- Whale bought 437K UNI, fueling price recovery.

- Uniswap targets $12 as buyers defended key $8.4 support levels.

As a seasoned researcher with years of experience in the cryptosphere, I find it fascinating to witness such significant whale activities as the one we recently saw with Uniswap [UNI]. The $4 million USDC purchase of 437,000 UNI tokens by a DeFi whale not only demonstrates confidence in the project but also sets the stage for potential growth.

Could it be that the surge in Uniswap’s [UNI] value is due to large investors quietly amassing the token, setting the stage for potential growth over the next few weeks compared to other tokens?

Whale’s bold play on Uniswap

A recent post on X (formerly Twitter) by blockchain tracker Spot On Chain highlighted the activity of a DeFi whale who spent $4 million USDC to purchase 437,000 UNI tokens.

This particular whale has amassed a total of 2.248 million UNI tokens, which currently have a market value of approximately $20.8 million. These tokens represent unrealized profits of around $5 million, equating to an increase of about 31.5%. The whale acquired these tokens at an average price of $7.06.

After the significant acquisition, the price of Uniswap has bounced back from previous declines, currently increasing by 0.08% to trade at $9.17, as of now.

Moreover, there’s been a 38.85% increase in trading activity during the last 24 hours. This suggests heightened engagement and investment from both traders and investors, possibly stimulated by the actions of this significant player in the market.

A drop in Uniswap addresses hints at…

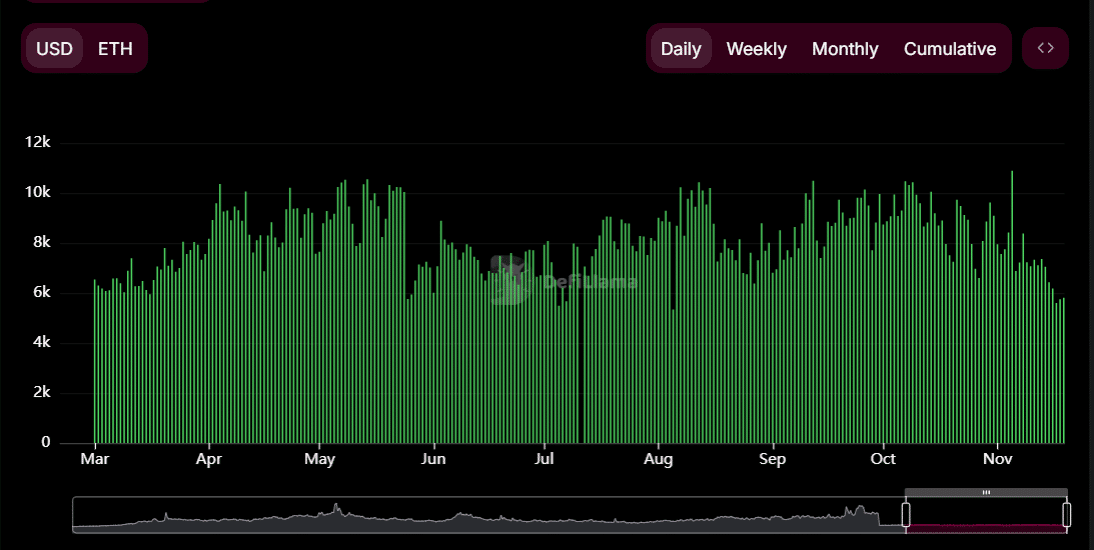

Uniswap’s Daily Active Addresses(DAA) fluctuated between 6,000 and 10,000 from March to November.

On the 5th of November, I noticed an impressive surge that pushed the number of active addresses past 11,000. This indicated a significant increase in user interaction with cryptocurrencies during that specific timeframe.

After reaching this high point, the number of active Bitcoin addresses has been slowly decreasing, hovering around 8,000 to 9,000.

This drop could suggest a possible lessening of speculative actions, or perhaps a decreased enthusiasm for quick trades.

Despite the reduction, the consistent activity levels suggested that core users and long-term participants continue to support the platform. This aligns with increased whale accumulation and steady trading volumes.

The drop suggests a possible period of consolidation might be underway, during which lower involvement could pave the way for resurgent expansion or major shifts in the market.

UNI targets $12 as buyers defend THIS support level

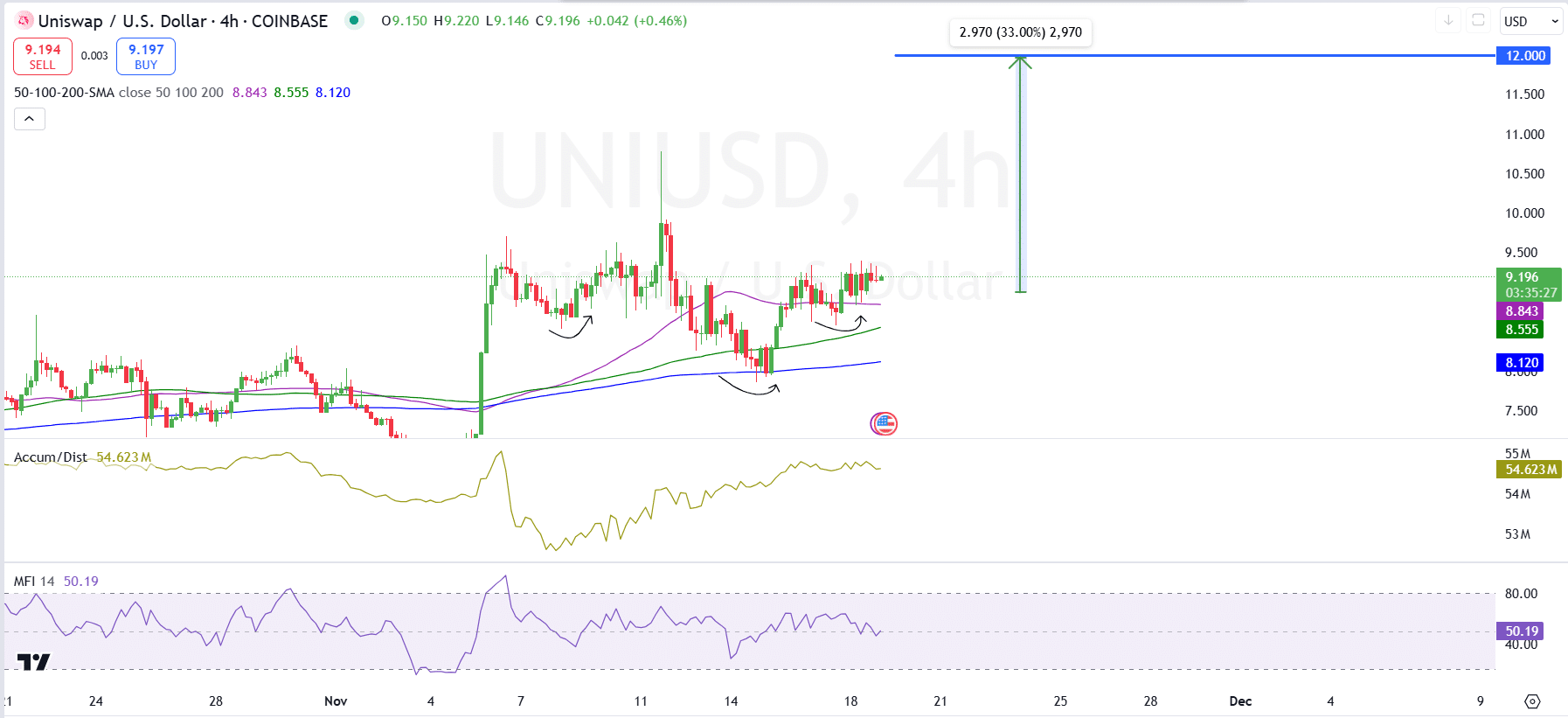

The four-hour chart for UNI highlightsed a bullish structure forming around key support levels.

On Uniswap, the price hovered slightly higher than its 50 Exponential Moving Average (EMA) of around $8.84, the 100 EMA at approximately $8.55, and the 200 EMA at roughly $8.12. These levels served as robust areas where the price could find support.

This arrangement suggests that purchasers are aggressively safeguarding these points, thus maintaining the upward trend unbroken.

The Accumulation/Distribution Line stood firm at approximately 54.623 million, indicating consistent buying by traders who are growing their holdings in expectation of potential price increases.

Currently, the Money Flow Index (MFI) stands slightly above neutral at 50.19, indicating that buying and selling forces are roughly equal. This situation leaves potential for additional bullish movement.

A breakout to the projected target of $12.00 represents a 33% increase from current levels.

Realistic or not, here’s UNI’s market cap in BTC’s terms

As a researcher analyzing Uniswap’s price movements, if the price manages to hold above the 50 Exponential Moving Average (EMA) and surpasses the $10 resistance level, I believe the bullish momentum could drive Uniswap towards this potential target.

However, a breakdown below $8.12 could invalidate the bullish setup and prompt further downside.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-11-19 19:36