- UNI just pulled a 17% rally, strutting its stuff at $7.67, flipping that $7.5 resistance like a pancake! 🥞

- Watch out for a golden cross near $7.818—if it can’t hold $6.87, we might be in for a bumpy ride! 🎢

So, guess what? Uniswap [UNI] decided to throw a surprise party on its price charts! 🎈 It jumped from a low of $6.2 to a high of $7.67, breaking free from its downtrend like a kid escaping from a boring family dinner.

Just two weeks ago, UNI was rejected at $7.50 while trying to break out of a descending channel. Talk about a dramatic breakup! 💔 But now, it’s back, defending support at $5.60 and rising 17% to a two-month high of $7.60. This time, buyers are showing up like they just heard there’s free pizza! 🍕

And the demand? Oh honey, it surged by 89.5%, hitting a whopping $1.53 billion in volume with a Daily Trading Volume of $901.6 million. That’s a lot of dough! 💰

Whale activity returns in force

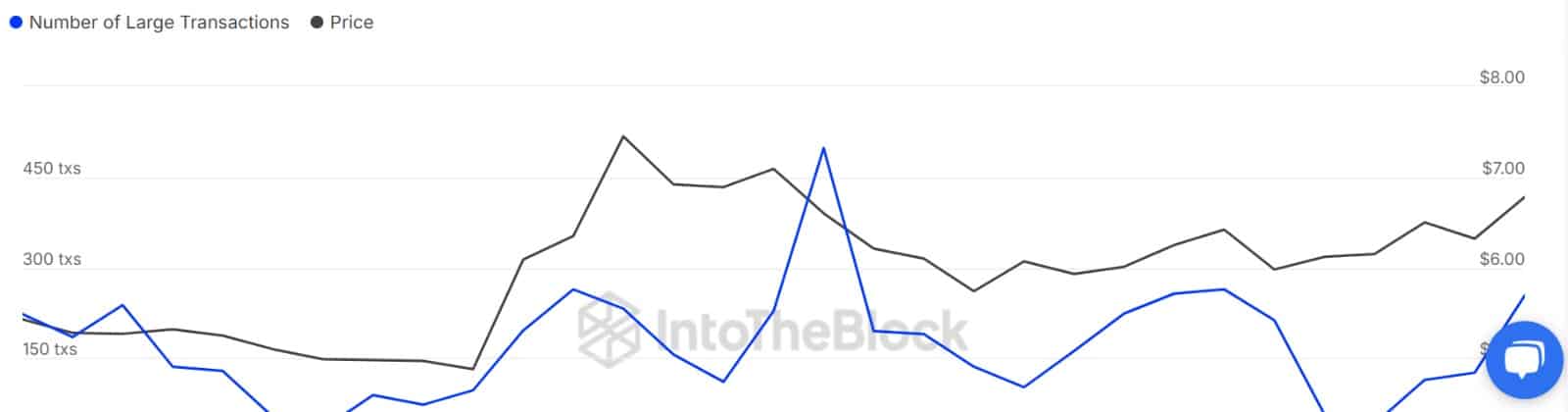

This demand isn’t just from retail traders; the whales are back in town! 🐋 Over the last three days, large transactions jumped from 41 to 254. Naturally, this spike raised eyebrows—are we witnessing a buying spree or an exit dump? 🤔

But wait, there’s more! Netflow data is here to clarify the picture. 📊

Whales are net buyers—for now

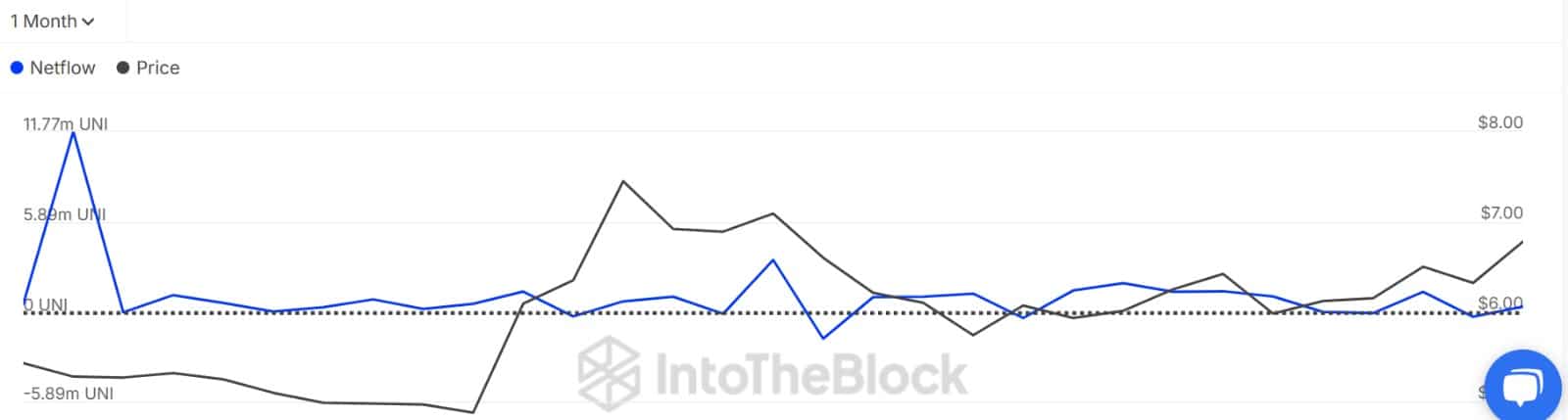

According to the Large Holders’ Netflow, most whales are hoarding the altcoin like it’s the last slice of cake at a birthday party. 🎂 Large Holders’ Capital Inflow surged to 6.75 million UNI, while they’ve offloaded 6.3 million tokens. So, they’re buying more than they’re selling—classic whale behavior! 🐳

And guess what? The spot market is also buzzing! UNI saw 6.96 million tokens bought via taker orders, flipping the CVD (Cumulative Volume Delta) into buyer-dominant territory. Clearly, the bulls are not sitting this one out! 🐂

Can Uniswap maintain the uptrend?

As we can see, demand for Uniswap has surged significantly, with both whales and small traders diving into the market like it’s a pool party. 🏊♂️ But hold your horses—there’s a new risk on the horizon: profit realization. 😬

Uniswap Exchange Netflow has remained positive for two consecutive days, indicating higher exchange inflows than outflows. It’s like a party where more people are coming in than leaving! 🎉

But let’s be real—investors who’ve been underwater since early April might use this bounce to exit, capping upside in the near term. 🏖️

For Uniswap to keep the party going, UNI needs to complete a golden cross on the short-term MA. The short-term 9DMA is almost crossing the 21 DMA from the downside to the upside. If this happens, it’ll validate the uptrend. 🎯

If this cross completes and the price holds above $7.818 (200 EMA), UNI might just extend its gains. But if it fails to hold $6.87 (21DMA), we could be looking at a pullback toward $6.4. Yikes! 😱

In short, demand has returned across the board—but whether this rally sticks depends on how UNI navigates the next profit wave. Surf’s up! 🌊

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

2025-05-29 16:12