-

Uniswap whales observed to be selling a significant amount of their tokens

Network growth for UNI declined significantly over the last few days

As a crypto investor who has closely followed Uniswap’s [UNI] journey since its inception, I have seen firsthand how this DEX has grown into one of the largest players in the decentralized exchange sector. However, recent on-chain data suggests that UNI may be losing steam.

As a successful crypto investor, I’ve closely watched Uniswap (UNI) soar among Decentralized Exchanges (DEXs) due to the bullish market sentiment surrounding UNI at the start of the year. However, my observation at present reveals a noticeable decrease in enthusiasm for UNI.

Whales swim away

Based on Lookonchain’s report, a significant investor transferred 561,782 UNI tokens, equivalent to around $4.38 million, into Binance just a few hours ago. This deposit came after a year-long accumulation phase during which the investor had not sold any UNI.

It’s intriguing that the whale’s UNI holdings have not diminished substantially, as they currently amount to 2 million UNI, equivalent to approximately $15.48 million in value.

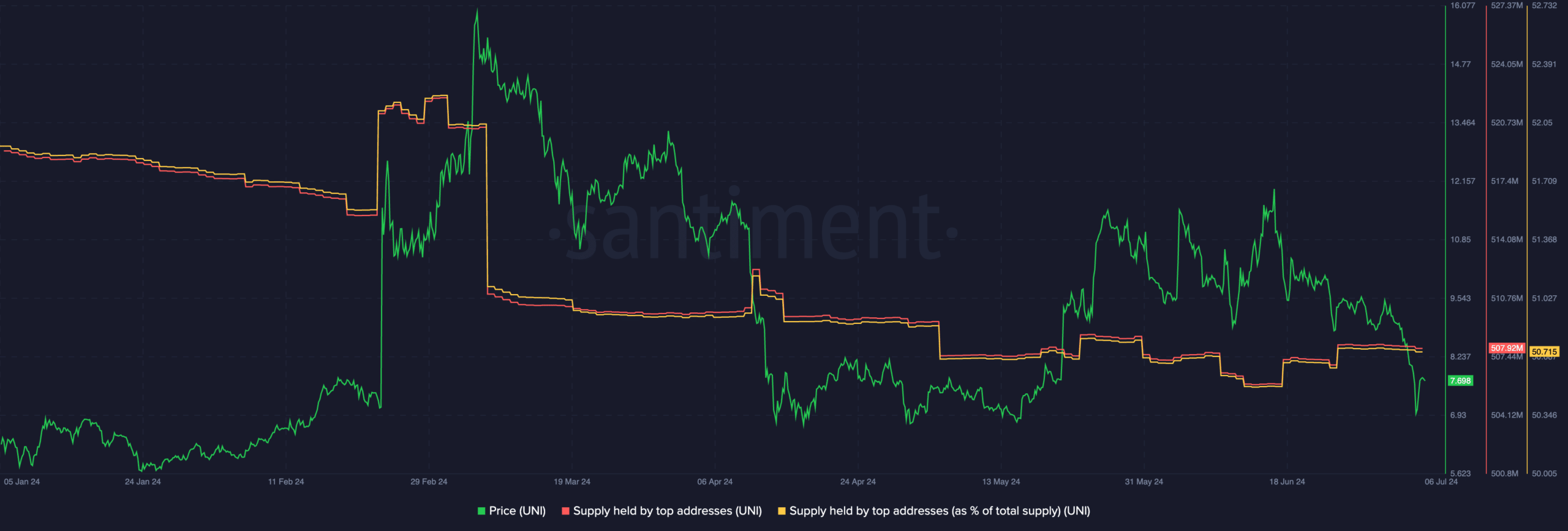

According to AMBCrypto’s examination, using data from Santiment, there has been a decrease in the proportion of substantial investors holding UNI. This could indicate that the recent large-scale UNI transaction was just one of several similar actions taken by these investors, potentially reflecting a broader trend of diminishing interest among major players in UNI.

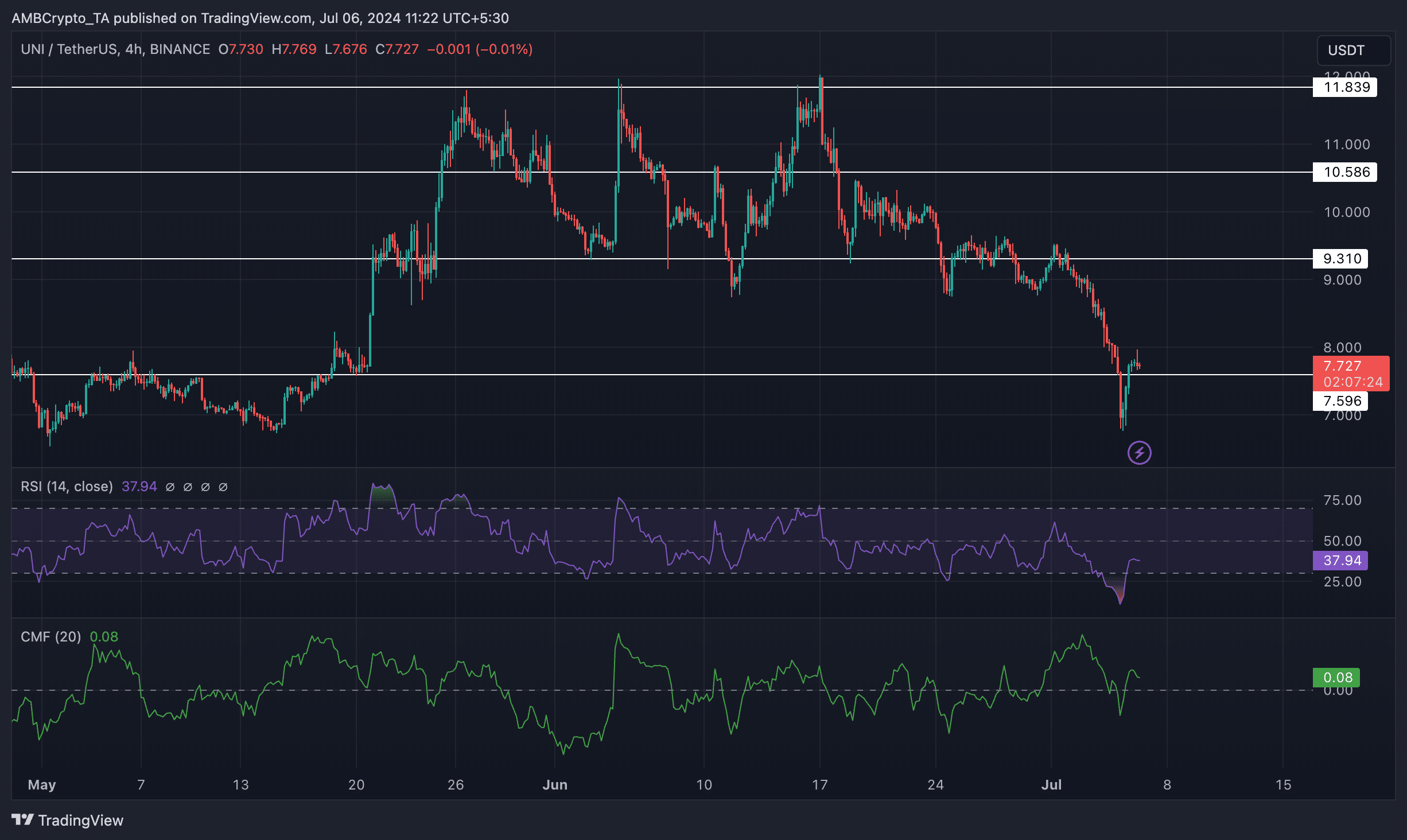

Over the past two weeks, from May 26th to June 17th, I’ve noticed an ominous triple bottom pattern emerging in UNI‘s price charts. This bearish formation was characterized by lower lows and lower highs, a clear warning sign of a downward trend. In order for UNI to stage a potential comeback, it would be crucial for the token to revisit the $9.310 support level multiple times before we could even consider a possible price reversal.

Over the past few days, the UNI stock’s Relative Strength Index (RSI) dropped to 37.94. This signifies a weakening of the bullish trend for UNI.

Additionally, the Chaikin Money Flow (CMF) indicator for UNITEDNETWORK (UNI) has decreased on the graphs, suggesting that there has been a diminished inflow of money into the token.

What does on-chain data say?

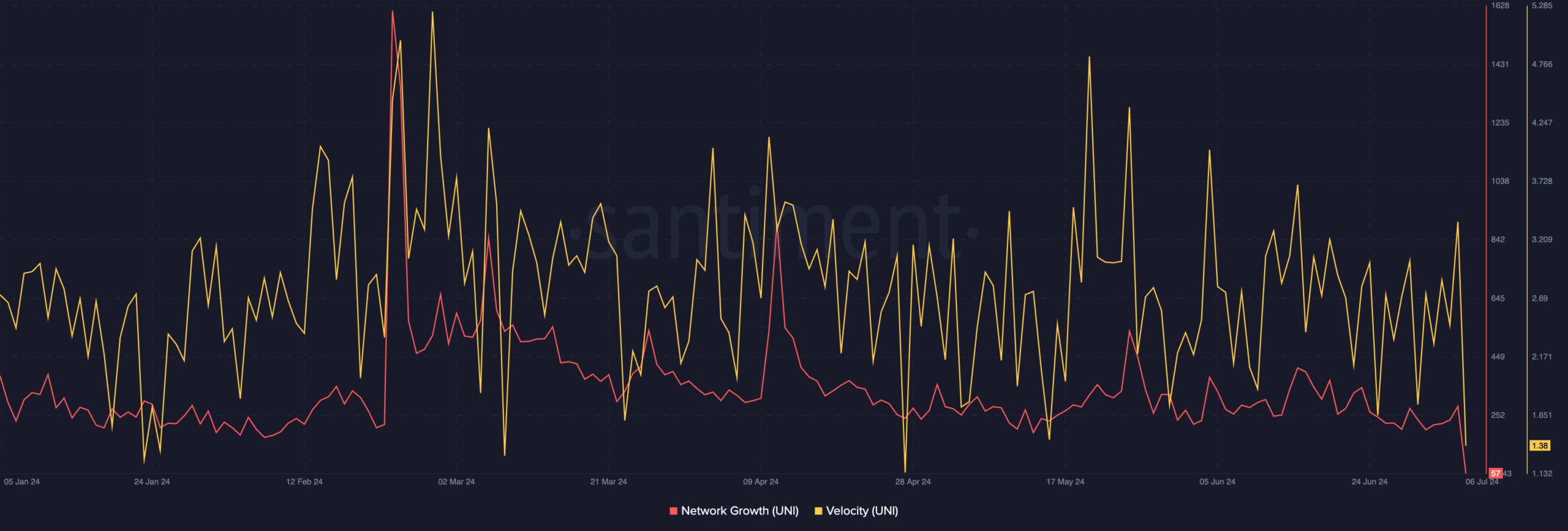

Ultimately, the number of connections in UNI‘s network decreased significantly, implying that fewer new addresses were engaged with the token.

Additionally, the altcoin’s velocity depreciated significantly over the last few days as well.

The latest Uniswap v4 upgrade may positively impact UNI by potentially increasing its value. This effect is primarily due to the innovative introduction of a new mechanism referred to as “hooks.”

These hooks function as short codes tailored for execution at particular stages of a pool’s existence. They get activated during specific events such as:

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-07-06 17:11