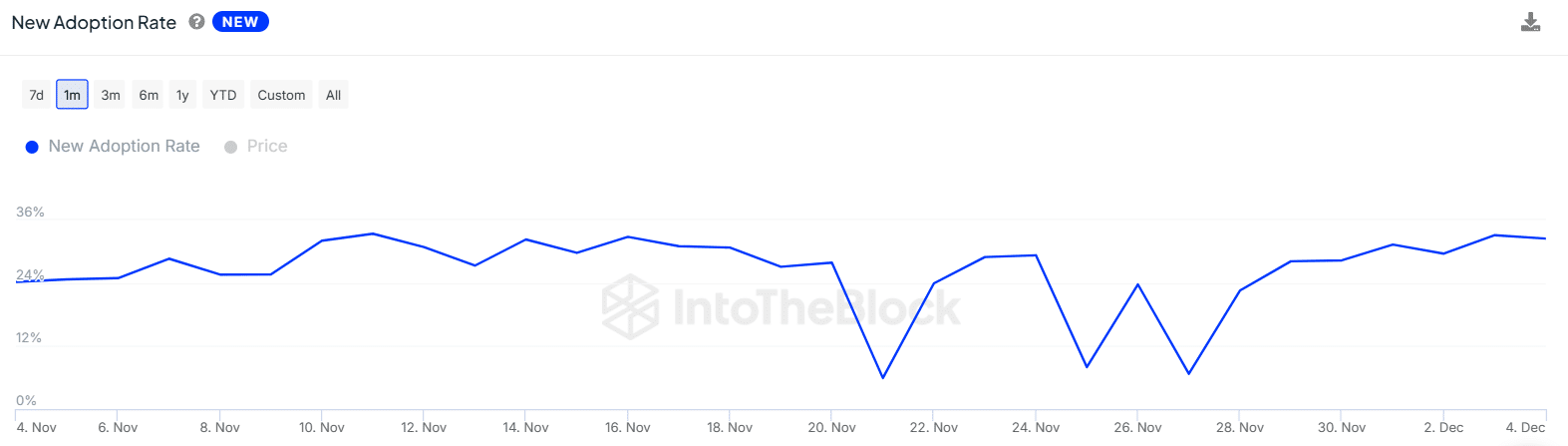

Rising new adoption rate suggests…

Over the last seven days, according to IntoTheBlock, the rate at which Uniswap is being adopted has been steadily increasing and now stands at approximately 32.44%. This trend indicates a substantial number of new investors are amassing Uniswap.

A rise in the number of new Uniswap accounts suggests that retail investors are experiencing fear of missing out (FOMO), potentially speeding up the upward trend and leading to further profits for UNI.

Read More

- OM PREDICTION. OM cryptocurrency

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- WWE’s Braun Strowman Suffers Bloody Beatdown on Saturday Night’s Main Event

- Elevation – PRIME VIDEO

- Serena Williams’ Husband Fires Back at Critics

- Christina Haack and Ant Anstead Team Up Again—Awkward or Heartwarming?

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

2024-12-05 21:45