- UNI large transactions have surged by 694% in the last 24 hours.

- Positive on-chain metrics and a bullish long/short ratio suggest the potential for further price gains.

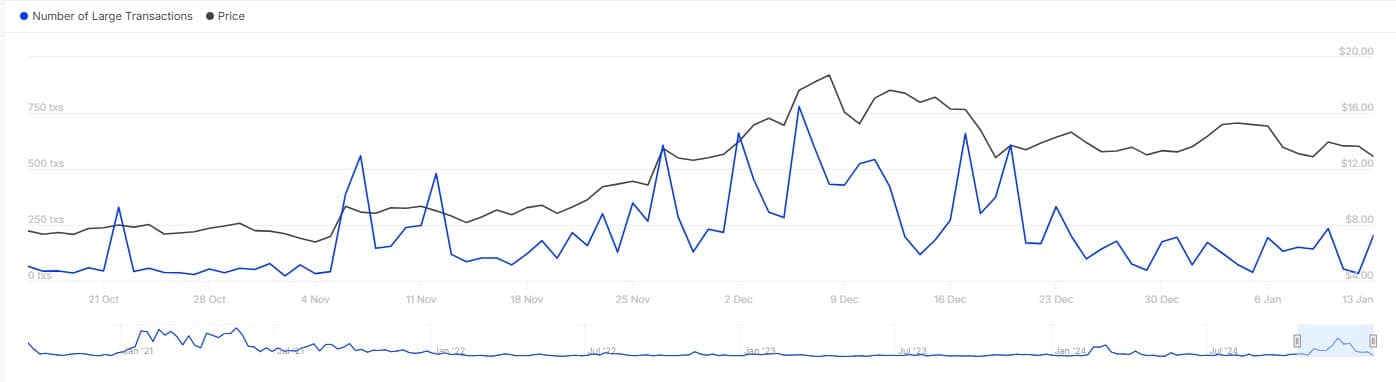

In recent times, there’s been a substantial increase in large transactions involving Uniswap [UNI]. As reported by IntoTheBlock, these significant transactions have jumped an impressive 694% within the last day.

This increase indicates a significant rise in whale-related activities, where major investors might be influencing the market. Notably, the price of UNI has been stabilized around the $12 mark.

Historically, when whales (large-scale investors) become more active with a particular cryptocurrency like UNI, it tends to indicate they have higher confidence in its value. This increased activity might pave the way for significant changes in its price.

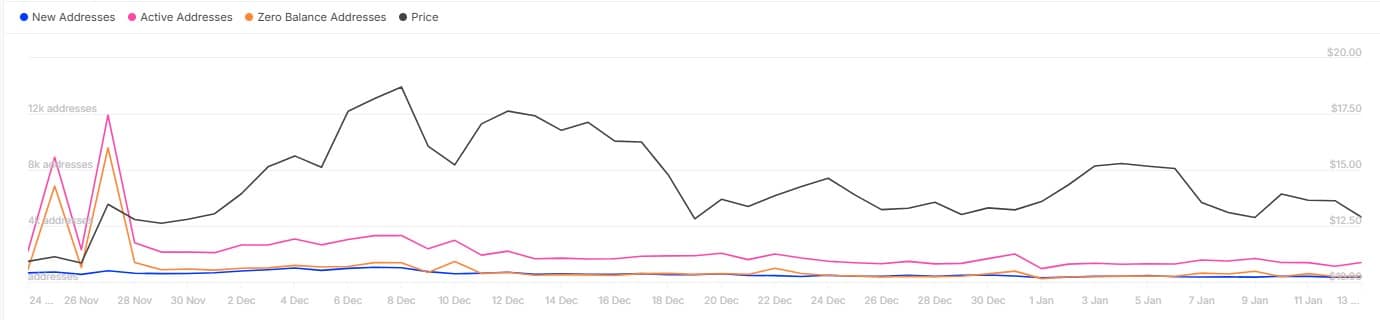

Bolstering the movement, the activity at UNI’s trading desk is on the rise. The number of active addresses associated with this altcoin increased by a significant 23% over the course of just one day.

The rise in trading actions suggests a surge in curiosity and involvement within the network, which might strengthen optimistic expectations among traders.

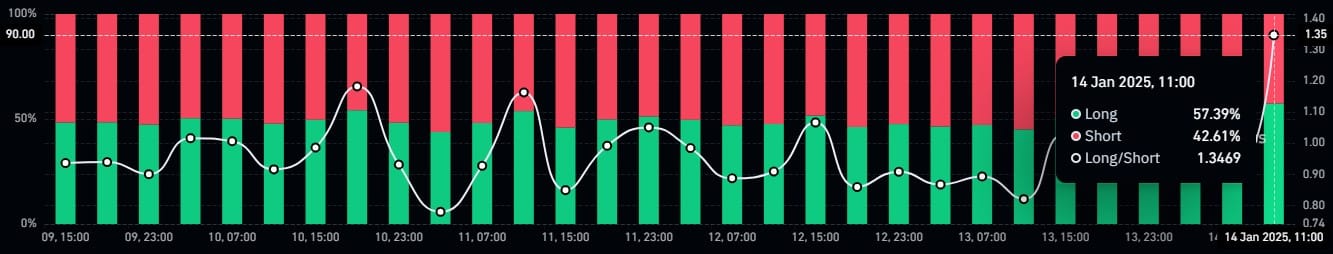

Long/Short Ratio leans to the bulls’ side

A helpful indicator backing the positive perspective is the long/short ratio, which at the moment is 57%. This means that more investors are taking long positions in the market compared to short ones.

One piece of data pointing towards an upbeat view is the long/short ratio. As it currently stands, this ratio is 57%, suggesting that a larger number of traders are opting for long positions rather than short ones.

Typically, when the number of long positions exceeds short ones, it usually indicates a widespread belief that the market’s price is likely to rise more in the future.

With a rise in whale interactions and substantial market trading, it presents an engaging scenario for predicting UNI’s near-future direction.

Key resistance at $17 in sight

From a technical perspective, if the ongoing trend continues, UNI might encounter a significant resistance point around $17. Should it reach there, it could potentially lead to an upward push. Overcoming this resistance level may indicate the beginning of another bullish surge.

In general, the behavior of large investors (often referred to as “whales”) often signals upcoming changes in prices. Given that these whales are currently buying UNI, it suggests a positive outlook for its future value.

Furthermore, the combination of increased whale activity, growing number of active addresses, and a favorable long/short ratio fosters conditions that could lead to price increases.

Can UNI sustain the accumulating bullish momentum?

Although the present data looks promising, the market can change dramatically at any moment. The overall market tendencies and investors’ attitudes will significantly impact UNI’s capacity to maintain its growth trend.

Read Uniswap’s [UNI] Price Prediction 2025–2026

At the University (UNI), on-chain statistics and whale behavior suggest possible bullish actions might occur. As the next barrier at $17 approaches, this cryptocurrency surge may intensify if current tendencies persist.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Everything Jax Taylor & Brittany Cartwright Said About Their Breakup

- The Battle Royale That Started It All Has Never Been More Profitable

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Chainlink: Checking LINK’s 20% drop amid a 4x jump in fees

- Your Friendly Neighborhood Spider-Man Boss Teases Surprising Doc Ock Detail

- How to get tickets to see Kendrick Lamar and SZA on their Grand National world tour

- Best Axe Build in Kingdom Come Deliverance 2

- Meghan’s Sweet Kids Tribute in Latest Vid!

2025-01-15 07:03